Because of pressures applied by some influential groups on the Philippine government over the risks of property bubbles, officials of the Philippine central bank, the Bangko Sentral ng Pilipinas (BSP), proposes to establish a “residential property-price index” index to monitor “asset bubble risks” in the property sector at the first half of the year.

Overheating is a Sign of a Maturing Inflationary Boom

Yet while the government including the President rabidly denies the “overheating” of the economy, a private company Colliers International notes that “February projected property prices in Manila’s financial district Makati, which climbed to a record last year will rise a further 8 percent in 2014.”[1]

The tautology of “economic overheating” is what I had predicted would become the catchphrase for the mainstream[2],

Eventually, the current boom will get out of hand, which will be manifested through rising interest rates, which the mainstream vernacular will call “economic overheating” …

Of course, record property prices on itself are hardly sufficient representative of an escalating bubble, as record property prices are merely symptoms.

The question what has financed property prices to reach such record levels?

The answer as I have been pointing out here has been intensifying asset speculation financed by debt.

The article further notes that “property loans and investments rose 6.8 percent to a record 900.1 billion pesos ($20 billion) in the second quarter of 2013 from the previous three-month period, the central bank reported in November. Property made up 22 percent of the total loan portfolio at banks.” (bold mine)

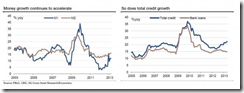

Record property prices backed by record debt. Record debt spending as expressed by a 30++% jump in money supply.

The fundamental problem with the mainstream’s heavy dependence to look at ‘select’ statistics in measuring economic activities has been at the risks of isolating economic variables which are really entwined or interrelated

As the great Austrian economist Ludwig von Mises reminds us[3].

Economics does not allow any breaking up into special branches. It invariably deals with the interconnectedness of all phenomena of acting and economizing. All economic facts mutually condition one another. Each of the various economic problems must be dealt with in the frame of a comprehensive system assigning its due place and weight to every aspect of human wants and desires.

And this is why overheating hasn’t just been as “property” problem. Measuring property and property related credit alone will tend to diminish the size and scale of risks.

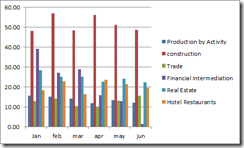

Bubbles operate like a vortex, they draw in associated industries which piggybacks on the main beneficiaries of the credit boom.

Think of it, will shopping mall operators continue with their wild expansion plans if they don’t project a sustained demand for their retail outlets? Will hotel developers also be in an expansion spree if they don’t foresee a sustained boom for their services from both resident and non-resident tourists? Will office building developers continue to expand if they don’t expect to see their units bought or leased out at profitable rates?

This is why the Philippine property bubble incorporates the shopping mall, hotel and restaurants and vertical non-residential edifices, as well as, the trade industry.

The banking and other financial intermediaries and the capital markets (stocks and bonds) which have all served as the property sector’s financial conduits or agents are also considered as bubble beneficiaries or appendages.

Statistics which signifies history of specific variable/s in numbers will not tell you this, it is economic deductive causal-realist logic that does.

This also means the BSP will gravely underestimate on their assessment of bubble risks by solely looking at “residential property-price index” while ignoring the other dimensions of the property sectors that have also been scampering to chase yields financed by debt.

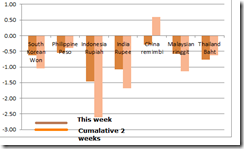

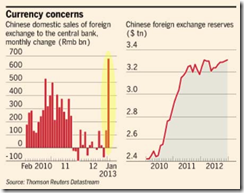

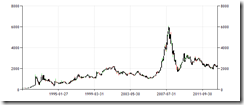

As one would note, aside from record property prices, and the revival of the credit inspired mania in domestic stocks, the peso has been falling despite the this week’s region driven rebound and yields of Philippine treasuries remain stubbornly above 2013 levels while price inflation, despite so called .1% pullback from 4.2% to 4.1% this February[4] remains at the high end of the government estimates. All these come in the face of money supply growth going berserk.

And all these converge to depict that the statistical economy has been ‘overheating’ regardless of the official denial.

As a side note; speaking of the domestic currency, the USD-peso has sharply fallen Friday to close the year almost unchanged. The two week rally in Emerging Asian currencies signifies a regional phenomenon brought about by “resistance-to-change” outlook in the attempt again to resuscitate regional bubbles.

