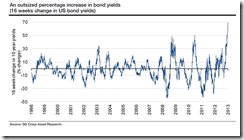

Presenting the “There’s No Inflation” Checklist1) Don’t go to school – if you want to learn then turn on CNN.2) Don’t pay for medical care – if you get hurt then put on a band-aid and drink more water.3) Don’t pay for transportation – if you have to get somewhere then teleport.4) Don’t eat – if you HAVE to then cut your food into small pieces so it lasts longer (cough cough cough #McResources cough).5) Don’t buy a house – if you have to live somewhere then pitch a tent in your local park.6) Look at stupid charts such as:* because CBOs projections are always right (warning: do NOT check the CBO's track record)7) Ignore charts such as:8) Stop paying for things, idiot.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Friday, August 29, 2014

Checklist for Claims that “There’s No Inflation”

Wednesday, September 25, 2013

Is Anarchism Utopian?

Let us do away with ideology first and deal with facts.

Human society emerged from the prehistoric stateless hunter-gatherer societal relationship

Hunting and gathering was the ancestral subsistence mode of Homo. As The Cambridge Encyclopedia of Hunter-Gatherers says: "Hunting and gathering was humanity's first and most successful adaptation, occupying at least 90 percent of human history. Until 12,000 years ago, all humans lived this way."

Hunter-gatherers move around constantly in search of food. As a result, they do not build permanent villages or create a wide variety of artifacts, and usually only form small groups such as bands and tribes. However, some hunting and gathering societies in areas with abundant resources (such as the Tlingit) lived in larger groups and formed complex hierarchical social structures such as chiefdoms. The need for mobility also limits the size of these societies. They generally consist of fewer than 60 people and rarely exceed 100. Statuses within the tribe are relatively equal, and decisions are reached through general agreement. The ties that bind the tribe are more complex than those of the bands.Leadership is personal—charismatic—and used for special purposes only in tribal society. There are no political offices containing real power, and a chief is merely a person of influence, a sort of adviser; therefore, tribal consolidations for collective action are not governmental. The family forms the main social unit, with most societal members being related by birth or marriage. This type of organization requires the family to carry out most social functions, including production and education.

Pastoralism is a slightly more efficient form of subsistence. Rather than searching for food on a daily basis, members of a pastoral society rely on domesticated herd animals to meet their food needs. Pastoralists live a nomadic life, moving their herds from one pasture to another. Because their food supply is far more reliable, pastoral societies can support larger populations. Since there are food surpluses, fewer people are needed to produce food. As a result, the division of labor (the specialization by individuals or groups in the performance of specific economic activities) becomes more complex. For example, some people become craftworkers, producing tools, weapons, and jewelry. The production of goods encourages trade. This trade helps to create inequality, as some families acquire more goods than others do. These families often gain power through their increased wealth. The passing on of property from one generation to another helps to centralize wealth and power. Over time emerge hereditary chieftainships, the typical form of government in pastoral societies.

Wednesday, August 21, 2013

Asia Slump: Has Capital Been Flowing Back to the US?

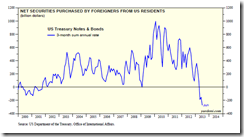

The US Treasury released data last Thursday tracking international capital flows for the US through June. The outflows out of US securities was shocking. Especially troubling was the amount of US Treasuries sold by foreigners. Their outflows exceeded those from US bond funds. Of course, some of the outflows from the bond funds could be attributable to foreign investors. Nevertheless, the data suggest that foreign investors may have been more spooked by the Fed’s tapering talk in May and June than domestic investors.As the US federal deficits have swelled, the US government has become more dependent on the kindness of strangers. Apparently, they are losing their interest in helping us out with our debts. Consider the following TIC data:(1) Total securities. During June, foreigners sold $934.1 billion (annualized) in US Treasury bills, notes, and bonds; Agency bonds; corporate bonds; and US equities (Fig. 1). Over the past three months, the annualized net capital outflows from these securities was $462.8 billion (Fig. 2).(2) Treasury notes & bonds. During June, the net outflows from US Treasury notes and bonds was $489.2 billion (annualized). The annualized rate out of these securities over the past three months was $271.1 billion.(3) US equities. Over the past three months through June, foreigners have also been net sellers of US equities totaling $97.1 billion at an annual rate.(4) Agency & corporate bonds. Foreigners haven’t been selling US Agency and corporate bonds, but they haven’t been buying them either.

Thursday, March 08, 2012

Science: Is the Creative Right Brain Theory a Myth?

Yes. That’s according to an article at the Kurzweil Accelerating Intelligence

Yet another brain myth bites the dust, joining “we only use 10 percent of our brain,” and other pseudoscience nonsense that tries to cram people in nice neat boxes.

The left hemisphere of your brain, thought to be the logic and math portion, actually plays a critical role in creative thinking, University of Southern California (USC) researchers have found, at least for visual creative tasks (and musical, as previously found).

“We need both hemispheres for creative processing,” said.Lisa Aziz-Zadeh, assistant professor of neuroscience.

More from the same article…

The “creative right brain” myth apparently originated from misinterpretations of Roger Sperry’s split-brain experiments on epileptics in the 60s, which earned him a Nobel Prize in 1981. It has already been debunked.

See, for example, University of Washington neurobiologist Dr. William H. Calvin’s excellent 1983 book,Throwing Madonna:Essays on the Brain (the text of chapter 10, “Left Brain, Right Brain: Science or the New Phrenology?” is accessible here).

