EIA estimates that global oil inventories increased by almost 0.8 million bbl/d in 2014, the largest build since 2008, when falling demand for oil caused prices to drop sharply during the second half of the year. However, unlike in 2008, the current market imbalance has been predominantly supply-driven, as production from countries outside of the Organization of the Petroleum Exporting Countries (OPEC) grew by a record high of 2.0 million bbl/d in 2014. Global oil inventories are expected to continue to grow by 0.9 million bbl/d during the first half of 2015, but to taper off by the end of the year as non-OPEC supply growth, particularly from the United States, weakens because of lower oil prices.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Tuesday, February 03, 2015

Has Crashing Oil Prices Been About “Glut”?

Monday, July 15, 2013

How Stock Markets React to Rising Oil Prices

Yet interest rates will ultimately be determined by market forces influenced from one or a combination of the following factors: balance of demand and supply of credit, inflation expectations, perception of credit quality and of the scarcity or availability of capital.

Bank lending to US companies is rising at a pace that will by year-end push the total above the record high of US$1.61 trillion reached in 2008.Commercial and industrial loans outstanding climbed to US$1.56 trillion in the week ended June 26, an increase of 4.1 per cent this year and up from the low of US$1.2 trillion in October 2010 following the worst financial crisis since the Great Depression, according to Federal Reserve data. The amount surged about US$18 billion last month, the most this year.

Now what happens when banks print new money (whether as bank notes or bank deposits) and lend it to business? The new money pours forth on the loan market and lowers the loan rate of interest. It looks as if the supply of saved funds for investment has increased, for the effect is the same: the supply of funds for investment apparently increases, and the interest rate is lowered. Businessmen, in short, are misled by the bank inflation into believing that the supply of saved funds is greater than it really is. Now, when saved funds increase, businessmen invest in "longer processes of production," i.e., the capital structure is lengthened, especially in the "higher orders" most remote from the consumer. Businessmen take their newly acquired funds and bid up the prices of capital and other producers' goods, and this stimulates a shift of investment from the "lower" (near the consumer) to the "higher" orders of production (furthest from the consumer)—from consumer goods to capital goods industries

The roots of the differences go back to the 7thcentury CE, with the death of the prophet Muhammad. Those who accepted Abu Bakr, Muhammad's father-in-law, as caliph (meaning successor) became known as the Sunnis. Those who believed that Ali, Muhammad’s son-in-law, should be caliph became the Shiites. From there, the differences grew, many battles ensued, and a schism formed between the two groups.Why has the American government backed the Sunnis, you may ask. Saudi Arabia is the short answer.If a decisive Shiite victory were to occur in Syria, it would have enduring implications throughout the Middle East, but most importantly in Saudi Arabia. Though Saudi Arabia's population and leadership are both Sunni, and two of the holiest cities of Islam (Mecca and Medina) are situated in the country, the oil-producing areas in the eastern portion of the country have significant Shi'a populations. If an uprising were to occur there in response to Shiite success in Syria, Saudi Arabia's oil production (as well as economic, political, and social stability) would suffer a huge setback.It is critical for both the US as well as the European Union that Saudi Arabia stay as it is to keep the balance of power intact in the Middle East. That's seen as a necessity for stability in the global oil markets. If Saudi Arabia's oil production were to stop, we could be looking at US$200 or more per barrel of oil immediately. That's how important Saudi Arabia is to the spot oil price.

For the last two to three years, just as the Federal Reserve drove investors to look ever harder for yield, WTI’s steep contango provided a neat carry trade, allowing it to be a fairly steady provider of decent (if unspectacular) returns.Boiled down to the basics, investors were selling one year out time spreads, where the curve was relatively flat, and waiting for them to move into contango as the futures approached the prompt month. Now that the WTI curve has flipped into backwardation, this trade no longer works and the remaining, perhaps significant, positions are being unwound.To do so, funds must buy the front and sell the back, further exacerbating WTI’s backwardation.

Friday, February 24, 2012

Are Surging Oil Prices Symptoms of a Crack-up Boom?

