Greed.

One way to win voters during an election period is to bash a minority group and appeal to the majority for the use of institutional or organized political force to achieve social goals as ‘equality’.

This Wall Street Journal article spares me precious time to parse on the newly released 2011 Wealth report from Credit Suisse, but nevertheless reflects on the du jour political theme: Greed is evil.

Wall Street the Wealth Report Blog’s Robert Frank writes,

Here’s another stat that the Occupy Wall Streeters can hoist on their placards: The world’s millionaires and billionaires now control 38.5% of the world’s wealth

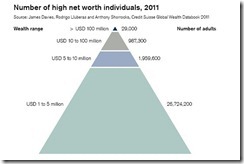

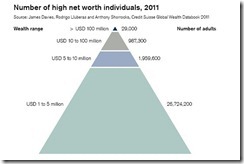

According to the latest Global Wealth Report from Credit Suisse, the 29.7 million people in the world with household net worths of $1 million (representing less than 1% of the world’s population) control about $89 trillion of the world’s wealth. That’s up from a share of 35.6% in 2010, and their wealth increased by about $20 trillion, according Credit Suisse.

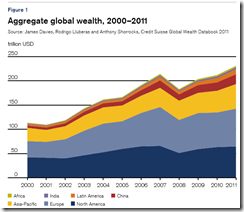

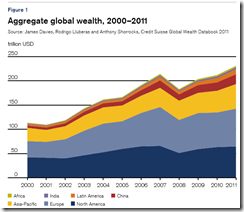

The wealth of the millionaires grew 29% — about twice as fast as the wealth in the world as a whole, which now has $231 trillion in wealth.

The U.S. has been the largest wealth generator over the past 18 months, according to the report, adding $4.6 trillion to global wealth. China ranked second with $4 trillion, followed by Japan ($3.8 trillion), Brazil ($1.87 trillion) and Australia ($1.85 trillion).

There are now 84,700 people in the world worth $50 million or more — with 35,400 of them living in the U.S.. There are 29,000 people world-wide worth $100 million or more and 2,700 worth $500 million or more.

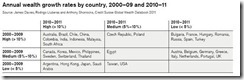

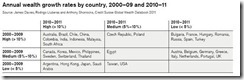

The fastest growth in the coming years will be in China, India and Brazil. China now has a million millionaires. Wealth in China and Africa is expected to grow 90%, to $39 trillion and $5.8 trillion respectively, by 2016. Wealth in India and Brazil is expected to more than double to $8.9 trillion and $9.2 trillion respectively.

The article does not specify ‘greed’ or what form of greed constitutes evil. Nevertheless, the article already suggests that the statistics presented by the study could serve as an emotional fodder for the current movement of global protests.

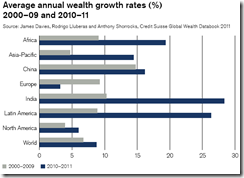

Yet to broaden the perspective let me add more charts from the same study

Worldwide wealth in dollar terms has been expanding

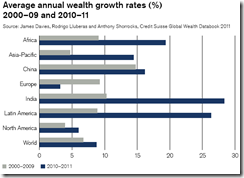

The degree of growth varies from nation to nation

Or even seen from the perspective of region to region. The point is that wealth is relative.

Alternatively, this also means that wealth creation basically reflects on the idiosyncratic structure of a nation’s political economy.

Bottom line: Wealth is NOT created equally and will never be equal.

This runs contrary to socialist utopian abstractions which tries to project ‘equality’ where everyone should not only have same degree of income and wealth or access to public goods, but also perhaps the impossibility of us having to look alike, think alike, share the same value, share similar space for our presence and spouse, etc...

A Wall Street Journal editorial expounds on Asia’s newfound wealth (bold emphasis mine),

Rising net worth ought to be a sign that a growing number of individuals are spotting productive economic opportunities and profiting handsomely in return for the big entrepreneurial risks they've taken. That's certainly how the likes of Steve Jobs or Richard Branson made their billions in the West. There's also a fair share of that in Asia.

But it's also true—and troubling—that so much wealth-creation in the region is related to various forms of government patronage. There are the Hong Kong tycoons who benefit from favorable government land-sale rules, or the Korean chaebol executives who gain from lenient treatment "for the national economic interest" when corporate fraud allegations pop up. China is especially notable for being an environment where friendly connections with government officials can pave the way through a bureaucratic labyrinth, even easing access to capital that's scarce for purely private-sector enterprises.

