The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Monday, July 03, 2017

The Beauty and Perils of Narratives (Reasoning from Fait Accompli/Ticker Tape)

Tuesday, July 10, 2012

Graphic of the Day: Thou Shalt Not Commit Logical Fallacies

Wednesday, June 06, 2012

The Essence of Keynesian Economics

The following is an excerpt from a speech/keynote address by Dr. Richard Ebeling (hat tip Bob Wenzel) [bold emphasis mine, italics original]

The General Theory of Employment, Interest and Money was published on February 4, 1936. The essence of Keynes’s theory was to show that a market economy, when left to its own devices, possessed no inherent self-correcting mechanism to return to “full employment” once the economic system has fallen into a depression.

At the heart of his approach was the belief that he had demonstrated an error in Say’s Law. Named after the nineteenth-century French economist Jean-Baptiste Say, the fundamental idea is that individuals produce so they can consume. An individual produces either to consume what he has manufactured himself or to sell it on the market to acquire the means to purchase what others have for sale.

Or as the classical economist David Ricardo expressed it, “By producing, then, he necessarily becomes either the consumer of his own goods, or the purchaser and consumer of the goods of some other person . . . Productions are always bought by productions, or by services; money is only the medium by which the exchange is effected.”

Keynes argued that there was no certainty that those who had sold goods or their labor services on the market will necessarily turn around and spend the full amount that they had earned on the goods and services offered by others. Hence, total expenditures on goods could be less than total income previously earned in the manufacture of those goods. This, in turn, meant that the total receipts received by firms selling goods in the market could be less than the expenses incurred in bringing those goods to market. With total sales receipts being less than total business expenses, businessmen would have no recourse other than to cut back on both output and the number of workers employed to minimize losses during this period of “bad business.”

But, Keynes argued, this would merely intensify the problem of unemployment and falling output. As workers were laid off, their incomes would necessarily go down. With less income to spend, the unemployed would cut back on their consumption expenditures. This would result in an additional falling off of demand for goods and services offered on the market, widening the circle of businesses that find their sales receipts declining relative to their costs of production. And this would set off a new round of cuts in output and employment, setting in motion a cumulative contraction in production and jobs.

Why wouldn’t workers accept lower money wages to make themselves more attractive to rehire when market demand falls? Because, Keynes said, workers suffer from “money illusion.” If prices for goods and services decrease because consumer demand is falling off, then workers could accept a lower money wage and be no worse off in real buying terms (that is, if the cut in wages was on average no greater than the decrease in the average level of prices). But workers, Keynes argued, generally think only in terms of money wages, not real wages (that is, what their money income represents in real purchasing power on the market). Thus, workers often would rather accept unemployment than a cut in their money wage.

If consumers demand fewer final goods and services on the market, this necessarily means that they are saving more. Why wouldn’t this unconsumed income merely be spent hiring labor and purchasing resources in a different way, in the form of great¬er investment, as savers have more to lend to potential borrowers at a lower rate of interest? Keynes’s response was to insist that the motives of savers and investors were not the same. Income-earners might very well desire to consume a smaller fraction of their income, save more, and offer it out to borrowers at interest. But there was no certainty, he insisted, that businessmen would be willing to borrow that greater savings and use it to hire labor to make goods for sale in the future.

Since the future is uncertain and tomorrow can be radically different from today, Keynes stated, businessmen easily fall under the spell of unpredictable waves of optimism and pessimism that raise and lower their interest and willingness to borrow and invest. A decrease in the demand to consume today by income-earners may be motivated by a desire to increase their consumption in the future out of their savings. But businessmen cannot know when in the future those income-earners will want to increase their consumption, nor what particular goods will be in greater demand when that day comes. As a result, the decrease in consumer demand for present production merely serves to decrease the business¬man’s current incentives for investment activity today as well.

If for some reason there were to be a wave of business pessimism resulting in a decrease in the demand for investment borrowing, this should result in a decrease in the rate of interest. Such a decrease because of a fall in investment demand should make savings less attractive, since less interest income is now to be earned by lending a part of one’s income. As a result, consumer spending should rise as savings goes down. Thus, while investment spending may be slackening off, greater consumer spending should make up the difference to assure a “full employment” demand for society’s labor and resources.

But Keynes doesn’t allow this to happen because of what he calls the “fundamental psychological law” of the “propensity to consume.” As income rises, he says, consumption spending out of income also tends to rise, but less than the increase in income. Over time, therefore, as incomes rise a larger and larger percentage is saved.

In The General Theory, Keynes listed a variety of what he called the “objective” and “subjective” factors that he thought influenced people’s decisions to consume out of income. On the “objective” side: a windfall profit; a change in the rate of interest; a change in expectations about future income. On the “subjective” side, he listed “Enjoyment, Shortsightedness, Generosity, Miscalculation, Ostentation and Extravagance.” He merely asserts that the “objective” factors have little influence on how much to consume out of a given amount of income—including a change in the rate of interest. And the “subjective” factors are basically invariant, being “habits formed by race, education, convention, religion and current morals . . . and the established standards of life.”

