The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Wednesday, November 20, 2013

Monday, October 21, 2013

Phisix: US Debt Ceiling Deal and UNTaper Spurs a Global Melt UP

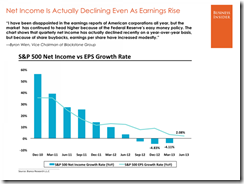

Listed firms invest substantially less and are less responsive to changes in investment opportunities compared to matched private firms, even during the recent financial crisis. These differences do not reflect observable economic differences between public and private firms (such as lifecycle differences) and instead appear to be driven by a propensity for public firms to suffer greater agency costs. Evidence showing that investment behavior diverges most strongly in industries in which stock prices are particularly sensitive to current earnings suggests public firms may suffer from managerial myopia.

Google is higher today because it reported strong numbers, but it's not a 10% better company today than it was 24 hours ago. Wall Street is in a manic phase at the moment. For all the terrific things about Google's third-quarter, the best thing about the report was that it came on a day when institutional investors are feeling like they have far too little exposure to stocks. The average hedge fund was up less than 10% through September and there weren't many people expecting this race to new highs on the S&P500 (^GSPC) on the heels of debt ceiling debacle.

Monday, June 18, 2012

War on Internet: Google Reports Increasing Government Requests for Censorship

Governments of western economies has been breathing down the neck of Google to censor ‘political’ content on Google’s cyberspace.

From TGDaily.com

Google's released data on the governments aiming to censor internet content, and says it's seen a worrying rise in the number of such requests from Western democracies.

In the second half of last year, for example, Spanish regulators asked for the removal of 270 search results that linked to blogs and newspaper articles referencing individuals and public figures, including mayors and public prosecutors.

One example that's more entertaining than chilling came from the Canadian authorities. They called for the removal of a YouTube video showing a man urinating on his passport and flushing it down the toilet. Google let the video stand.

"When we started releasing this data in 2010, we also added annotations with some of the more interesting stories behind the numbers. We noticed that government agencies from different countries would sometimes ask us to remove political content that our users had posted on our services. We hoped this was an aberration. But now we know it’s not," says senior policy analyst Dorothy Chou…

Google also received a number of requests from US law enforcement agencies. One concerned a blog post alleged to defame a law enforcement official in a personal capacity; another a series of 1,400 YouTube videos that were claimed to constitute harassment.

Google has so far ‘refused to comply’ with these requests and thus deserves a pat on the back.

Google earlier announced that they will warn users of state sponsored privacy intrusions.

My guess is that governments will continue to pressure Google, but perhaps more through indirect channels (taxes, licenses, anti-trust etc..) to get their wishes done.

Will Google eventually cave in?

Friday, June 08, 2012

War on Internet: Google will warn Users of State Sponsored Attacks

Hail Google. Google will warn their users of state sponsored privacy intrusions.

From Foreign Policies the Cable

UPDATE: A senior Senate aide confirmed that this evening he received a warning on his Gmail account that Google suspected he had been the target of a state-sponsored cyber attack.

Web giant Google is about to announce a new warning informing Gmail users when a specific type of attacker is trying to hijack their accounts -- governments and their proxies.

Later today, the company will announce a new warning system that will alert Gmail users when Google believes their accounts are being targeted by state-sponsored attacks. The new system isn't a response to a specific event or directed at any one country, but is part and parcel of Google's recent set of policy changes meant to allow users to protect themselves from malicious activity brought on by state actors. It also has the effect of making it more difficult for authoritarian regimes to target political and social activists by hacking their private communications.

"We are constantly on the lookout for malicious activity on our systems, in particular attempts by third parties to log into users' accounts unauthorized. When we have specific intelligence-either directly from users or from our own monitoring efforts-we show clear warning signs and put in place extra roadblocks to thwart these bad actors," reads a note to users by Eric Grosse, Google's vice president for security engineering, to be posted later today on Google's Online Security blog, obtained in advance by The Cable. "Today, we're taking that a step further for a subset of our users, who we believe may be the target of state-sponsored attacks."

When Google's internal systems monitoring suspicious internet activity, such as suspicious log-in attempts, conclude that such activities include the involvement of states or state-backed initiatives, the user will now receive the specialized, more prominent warning pictured above. The warning doesn't necessarily mean that a user's account has been hijacked, but is meant to alert users that Google believes a state sponsored attack has been attempted so they can increase their security vigilance.

Google wants to be clear they are not singling out any one government for criticism and that the effort is about giving users transparency about what is going on with their accounts, not about highlighting the malicious actions of foreign states.

Read the rest here

Thursday, April 26, 2012

Google Launches the Google Drive

The information age will bring about a deluge of innovative consumer friendly applications in the thrust to competitively serve the consumers.

Yesterday, technology giant Google launched the Google Drive which aims to integrate much of Google’s applications and MORE.

