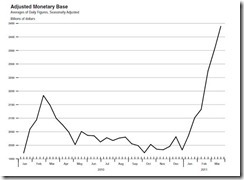

``We have seen that according to popular thinking, an asset bubble is a large increase in asset prices. A price is the amount of dollars paid for a given thing. We may just as well say, then, that a bubble is a large increase in the payment of dollars for various assets. As a rule, in order for this to occur there must be an increase in the pool of dollars, or the pool of money. So, if one accepts the popular definition of what a bubble is, one must also concede that without an expansion in the pool of money, bubbles cannot emerge. If the pool of money is not expanding, then people — irrespective of their psychological disposition — simply do not have the ability to generate bubbles in various markets.” Frank Shostak, How Can the Fed Prevent Asset Bubbles?

It looks likely that we may have reached a turning point for this cycle.

I’m not suggesting that we are at the end of the secular bull market phase, but given the truism that no trend moves in a straight line, a reprieve should be warranted.

To consider, September and October has been the weakest months of the annual seasonal cycle, where most of the stock market “shocks” have occurred. The culmination of last year’s meltdown in October should be a fresh example.

Although, this is not to imply that we are about to be envisaged by another crisis this year (another larger bust looms 2-4 years from now), the point is, overstretched markets could likely utilize seasonal variables as fulcrum for a pause-or a window of opportunity for accumulation.

A China Led Countercyclical Trend

My case for an ephemeral inflection point is primarily focused on China.

Since China’s stockmarket bellwether, the Shanghai Index (SSEC), defied “gravity” during the predominant bleakness following last year’s crash, and most importantly, served as the inspirational leader for global bourses, its action would likely have a telling impact on the directions of global stock markets.

In short, my premise is that global markets are likely to follow China.

True, the SSEC had a two week correction, which have accounted for nearly 11% decline (as seen in Figure 1) but this has, so far, been largely ignored by global bourses.

Figure 1: Stockcharts.com: The Shanghai Index Rolling Over

Figure 1: Stockcharts.com: The Shanghai Index Rolling Over

Nevertheless, the action in China’s market appears to weigh more on commodities on the interim. This should impact the actions in many commodity exporting emerging markets.

The Baltic Dry Index (BDI) which tracks international shipping prices of various dry bulk cargoes of commodities as coal, iron ore or grain has been on a descent since June.

This has equally been manifested in prices Crude oil (WTIC) which appears to have carved out a “double top” formation.

In short, there seems to be a semblance of distribution evolving in the China-commodity markets.

The possible implication is perhaps China’s leash effect on global stock markets will lag.

From a technical perspective, using the last major (Feb-Mar) correction as reference, a 20% decline would bring the SSEC to a 50% Fibonacci retracement, while a 25% fall would translate to 61.8% retracement.

And any decline that exceeds the last level may suggest for a major inflection point, albeit technical indicators are never foolproof.

Moreover, from a perspective of double top formation in oil; if a breakdown of the $60 support occurs then $49-50 could be the next target level.

As a reminder, for us, technicals serve only as guidepost and not as major decision factors. The reason I brought up the failure in the S&P 500 head and shoulder pattern last July [see Example Of Chart Pattern Failure] was to demonstrate the folly of extreme dependence on charts.

As prolific trader analyst Dennis Gartman suggests in his 22 Trading rules, ``To trade successfully, think like a fundamentalist; trade like a technician. It is imperative that we understand the fundamentals driving a trade, but also that we understand the market's technicals. When we do, then, and only then, can we or should we, trade.”

In short, understanding market sponsorship or identifying forces that have been responsible for the actions in the marketplace are more important than simple pattern recognition. Together they become a potent weapon.

So despite the recent 11% decline of the SSEC, on a year date basis it remains up by a staggering 67%.

Politicization Of The Financial Markets

Some experts have suggested that when global stock markets would correct, such would transpire under the environment of a rising US dollar index, since this would signal a liquidity tightening.