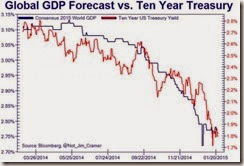

Dr. Ed Yardeni thinks that there has been a mismatch between oil prices and oil demand

Dr. Yardeni writes

The price of Brent crude oil is up again this morning over $124 a barrel. It’s up from $107.65 at the end of last year as a result of increasing tensions with Iran following the imposition by the US and Europe of tough new sanctions on Iran. They are already reducing the ability of Iran to export crude oil. Last year, Iran exported about 2mbd. That is likely to get cut by half or more. That’s not enough to explain why oil prices are soaring given that global oil supply is around 88mbd. Of course, concerns are mounting that the diplomatic and economic confrontation with Iran could turn into a military conflict that would disrupt oil traffic coming out of the Persian Gulf. This certainly explains why oil prices are rising.

Global oil demand, on the other hand, is weakening and suggests that oil prices could fall sharply if the Iranian issue can be resolved without push coming to shove. As I’ve explained previously, I believe that the sanctions are rapidly crushing Iran’s economy and may force the Mullahs to give up their ambitions to build nuclear weapons. This may take some time, of course. Meanwhile, if oil and gasoline prices continue to rise, I expect that the Obama administration will coordinate a global release of supplies from the Strategic Petroleum Reserves, as occurred last summer in response to the drop in Libya’s exports.

While tensions over Iran partly contributes to the elevated state of oil prices, there are deeper factors involved as previously explained

Importantly when mainstream economists talk about demand they usually refer to consumption demand and ignore the second type of demand—reservation demand.

The distinguished dean of the Austrian school of Economics Murray N. Rothbard explained,

The amount that sellers will withhold on the market is termed their reservation demand. This is not, like the demand studied above, a demand for a good in exchange; this is a demand to hold stock. Thus, the concept of a “demand to hold a stock of goods” will always include both demand-factors; it will include the demand for the good in exchange by nonpossessors, plus the demand to hold the stock by the possessors. The demand for the good in exchange is also a demand to hold, since, regardless of what the buyer intends to do with the good in the future, he must hold the good from the time it comes into his ownership and possession by means of exchange. We therefore arrive at the concept of a “total demand to hold” for a good, differing from the previous concept of exchange-demand, although including the latter in addition to the reservation demand by the sellers.

Yet what prompts for an increase in reservation demand?

Again Professor Rothbard

an increase in reservation demand for the stock may be due to either (a) an increase in the direct use-value of the good for the sellers; (b) greater opportunities for making exchanges for other purchase-goods; or (c) a greater speculative anticipation of a higher price in the future

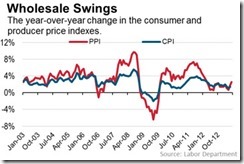

Speculative activities also drive the increased demand to hold a stock of goods. Or in the case of oil prices, increased speculation has also been responsible for the recent spike.

This means that monetary policies designed to ease credit via zero interest rates and quantitative easing have been responsible for encouraging, not only consumption but speculative activities too, by increasing people’s time preferences.

One would note that oil prices and stock market prices (S&P 500) have been ramping up. These are symptoms of an inflationary boom.

Of course, inflationary boom extrapolates to a boom bust cycle or to a crack-up boom.

As Professor Ludwig von Mises wrote

The boom could continue only as long as the banks were ready to grant freely all those credits which business needed for the execution of its excessive projects, utterly disagreeing with the real state of the supply of factors of production and the valuations of the consumers. These illusory plans, suggested by the falsification of business calculation as brought about by the cheap money policy, can be pushed forward only if new credits can be obtained at gross market rates which are artificially lowered below the height they would reach at an unhampered loan market. It is this margin that gives them the deceptive appearance of profitability. The change in the banks' conduct does not create the crisis. It merely makes visible the havoc spread by the faults which business has committed in the boom period.

Neither could the boom last endlessly if the banks were to cling stubbornly to their expansionist policies. Any attempt to substitute additional fiduciary media for nonexisting capital goods (namely, the quantities p3 and p4) is doomed to failure. If the credit expansion is not stopped in time, the boom turns into the crack-up boom; the flight into real values begins, and the whole monetary system founders. However, as a rule, the banks in the past have not pushed things to extremes. They have become alarmed at a date when the final catastrophe was still far away.

While a crack-up boom is not imminent, current monetary policies have brought us into this direction. The more governments engage in reckless policymaking in our monetary affairs, the greater risks of spiraling commodity prices.