Indeed, Keynes reaches the peculiar conclusion that because men’s wants are basically determined and fixed by their social and cultural environment and only change very slowly, “The greater . . . the consumption for which we have provided in advance, the more difficult it is to find something further to provide for in advance.” That is, men run out of wants for which they would wish investment to be undertaken; the resources in the society—including labor—are threatening to become greater than the demand for their employment.

Keynes, in other words, turns the most fundamental concept in economics on its head. Instead of our wants and desires always tending to exceed the means at our disposal to satisfy them, man is confronting a “post-scarcity” world in which the means at our disposal are becoming greater than the ends for which they could be applied. The crisis of society is a crisis of abundance! The richer we become, the less work we have for people to do because, in Keynes’s vision, man’s capacity and desire for imagining new and different ways to improve his life is finite. The economic problem is that we are too well-off.

As a consequence, unspent income can pile up as unused and uninvested savings; and what investment is undertaken can erratically fluctuate due to what Keynes called the “animal spirits” of businessmen’s irrational psychology concerning an uncertain future. The free market economy, therefore, is plagued with the constant danger of waves of booms and busts, with prolonged periods of high unemployment and idle factories. The society’s problem stems from the fact that people consume too little and save too much to assure jobs for all who desire to work at the money wages that have come to prevail in the market, and which workers refuse to adjust downward in the face of any decline in the demand for their services.

Only one institution can step in and serve as the stabilizing mechanism to maintain full employment and steady production: the government, through various activist monetary and fiscal policies.

In Keynes’s mind the only remedy was for government to step in and put those unused savings to work through deficit spending to stimulate investment activity. How the government spent those borrowed funds did not matter. Even “public works of doubtful utility,” Keynes said, were useful: “Pyramid-building, earthquakes, even wars may serve to increase wealth,” as long as they create employment. “It would, indeed, be more sensible to build houses and the like,” said Keynes, “but if there are political or practical difficulties in the way of this, the above would be better than nothing.”

Nor could the private sector be trusted to maintain any reasonable level of investment activity to provide employment. The uncertainties of the future, as we saw, created “animal spirits” among businessmen that produced unpredictable waves of optimism and pessimism that generated fluctuations in the level of production and employment. Luckily, government could fill the gap. Furthermore, while businessmen were emotional and shortsighted, the State had the ability to calmly calculate the long run, true value and worth of investment opportunities “on the basis of the general social advantage.”

Indeed, Keynes expected the government would “take on ever greater responsibility for directly organizing investment.” In the future, said Keynes, “I conceive, therefore, that a somewhat comprehensive socialization of investment will prove the only means of securing an approximation to full employment.” As the profitability of private investment dried up over time, society would see “the euthanasia of the rentier” and “the euthanasia of the cumulative oppressive power of the capitalist” to exploit for his own benefit the scarcity of capital. This “assisted suicide” of the interest-earning and capitalist groups would not require any revolutionary upheaval. No, “the necessary measures of socialization can be introduced gradually and without a break in the general traditions of the society.”

This is the essence of Keynes’ economics.

Read more about the policy influences from Keynesian economics by Dr. Ebeling here

I would add that the Keynesian economics has been fraught with many logical fallacies but had been gained wide acceptance due to its math models or aggregate driven analysis.

Nonetheless one standout among the many logical fallacies would be Begging the Question where (Nizkor Project)

Begging the Question is a fallacy in which the premises include the claim that the conclusion is true or (directly or indirectly) assume that the conclusion is true

The embedded conclusion is that government is the elixir while the market is the problem, thus, all premises have been adjusted to conform to these even if the logical sequence of their argument becomes self-contradictory (yes thus the crisis of abundance!)

In short, the cart before the horse reasoning.

Keynesianism is essentially heuristics but garbed with mathematical formalism.

So when practitioners of the faith are caught with their internal logical inconsistencies, they deliberately resort to verbal prestidigitation (usually by using moral high ground of social justice based on short term solutions) as an escape mechanism.

Thursday, May 10, 2012

Quote of the Day: A Foolish Thing is a Foolish Thing

The following quote seems profoundly relevant especially to politics and media, and has likewise noticeable influence on the financial markets or even in social networking media such as Facebook.

If fifty* million people say a foolish thing, it is still a foolish thing.

That’s from Anatole France, French author and winner of the Nobel Prize in Literature (1921), as quoted in Listening and Speaking : A Guide to Effective Oral Communication (1954) by Ralph G. Nichols and Thomas R. Lewis, p. 74 (Wikiquote.org)

*the common attribution has been “If a million people”…

Tuesday, March 13, 2012

The Toxicity of Mainstream News

Chris Mayer at the Daily Reckoning explains why we should not rely on mainstream news as source for decision making (bold emphasis mine)

Dobelli’s analogy with food is a good one. We know if you eat too much junk food, it makes us fat and can cause us all kinds of health problems. Dobelli makes a good case that the mind works the same way. News is brightly colored candy for the mind.