For instance Indonesia’s rupiah has massively rallied over the past 2 weeks, even when there has only been marginal improvement in the so-called current account and balance of trade deficits. Indonesia’s external debt swelled by about 5% in 2013. Meanwhile the Philippine peso has seesawed from big rallies to big losses. Friday monster rally seems part of the recent sharp volatility swings. We will see how rallying ASEAN currencies will react to the crash in China’s exports.

Why the BSP seems Trapped

Going back to BSP’s proposed anti-bubble measures, and this seems why the BSP-Philippine government appears to be trapped.

An asset bubble thermometer has already been in existence. There is an extant 20% cap on bank lending to the property sector. But as early as May 2013, the cap or the quota has been breached[5]. Now property sector lending has swelled by over 10% or 22% of the threshold. In short, the BSP, despite the self-imposed legal proscription, has been tolerant of the breach.

While it may be partly true that banks have been tightening lending standards for the commercial property sector “for the sixth consecutive quarter in the three months through December”, there has been a vast discrepancy between reports framed from the government’s perspective and what the stock market has been cheering about.

I have noted last week that the expected expansion on capital spending for real estate and allied industries will reach a very conservative Php 250 billion[6]. Most of the companies have declared borrowing as the source of finance for such expansion.

In terms of proportionality, 250 billion pesos amidst a record 900.1 billion pesos in property loans and investments in the banking system for 2013 will extrapolate to a 27.8% jump in credit! As a share of overall banking loans based on 2013 data, real estate loans will balloon to 26.5%. That’s if all these will be sourced from the banks.

Yet if the BSP stringently enforces the cap, there are many implications on these.

Property firms may circumvent the cap through camouflaged borrowing which is borrowing, coursed through other industries from which these property firms have exposure to. Say for instance, if a company’s portfolio includes energy or manufacturing or other non-real estate industries, the sister companies may secure borrowing from banks then execute intercompany loans.

This has been the case in the 2011 Bangladesh stock market crash. Lending caps on the banking system were dodged when loans were acquired through industrial companies and then diverted into the stock market. When the government tightened by raising bank reserves requirements, these loans came under pressure that led to the stock market collapse[7].

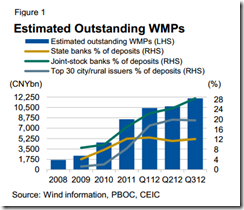

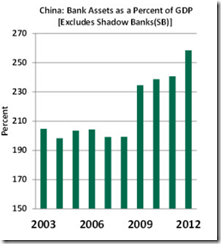

A second scenario is related to the first. This for current banks to do what has become one of the alternative main avenues for local government financing in China; the use loopholes via the establishment of non-property companies that serve as intermediaries to acquire and re-channel loans to the intended firms hobbled by such regulations. This is known as the Shadow Banks[8].

The Philippines have already existing shadow banks, according to the World Bank[9]. But one of the current main forms of shadow banks has been to finance buyers of property from the informal economy.

Nonetheless a strict enforcement of banking property loan quota by the BSP will impel for innovative ways to get around such regulations

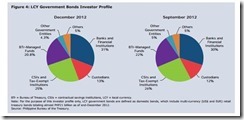

A third way to go around the restrictions will be through deepening access of the domestic bond and international bond markets. Many companies have already expressed the former option.

Yet a ceiling on debt means reduced availability of funds from domestic sources which implies of HIGHER domestic interest rates. Should domestic interest rates rise faster than foreign based rates then these property companies may resort to more offshoring borrowings. Such may also include borrowing from offshore banks.

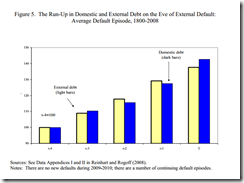

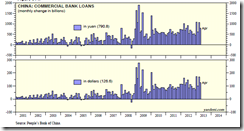

Again the Chinese experience can be instructive. In the face of relatively faster rising rates, US dollar loans by Chinese property companies have raised $40 billion over the past 2 years[10].

Of course expectations of currency conditions will play a big role in determining sourcing of credit for these companies. Then, the yuan had been a one way trade, so Chinese property companies underestimated on the currency risks by borrowing US dollar loans

The fourth setting will be for the industry to vastly reduce or even desist from expansions. But this will be devastating for the incumbent government who has been starved out of funds to finance their burgeoning boondoggles.