Rising oil price, thus can be seen as symptoms of a chronic disorder in the current state of money.

Wednesday, January 25, 2012

Saber Rattling over Iran is only Part of the Big Oil Price Story

Dr. Ed Yardeni writes at his blog,

Despite Iran’s saber rattling, the price of oil hasn’t soared. The price of a barrel of Brent has been hovering around $110 since last summer. That’s even after President Barack Obama signed a bill imposing tougher sanctions on Iran at the end of last year. The price didn’t go up after the Iranians publicly threatened to close the Strait of Hormuz and warned Saudi Arabia not to fill any expected gap in oil demand when the world stops buying Iranian crude. According to a report in today’s Al Arabiya News, Iranian boats with men armed with machine guns on board were recently sent to the waters near the Saudi oil-production areas. Yet the price of oil hasn’t budged much from $110. Spain’s foreign minister said on Monday that Saudi Arabia has promised that it will make up for supplies of oil lost as a result of EU sanctions on Iran, and will do so at the same price.

If it weren’t for all the saber rattling, the price of oil would probably be falling.

Saber rattling over Iran represents only a fragment of the big picture. In other words, the Iran controversy does not capture the major elements of oil politics which drives oil prices.

In examining the political structure of major oil producing economies, we find that there is a watershed level for these welfare states to survive, for instance Saudi Arabia requires some $88 per barrel to buy off their people, Iran some $ 80 per barrel and etc…

In short, anytime oil prices go below these threshold levels, you can expect the “Arab Spring” revolts to make a rip-roarin’ comeback.

So as with the politics of subsidized renewable energy. Aside from environmental concerns, alternative energy requires elevated oil prices to remain an “attractive” alternative.

As this article from Scientific American says,

Today renewable technologies such as wind and solar are close to being competitive with fossil fuels. But we can say good-bye to that prospect if oil prices decline to $60 to $70 a barrel, which could easily happen in a recession, as we witnessed in October.

This means that many entrenched political groups (and their business allies or associates) are dependent on high oil prices.

From the above we come to the following conclusion

-Free markets don’t drive oil prices. Or that oil prices are greatly influenced by the political setting of mainly the oil producers (not on Iran alone).

-To maintain or preserve the current political environment, particularly welfare states of oil producing nations and the promotion of green energy, political measures would need to be resorted to in order to bring about the required oil threshold levels.

Such political measures will possibly include saber rattling (brinkmanship) politics, various market interventions by governments (to restrict supplies) as the Keystone Pipeline Controversy [also remember that 80% of oil reserves are held by governments or National Oil companies, so supply is very much sensitive to actions of political leaders since they control a significant majority of world's reserves], and importantly for global central banks to ramp up on money supply.

As you can see plainly looking at barrels consumed and barrels produced alone is grossly an insufficient way to study and assess oil economics. That’s because politics has an immense influence on how oil prices are being shaped.

Monday, November 22, 2010

The Peak Oil Myth

Here are my thoughts on Peak oil

While peak oil (via Hubbert Peak Theory) may be a valid engineering theory, it is a poor economic concept for the simple reason that engineering theories (like quant models) do not capture people’s behaviour.

Let us learn from the history of oil as narrated by investment guru Steve Leuthold

500 Years Ago… England

First let’s go back about 500 years. During the Renaissance, wood was the critical energy component in England and other European economies, much as fossil fuel is today. Wood was the primary provider of heat, light, and food preparation. However, England, having chopped down most of its trees became a large wood importer, primarily from the Scandinavian countries.

Of course prices rose as wood became more scarce causing domestic brewers, bakers, and others to go out of business hit by lower priced imports from wood rich countries. The English citizenry rebelled, having to pay exorbitant rates for wood to heat their homes, light their nights, and cook their food. Thus in 1593 and again in 1615, Parliament enacted energy conservation legislation, including limiting the use of wood in construction and mandating the use of bricks (but it took more wood to bake the bricks than to build wood structures).

From 1600 to about 1650 the price of firewood soared 80%. Then in a single year the price of wood jumped another 300%. Some families were forced to burn furniture and even parts of their houses to survive the winters. Back then, there were no government wood subsidies for freezing families.