News is systematically misleading, reporting on the highly visible and ignoring the subtle and deeper stories. It is made to grab our attention, not report on the world. And thus, it gives us a false sense of how the world works, masking the truer probabilities of events.

News is mostly irrelevant. Dobelli says to think about the roughly 10,000 news stories you’ve read or heard over the past year. How many helped you make a better decision about something affecting your life? This one hit home…

We get swamped with news, but it is harder to filter out what is relevant — which gets me to another point that hit home. Dobelli talks about the feeling of “missing something.” When traveling, I sometimes have this feeling. But as he says, if something really important happened, you’d hear about it from your friends, family, neighbors and/or co-workers. They also serve as your filter. They won’t tell you about the latest antics of Charlie Sheen because they know you won’t care.

Further, news is not important, but the threads that link stories and give understanding are. Dobelli makes the case that “reading news to understand the world is worse than not reading anything.” In markets, I find this is true. The mainstream press has little understanding of how markets work. They constantly report on trivia and make links where none exist for the sake of a story, or just for the sake of having something that “makes sense.”

In markets, reporters try to explain the market every day. “The market falls on Greek news” is an example. Better to not read anything if you’re going to take this kind of play-by-play seriously at all.

The fact is we don’t know why lots of things happen. We can’t know for sure why, exactly, things unfolded just as they did when they did. As Dobelli writes, “We don’t know why the stock market moves as it moves. Too many factors go into such shifts. Any journalist who writes, ‘The market moved because of X’... is an idiot.”

You contaminate your thinking if you accept the neat packages news provides for why things happen. And Dobelli has all kinds of good stuff about how consuming news makes you a shallow thinker and actually alters the structure of your brain — for the worse.

News is also costly. As Dobelli points out, even checking the news for 15 minutes three times a day adds up to more than five hours a week. For what? He uses the example of the Mumbai terror attacks in 2008. If a billion people spent one hour of their attention on the tragedy by either reading about it in the news or watching it, you’re talking about 1 billion hours. That’s more than 100,000 years. Using the global life expectancy of 66 years means the news consumed nearly 2,000 lives!

Pretty wild, right?

So what to do? Dobelli recommends swearing off newspapers, TV news and websites that provide news. Delete the news apps from your iPhone. No news feeds to your inbox. Instead, read long-form journalism and books. Dobelli likes magazines like Science and The New Yorker, for instance.

News and analysis from the mainstream usually represents oversimplified narration of facts that has been typically grounded from cognitive biases (heuristics) and logical fallacies.

Also because news outfits are profit based businesses, their presentations are often designed to generate or to solicit public’s attention through sensationalist reporting or through supposed “analytical” discussions mostly predicated on the emotive dimensions.

Moreover because news outfits have enormous influence on voters, they have embedded ties with the establishment as they reciprocate each other in projecting "noble"political goals. Thus media's bias has been to promote the establishment's interests and frequently serve as discreet channels for political propaganda.

Noticeably most of their arguments have been focused on personality issues rather than the objective evaluation of the system.

Yet their basic recourse to any social problem would be to: 1) change the leader, 2) throw money at the problem, 3) prohibit or intervene on any supposed social ills or 4) tax particular groups. No one ever sees how their proposed interventionism creates more problems which they intend to resolve.

Except for the facts I usually refrain from reading or listening to any of their stupefying analysis.

And I firmly agree with Mr. Dobelli who is quoted above saying “reading news to understand the world is worse than not reading anything”. I’d rather be dumb than be indoctrinated with a quack view of the world.

Friday, March 09, 2012

Draghi’s Defense of ECB’s Balance Sheet Expansion: Two Wrongs Make a Right

From the Wall Street Journal Blog

One thing we all know about Mario Draghi now: he reads the papers.

The European Central Bank president used his monthly press conference to take issue with a recent Wall Street Journal article on the ECB’s balance sheet now exceeding three trillion euros after it pumped a total of one trillion euros in three-year loans into European banks.

The ECB’s balance sheet equals one-third of euro-zone GDP, a bigger share than the Federal Reserve’s balance sheet, which makes up 19% of U.S. GDP, and the Bank of England’s, which is 21% of U.K. GDP, the article noted.

“You conclude that the expansion in the euro area is bigger than it is in the U.S. or the U.K.,” Mr. Draghi said.

Mr. Draghi’s point was that looking at the total size of the balance sheet gives an incomplete view. The ECB holds large amounts of gold and currency reserves on its books that have nothing to do with monetary policy, he said. The Fed’s balance sheet, he said, “is very, very lean” in that regard, and “the Bank of England is also the same.”

Instead, Mr. Draghi said the share of assets related to monetary policy is the more relevant indicator of risk. By that measure the ECB’s balance sheet is at 15% of GDP compared to 19% for the Federal Reserve and 21% for the Bank of England, he said.

“At the present time to say the risks for the ECB balance sheet are now higher than what they are in the Fed and Bank of England is not correct,” he said.