I am not sure that this would be the case, although the market actions may work in such direction where the causality would appear reflexive.

Unless the implication is that the impact from the inflationary policies has reached its pinnacle or would extrapolate to a manifestation of the eroding effects of such policies, where forces from misallocated resources would be reasserting themselves, such reasoning overlooks prospective policy responses.

The US dollar index (USD) has recently broken down but has been drifting above the breached support levels (see above chart).

It could rally in the backdrop of declining stock markets and commodity prices, although it is likely to reflect on a correlation trade than a cause and effect dynamic.

By correlation trade, I mean that since the markets have been accustomed or inured to the inverse relationship of the US dollar and commodities, any signs of weaknesses in the commodities sphere would likely spur an intuitive rotation back into the US dollar.

Some may call it “flight to safety”. But I would resist the notion that the US dollar would represent anywhere near safehaven status given the present policy directions.

However, if the US dollar fails to rally while global stocks weaken, then any correction, thus, will likely be mild and short.

So yes, the movement of the US dollar index is an important factor in gauging the movements of the global stock markets.

But one must be reminded that last year’s ferocious rally in the US dollar index was triggered by a dysfunctional global banking system when the US experienced a near collapse prompted by electronic “institutional” bank run.

This isn’t likely to be the case today.

So far, aside from the seeming “normalization” of credit flows seen in the credit markets, our longstanding premise has been that global authorities, operating on the mental and theoretical framework of mainstream economics, will refrain from exhausting present gains from which have been viewed as policy triumph.

Hence our bet is that they will likely pursue the more of the same tact in order to sustain the winning streak. The latest US FOMC transcript to maintain current policies could be interpreted as one.

Why take the party punch bowl away when the financial elite are having their bacchanalian orgy?

As we noted in last week’s Crack-Up Boom Spreads To Asia And The Philippines, ``Where financial markets once functioned as signals for economic transitions, it would now appear that financial markets have become the essence of global economies, where the real economy have been subordinated to paper shuffling activities.”

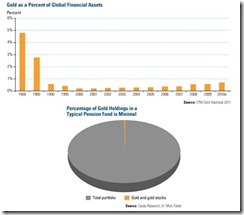

Where policymakers inherently sees rising financial assets as signals of economic growth, the reality is that most of the current pricing stickiness has been fueled by excessive money printing that has prompted for intensive speculations more than real economic growth.

Figure 2: New York Times: Hints of a Rebound in Global Trade?

Figure 2: New York Times: Hints of a Rebound in Global Trade?

For instance, Floyd Norris of the New York Times has a great chart depicting the year on year changes of global trade based on dollar volume of exports.

While there has indeed been some improvements coming off the synchronized collapse last year, the growth rates haven’t been all that impressive.

In short, rapidly inflating markets and a tepid growth in the global economy manifest signs of disconnect!

Yet global policymakers won’t risk the impression that economic growth will falter as signaled by falling financial asset prices. Hence, they are likely to further boost the “animal spirits” by adopting policies that will directly support financial assets and hope that any improvements will have a spillover effect to the real economy via the “aggregate demand” transmission mechanism.

Alternatively, one may interpret this as the politicization of the financial markets.

To give you an example, bank lending in China has materially slowed in July see figure 3. This could have accounted for the recent correction in the SSEC.

Figure 3: US Global Investors: Declining Bank Loans

Figure 3: US Global Investors: Declining Bank Loans

According to US Global Investors ``China’s new lending data for July may be a blessing in disguise, as the slowdown can partly be attributed to a sharp month-over-month decrease in bill financing. Excluding bills, July’s new loans to companies and households were comparable to May and higher than April. With more higher-yielding, long-term loans replacing lower interest-bearing bill financing, margins at Chinese banks should improve as long as corporate funding demand remains strong and overall loan quality stays healthy.”