The Wood To Coal Transition

In the early 1600s, people were aware coal was an alternative energy source. But prior to the huge rise in wood, coal was far too dirty and expensive. Chopping down trees was easier and cheaper than hacking the coal out from underground. But, as the coal industry grew, mining sophistication and technology reduced the extraction costs and as coal supplies rose prices fell.

Coal was soon found to be a far superior industrial fuel and with vast improvements in coal mining productivity the price of coal kept falling. First iron production increased with quality improving. Then came steel and steam power. The Industrial Revolution was underway led by England, which was bigger, better and earlier than old Europe. England had become the world’s industrial revolution leader. The real catalyst was the Wood Crisis.

Over 150 Years Ago… United States

Now let’s go back about 200 years to the early 1800s. Once again it’s the beginning of another hugely important energy revolution. Since Colonial times, the primary source of illumination in the U.S. had been whale oil. But by 1850 the North Atlantic had almost been whaled out by New England’s whaling fleet. The shore price of whale oil doubled and then doubled again, even though new whaling technologies had maximized oil recovery from the whales that were taken.

The high whale oil prices were also making it profitable to harpoon smaller and smaller lesser yield whales.

The U.S. was growing fast while the North Atlantic with the whale oil field yielding less and less. At the time there were, on the East Coast, no known substitutes for whale oil. By 1848 prices had skyrocketed by 600%. Then in 1848 the shortage was temporarily alleviated by the discovery (and subsequent decimation) of the South Pacific whale herds. Whale oil prices temporarily moved lower. Yes, it was a long and expensive journey for the New England whalers exploiting the new whale oil find. A whaling expedition around the horn and back could take as much as two years.

By the advent of the Civil War even this new whale oil field was played out. Low grade whale oil was $1.45 a gallon by 1865, up from 23 cents in the 1840s. To put this in to perspective, in 1868 a complete dinner in a New York restaurant cost 19 cents. A customer could buy over seven dinners for the price of a single gallon of lighting oil. It cost restaurant owners more to light the place at night than they were paying for the food they served.

The Whale Oil To Kerosene Transition

An alternative energy source became essential as high prices, population growth and shrinking supplies of whale oil combined into a crisis for businesses in east coast cities such as New York, Boston and Philadelphia. Edwin Drake set out to find that alternative. In 1858 he first found it in Titusville, Pennsylvania.

The U.S. entered the Petroleum Age. By 1867, kerosene, refined from Pennsylvania crude broke the whale oil market. By 1900 whale oil prices had fallen 70% from their highs and whale oil lamps had become collector items. Kerosene prices, with production efficiencies, became cheaper and cheaper. More importantly, just as with the development of coal as an energy alternative 200 years earlier, a chain reaction of technological and economic development was triggered. Oil soon became the new foundation of the economy not merely the low cost provider of light at night.

Lessons gleaned from the history of oil

1. People (via supply and demand) adjust to prices, where high prices leads to conservation or substitution, e.g. the wood crisis that triggered a shift to coal, whale oil crisis that led to kerosene

2. commodities obtain values only when it becomes an economic good, e.g. oil was nothing or did not have value during the age of the wood and coal or whale oil.

3. technology enhances production.

We seem to be seeing a combination of the above dynamics playout today, where alternative energies such as the production of Shale oil has been vastly expanding

To quote University of Michigan’s Professor Mark Perry (chart from Professor Perry)

New, advanced techniques for drilling oil have revolutionized the domestic oil industry in North Dakota in ways that couldn't have even been predicted just a few years ago, and will likely also open up new oil production in other parts of the world in the near future (like the Alberta Bakken in Canada) that also would have been unimaginable before this year. That's one reason that "peak oil" is peak idiocy: it always underestimates the ultimate resource - human capital (i.e. human ingenuity and the resulting innovation, advances, new technology) - which is endless and boundless, and will never peak.

Let me add that the current high prices of energy and commodities are not only from the consumption model but also from the reservation demand model—where monetary inflation influences prices.

Of course, there are other factors involved, most of which have been government imposed: geographical access restrictions, trade restrictions, price controls, subsidies, cartels, tariffs and other forms of protectionism (aside from inflationism)

Sunday, November 16, 2008

Reflexivity Theory And $60 Oil: Fairy Tales or Great Depression?