Mr. Draghi does not deal with the merits or the essence and risk-reward or the consequences of the ECB’s actions, instead he applies the logical fallacy of two wrongs make a right—everybody is doing it, mine has been less than the others. This is also an example of a red herring (Ignoratio elenchi) argument which attempts to distract the public.

Yet the above is an illustration of the typical communications approach anchored on sophistry used by political authorities to justify their proposals or actions.

Tuesday, January 10, 2012

State Propaganda, Post Hoc Fallacies and Critical Thinking

The North Korean government says that nature has been sympathizing with the recent loss of their leader.

The Reuters reports,

The passing of North Korean strongman Kim Jong-il has been marked by plunging temperatures, mourning bears and now, according to North Korean state media, by flocks of magpies.

Kim, who died in December aged 69 years after 17 years running the world's most reclusive state, was reputed to be able to control the weather, as well as to have scored a miraculous 38 under par round of golf.

"At around 17:30 on December 19, 2011, hundreds of magpies appeared from nowhere and hovered over a statue of President Kim Il Sung on Changdok School campus in Mangyongdae District, clattering as if they were telling him the sad news," state news agency KCNA reported on Monday.

To an outsider this would be read as absurd, because it is.

But unknown to most, such medium of political communication represents the dominant or mainstream way of how social issues are dealt or tackled with by the political order and by the political establishment influenced media—whether in the US, the Philippines or anywhere around the world.

Most of media’s treatment revolves around the same fallacy: Post hoc ergo propter hoc or “after this, therefore because of this"

Whether social issues as anthropomorphic global warming, trade imbalances, the ‘necessity’ of government spending, militant foreign policy, retributionist healthcare and education and others, hardly anyone seem to care about the research or analytical methodologies used for arriving at implied conclusions.

These social events are considered as given or as ‘facts’ which are mostly backed by references of politicians and or their academic and or institutional factotums (where the latter’s arguments have been premised on math ‘models’).

That’s the difference between the blatant propaganda by the North Korean media and the subtle propaganda masqueraded as well thought public issues in mainstream politics and media.

And the ensuing public debate would mostly center on these assumed ‘facts’ which only magnifies the influence of state propaganda to the public—mostly through the power of suggestion, which again are predicated on the veracity of these assumptions.

As Lenin once said,

A lie told often enough becomes the truth

In short, what the public sorely lacks is critical thinking. Yet the absence of critical thinking is what makes the public crucially vulnerable to political manipulation.

Monday, November 22, 2010

Ireland’s Woes Won’t Stop The Global Inflation Shindig

``When governments try to confer an advantage to their exporters through currency depreciation, they risk a war of debasement. In such a race to the bottom, none of the participants can gain a lasting competitive edge. The lasting result is simply weaker and weaker currencies against all goods and services — meaning higher and higher prices. Inflationary policies do not confer lasting advantages but instead make it more difficult to plan for the future. Stop-and-go inflationary policies actually reduce the benefits of using money in the first place.” Robert P. Murphy Currency Wars

For the mainstream, effects are usually confused with the cause to an event. And the misdiagnosis of the symptoms as the source of the disease frequently leads to the misreading of economic or financial picture which subsequently entails wrong policy prescriptions or erroneous predictions.

Yet many mainstream pundits, whom has had a poor batting average in predicting of the markets, have the impudence, premised on either their perceived moral high grounds or their technical knowledge, to prescribe reckless political policies that would have short term beneficial effects at the costs of long term pain with a much larger impact.

Take for instance currency values. Many pundits tend to draw upon “low” currency values as the principal means of attaining prosperity via the “export trade” route. As if low prices mechanically equates to strength in exports. And it is mainly this reason why these so called experts support government interventionism via currency devaluation.

Yet what is largely ignored is that in the real world most of the world’s largest exporters have currencies that are relatively “pricier”, and that most of the “cheap” currency economies tend to be laggards in trade—the latter mostly being closed economies.

In contrast to mainstream thinking, prosperity isn’t about the unwarranted fixation of currency values, but about societies that promotes competitiveness and capital accumulation.

As Ludwig von Mises once wrote[1], (bold emphasis mine)

The start that the peoples of the West have gained over the other peoples consists in the fact that they have long since created the political and institutional conditions required for a smooth and by and large uninterrupted progress of the process of larger-scale saving, capital accumulation, and investment.”

In other words, prosperity emanates from a society which respects the sanctity of property rights premised on the rule of law, which subsequently acts as the cornerstone or foundations of free trade and economic freedom that shapes the state of competitiveness of the economy.

The allure of the polemics of “cheap” currency is no less than “smoke and mirror” chicanery aimed at promoting the interests of a politically privileged class that does little or nothing to advance general welfare.

In short, what is being passed off or masqueraded as an expert economic opinion, is no less than a political propaganda.

Discipline As Basis For Bearishness?

And this applies as well to debt.

Many see the humongous debt load by developed nations as the kernel of the most recent economic crisis. They also use the debt argument as the main basis in projecting the path of economic and financial progress.

Yet debt serves NOT as the principal cause, but as a SYMPTOM of an underlying cause.

