Keynesians have been on a losing streak. They have got it so wrong in predicting the direction of markets and inflation. And importantly, their policy prescriptions have likewise failed to achieve the purported economic recovery.

In a comparison between Reagan and Obama policies, the Wall Street Journal concludes, (bold emphasis mine)

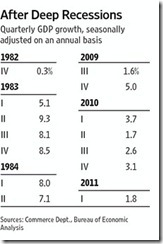

The contrast in results between the current recovery and the Reagan years is instructive because the policy mix was so different. In the 1980s, the policy goals were to cut tax rates, reduce regulatory costs and uncertainty, let the private economy allocate capital free of political direction, and focus monetary policy on price stability rather than on reducing unemployment. This is the policy mix we need to rediscover if we are going to escape our current malaise and stop suffering from the Keynesian discount.

In reaction to this article, economist Tim Kane of the Kauffman Foundation writes, (bold emphasis original)

The great advantage of Keynesianism is also its great weakness. It is exceedingly simple. It's fair to think of monetary policy in simple terms: tighten money supply or loosen it? While there are surely nuances of financial oversight and regulation, the point is that fiscal policy is simply never going to be so simple. It wasn't simple in 1500, and it sure isn't simple now. Fiscal policy under modern Keynesianism is, in public policy discussion, reduced to precisely that crude metric: more deficit-based government expenditures/taxes or less. To say it misses the forest for the trees is also too simple. What it misses is the genotype for the phenotype. Or how about: it misses the recipe for the ingredients?...

The one dilemma I have is not whether modern Keynesianism is bankrupt (it is), but what that implies about the growth rate. When I heard Scott Sumner speak in January, I really had to wonder if I, let alone he, believed there was a bubble in 2008 or not. If it was a bubble, then we shouldn't expect GDP to "recover," nor can anyone blame politicians for the relatively weak recovery. Right? No, wrong, dead wrong. If it was a real recession and not a bubble, then clearly the policy response has failed. If instead it was a bubble, then the policy response has been an obscene waste of money. There is no way out for Keynesians now.

It’s no use to for liberals to make the excuse that “crisis has setback the pace of economic activity by a greater degree compared with other post-war recessions” for the failure of their policies to generate traction. That would signify as red herring.

That’s because the financial crisis had been the outcome of the same set of Keynesian policies employed to inflate the last bubble.

As Paul Krugman wrote in 2002 (New York Times) (bold emphasis mine)

The basic point is that the recession of 2001 wasn't a typical postwar slump, brought on when an inflation-fighting Fed raises interest rates and easily ended by a snapback in housing and consumer spending when the Fed brings rates back down again. This was a prewar-style recession, a morning after brought on by irrational exuberance. To fight this recession the Fed needs more than a snapback; it needs soaring household spending to offset moribund business investment. And to do that, as Paul McCulley of Pimco put it, Alan Greenspan needs to create a housing bubble to replace the Nasdaq bubble.

Apparently Mr. Greenspan complied.

And the great Ludwig von Mises had been validated anew when he presciently wrote, (bold highlights mine)

There are still teachers who tell their students that “an economy can lift itself by its own bootstraps” and that “we can spend our way into prosperity.” But the Keynesian miracle fails to materialize; the stones do not turn into bread. The panegyrics of the learned authors who cooperated in the production of the present volume merely confirm the editor’s introductory statement that “Keynes could awaken in his disciples an almost religious fervor for his economics, which could be affectively harnessed for the dissemination of the new economics.”…

There is no use in arguing with people who are driven by “an almost religious fervor” and believe that their master “had the Revelation.” It is one of the tasks of economics to analyze carefully each of the inflationist plans, those of Keynes and Gesell no less than those of their innumerable predecessors from John Law down to Major Douglas. Yet, no one should expect that any logical argument or any experience could ever shake the almost religious fervor of those who believe in salvation through spending and credit expansion.

The false religion has been exposed anew.