Bubble Revenues in Support of Government Spending Bubble

Easy access to finance would mean to impress upon to the creditors of the salutary state of financial conditions of the debtors. As such, in terms of the Philippine political economy, confidence has to be established by the impression of a booming economy.

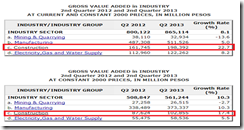

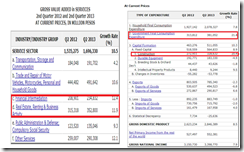

And real estate has been a key anchor to the statistical boom. For instance, construction and Real Estate accounted for 18.18% of statistical GDP growth for the Philippines in 2013 based in the industry origins at current prices. If we should include trade and financial intermediation, the share of exposure of the said credit driven frothy industries balloon to 43.66%. In other words, tighten credit (either via interest rates or strict imposition of banking loan ceiling cap) and your “fastest economy in Asia” crumbles.

Notice: Credit tightening doesn’t mean that the entire 43.66% will collapse. It means that big overleveraged participants in the sector, which when affected, will drag down many entities of the related sectors and even to the non-related sectors. Yet ironically some [debt free] companies from the same sector may benefit from the problems of their colleagues. The latter could be buyers of problematic assets at fire sale (market clearing) prices.

Also remember access to the formal banking and credit system has been very limited (2-3 out of 10 households), which means all these so-called growth has concentrated. Alternatively this means risks have also been concentrated.

On a side but related note, one has to just ask why is it that the Philippines, an agricultural country, have essentially no commodity spot and futures markets and have been left behind by her neighbors[11]. The benefits from commodity markets should have been the purge or reduction of the role of the middleman, diminished transaction costs, to empower and enrich the agricultural and commodity producers, generate pricing efficiency, spread risks and expand access to credit by allowing the informal sector to migrate to the formal sector. And yet the public blathers about the sins of rice smuggling[12], duh!

This is also related to why the PSE dithers (or refuses) to integrate her bourses with region[13].

And this is also why there has been a growing divergence in sentiment between the informal and the formal sectors[14].

Also such divergence has brought about the mainstream’s perplexity on why the so-called boom has not been translating into more jobs. Paradoxically, highly paid experts have offered little but to associate joblessness with poverty rates[15].

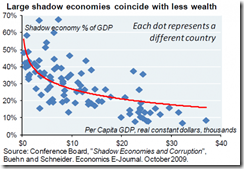

As I have been pointing out numerous times, real economic growth can’t happen when there is a huge formal-informal system divide. As one can see from the above chart[16], the degree of shadow economies has been tightly associated with degree of wealth conditions. Naturally any informal economy includes informal or shadow banking too.

The informal economy which is a product of economic and financial repression[17] extrapolates to high transaction costs, high cost of capital and equally inefficient means to accumulate real savings and capital[18]. This also means limited growth because substantial growth postulates migration to the formal economy which poses as a disincentive for many in the informal economy.

So the mainstream can continue to prattle about growth statistics but by ignoring the informal economy they will tend to miss out on the real conditions of the economy, that’s because the informal sector constitutes a huge share of the population.

This brings us back to issue of easy access to credit. The Philippine government missed her tax collection target by a slight 2.95% in 2013, albeit overall collections grew by 15% year on year. While this is good news so far as for the statistical concentrated economy, the bad news is that aside from stagflation, taxes will even grow at a faster rate this year.

The BIR, which accounts for 70% of the government’s total revenues, expects a 16.16% increase in her 2014 target[19]. That’s because national government budget will expand by 13% to Php 2.265 trillion in 2014[20]. So government spending will grow about twice the statistical economy.

This explains why in spite of the so-called boom, the BIR has been tightening on the noose of practicing doctors[21], where the latter have pushed backed, and even on the ‘lechon’ or roast pork vendors[22]. As one would note, the government has been waging war on the informal economy. So one can’t expect real growth to occur when government tries to restrict commercial activities.

Oh by the way the Philippine national government has so far done well in containing budget deficit. As of November 2013, annualized deficit (Php 111.464 billion) has been sharply lower, down by 54% compared to the yearend of 2012 (Php 242.827 billion). That’s the good news. The bad news is that the good upkeep depends on revenues from an unsustainable bubble blowing economy.