It is the collective monetary and administrative policies that have promoted debt financed consumption predicated on the presumed universal validity of AGGREGATE DEMAND that has been responsible for most of the present woes. This has largely been operating for the benefit the government-banking industry-central banking cartel worldwide[2]. Yet such irresponsible policies have spawned endless boom bust cycles and outsized government debts from repeated bailouts and various redistribution schemes which ultimately end in tears. Yet no lesson is enough to restrain these pundits from making nonsensical rationalizations of encouraging a repeat of the same mistakes.

The point is, redistribution has its limits, and we may be reaching the tipping point where the natural laws of economics will undo such false economic premises. And this would represent the grand failure of Keynesian economics from which today’s paper money standard has largely been anchored upon.

For instance the current woes in Ireland, which has not been about the imploding unwieldy social welfare programs yet, but has been about the BLANKET GUARANTEES issued by the Irish government to some of their major ‘too big to fail’ banks, have been used by perma bears to argue for the revival of the ‘deflation’ bogeyman.

While the Ireland debt crisis seem to share a similar characteristic to that of the experience of Iceland[3] in 2008, where the presumed ascendancy or infallibility of government “guarantees” crumbled in the face of economic laws, Ireland’s case is different in the sense that there appears to be political manoeuvring behind the pressure for the latter to comply with the proposed bailout.

Rumors have been rife that the proposed bailout of Ireland have been meant to raise Ireland’s exceptionally low 12.5% corporate tax rates, which has been an object of contention by European policymakers, most especially by the European Central Bank (ECB)

According to the Wall Street Journal[4],

``Brussels has always resented that Ireland transformed its economic fortunes by cutting corporate income taxes and marginal tax rates. At various times, the EU has sued Ireland to raise its rates, accused it of "social dumping" for having a 12.5% corporate income tax, and threatened to cut off European subsidies unless it hiked taxes. None of it worked, but now, with Ireland's banks teetering and its economy in its worse shape in a generation, Europe is moving in for the kill.”

And what better way to compel Ireland to accede to the whims of the bureaucrats in Brussels than to force a crisis from which Ireland would need to accept political conditionalities in exchange for a rescue!

Of course, politicians such as French President Nicolas Sarkozy had been quick to deny the political blackmail[5], saying that “But that’s not a demand or a condition, just an opinion.”

However the important point is that what is being misread by the mainstream as an economic predicament is actually a self inflicted mayhem arising from the political ruse meant at achieving certain political goals.

And unelected politicians have used the markets, largely conditioned to the moral hazard of bailouts and inflationism, to advance their negotiating leverage.

Another point I wish to make is that Euro bears have emphasized that the decision by some Eurozone members to assimilate fiscal austerity has been interpreted as a reason to be bearish on the Euro.

For this camp, the alleged political angst from imposing fiscal discipline would allegedly force the disintegration of the currency union. This is plain AGGREGATE DEMAND based hogwash.

How can it be bearish for individuals or nations (which comprises a community of individuals within defined territorial or geographical boundaries) to act on cleaning up their balance sheets? The excuse is that the lack of AGGREGATE DEMAND will pose as a drag to the economy undergoing the process of “develeraging” from which the government should takeover. What works for the individuals does NOT work for the nation.

Of course the distinction of the paradox can viewed based on time preferences: short term negative and long term positive. People who emphasize on the long term see the positive effects of the structural adjustments even amidst the necessary process of accepting short term pain. Like any therapeutic process, it takes time, regimented diet and regular exercise to recover. There is no short cut, but to observe and diligently work by the process.

On the other hand, there are those who cannot accept any form suffering, or the entitlement mentality. And this mindset characterises the advocates of short term policy fixes.

For politicians who depend on the electoral process to remain in office, any form of suffering represents a taboo as this would signify as loss of votes and consequently the loss of office. Thus, politicians have used short term premised Keynesian economics to justify their actions mostly via the magic of turning bread into stones—printing money.

For unelected bureaucrats the incentives are almost similar, the consequences of any imbalances must be kicked down the road and burden the next officeholder.

For academic or professional supporters, whom are employed in the industries that have privileged ties with the government or whose institutions are funded directly or indirectly by the government, they serve as mouthpieces for these interest groups by embellishing propaganda with expert opinion covered by mathematical models.

The point is this that the AGGREGATE DEMAND paradigm from debt based consumption is not only unsustainable but unrealistic. Yet mainstream experts purposely confuse interpreting the effects as the cause to advance vested interest or for blind belief from dogmatism.

Remaining Bullish On The Euro

And having to confuse effects with the cause is one way to take the wrong side of the markets.

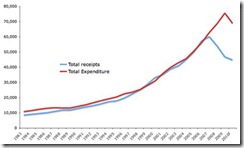

Figure 1: Ireland Government’s Spending Binge

As we pointed out above it is not debt but the incentive by politicians to spend taxpayer money to the point of accruing heavy debt loads that has aggravated the present woes.

