The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Tuesday, October 06, 2015

Friday, July 12, 2013

Quote of the Day: Quackroeconomics

In discussions of macroeconomic policy in Washington and in the press, these four propositions are taken as given:(S) Spending is what drives the economy. Spending creates jobs, and jobs create spending. When unemployment is high, the problem is too little spending.(M) Monetary policy must steer the economy carefully between overheating and slumping. Doing so requires high levels of skill and intellectual resources.(F) Fiscal policy is just as important. When there is unemployment, monetary policy cannot do the job alone, because the Federal Reserve also has to keep an eye on inflation. So the Federal government must engage in deficit spending to stimulate the economy.(C) Computer models are essential tools that enable economists to forecast the economy and assess the impact of alternative economic policies. Using computer models, the Congressional Budget Office is able to score the number of jobs a particular policy will add to or subtract from the economy.These four propositions are what I term quack macroeconomics, or quackroeconomics for short. Like quack medicine, quackroeconomics is unproven, unreliable, inconsistent with the views of leading researchers in the field, and possibly dangerous.

Saturday, May 25, 2013

Iceland’s Recovery: Hardly about Currency Devaluation

Iceland’s recent devaluation was highly orthodox policy condition for wards of the IMF (strings attached to a $2 bn. loan). Unfortunately, such devaluations often backfire by inflating commodity costs, interest rates and the burden of foreign debt. The Icelandic krona fell from 64 to the dollar in 2007 to 123.6 in 2009, before strengthening with the economy to nearly 116 in 2011.Since oil, grains and metals are priced in dollars, the 2008-2009 devaluation inflated Iceland’s cost of production and cost of living. Inflation rose from 5.1 percent in 2007 to 12 percent or more in 2008 and 2009; real GDP fell by 6.8 percent in 2009 and 4 percent in 2010. Faced with a collapsing currency, the central bank interest rate was hiked to 18 percent by October 2008. It could have been worse. If Iceland’s Supreme Court had not nullified loans indexed to foreign currencies in June 2010, devaluation would have doubled the cost of repaying foreign debt.Devaluation was supposed to boost GDP by making imports costly and exports cheap, thus narrowing the trade deficit. The current account deficit did fall after 2008, but that always happens when recessions slash imports. Ireland had a current account surplus from 2010 to 2012 without devaluation, even as Iceland’s current account deficit was still 7-8 percent of GDP.Iceland’s economy grew by 3.1 percent in 2011 when the currency appreciated and the budget deficit was deeply cut to 4.4 percent of GDP. Devaluation explains the previous spike in inflation and interest rates, but little else.

Monday, May 06, 2013

Phisix 7,200: Up, up and away! The Illusions of Comfort

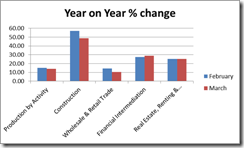

Loans for production activities—which comprised more than four-fifths of banks’ aggregate loan portfolio—grew at a slower pace of 14.2 percent in March from 15.1 percent (revised) in February. Similarly, the growth in consumer loans eased to 10.8 percent in March from 11.9 percent in February due mainly to the slowdown across all types of household loans.The expansion in production loans was driven primarily by increased lending to the following sectors: real estate, renting, and business services (25.2 percent); financial intermediation (28.8 percent); transportation, storage and communication (26.2 percent); wholesale and retail trade (10.4 percent); and, electricity, gas and water (15.4 percent). Meanwhile, lending to agriculture, hunting, and forestry (-10.3 percent) continued to decline in March.

Domestic liquidity (M3) increased by 11.4 percent year-on-year (y-o-y) in March to reach P5.1 trillion. This growth was faster than the 9.4 percent (revised) expansion recorded in the previous month. On a monthly basis, seasonally-adjusted M3 also expanded at a faster pace of 1.5 percent compared to the 0.2 percent (revised) month-on-month growth in February.The growth in money supply was driven largely by the sustained expansion in net domestic assets (NDA). NDA increased by 20.4 percent y-o-y in March from 16.5 percent (revised) in the previous month due largely to the continued increase in credits to the private sector, reflecting the robust lending activity of commercial banks. Claims on the private sector increased by 12.7 percent in March. Similarly, claims on the public sector increased by 12.3 percent in March, reversing the 6.5 percent decline (revised) in the previous month, a result of the increase in credits to the National Government (NG) and the decline in NG deposits.