``Oil prices are coming down for all the wrong reasons: low economic growth and low demand. What we are not seeing is oil prices coming down because there is new supply coming on to the market or because the world has got more efficient.” Tony Hayward, BP chief executive

Allow me to disinterest you with a prosaic discourse on market psychology. Why? Because psychology drives the markets more than anything else. Said differently, economies and or markets are driven by people’s incentives to act for a particular goal. And present activities seem to reflect emerging signs of inconsistencies enough to make us discern that some prices haven’t been reflecting “reality”, but of “perceptions” of reality.

Since we will dwell much of successful speculator George Soros’ “reflexivity theory”, this also means we will be having a quote-fest from Mr. Soros.

Understanding George Soros’ Reflexivity Theory

Let me begin with Mr. Soros’ fundamental explanation of the Reflexivity theory [The Alchemy of Finance p. 318]

``The structure of events that have no thinking participants is simple: one fact follows another ending in an unending casual chain. The presence of thinking participants complicates the structure of events enormously: the participants thinking affects the course of action and the course of action affects the participants thinking. To make matters worst, participants influence and affect each other. If the participants’ thinking bore some determinate relationship to the facts there would be no problem: the scientific observer could ignore the participants’ thinking and focus on the facts. But the relationship cannot be accurately determined for the simple reason that the participants’ thinking does not relate to facts; it relates to events in which they participate, and these events become facts only after the participants’ thinking has made its impact on them. Thus the causal chain does not lead directly from fact to fact, but from fact to perception and from perception to fact with all kinds of additional connections between participants that are not reflected fully in the facts.

``How does this complex structure affect the ability of an observer to make valid statements about the course of events? His statements must also be more complex. In particular, they must allow for a fundamental difference between past and future: past events are a matter of record, while the future is inherently unpredictable. Explanation becomes easier than prediction.” (all emphasize mine)

Essentially, there are three variables that shape the reflexivity theory: facts, events and perception.

Let me cite a hypothetical situation:

Fact: Falling Prices or bear market

Event: Official Recession is declared

Perceptions:

1) Concerns about recession prompt for falling prices.

2) Falling prices impels the perception of an economic recession.

The dilemma: This becomes a chicken and egg problem of having to ascertain which among the two comes first or which causes which?

In the same plane, we ask “does the causal chain equate to events (recession) reinforcing the facts (falling prices) or has the facts (falling prices) been shaping events (recession)?”

Facts or events are always seen from the privilege of hindsight or ex-post. But since people don’t exactly know the future, it is always easier to explain away as predictions by the convenience of associations, buttressed by additional connections, the past activities. Essentially, such predicament represents as feedback loop transmission which predominate the thinking process operating in the marketplace.

And where such feedback loop gets bolstered-both falling prices and economic weakness are increasingly being felt and validated-the tendency is to draw enough “following” or “crowd” to shape the growing conviction into a major trend or into a socially accepted and popularly entrenched view or belief.

A vivid empirical example, a non-financial or non-market practitioner neighbor whom I recently bumped into at the local “sari-sari” store confidently insisted to me that the Philippines will experience an “economic recession” in 2009! Wow. Obviously his pronouncements had either been influenced by the headlines from the broadsheet or from news broadcasted by the media airwaves.

Now going back to the feed back loop mechanism of falling prices and recession, such chain of linear “cause-and-effect” thinking leads to the point where the denouement extrapolates to our perdition, or said differently, the ultimate outcome from such induction process is that prices will fall to zero and or society will stop functioning-which is nothing but plain balderdash.

If the US is now in the “eye” of the recession storm, it means that many parts of its “complex” or highly structured economy, which has been unduly boosted by tremendous doses of debt driven malinvestments, are presently enduring from a painful but necessary adjustment process which involves the clearing out of such excesses.

But it doesn’t mean that ALL of the US economy is suffering, because people’s lifestyle fine tune under dynamic operating conditions. The fact that the world’s largest publicly listed company (money.con.com) and retail behemoth Walmart reported a 10% rise in profits (Reuters) amidst the third quarter squall suggest of the societal response to income elasticity of demand, where changes of income prompts for a change in consumption pattern. The truism is that people will continue to live or society will continue to exist, even at more financially or economically difficult environment, but some sectors are likely to benefit from such adjustments.