As Cato’s Dan Mitchell[6] points out in the case of Ireland,

``When the financial crisis hit a couple of years ago, tax revenues suddenly plummeted. Unfortunately, politicians continued to spend like drunken sailors. It’s only in the last year that they finally stepped on the brakes and began to rein in the burden of government spending. But that may be a case of too little, too late.”

And contrary to the outlook of the Euro bears, the incumbent low corporate taxes seem likely to attract many investors into Ireland.

According to the Economist[7],

IDA Ireland, the agency that targets such investors, says FDI in 2010 will be the best for seven years. A new generation of firms, including computer-gaming outfits like Activision Blizzard and Zynga, are joining the established operations of Intel and Google. Ireland’s workforce is young, skilled and adaptable. Rents are coming down even faster than wages.

So not limited to low taxes, Ireland’s less activist government has resulted to more market based responses in the economy that seems to have also been generating incentives for investors to react positively in spite of the ongoing crisis.

Euro bears are wrong for interpreting discipline and responsible housekeeping as a bearish sign, and equally mistaken for prescribing unsustainable policies that play by the book of mercantilists.

We must be reminded of Professor von Mises’ advise on assessing currency values where ``valuation of a monetary unit depends not on the wealth of a country, but rather on the relationship between the quantity of, and demand for, money”[8]

This means that in terms of relative policies between the US and the Eurozone, the policy of inflationism as administered by the US monetary authorities, seem to tilt the relationship between the quantity (via Euro austerity) and demand, in favour the Euro, whose rally we have rightly predicted[9] in mid of this year.

Alternatively this means that any dip should be considered as a short term countercyclical trend or must be considered a buying window.

Misunderstanding Deflation

Finally, those who continually obsess over the prospects of a deflation environment similar to that of the Great Depression are bound to be incorrigibly wrong.

The Great Depression wasn’t not only a result of contraction of money supply via collapsing banks, but likewise the curtailment of trade from rampant protectionism (Smoot Hawley) and obstructionist policies (regime uncertainty) that inhibited the incentive of the public to invest.

Left to its own devise and unobstructed by government, the marketplace would result to an optimal supply of money. This means for as long as globalization remains operational there won’t be “deflation”.

As another great Austrian Economist, Murray N. Rothbard explained[10],

But money is uniquely different. For money is never used up, in consumption or production, despite the fact that it is indispensable to the production and exchange of goods. Money is simply transferred from one person’s assets to another. Unlike consumer or capital goods, we cannot say that the more money in circulation the better. In fact, since money only performs an exchange function, we can assert with the Ricardians and with Ludwig von Mises that any supply of money will be equally optimal with any other. In short, it doesn’t matter what the money supply may be; every M will be just as good as any other for performing its cash balance exchange function.

If there is any deflation it won’t be from what the mainstream expects, because price deflation would emanate from productivity growth instead of debt deflation, Think mobile phones or computers.

And that’s the reason why perma bears have gotten it miserably wrong, even all the credit indicators previously paraded to argue their case based on the flawed AGGREGATE DEMAND have NOT materialized[11] and worked to their directions.

Now that these indicators either have bottomed out or have manifested signs of improvements, they have NOT been brandished as examples.

So perma bears have been desperately looking for scant real world evidence to support their views.

Bond Markets Reveal Upsurge In Inflation Expectations

IF there would be any ONE thing that would crush the ongoing liquidity party it would be a chain of interest rates increases that eventually would reach levels that would trigger many projects or speculative positions financed by leverage or debt as unprofitable. This would be the credit cycle as narrated by Hyman Minsky.

This means that a bubble fuelled by systemic leverage would be pricked by the proverbial interest rate pin that would unleash a cascade of asset unwinding. This has been a common feature of our paper money system which only shifts from certain asset markets to another.

The motion of rising interest rates would surface from a pick-up in credit demand, which may reflect on policy induced illusory economic growth, broad based consumer inflation as a consequence to sustained monetary inflation or a dearth of capital, which may be prompted for by a surge of protectionism, a collapse in the banking system or snowballing questions over the credit quality on major institutions, if not on claims on sovereign liabilities.

Figure 2: Municipal Bonds by Rising Yields Over The Long End

Despite the recent statistical reports of muted consumer price inflation which marked “the smallest increase since records started in 1957”[12], one must be reminded that consumer price indices represent a basket of goods, services and assets based on the construct of the US government. And these hardly reflect on the accuracy of the real rate of consumer price inflation because they are determined based on the interpretation of government technocrats on what they perceive constitutes as a meaningful measure of “inflation” based on the aggregate assumptions.

So even if food and oil prices have been rising (CCI index in figure 2) it appears that these increases have hardly filtered into the government’s statistical data.

Yet the contradiction appears to have been vented on the bond markets as US treasury yields surge across the long end of the curve as seen in the US 1 year yield (UST1Y) and the 10 year yields (TNX).

As we have been echoing the view of Austrian economists, the inflation which signifies as a political process, would have uneven effects on the economy.