All these means that the incumbent government will have to increasingly rely on a sustained credit financed boom of assets in the formal economy in order to fund her fast expanding spendthrift appetite, as well as, to maintain zero bound rates or negative real rates (bluntly financial repression) to keep her debt burden manageable.

So the supposed boom in statistical formal economy translates to a boom in government spending financed by a boom in taxes derived from bubbles

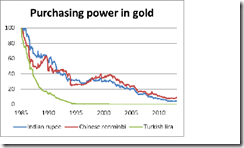

Aside from the government, the other beneficiaries of BSP subsidies are the asset holders and formal economy debtors, which come at the expense of savers, non-asset holders and peso holders (outside the beneficiaries whose assets offset the loss in purchasing power).

Yet the only way to neutralize the negative effects of excessive money supply growth is through productivity growth.

But blowing bubbles and taxes diverts resources from high value productive uses to non-productive consumption activities. Thus a statistical boom can occur in the face of a loss of productivity. Yet this isn’t real growth, but that’s how bubbles operate

Think of it, if the BSP rigidly imposes banking caps, a tightening would result to a market meltdown and which will most likely get transmitted to the real economy via a significant slowdown or even a contraction, if not a crisis. This will not only undermine the leadership’s political goals but also bring to the surface the economic and political imbalances that have been built to promote access to easy credit via populist politics. And economic strains will likely bring about a more intense popular demand for the scrutiny of political malfeasances.

So the Philippine government together with the BSP has been trapped. They will need to keep the musical chairs going by continuing to inflate on asset bubbles and hope that such bubbles won’t pop under their terms. Thus this explains two factors: one the Pollyannaish declarations by the officialdom, which has been bought hook, line and sinker by media and industry participants benefiting from the phony boom. Second, the public denials and the superficial measures announced by authorities supposedly to contain the risks of financial instability via asset bubbles.

Yet everything will depend on the bond vigilantes. If interest rates as expressed by bond yields continue to climb, then what is politically hoped for may not be attained, they may even backfire.

As John Adams US founding father and 2nd US President in his defense at the Boston Massacre Trial said,

Facts are stubborn things; and whatever may be our wishes, our inclinations, or the dictates of our passion, they cannot alter the state of facts and evidence.

[1] Bloomberg.com Philippine Index to Monitor the Risk of Property Bubble March 4, 2014

[2] See What to Expect in 2013 January 7, 2013

[3] Ludwig von Mises, The Why of Human Action, Economic Freedom and Interventionism

[4] Wall Street Journal Slower Inflation Gives Philippine Central Bank Reprieve March 6, 2014

[5] Bangko Sentral ng Pilipinas BSP Releases Results of Expanded Real Estate Exposure Monitoring, May 10, 2013

[6] See Phisix: Why Tomorrow’s Fundamentals will be Distinct from Yesterday, March 3, 2014

[7] See Bangladesh Stock Market Crash: Evidence of Inflation Driven Markets January 11, 2011

[8] See Will China Trigger the Black Swan Event in 2014? January 20, 2014

[9] See The Flaws of BSP’s Real Estate Monitoring and Banking Stress Tests May 20, 2013

[10] Reuters.com Renminbi swings shake Chinese developers March 6, 2014

[11] See A Prospective Boom in Philippine Agriculture! February 25, 2008

[12] Wall Street Journal Crackdown on Rice Smuggling Blamed for Price Jump February 26, 2014

[13] See Phisix 7,200: Up, up and away! The Illusions of Comfort May 6, 2013

[14] See Phisix: Stagflation is here, Expect a Weaker Peso February 17, 2014

[15] Wall Street Journal Few Good Jobs In Fast-Growing Philippines, March 4, 2014

[16] Zero Hedge JPMorgan's Biggest Concern Is That Bitcoin Will Succeed March 7, 2014

[17] See Does The Government Deserve Credit Over Philippine Economic Growth? May 31, 2010

[18] See Phisix: Global Financial Volatility Intensifies February 10, 2014

[19] Malaya BIR MISSES 2013 TARGET BY 3% February 20, 14

[20] Rappler.com Aquino signs P2.265-T 2014 budget December 20, 2013

[21] Inquirer.net Doctors slam BIR ad: We’re not tax cheats March 4, 2014

[22] Manila Standard Taxman roasts lechon traders January 9, 2014