The other obvious point is that the present “prevailing bias” dynamics (of falling prices-deleveraging/recession feedback loop) will eventually outlive its usefulness, whose popular convictions will extend to the extremes and morph into a false premise.

To quote Mr. Soros anew, ``Economic history is a never-ending series of episodes based on falsehoods and lies. The object is to recognize the trend whose premise is false, ride the trend, then step off before the premise is discredited." (highlight mine)

Reflexivity and Oil Prices: Spotting False Premises?

In recognition of a trend whose premises could seemingly false, where prices don’t square with economics, oil prices could be an embodiment.

The fact: Prices for oil as measured by the WTIC (West Texas Intermediate Crude) have been in a bear market. To date, prices have lost some 60% from its peak last July.

The event: Pronouncements from energy authorities that demand growth could become negative.

This excerpt from Wall Street Journal (highlight mine): ``The International Energy Agency warned Thursday that world oil-demand growth this year is on the cusp of falling into negative territory for the first time in 25 years, as global economic problems hammer away at energy consumption.

``In a new twist from past months, the agency also substantially lowered its forecast for oil demand in China and other emerging markets, where much of the growth in energy consumption is coming from. The IEA cut its expectations for demand in 2009 in these nations by 260,000 barrels a day.

``The IEA, in its monthly oil market report, said world oil demand will grow by 0.1% in 2008, down from a previous growth projection of 0.5% and far below the 1.1% growth in 2007. Globally, consumers and businesses will use on average 86.2 million barrels a day, 330,000 barrels lower than IEA's previous report.”

The popular perception: Falling demand have sparked a fall in oil prices. Falling oil prices reflect oil demand deterioration. So a feedback loop between falling demand and falling oil prices have fundamentally been reinforcing each other.

In our latest outlook, Demystifying the US Dollar’s Vitality we noted how OIL prices peaked at the same time the US dollar bottomed. We equally pointed out that the rapid pace of acceleration in the surge of the US dollar (as measured by the US dollar index basket) mirrored the sharp degree of descent by oil prices where we opined that the carry trade of being “short the US dollar- long commodities” have basically been unwinding.

We also posited that the all important driver that has virtually been encompassing the divergent global markets- such as the surge in the US dollar, the downside volatilities in the ex-US dollar currencies (except the Yen), the crash of the oil, commodities, emerging markets, the widening of various credit spreads, the collapse of asset backed markets, commercial paper markets, globally stock markets, surfacing of various crisis in different nations (such as Iceland, Hungary, Pakistan, South Korea etc.) and the disruptions in trade finance-have been the ongoing debt deflation or “deleveraging” dynamics.

The recent seizure of the credit markets and the ensuing gridlock in the US banking system has fundamentally impaired the flow of financing enough to have a substantial spillover impact to the global economy.

Thus, the prevailing bias or perception has been one of decelerating global economic dynamics prompting for the selling pressure in oil prices as indicated by the above by the Wall Street report.

And amidst falling oil prices and empirical evidences of deteriorating global economic growth, the feedback loop transmission of falling prices and falling demand has now been fostered into a conventional theme.

So where does this race to the bottom all stop?

With such linear based thinking, some questions pop into our mind: will oil fall below $50 to $10 per barrel or even to zero? Will people shun traveling? Will commerce stop? Will our lives grind to a complete halt?

The world is evidently so consumed with the Keynesian brand of economics, where almost everything seems centered on demand aggregates such that the mainstream appears to have forgotten the supply side variables.

It’s Not All About Demand, Supply Matters Too

Here is where we part with the consensus.

As Figure 1 from IEA world energy outlook 2008 shows how conventional oil fields (dark blue) are expected to rapidly deteriorate following a “peak” by 2010.

And even without the popular political rhetoric of “energy independence” (an issue we will discuss in the future), such a gap would need to be filled by new oil fields or non-conventional oil or natural gas liquids.