As Professor von Mises wrote, (bold highlights mine)

``Changes in money prices never reach all commodities at the same time, and they do not affect the prices of the various goods to the same extent. Shifts in relationships between the demand for, and the quantity of, money for cash holdings generated by changes in the value of money from the money side do not appear simultaneously and uniformly throughout the entire economy. They must necessarily appear on the market at some definite point, affecting only one group in the economy at first, influencing only their judgments of value in the beginning and, as a result, only the prices of commodities these particular persons are demanding. Only gradually does the change in the purchasing power of the monetary unit make its way throughout the entire economy.

So yes the ‘definite point’ where the symptoms of inflation appear to emerge can be seen in emerging markets, commodities and commodity related industries, with the succession of growing inflation expectations permeating presently into the bond markets.

Remember, recently investors bought into US Treasury Inflation Protected Securities (TIPs) at negative interest rates[13] indicative of mounting expectations of the resurgence of inflation.

So pundits sarcastically questioning “inflation where” are misreading the gradualist dynamics of deepening and spreading inflation. They will instead show you employment data and output gap to argue for “no” inflation regardless of what the bond, stockmarket and commodity markets have been saying.

The other sins of omission by the mainstream has been to read present trends as tomorrow’s dynamics.

Now the tax free US municipal bond markets had likewise been slammed by the surging treasury yields (despite the Fed’s QE 2.0 aimed at keeping interest rates at artificially low levels). As long term US treasury yields have soared, so has these tax free yields.

Other reasons attributed[14] to the recent collapse in muni bond markets have been the expectations of more issuance from many revenue strained states and the potential abbreviation of issuance of Build American Bonds (BABs) given a gridlocked in the US House of Congress, which may have prompted for a deluge of offering in order beat the deadline.

In my view, all these other excuses appear to be secondary to the deepening trend of inflation expectations.

Of course rising interest rates would also put more pressure on the already strained recovery in the US housing markets which I believe has been the object of QE 2.0.

Yet earlier this year we have debunked claims by the government officials and the mainstream pundits supporting the notion of “exit strategies” which I labelled as Poker bluff[15]. (Yes we are once again validated)

And this means that further stress into the housing markets which would translate into balance sheet problems for the US banking system will be perceived by officialdom as requiring more QE’s. So you can expect the Federal Reserve to feed on more QEs as strains on the housing sector remain unresolved.

Another beneficiary of the QE has been the US Federal government. While government spending may be curtailed under the new US Congress, concerns by emerging markets over “currency wars” may lead to less appetite in financing of US debts. This implies that the US will likely resort to the age old ways of financing deficits-debase of the currency. In short, more QEs to come.

So what all these imply for the markets?

It’s still an inflation shindig ahead.

Of course considering the inflation process distorts the market mechanism, we should expect sharp swings in the upside as well as the downside, but with the upside trend becoming more dominant as US monetary authorities resort to more QEs which will be transmitted globally.

Nevertheless, the so-called “crack up boom” or the flight from paper money appears to be taking place worldwide as gold has been fervently rising against all currencies.

With markets expectations over inflation getting more widespread, stay long commodity or commodity related investments.

Lastly, avoid the confusion trap of misreading effects as causes.

[1] Mises, Ludwig von, Period of Production, Waiting Time, and Period of Provision, Chapter 18 Section 4, Human Action

[2] See QE 2.0: It’s All About The US Banking System, November 8, 2010

[3] See Iceland, the Next Zimbabwe? A “Riches To Rags” Tale?, October 14, 2008

[4] Wall Street Journal Editorial Target: Ireland, October 5, 2010

[5] Bloomberg.com Ireland Aid From EU Won’t Require Tax Increase, Sarkozy Says, November 21, 2010

[6] Mitchell, Daniel J. Don’t Blame Ireland’s Mess on Low Corporate Tax Rates, November 18, 2010

[7] The Economist, Saving the euro, November 18, 2010

[8] Mises, Ludwig von Monetary Stabilization And Cyclical Policy (1928) The Causes Of The Economic Crisis, p.18

[9] See Buy The Peso And The Phisix On Prospects Of A Euro Rally June 14, 2010

[10] Rothbard, Murray N. Mystery of Banking, p. 34

[11] See Trick Or Treat: The Federal Reserve’s Expected QE Announcement, October 31, 2010

[12] Reuters.com Dollar hampered by tame U.S. inflation data November 17, 2010

[13] See Trick Or Treat: The Federal Reserve’s Expected QE Announcement, October 31, 2010

[14] Mousseau, John The Spike in Muni Yields - an Opportunity, cumber.com November 16, 2010

[15] See Poker Bluff: The Exit Strategy Theme For 2010, January 11, 2011

Tuesday, August 31, 2010

Is Sound Money Incompatible With Democracy?

One of the recent feedbacks I received is the attribution that sound money can’t be compatible with democracy. The implication is that inflationism is an indispensable instrument for democratic survival.

Of course, this assertion accounts no less than an arrant bunk (nonsense) for the following reasons:

One, this serves as an example of argumentum ad populum (appeal to popularity), where the belief of the many holds that the argument is true.