Capital inflows went to PSE-listed securities (US$2.0 billion or 84.2 percent), Peso GS (US$351 million or 15.0 percent) and Peso time deposits (US$18 million or 0.8 percent). For PSE-listed securities, the main beneficiaries were holding firms (US$510 million), property companies (US$454 million), banks (US$333 million), telecommunication firms (US$185 million), and food, beverage and tobacco companies (US$183 million).

Joblessness in the country worsened in the first quarter of the year, the latest Social Weather Stations (SWS) survey found, with an economist tracing the rise in unemployment rate to fresh graduates joining the labor pool.Filipino adults without jobs numbered 11.1 million, up 10 percent from the 10.1 million recorded at the end of 2012, results of the survey that SWS conducted from March 19 to 22 showed.

The illusion that one understands the past feeds further illusion that one can predict and control the future. These illusions are comforting. They reduce the anxiety that would experience if we allowed ourselves to fully acknowledge the uncertainties of existence. We all need for the reassuring message that actions have appropriate consequences, and that success will reward wisdom and courage. Many business books are tailor-made to satisfy this need.

S&P estimated that the country’s per capita income (the total value of the economy’s output divided by the population) would settle at $2,850 this year, a level lower than those of most countries with the same credit rating.“The Philippine economy’s low income level remains a key rating constraint. The concentrated nature of the economy, infrastructure shortfalls and restrictions on foreign ownership, which deter foreign investment, are factors that hamper growth,” S&P said.

Alas, one cannot assert authority by accepting one’s own fallibility. Simply people need to be blinded by knowledge—we are made to follow leaders who can gather people together because the advantages of being in groups trump the disadvantages of being alone. It has been more profitable for us to bind together in the wrong direction than to be alone in the right one. Those who have followed the assertive idiot rather than the introspective wise person have passed us some of their genes

To avoid the middle-income trap, one must increase investments and expand the economy’s absorptive capacity. Now is a very good time to do that given the low interest rates and sufficient liquidity that can be tapped for investment activitiesGovernment spending has gone up over the last three years, and it has significantly contributed to the country’s growth. The private sector should now invest more and serve as the main growth driver of the economy

the more intervention, the lesser the capital accumulation or reduced economic growth. When politicians become greedy enough to divert much wealth into policy driven consumption activities then productivity diminishes. And that's where the so-called statistical 'trap' comes in.

Southeast Asia's efforts to create a single market by 2015 are in their hardest phase owing to protectionist reflexes on sensitive sectors, Philippine President Benigno Aquino said.Despite the challenges, however, leaders of the Association of Southeast Asian Nations are working hard to meet the target, Aquino told reporters on Wednesday night, April 24, in Brunei where he is attending ASEAN's annual summit."They have finished with the easy parts but the accomplishments will not be as fast as in discussing the hard parts. When you reach that point, there can be some protectionist measures taken by each economy," Aquino said."But since we are focused on reaching the target, everyone who believes that one community is beneficial to everybody concerned will really try hard (to reach the goal)."

Asia's 'financial' indicators are flashing warning signs, even if there does not appear any immediate threat of instability, and many financial regulation lessons from the Asia crisis have remained 'learned'.But excluding China, the ratio of credit to GDP has risen to over 100% — higher than it was in 1997. Also, land loan to deposit ratios in Asian banking systems are rising significantly again.

Once its takes root, monetary expansion enjoys powerful momentum and powerful constituents. The bias is always to get bigger, with system deficiencies amply available for justification and rationalization.

Monday, March 11, 2013

Video: Peter Schiff Versus John Mauldin on US Dollar and Deficits

Based on the coming 'oil revolution', John Mauldin makes the point that the US can run $300-400 billion deficits and the Fed "can print trillions" and the dollar will surge (since the rest of the world demands it). Peter Schiff begins quietly adding that "we don't have that much oil" then goes on to discuss the 'ifs' in Mauldin's thesis, beginning the wildcard that "we can't suppress interest rates indefinitely" as we await this supposed oil export boom to begin - and that somehow the US is expected to generate a budget surplus when even the perpetually optimistic CBO in its most recent forecast gave up on expecting a surplus in the future of America. Ever. The ensuing 3 minutes or so is worth the price of admission as Dollar bull meets Dollar bear in a nose-dripping, face-ripping trip into the future.