According to the IEA fact sheet, ``The world’s endowment of oil is large enough to support the projected rise in output, but rising oilfield decline rates will push up investment needs. Proven reserves of close to 1.3 trillion barrels equal more than 40 years of output at current rates; remaining recoverable resources of conventional oil alone are almost twice as big. But there can be no guarantee that those resources will be exploited quickly enough to meet the level of demand projected in our Reference Scenario. Decline rates – the rate at which individual oilfields decline annually – are set to accelerate in the long term in each major world region. The average observed decline rate worldwide is currently 6.7% for fields that have passed their production peak. This rate rises to 8.6% in 2030.” (underscore mine)

This means that massive investments are needed to cover such deficits.

But the question is, how will the investments come about and where will the investments come from when access to credit have been severely limited, or if not, the cost of money have been pricier, or oil prices have not been enough to prompt for a revenue stream required to fund or finance future oil projects?

Windfall Profit Taxes and Fairy Tale Oil Prices

Figure 2 shows that at $57 oil, most of the alternatives to the conventional oil have been rendered unfeasible, as present prices appear to be at below the estimated cost of production. This also means at present prices oil companies, whether state owned or privately owned companies are suffering from losses.

Proof?

From Timesonline.co.uk (highlights mine),

``Leading Russian oil producers, including TNK-BP, BP's Russian affiliate, are grappling with a collapse in profits from the export of Siberian oil.

``Heavy export tariffs have almost wiped out the profit margin from selling crude oil outside Russia, forcing Siberian producers to sell at prices as low as $10 a barrel on Russia's domestic market. Fears are mounting that the profits squeeze may speed the decline in Russian oil output, already down 6 per cent this year.

``The profits crunch, caused by the collapse in the worldwide price of crude, is provoking concern within Russia's oil community that capital expenditure budgets will have to be cut if profits from oil sales do not recover. “The tax burden is very tough,” Valeri Nesterov, an oil analyst at Troika Dialog, the Moscow brokerage, said. “The problem is that the future of the oil sector might be jeopardised if the Government doesn't reduce the tax burden.”

As you can see, high taxes and a sharp drop in oil prices pose as double whammies and threaten to curb the immediate supply in the global oil markets as capex are likely to get excised if losses continue to mount.

Besides, high taxes are products of reactionary government policies aimed at attempting to secure more revenues in anticipation of “eternally” high oil prices.

This should also serve as lesson to windfall profit advocates. What has been missed by governments and their social liberal proponents of taxing windfall profits are that

1) Oil is a cyclical commodity

2) Oil prices are never permanent and subject to the balance of demand and supply

3) High taxes tend to compound the miseries of oil companies when prices become unfavorable.

4) Profits are needed to fund or finance future oil or energy supplies.

5) Speculation or “greed” does not drive oil prices as evidenced by the 60% loss from the top.

To quote Steven Landsburg, ``Most of economics can be summarized in just four words: People respond to incentives. The rest is commentary."

More proof?

Mexico, the third largest oil exporter to the US following Canada and Saudi Arabia (EIA) has been encountering a precipitate decline in oil production as shown in figure 2. The Cantarell oil field which accounts for 60% of Mexico’s oil production has been declining at a rate by nearly 20% and could reach 30% (oil drum).

Remember, about 40% of state revenues come from the oil industry which means unless Mexico’s economy diversifies or expand its oil output, the country runs the risk of declining revenues, which given the present conditions of state spending could lead to a debt default.

Yet for years, Mexico has prohibited foreign companies from exploring on its national geography, which has been controlled by state owned monopoly the PEMEX. But recent events have reinforced the political and economic exigency to expand production by accepting foreign investments. Hence, the Mexican government, despite the unpopularity of the measure, has signaled its willingness to subcontract exploration and drilling to foreign companies (time.com).

To quote James Pressler of Northern Trust, ``The only thing that could make this situation worse for Mexican oil production would be an actual storm. The Mexican government, seeing the same warnings we are, has finally passed a much-contested and watered-down energy reform bill to get the sector back in shape by allowing foreign investment – though some fear that it is too little too late. The concern is that the weak legislation is not nearly enough to reverse the strong, downward trends of the oil sector. The justification: Pemex posted a $1.3 billion loss in Q3 as crude production fell almost 10% from a year ago. Clearly, it’s going to take a lot of foreign investment to turn Pemex around, and a lot of time. The real question is, will any private firm invest now that oil has fallen below $60 pb, the credit markets have all but seized up, and Mexican security conditions have worsened?”