Just because many seek to live off at the expense of the others this doesn’t mean that their demands are necessarily justifiable or valid and should be provided for.

This is similar to the unwisdom of the crowds which we have recently critiqued. Moreover, these proponents seem oblivious to the fact that populist policies tend to self-destruct overtime. What is unsustainable won’t last.

Second, the alleged incompatibility is also misleading because this operates on the premises of the 'tyranny of the majority' or the rule of the mob.

Say for example, 10 persons get stuck in a remote island where only one of them is a woman. Yet 6 of the male elected to force themselves on her. Is the majority’s action justified? The answer is obviously NO. The means to an end isn’t justified by mere numbers.

What is needed is the rule of law, of which inflationism chafes at.

As Friedrich A. von Hayek wrote in the Decline of the Rule of Law, Part 1

The main point is that, in the use of its coercive powers, the discretion of the authorities should be so strictly bound by laws laid down beforehand that the individual can foresee with fair certainty how these powers will be used in particular instances; and that the laws themselves are truly general and create no privileges for class or person because they are made in view of their long-run effects and therefore in necessary ignorance of who will be the particular individuals who will be benefited or harmed by them. That the law should be an instrument to be used by the individuals for their ends and not an instrument used upon the people by the legislators is the ultimate meaning of the Rule of Law.

Three, the collectivist charade is to sell popular wisdom to the economic ignoramus. The collectivists forget to tell everyone that inflationism is a redistribution scheme which benefits the minority at the expense of society.

As Jörg Guido Hülsmann wrote in Deflation and Liberty (emphasis added)

``Inflation is an unjustifiable redistribution of income in favor of those who receive the new money and money titles first, and to the detriment of those who receive them last. In practice the redistribution always works out in favor of the fiat-money producers themselves (whom we misleadingly call central banks) and of their partners in the banking sector and at the stock exchange. And of course inflation works out to the advantage of governments and their closest allies in the business world. Inflation is the vehicle through which these individuals and groups enrich themselves, unjustifiably, at the expense of the citizenry at large. If there is any truth to the socialist caricature of capitalism—an economic system that exploits the poor to the benefit of the rich—then this caricature holds true for a capitalist system strangulated by inflation. The relentless influx of paper money makes the wealthy and powerful richer and more powerful than they would be if they depended exclusively on the voluntary support of their fellow citizens. And because it shields the political and economic establishment of the country from the competition emanating from the rest of society, inflation puts a brake on social mobility. The rich stay rich (longer) and the poor stay poor (longer) than they would in a free society.”

Fourth, what collectivists see as essential is actually the opposite. History reveals that democracy and sound money has had and can have a symbiotic relationship.

In The Gold Standard, Indirect Exchange section of the epic Human Action, Ludwig von Mises wrote, (bold emphasis mine)

``The gold standard was the world standard of the age of capitalism, increasing welfare, liberty, and democracy, both political and economic. In the eyes of the free traders its main eminence was precisely the fact that it was an international standard as required by international trade and the transactions of the international money and capital market. It was the medium of exchange by means of which Western industrialism and Western capital had borne Western civilization into the remotest parts of the earth's surface, everywhere destroying the fetters of age-old prejudices and superstitions, sowing the seeds of new life and new well-being, freeing minds and souls, and creating riches unheard of before. It accompanied the triumphal unprecedented progress of Western liberalism ready to unite all nations into a community of free nations peacefully cooperating with one another.”

Finally, the hucksters of false promises of inflationism are no less than blinded by economic dogma whose foundations seem to operate outside the realm of the law of scarcity—yes fantasyland.

As Ron Paul wrote on Why Governments Hate Gold, (bold emphasis mine)

``Time and again it has been proven that the Keynesian system of big government and fiat paper money are abject failures in the long run. However, the nature of government is to ignore reality when there is an avenue that allows growth in power and control. Thus, most politicians and economists will ignore the long-term damage of Keynesianism in the early stage of a bubble when there is the illusion of prosperity, suggesting that the basic laws of economics had been repealed.”

Hardly does any of these fanatics have ever explained why throughout the centuries, experiments with paper money has ALWAYS failed.

Of course if one believes redistribution is a way or a path to prosperity, then apparently they are merely deluding themselves.

As Henry Hazlitt once wrote,

Any attempt to equalize wealth or income by forced redistribution must only tend to destroy wealth and income. Historically the best the would-be equalizers have ever succeeded in doing is to equalize downward. This has even been caustically described as their intention.

The collectivists amuse us with their logical fallacies, incoherent theories, misleading definitions, short term nostrums, and misinterpretation and deliberate twisting of facts.

For them it’s not about being right, but about blind faith.

Beware of false prophets.

Tuesday, June 22, 2010

Thought Of The Day: The Keynesian Circular Thought Process

Thursday, June 17, 2010

Thought Of The Day: The Fallacy of Deficit Spending

(bold highlights mine)

Tuesday, June 15, 2010

Putting The TED Spread Into Perspective

Yet seen from a 5-year period, the perspective dramatically changes.