Professors Daron Acemoglu and Simon Johnson writes,

In 1979 Paul A. Volcker became chairman of the Fed and tamed inflation by raising interest rates and inducing a sharp recession. The more general lesson was simple: Move monetary policy further from the hands of politicians by delegating it to credible technocrats.

I hope the world operates in such simplicity. We just hire the right persons of virtue and intellect and our problems would vanish.

But that’s not the world we live in.

First of all, too much credit has been given to the actions of ex-US Federal Reserve chief Paul Volcker, who may just be at the right place at the right time.

Here is Dr. Marc Faber on Paul Volcker, (bold emphasis mine)

In the 1970s, the rate of inflation accelerated, partly because of easy monetary policies, which led to negative real interest rates, partly because of genuine shortages in a number of commodity markets, and partly because OPEC successfully managed to squeeze up oil prices. But by the late 1970s, the rise in commodity prices led to additional supplies and several commodities began to decline in price even before the then Fed chairman Paul Volcker tightened monetary conditions.

Similarly, soaring energy prices in the late 1970s led to an investment boom in the oil- and gas-producing industry, which increased oil production while at the same time the world learned how to use energy more efficiently. As a result, oil shortages gave way to an oil glut, which sent oil prices tumbling after 1985.

At the same time, the US consumption boom that had been engineered by Ronald Reagan in the early 1980s (driven by exploding budget deficits) began to attract a growing volume of cheap Asian imports, first from Japan, Taiwan, and South Korea, and then, in the late 1980s, also from China.

I would therefore argue that even if Paul Volcker hadn't pursued an active monetary policy that was designed to curb inflation by pushing up interest rates dramatically in 1980/81, the rate of inflation around the world would have slowed down very considerably in the course of the 1980s, as commodity markets became glutted and highly competitive imports from Asia and Mexico began to put pressure on consumer product prices in the USA.

Then, markets had already been signaling the unsustainability of Fed induced inflation which had been underpinned by real market events as oversupply and globalization. Thus, Paul Volcker’s actions may have just reinforced an ongoing development.

In short, lady luck may have played a big role in Mr. Volcker’s alleged feat.

Next, looking at the world in a static frame misleads.

Conditions today are vastly dissimilar from the conditions then, as I recently wrote,

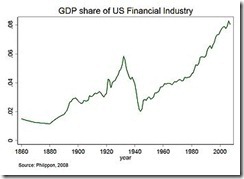

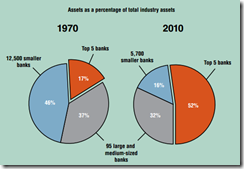

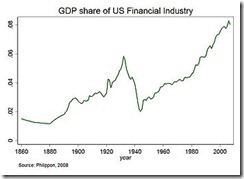

Circumstances during Mr. Volker’s time have immensely been different than today. There has been a vast deepening of financialization of the US economy where the share of US Financial industry to the GDP has soared. In short, the financial industry is more economically (thus politically) important today than in the Volcker days. Seen in a different prism, the central bank-banking cartel during the Volcker era has not been as embedded as today.

Yet how did this came about?

According to Federal Reserve of Dallas Harvey Rosenblum

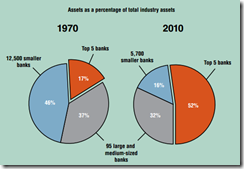

Banks have grown larger in recent years because of artificial advantages, particularly the widespread belief that government will rescue the creditors of the biggest financial institutions. Human weakness will cause occasional market disruptions. Big banks backed by government turn these manageable episodes into catastrophes

Put differently, public policies or regulations spawn a feedback mechanism between regulators and the regulated through human interactions.

Laws and regulations don’t just alter the incentives of the market participants, they foster changes in the relationship between political authorities and the regulated industry.

More laws tend to increase or deepen the personal connections and communications between authorities and the regulated. This magnifies opportunities to leverage personal relationships where market participants seek concessions or compromises from their regulatory overseers, which leads to political favors, corruption, influence in shaping policies and the ‘captured’ regulators. And such relationships bring about the insider-outsider politics as evidenced by revolving door syndrome.

As human beings we live in a social world. The idea where “virtue” and knowledge are enough to shield political authorities from the influences of the regulated and or the political masters of public officials and or from personal ties, represents a world of ivory towers, and simply is fiction.

The true reason behind the illusions of technocracy as stated by Murray N. Rothbard, (bold emphasis added)

There are two essential roles for these assorted and proliferating technocrats and intellectuals: to weave apologies for the statist regime, and to help staff the interventionist bureaucracy and to plan the system.

The keys to any social or political movement are money, numbers, and ideas. The opinion-moulding classes, the technocrats and intellectuals supply the ideas, the propaganda, and the personnel to staff the new statist dispensation. The critical funding is supplied by figures in the power elite: various members of the wealthy or big business (usually corporate) classes. The very name "Rockefeller Republican" reflects this basic reality.

While big-business leaders and firms can be highly productive servants of consumers in a free-market economy, they are also, all too often, seekers after subsidies, contracts, privileges, or cartels furnished by big government. Often, too, business lobbyists and leaders are the sparkplugs for the statist, interventionist system.

What big businessmen get out of this unholy coalition on behalf of the super-state are subsidies and privileges from big government. What do intellectuals and opinion-moulders get out of it? An increasing number of cushy jobs in the bureaucracy, or in the government-subsidized sector, staffing the welfare-regulatory state, and apologizing for its policies, as well as propagandizing for them among the public. To put it bluntly, intellectuals, theorists, pundits, media elites, etc. get to live a life which they could not attain on the free market, but which they can gain at taxpayer expense--along with the social prestige that goes with the munificent grants and salaries.

This is not to deny that the intellectuals, therapists, media folk, et al., may be "sincere" ideologues and believers in the glorious coming age of egalitarian collectivism. Many of them are driven by the ancient Christian heresy, updated to secularist and New Age versions, of themselves as a cadre of Saints imposing upon the country and the world a communistic Kingdom of God on Earth.

Bottom line: Technocrats are no different than everyone else. They are human beings. They may have specialized knowledge covering certain areas of life, but they don’t have general expertise over the complex world of interacting human beings and of nature.

Technocrats have not been bestowed with omniscience enough to know and dictate on how we should live our lives. Instead, technocrats use their special ‘knowledge’ to advance their personal interests, by short circuiting market forces through politics, and who become tools for politicians or vested interest groups.

And that's why they are technocrats, they are afraid to put their knowledge to real tests by taking risks at the marketplace and rather hide behind the skirt of politics.

Thus, the idea of political efficacies from the philosopher king paradigm through modern day technocratic governance is a myth.