In a modern free economy it's false to suggest that the wealth of one entrepreneur impoverishes others—the pie can grow for everyone even if it grows faster for some. But wealth amassed through collecting government favors often does impoverish others: those who don't enjoy similar benefits. This fact, and the cynicism it breeds, is a greater threat to social stability than unequal wealth distribution.

In short, wealth is achieved either by political means or by market (economic) means.

The other way to say this is that ‘greed’ as a human trait influences BOTH the market and politics. And the process undertaken to achieve an end (‘equality’) extrapolates to a TRADEOFF between these two means.

For example if society aims to attain ‘equality’ through the markets then the tradeoff equates to lesser political interventions. Yet if society opts to distribute resources ‘equally’ via the political means then market influences will diminish.

The $231 trillion question is which of these two means will function as the more efficient way to arrive at social prosperity.

Thus such tradeoffs suggests that there will either be market inequality or political inequality. The reality is that there will be no equality in whatever sense.

In the real world operating on scarce resources, then equality is no more than a utopian fantasy or mental self-abuse.

To give you an idea how some of the world’s wealth have been politically derived, the following excerpt is from the New Scientist (bold emphasis mine)

The Zurich team can. From Orbis 2007, a database listing 37 million companies and investors worldwide, they pulled out all 43,060 TNCs and the share ownerships linking them. Then they constructed a model of which companies controlled others through shareholding networks, coupled with each company's operating revenues, to map the structure of economic power.

The work, to be published in PloS One, revealed a core of 1318 companies with interlocking ownerships. Each of the 1318 had ties to two or more other companies, and on average they were connected to 20. What's more, although they represented 20 per cent of global operating revenues, the 1318 appeared to collectively own through their shares the majority of the world's large blue chip and manufacturing firms - the "real" economy - representing a further 60 per cent of global revenues.

When the team further untangled the web of ownership, it found much of it tracked back to a "super-entity" of 147 even more tightly knit companies - all of their ownership was held by other members of the super-entity - that controlled 40 per cent of the total wealth in the network. "In effect, less than 1 per cent of the companies were able to control 40 per cent of the entire network," says Glattfelder. Most were financial institutions. The top 20 included Barclays Bank, JPMorgan Chase & Co, and The Goldman Sachs Group.

The list of the biggest interlocking companies

Focusing on the financial behemoths, the above serves as example of crony capitalism or corporatism, where politically privileged private companies benefit from political concessions, regulations, monopolies, subsidies, private-public partnerships or other anti-market policies premised on “privatizing profits and socializing losses” that SHOULD BE differentiated from wealth derived from entrepreneurial or capitalist functions, whose gains are derived from pleasing consumers.

Political wealth (pelf) is mainly extracted from the looting of the taxpayer.

In fact the above only underscores the Austrian economic school’s thesis of a central-bank-cartel based [banking-and-financial sector cronyism] whom has lately been living off tremendous amounts of government subsides, bailouts, central bank QEs and massive interventions in the marketplace all of which has been designed to preserve the current cartel based welfare-warfare state.

Of course not all of the abovestated interlocking companies represent cronyism or politically generated wealth.

Cato’s Dr. Tom Palmer explains the differences of wealth in the video below

Cato’s Dan Mitchell also expounds on differences of entrepreneurship from political privileges in this Fox interview

Finally a good reminder comes from this classic video interview of the illustrious Milton Friedman on Greed, as I earlier posted

The magnificent Milton Friedman quote:

Well, first of all, tell me is there some society you know that doesn’t run on greed? You think Russia doesn’t run on greed? You think China doesn’t run on greed? What is greed? Of course none of us are greedy; its only the other fellow who’s greedy.

The world runs on individuals pursuing their separate interests. The great achievements of civilization have not come from government bureaus. Einstein didn’t construct his theory under order from a bureaucrat. Henry Ford didn’t revolutionize the automobile industry that way. In the only cases in which the masses have escaped from the kind of grinding poverty you’re talking about, the only cases in recorded history are where they have had capitalism and largely free trade. If you want to know where the masses are worst off, it’s exactly in the kinds of societies that depart from that. So that the record of history is absolutely crystal clear: that there is no alternative way so far discovered of improving the lot of the ordinary people that can hold a candle to the productive activities that are unleashed by a free enterprise system.

As said above, greed is a human trait that plagues politicians too.

Here is the list of the richest politicians of the world

Again to re-quote Milton Friedman above

none of us are greedy; its only the other fellow who’s greedy