Fact: every dollar that goes into government debt is not going into the private sector. This is a major problem today. The U.S. government is borrowing and wasting an additional $1.2 trillion a year in on-budget (admitted) debt. Meanwhile, it must roll over existing debt as it matures.

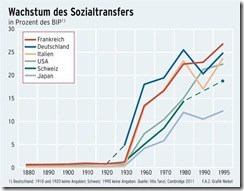

The single most important economic factor in strengthening the growth of the modern state has been the development of government bonds. Governments have been able to sustain their growth because they have promised investors to pay interest on money lent to the government.

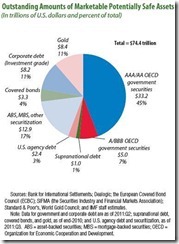

The government guarantees the payment of a specific rate of interest over a specific period of time. Investors, looking for safety, and looking also for a steady stream of income that is not subject to the risks of the free market, hand over their money to the government on the basis of their trust that the government will not default in any way on its obligations.

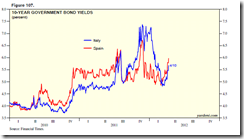

As mentioned, a major way that governments default is accomplished through mass inflation, or even hyperinflation. When governments, meaning central banks, increase the money supply, this has an effect on prices. Prices will begin to rise. Investors realize that the money that they will get back over the period of the loan will be worth less than today. So, they demand that the government promise to pay a higher rate of interest.

Those investors who accepted the government's promise when the rate of inflation was lower now suffer capital losses. They hold IOUs from the government to pay a particular rate of interest, and now the government is paying new investors a higher rate of interest. So, new investors are not going to buy bonds from the older investors at the old selling price, because those bonds pay a lower rate of interest than newer ones. They are going to demand that existing sellers of bonds take a lower price than the sellers paid when they bought the bonds from the government.

The ability of the government to extract wealth from rich people through taxation has always been limited. Rich people know how to hide their money. They know how to get it out of the country, and they know how to get it into markets that are less easily taxed.

So, politicians learned half a millennium ago to get their hands on rich people's money before rich people started hiding their money. They did this by promising to pay a rate of interest on the money. Government bonds are ways of extracting money in advance, especially from rich people, which politicians would have preferred to tax directly, but which they did not tax directly because they knew that rich people would hide the money.

The whole point of the bond market is to enable the government to expand its operations beyond what would be possible by collecting taxes today. Politicians are able to get more money to expand operations today, because they promise to repay lenders a specific rate of interest. But, of course, this does not promise that the government will not repay with debased money.

That’s from Professor Gary North. Read the rest here

.bmp)

.png)