And just how much investments are needed to bring supplies on stream to balance with demand?

Mr. Byron King writing in the Rude Awakening from agorafinancial.com gives us a clue,

``According to the IEA, even with massive levels of investment in the oil patch, the best estimate is that the global oil industry can reduce the rate of depletion to perhaps the 6% range. So the world energy industry will have to run faster just to keep from falling too far behind the demand curves.

``Again, you need to keep in mind that current energy prices are just too low to support the level of energy investment that the world needs going forward. (Meanwhile, the U.S. government is spending trillions of dollars just to bail out the banks and bankers, not one of whom runs pump jacks.)

``The IEA estimates that the oil industry will have to invest over $350 billion per year to counter the steep rates of decline in output. And even that will not be sufficient to maintain levels of output for traditional forms of crude oil. Thus, much of the future investment will have to go toward extracting other kinds of hydrocarbon substances. And these "other kinds" tend to be very expensive to develop.”

In addition, capital cost expected for the energy sector is projected at $26.3 trillion going into 2030 with 52% of the total or $13.2 trillion earmarked for the power sector and the balance for upstream oil and gas industry (IEA). Over the present term some of this are at risk.

So unless the world falls into a great depression (version 2.0), which seems unlikely unless global government start erecting barriers that would restrict trade and finance flows, the likelihood is that oil demand trends will continue to be strong over the medium to long term and will pose as hazardous strain to the demand-supply equation.

From the IEA, ``These global trends mask big differences across regions. All of the projected increase in world oil demand comes from non-OECD countries. India sees the fastest growth, averaging 3.9% per year over the projection period (to 2030), followed by China, at 3.5%. High as they are, these growth rates are still significantly lower than in the past. Other emerging Asian economies and the Middle East also see rapid growth. In stark contrast, demand in all three OECD regions (North America, Europe and the Pacific) falls, due to declining non-transport demand. The share of OECD countries in global oil demand drops from 57% in 2007 to 43% in 2030.”

Conclusion: Groping For A Guidepost

As you can see based on the above projections, oil below $60 dollars hasn’t been unambiguously reflective of real world economics. To paraphrase Agora’s Byron King, $60 oil seems priced at “Fairy Tale” levels.

Instead, oil at $60 has been a function of indiscriminate selling, triggered by the massive waves of debt deflation or delevaraging dynamics.

This downside overshoot only aggravates the structural imbalances in the supply demand equation over the medium to long term basis that risks an equivalent fierce overshoot to the upside once the present trends inflects or reverses.

This also means that while oil prices can remain at depressed levels as global financial markets attempt to find its footing, from which George Soros once observed ``“When a long-term trend loses momentum, short-term volatility tends to rise, it is easy to see why that should be so: the trend-following crowd is disoriented”, the brewing imbalances are likely incite a sharp recovery perhaps sooner than expected.

Furthermore, this also demonstrates how market psychology works; the public has been anchoring oil prices on the premise of a deep global recession, if not a great depression from a prospective an OECD deflationary environment. The latter idea is something we don’t share unless governments, as we stated earlier, start erecting firewalls.

As in the case of Zimbabwe, we understand that a government determined to inflate don’t need a functioning private credit system in order to inflate.

All it needs is 24/7 full scale operations by the printing presses and an expanding network of bureaucracy (or helicopters). As we noted in Black Swan Problem: Not All Markets Are Down!, its 231,000,000% (hyper) inflation has prompted for a year-to-date return of 960 QUADRILLION % (!!!) in its stock market as people flee its national currency. Why the refuge in stocks? Perhaps because to quote Mr. Soros, ``stock markets is one of the most important repositories of collateral”.

And as global governments combine to adopt a path to Zero Interest Rate Policy and have been flooding the world with “money from thin air” to rescue entities affected by the bubble bust, this equally reflects another reason why oil at $60 seems like a fantasy.

Finally, Mr. Soros tells us that ``People are groping to anticipate the future with the help of whatever guideposts they can establish. The outcome tends to diverge from expectations, leading to constantly changing expectations and constantly changing outcomes. The process is reflexive.”

Applied to the oil markets, it simply means that once oil prices begin to reverse, the “expert” rationalizations over “deflation and depression” will likely be replaced with stories of “recoveries” and renewed concerns over inflation.