Despite that, there are still lots of suppliers of education and training materials based on this myth, and lots of bureaucratic teachers, self-help writers, financial charlatans, polarizing politicians, and quick-buck counselors eager to put people into programmed slots where they can be easily manipulated and controlled.

Caveat emptor

Friday, July 29, 2011

Quote of the Day: Living Out of a Myth

Excerpt from the always eloquent marketing savant Seth Godin

Myths allow us to project ourselves into their stories, to imagine interactions that never took place, to take what's important to us and live it out through the myth.

The quote comes in the context of a “myth” or vicarious brand based marketing strategy.

But I think this valuable quote applies to many aspects of social activities.

In my field, they are represented by the rigid mechanical chartists and micro fundamentalists in the financial markets, hydraulic econometric-statistics-quant based economics or in the political sphere—ideologies based on utopianism.

These people tend to live out or rationalize their morals or beliefs or their fantasies as reality.

The tragic bombing and shooting massacre which left 68 people dead in Norway by deranged Anders Breivik seems an example.

Quoting Stratfor’s Scott Stewart, (bold emphasis mine)

Breivik also is somewhat unique in that he did not attempt to escape after his attacks or become a martyr by his own hand or that of the authorities. Instead, as outlined in his manifesto, he sought to be tried so that he could turn his trial into a grandstand for promoting his ideology beyond what he did with his manifesto and video. He was willing to risk a long prison sentence in order to communicate his principles to the public. This means that the authorities have to be concerned not only about other existing Justiciar Knights but also anyone who may be influenced by Breivik’s message and follow his example.

Living out of a myth can be fatalistic.

Thursday, September 10, 2009

The Myths of Deregulation and Lack of Regulation As Causal Factors To The Financial Crisis

His intro: (italics mine)

``The role of regulatory policy in the financial crisis is sometimes presented in simplistic and misleading ways. This essay will address the following myths and misconceptions

Myth 1: Banking regulators were in the dark as new financial instruments reshaped the financial industry.

Myth 2: Deregulation allowed the market to adopt risky practices, such as using agency ratings of mortgage securities.

Myth 3: Policy makers relied too much on market discipline to regulate financial risk taking

Myth 4: The financial crisis was primarily a short-term panic.

Myth 5: The only way to prevent this crisis would have been to have more vigorous regulation.

``The rest of this essay spells out these misconceptions. In each case, there is a contrast between the myth and reality."

In short, such misplaced arguments attempt to deflect on the culpability of the role of policymakers and their interventionists policies in shaping the financial crisis and instead pin the blame on "market failure" as justification for more government intervention.

Read the rest here

``The biggest myth is that regulation is a one-dimensional problem, in which the choice is either “more” or “less.” From this myth, the only reasonable inference following the financial crisis is that we need to move the dial from “less” to “more.”

``The reality is that financial regulation is a complex problem. Indeed, many regulatory policies were major contributors to the crisis. To proceed ahead without examining or questioning past policies, particularly in the areas of housing and bank capital regulation, would preclude learning the lessons of history."

Yes, oversimplification of highly complex problems can lead to more prospective troubles than function as preventive or cure to the disease, especially when myopic prescriptions ignore the human behavior dynamics in the face of regulatory circumstances.

Friday, August 14, 2009

Myths From Subprime Mortgage Crisis

Ms. Demyanyk's intro: (bold highlights mine)

``On close inspection many of the most popular explanations for the subprime crisis turn out to be myths. Empirical research shows that the causes of the subprime mortgage crisis and its magnitude were more complicated than mortgage interest rate resets, declining underwriting standards, or declining home values. Nor were its causes unlike other crises of the past. The subprime crisis was building for years before showing any signs and was fed by lending, securitization, leveraging, and housing booms."

Most of the misconceptions had been aggravating circumstances read as causal effects, logical fallacies or outright cognitive biases at work.

Myth 1: Subprime mortgages went only to borrowers with impaired credit

Myth 2: Subprime mortgages promoted homeownership

Myth 3: Declines in home values caused the subprime crisis in the United States

Myth 4: Declines in mortgage underwriting standards triggered the subprime crisis

Myth 5: Subprime mortgages failed because people used homes as ATMs

Myth 6: Subprime mortgages failed because of mortgage rate resets

Myth 7: Subprime borrowers with hybrid mortgages were offered (low) “teaser rates”

Myth 8: The subprime mortgage crisis in the United States was totally unexpected

Myth 9: The subprime mortgage crisis in the United States is unique in its origins

Myth 10: The subprime mortgage market was too small to cause big problems

Read her insightful revelations here.

My favorite quote from Yuliya Demyanyk's striking comments (oddly from a quasi government agency): From myth 2.(bold highlights mine)

``The availability of subprime mortgages in the United States did not facilitate increased homeownership. Between 2000 and 2006, approximately one million borrowers took subprime mortgages to finance the purchase of their first home. These subprime loans did contribute to an increased level of homeownership in the country—at the time of mortgage origination. Unfortunately, many homebuyers with subprime loans defaulted within a couple of years of origination. The number of such defaults outweighs the number of first-time homebuyers with subprime mortgages.

``Given that there were more defaults among all (not just first-time) homebuyers with subprime loans than there were first-time homebuyers with subprime loans, it is impossible to conclude that subprime mortgages promoted homeownership."

In short, inflationary "boom bust" policies has not only failed to achieve its goals, it has led to the sharp deterioration of the society's standard of living!!!