From the Google Official Blog, (hat tip Kurzweilai.net)

Today, we’re introducing Google Drive—a place where you can create, share, collaborate, and keep all of your stuff. Whether you’re working with a friend on a joint research project, planning a wedding with your fiancé or tracking a budget with roommates, you can do it in Drive. You can upload and access all of your files, including videos, photos, Google Docs, PDFs and beyond.

With Google Drive, you can:

You can get started with 5GB of storage for free—that’s enough to store the high-res photos of your trip to the Mt. Everest, scanned copies of your grandparents’ love letters or a career’s worth of business proposals, and still have space for the novel you’re working on. You can choose to upgrade to 25GB for $2.49/month, 100GB for $4.99/month or even 1TB for $49.99/month. When you upgrade to a paid account, your Gmail account storage will also expand to 25GB.

Drive is built to work seamlessly with your overall Google experience. You can attach photos from Drive to posts in Google+, and soon you’ll be able to attach stuff from Drive directly to emails in Gmail. Drive is also an open platform, so we’re working with many third-party developers so you can do things like send faxes, edit videos and create website mockups directly from Drive. To install these apps, visit the Chrome Web Store—and look out for even more useful apps in the future.

This is just the beginning for Google Drive; there’s a lot more to come.

Since alot of my work has been based on the Google platform, I applied for the free option and await for their notice of access.

And yes, as a fan of technology, although I hardly know how to use the many conventional sophisticated gadgets, I expect much more consumer friendly services to come not only from Google from the rest of the industry.

Tuesday, June 01, 2010

The Battle For The World's Most Valuable Technology Company

Apple recently grabbed the top spot as the "world’s most valuable technology company"...

Interesting comment by the New York Times:

Interesting comment by the New York Times:"The rapidly rising value attached to Apple by investors also heralds an important cultural shift: Consumer tastes have overtaken the needs of business as the leading force shaping technology."

This reminds us that consumers ALWAYS play the lead role in determining how resources are allocated. And businesses only compete to satisfy consumer needs or tastes, through innovation or adaption of more efficient processes. Profits and higher market cap are consequences of the success of such pursuit. According to Ludwig von Mises,

``The economic foundation of this bourgeois system is the market economy in which the consumer is sovereign. The consumer, i.e., everybody, determines by his buying or abstention from buying what should be produced, in what quantity and of what quality. The businessmen are forced by the instrumentality of profit and loss to obey the orders of the consumers, Only those enterprises can flourish that supply in the best possible and cheapest way those commodities and services which the buyers are most anxious to acquire. Those who fail to satisfy the public suffer losses and are finally forced to go out of business."

Go to the New York Times site here to see the company milestones accompanying the chart.

However, maybe the rivalry shouldn't be limited to Apple-Microsoft. Perhaps newcomer Google should be part of it.

Google's market cap is currently at $156 billion according to yahoo finance, (chart from bigcharts.com) more than 30% off from Apple's $233.7 billion.

Google's market cap is currently at $156 billion according to yahoo finance, (chart from bigcharts.com) more than 30% off from Apple's $233.7 billion. But again, the rewards will depend on who among these companies will satisfy the consumers most.

Tuesday, August 25, 2009

Where Yahoo Beats Google

This from Randall Stross (New York Times)

``Google has an outsize image as the deft master of information. Its superior technology seems to pitilessly grind up its rivals. But Google’s domination in search has proved hard for it to match in some information domains. When serving financial news and information, for example, Yahoo draws 17.5 times the traffic of Google, according to comScore Media Metrix.

``Yahoo Finance, which has occupied the top spot in the category for 19 consecutive months, drew 21.7 million unique United States visitors in July; Google Finance drew only 1.2 million unique visitors, placing it 17th in comScore’s rankings for the category, one slot above a site called FreePressRelease.com."

Thursday, April 09, 2009

Ahead of the Curve: Web Search Trends

Google offers an innovative method to predict market or economic trends: by search “query data”.

The above shows of a tight correlation between sales of Ford vehicles and the google search trends for Ford.

This from Hal Varian, Chief Economist and Hyunyoung Choi, Decision Support Engineering Analyst of Google (bold highlight mine),

``The answer depends on what you mean by "predict." Google Trends and Google Insights for Search provide a real time report on query volume, while economic data is typically released several days after the close of the month. Given this time lag, it is not implausible that Google queries in a category like "Automotive/Vehicle Shopping" during the first few weeks of March may help predict what actual March automotive sales will be like when the official data is released halfway through April.

``That famous economist Yogi Berra once said "It's tough to make predictions, especially about the future." This inspired our approach: let us lower the bar and just try to predict the present.

``Our work to date is summarized in a paper called Predicting the Present with Google Trends. We find that Google Trends data can help improve forecasts of the current level of activity for a number of different economic time series, including automobile sales, home sales, retail sales, and travel behavior.

``Even predicting the present is useful, since it may help identify "turning points" in economic time series. If people start doing significantly more searches for "Real Estate Agents" in a certain location, it is tempting to think that house sales might increase in that area in the near future.”

In other words, trends from web search data could function as "lead" indicator for possible “turning points” of economic or market activities.