Start at 5:25

Friday, July 20, 2012

Why Macroeconomics as Policy Tool Shouldn’t be Trusted…

…especially of the Paul Krugman strain.

Writes author and University of Rochester professor Steven Landsburg, (bold original)

Supply and demand (and, especially, triangles of welfare loss, etc) are not entirely rigorous, but they’re good useful simplifications that actually give useful (though approximate) answers to important policy questions. Sort of like Ohm’s Law for electrical circuits.

But IS-LM is not like that at all, because IS-LM does not even address the key policy questions in macroecomics. IS-LM can tell you, perhaps, how to fight a recession, but it can’t tell you whether the recession is worth fighting — not even loosely, because the model contains no individual utility functions and no social welfare function. It therefore does not allow you even to formulate the question of whether a given policy is worth its costs, because it provides no framework for weighing costs against benefits.

Analyzing policy via supply and demand is like analyzing electrical circuits with Ohm’s Law. It answers questions, and over a fairly wide range of situations, it answers them with tolerable accuracy. But analyzing policy via IS-LM is like analyzing electrical circuits with a barometer.

Saturday, March 26, 2011

The Inflation Spiel From Paul Krugman

Keynesian high priest (and Nobel awardee) Paul Krugman appears to be conditioning the public of a possible turnaround in his outlook!

He writes,

The Fed could directly finance the government by buying debt, or it could launder the process by having banks buy debt and then sell that debt via open-market operations; either way, the government would in effect be financing itself through creation of base money. So?

Well, the first month’s financing would increase the monetary base by around 12 percent. And in my hypothesized normal environment, you’d expect the overall price level to rise (with some lag, but that’s not crucial) roughly in proportion to the increase in monetary base. And rising prices would, to a first approximation, raise the deficit in proportion.

So we’re talking about a monetary base that rises 12 percent a month, or about 400 percent a year.

Does this mean 400 percent inflation? No, it means more — because people would find ways to avoid holding green pieces of paper, raising prices still further.

I could go on, but you get the point: once we’re no longer in a liquidity trap, running large deficits without access to bond markets is a recipe for very high inflation, perhaps even hyperinflation. And no amount of talk about actual financial flows, about who buys what from whom, can make that point disappear: if you’re going to finance deficits by creating monetary base, someone has to be persuaded to hold the additional base.

At this point I have to say that I DON’T EXPECT THIS TO HAPPEN — America is a very long way from losing access to bond markets, and in any case we’re still in liquidity trap territory and likely to stay there for a while.

Krugman admits that the Fed can directly “finance the government by buying debt” and indirectly “launder the process by having banks buy debt” which can cause HIGH inflation.

But yet he engages in subtle sophism by saying this won’t happen for as long as the US has access to bond markets—”very long way from losing access to bond markets”.

Obviously losing access to bond markets isn’t the issue, if the Fed continues to buy US debts!

And that’s exactly what the Quantitative Easing (QE) programs are for. And QE represents no more than a shell game. In other words, such shell game is happening NOW!

Here is the statement of the US Federal Reserve announcing QE 2.0 last November (CNN Money)

To promote a stronger pace of economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate, the Committee decided today to expand its holdings of securities. The Committee will maintain its existing policy of reinvesting principal payments from its securities holdings. In addition, the Committee intends to purchase a further $600 billion of longer-term Treasury securities by the end of the second quarter of 2011, a pace of about $75 billion per month. The Committee will regularly review the pace of its securities purchases and the overall size of the asset-purchase program in light of incoming information and will adjust the program as needed to best foster maximum employment and price stability.

The point is as Krugman continues to talk of inflation he prepares the public for that dramatic announcement where he’d probably mimic his idol, “When the facts change, I change my mind. What do you do sir?”

This should represent another MAJOR failure of the macroeconomic paradigm.