The main problem with the accumulation of debt at low rates is that it has the same effect as a real estate bubble. It disguises real liquidity and solvency risk, because borrowing costs are too good to be true. And they are not true—Daniel Lacalle

In this short issue

Will the Interim Return of the Low-Interest Rate Regime Fire Up the Philippine PSE’s Property Index?

I. As Financial Conditions Substantially Eased, Global Markets Celebrate with a Melt-Up!

II. In November, the PSEi 30 Surfed the Global Equity Boom Despite Hurdled with Low Liquidity

III. The PSEi 30’s Changing Market Leadership: From Finance to the Property Sector?

IV. Divergent Performance Among Developer Member Firms of the Property Index

V. Since 2019, Changes in BSP Rates Immaterial to the Property Index Slump

Will the Interim Return of the Low-Interest Rate Regime Fire Up the Philippine PSE’s Property Index?

The Property Index has been a primary beneficiary of the recent bounce in the PSE brought about by expectations of financial easing. Is this sustainable?

I. As Financial Conditions Substantially Eased, Global Markets Celebrate with a Melt-Up!

Inflationary biases unleashed!

Massive short squeezes, unwinding of hedge positions, and yield-chasing trend-following crowds have sent a flurry of bids across global asset classes.

Markets have interpreted global central banks—led by the US Federal Reserve—as signaling a dovish stance—which means forthcoming rate cuts!

Moreover, the snowballing trend of global central bank easing has reinforced this sentiment.

Under the spell of a "soft landing," the entranced global markets boomed as "Goldilocks economy meets the Santa Claus rally!" Amazing.

Figure 1

US financial conditions swung to an unprecedented easing last November as the US dollar sunk. (Figure 1, top two charts)

Global bonds rallied most since the Great Financial Crisis! (Figure 1, second to the lowest graphs)

Emerging Market funds reported their first inflows in four months. (Figure 1, lowest diagram)

US stocks nearing record highs! Bitcoin reached its highest level since May 2022! Gold prices soared to an all-time high!

Risks have been thrown under the bus.

What could go wrong?

II. In November, the PSEi 30 Surfed the Global Equity Boom Despite Hurdled with Low Liquidity

Figure 2

Aside from the gigantic rally in Philippine Treasuries, the PSEi 30 reported its 3rd best November month-on-month showing in the last eight years. (Figure 2, upper table)

November's gains whittled down the YTD and YoY losses to 5.22% and 8.22%, respectively.

Unfortunately, such advance emerged amidst a stunning drop in main board volume, which reached 2010 levels! (Figure 2, lower graph)

Remarkably, cross-trades have padded up the thinning volume. For instance, the December 2023 session opened with SPNEC special block sales, which accounted for 37% of the main board volume of Php 4.1 billion. Alternatively, the total mainboard volume would have been only Php 2.6 billion without the SPNEC trade.

Furthermore, the growing concentration of trading activities on heavyweights and the largest market cap issues expose the inherent build-up of risks.

III. The PSEi 30’s Changing Market Leadership: From Finance to the Property Sector?

Figure 3

Expectations of the BSP cuts have fueled a likely change in the complexion of the market leadership. Rising rates have led to the outperformance of financials that have recently cushioned the PSEi 30 from a substantial decline. (Figure 3, upper window)

However, easing financial conditions has strengthened the performance of the two-PSEi 30 property firms. The public has been impressed by the idea that low rates would reinvigorate the property bubble.

The free float market pie of the two property members of the PSEi 30 has started to gain ground against the three banks and the PSEi 30 composite. (Figure 3, lower chart)

IV. Divergent Performance Among Developer Member Firms of the Property Index

Figure 4

However, in the context of property developer members of the PSE Property Index, except for Double Dragon [PSE: DD], the focal point of most of the weekly rally has been on the two PSEi 30 issues: SM Prime [PSE: SMPH] and Ayala Land [PSE: ALI]. The rest of the developer members of the index showed modest monthly gains (Megaworld PSE: MEG & Robinsons Land PSE: RLC) while Filinvest Land [PSE: FLI] has lagged horribly in all categories. (Figure/Table 4 upper chart)

Using the pretext of low rates, index managers have attempted to shift the market's attention towards the embattled property sector—the reason the PSEi 30 remained afloat at the 6,250 level.

Yet, their price charts reveal the disparate paths. (Of course, past performance does not guarantee future results) (Figure 4, lower graph)

Divergent and concentration activities among members of the property index have signified a consequence of the low-volume market.

Let us see if the pumps would draw or attract foreign money.

V. Since 2019, Changes in BSP Rates Immaterial to the Property Index Slump

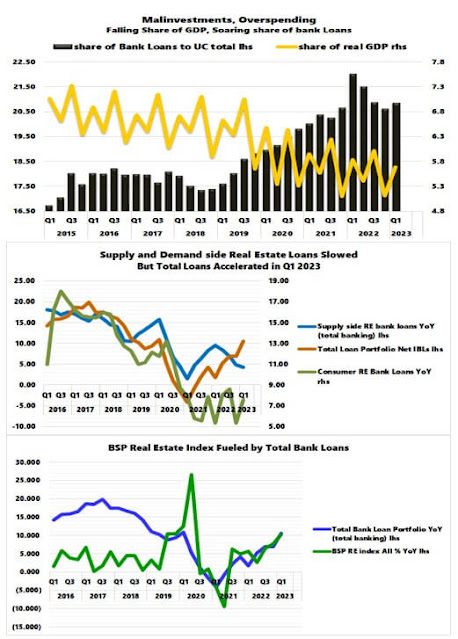

Figure 5

Of course, the most critical question is: Will low rates benefit the Property Index?

If recent history should rhyme, the answer is negative.

Since 2019, the bear market of the property index and its diminishing returns occurred despite historically low rates and the massive liquidity injections by the BSP. (Figure 5, top and middle windows)

It only worsened during the latest inflation spike and the BSP rate hikes.

Its falling share of the total PSE volume highlights the ordeal of the property index, which means the sector's liquidity drought has not been confined to the financial conditions but has diffused into their stocks. (Figure 5, lowest chart)

We recently delved or wrote an exposition of this.

Or, recent changes in BSP rates have had little influence on the financial and market entropy experienced by the sector.

If my humble guess is correct, any interim boom may represent a dead cat's bounce, a bear market rally, or a bull trap. After all, no trend moves in a straight line.

Sure, one can trade the momentum.

But caveat emptor.