I tried to confirm this theory by comparing the trend of stock market searches with the performance of global stock markets.

And got a pleasant surprise…

Of the last 6 spikes in Google trend’s search for stock market…

largely coincided with stock market bottoms or “inflection points” with stunning near precision (except during the meltdown in October).

Google trend’s activities somehow appear to mirror the VIX or Fear Index, where such correlation (a peak in searches and a stock market bottom) could have been due to people’s greater appetite for more information possibly out of fear or angst (especially during the latest panic).

Yet I think it won’t be long where markets could spawn out of Google’s trends something in the line of prediction markets or in derivatives.

Finally this reminds us of Jean Baptiste Say’s quote in A Treatise on Political Economy.

``the advantage enjoyed by everyone who, from distinct and accurate observation, can establish the existence of these general facts, demonstrate their connection and deduce their consequences. They as certainly proceed from the nature of things as the laws of the material world. We do not imagine them; they are results disclosed to us by judicious observation and analysis.....

Looks like a handy tool. Thanks for the tip Google.

Friday, June 27, 2008

Interesting Trivia on Google

Here is an interesting article from my default search engine Google as excerpted from Askmen.com…

“5 Things You Didn't Know: Google

There is no other company more synonymous with the internet than Google. As the mother of all search engines (a legitimate title considering Google surpassed Yahoo! as the most visited website in the U.S. in 2008), Google has come a long way since its early beginnings. It is also ranked as the No. 1 company to work for, according to Fortune magazine. Its popularity has become so widespread that most think Google was born along with the internet. To others, however, Google is the pinnacle of all internet companies -- a multifaceted search engine extraordinaire.

Why such intrigue? Well, here are a just a few things you didn’t know about Google.

1- Google spends $72 million a year on employee meals

Seventy-two million dollars a year -- that works out to about $7,530 per Googler (a term Google uses to identify employees). While the exact details vary depending on location (the Google empire spans the globe), employees at Google's California headquarters, aptly entitled the Googleplex, are welcome to at least two free meals a day from 11 different gourmet cafeterias. As if that weren’t enough, another thing you didn’t know about Google is that in addition to the cafeterias, Google offers numerous snack bars that are chock-full of healthy morsels to munch on.

And that's certainly not all. Is your car in a bit of a rut? Not to worry; Google offers on-site car washes and oil changes. The list of perks for working at Google is never-ending, making it no surprise that it's considered the No. 1 place to work, offering: on-site haircuts, full athletic facilities, massage therapists, language classes, drop-off dry cleaning, day cares, and on-site doctors, just to name a few. Oh, and if your dog is stuck at home and feeling a little lonely, just bring him to work -- Google doesn't mind.

2- Google was originally called BackRub

Like many other booming internet companies, Google has an interesting upbringing, one that is marked by a lowly beginning. Google began as a research project in January 1996 by cofounder Larry Page, a 24-year-old Ph.D. student at

Because of this unique strategy, another thing you didn't know about Google is that Page and Brin nicknamed the search engine BackRub. Thankfully, in 1998, Brin and Page dropped the sexually suggestive nickname, and came up with “Google,” a term originating from a common misspelling of the word "googol," which refers to 10100.

The word “google” has become so common, it was entered into numerous dictionaries in 2006, referring to the act of using the Google search engine to retrieve information via the internet.

3- Google loses $110 million a year through "I'm Feeling Lucky"

There's not much to see on Google's main search page, and perhaps simplicity is one of the keys to Google's success. When searching Google, you are given two options: “Google Search” or “I'm Feeling Lucky.” By clicking the former, you are given that familiar list of search results; by clicking the latter, however, you are automatically redirected to the first search result, bypassing the search engine’s results page.

Besides the fun factor, the idea behind the “I'm Feeling Lucky” feature is to provide the user with instant connection to the precise page they are searching for, thus saving them time that would normally be spent perusing endless search results. Sounds harmless enough, right? Not so fast. Because “I'm Feeling Lucky” bypasses all advertising, it is estimated that Google loses about $110 million per year in advertising-generated revenue. So why in the world would any Fortune 500 company not patch such a gaping leak? "It's possible to become too dry, too corporate, too much about making money. I think what's delightful about 'I'm Feeling Lucky' is that it reminds you there are real people here," Google Executive Marissa Mayer told Valleywag, an online tech-blog.

4- Google has a sense of humor

Google also offers full language support for Pig Latin, Klingon and even Elmer Fudd. Anyone else still feeling lucky? Try typing, “French military victories” and clicking “I'm Feeling Lucky.” Behold the result.

Some might remember the “miserable failure” fiasco when one typed those words and clicked “I'm Feeling Lucky,” and they were instantly connected to a biography of President George W. Bush on the White House website. Now, before you jump to conclusions, this trick -- which no longer works -- was carried out by members of the online community through the art of “Google bombing.” Google bombing works because of Google's backlink search strategy.”

Read the rest at askmen.com