While this could be seen as the optimistic aspect, the fact is that aside from the overheated and overextended stock markets, property markets have likewise been benefiting from the monetary shindig- property sales up 60% for the first seven months and where residential investments “rose 11.6 percent, up from 9.9 percent in the six months to June 30” “powered by $1.1 trillion of lending in the first six months” (Bloomberg)

True, some of these have filtered over to the real economy as China’s power generation expanded by 4.8% in July (Finfacts) while domestic car sales soared by 63% (caijing) both on a year to year basis.

So in the account of a persistent weak external demand, Chinese policymakers have opted to gamble with fiscal and policies targeted at domestic investments…particularly on property and infrastructure.

Remember, the US consumers, which had been China’s largest market, has remained on the defensive since they’ve been suffering from the adjustments of over indebtedness which would take years (if not decades) to resolve (see figure 4).

And since investments accounts for as the biggest share in China’s economy, as we discussed in last November’s China’s Bailout Package; Shanghai Index At Possible Bottom?, ``the largest chunk of China’s GDP has been in investments which is estimated at 40% (the Economist) or 30% (Dragonomics-GaveKal) of the economy where over half of these are into infrastructure [30.8% of total construction investments (source: Dragonomics-Gavekal)] and property [24% of total construction investments]”, the object of policy based thrust to support domestic bubbles seem quite enchanting to policymakers.

Besides, if the objective is about control, in a still largely command and control type of governance, then Chinese policymakers can do little to support US consumers than to inflate local bubbles.

Aside, as we discussed in last week’s The Fallacies of Inflating Away Debt, “conflict-of –interests” issues on policymaking always poses a risk, since authorities are likely to seek short term gains for political ends or goals.

From last week ``policymakers are likely to take actions that are designed for generating short term “visible” benefits at the cost of deferring the “unseen” cumulative long term risks, which are usually are aligned with the office tenure (let the next guy handle the mess) or if they happen to be politically influenced by the incumbent administration (generates impacts that can win votes)”

In China, political incentive issues could be another important variable at work in support of bubble policies.

Michael Kurtz, a Shanghai-based strategist and head of China research for Macquarie Securities Michael Kurtz, in an article at the Wall Street Journal apparently validates our general observation.

From Mr. Kurtz (bold highlights mine),

``…far from being an accidental consequence of loose monetary policy, stand out as the purpose of that policy. The fact that housing construction must carry so much of the growth burden means policy makers likely prefer to err well on the side of too much inflation rather than risk choking off growth too early by mistiming tightening.

``Meanwhile, China's political cycle may exacerbate risks of an asset bubble. President and Communist Party Chairman Hu Jintao and other senior leaders are expected to step down at the party's five-year congress in October 2012. Much of the jockeying for appointments to top jobs is already under way, especially for key slots in the Politburo. Mr. Hu will want to secure seats for five of his allies on that body's nine-member standing committee, ensuring his continued influence from the sidelines and allowing him to protect his political legacy.

``This requires that Mr. Hu deliver headline GDP growth at or above the 8% level that China's conventional wisdom associates with robust job creation, lest he leave himself open to criticism from ambitious rivals. The related political need to avoid ruffling too many feathers in China's establishment also may incline leaders toward lower-conflict approaches to growth, rather than deep structural reforms that would help rebalance demand toward sustainable private consumption. Easy money is less politically costly than rural land reform or state-enterprise dividend restructuring. This is especially the case given that much of the hangover of a Chinese asset bubble would fall not on the current leadership, but on the next.”

So the “window dressing” of the Chinese economy for election purposes fits our conflict of interest description to a tee!

Overall, it would seem like a mistake to interpret any signs of a prospective rally in the US dollar on “tightening” simply because policymakers (in China, the US, the Philippines or elsewhere) are likely to engage in more inflationary actions for political ends (policy triumph, elections, et. al.).

Hence, any signs of market weakness will likely prompt for more actions to support the asset prices.