Dr. Ben Bernanke and his team at the US Federal Reserve appears to be in a quandary over the surge of part time jobs.

The number of workers holding full-time positions fell in the U.S. in June as part-timers hit a record after rising for three straight months, according to the Bureau of Labor Statistics household data. Part-time employment has been outpacing full-time job growth since 2008. Economists cite still-tough economic conditions as the root cause, with some saying President Barack Obama’s 2010 health-care law exacerbates the trend.

U.S. Federal Reserve Chairman Ben Bernanke told a House committee July 17 that policy makers consider underemployment, which includes part-time workers who want full-time jobs, one of the gauges of labor-market strength…

The number of part-time employees in June rose by 360,000, the Bureau of Labor Statistics reported, based on its survey of households. Full-time workers fell by 240,000, erasing much of the gains from April and May. The share of Americans who work part-time for economic reasons, meaning they can’t find full-time jobs or because their hours have been cut, is 78 percent higher than in December 2007, when the 18-month recession began.

So what the mainstream sees as “strong” economic growth has been founded by part time jobs.

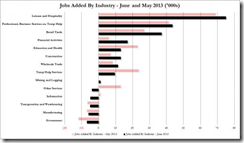

The charts above from Zero Hedge shows of how part time jobs came at the expense of full time jobs last June.

Importantly, much of the new jobs comes from the low wage segments of the service industry, particularly leisure and hospitality, retail trade and education, health and other temp jobs, as observed by the Zero Hedge.

Talk about economic "vigor".

Asked whether Obamacare has contributed to the part time jobs, from the same Bloomberg article (bold mine)

“It’s hard to make any judgment,” Bernanke said when Stutzman asked if the Patient Protection and Affordable Care Act’s mandates are slowing the economy. Bernanke said that it has been cited in the economic outlook survey known as the Beige Book, which the Federal Open Market Committee considers in assessing the economy.

“One thing that we hear in the commentary that we get at the FOMC is that some employers are hiring part-time in order to avoid the mandate,” Bernanke said. He added that “the very high level of part-time employment has been around since the beginning of the recovery, and we don’t fully understand it.”

For the official whose opinions and decisions moves the global financial markets and likewise plays a significant role in influencing activities on the main street and on the global economy, “we don’t fully understand it” looks really very reassuring. This means that “we don’t fully understand it” has been the basis of all grand experimental policies being conducted by the FED.

I believe that the crucial changes in the character of US employment has been related to the record cash pileup by US non-financial corporations

The Federal Reserve reported Thursday that nonfinancial companies had socked away $1.84 trillion in cash and other liquid assets as of the end of March, up 26% from a year earlier and the largest-ever increase in records going back to 1952. Cash made up about 7% of all company assets, including factories and financial investments, the highest level since 1963.

Both variables, the reluctance to invest (as expressed by huge cash holdings) and the change in the character of the US labor force, have been products of regime uncertainty.

Regime uncertainty as defined by Austrian economics professor Robert Higgs represents the “pervasive lack of confidence among investors in their ability to foresee the extent to which future government actions will alter their private-property rights”

On whether Obamacare has been responsible for such trend changes, Dr. Bernanke’s adroitly fudges the issue by referring to “the beginning of the recovery”.

The reality is that the Patient Protection and Affordable Care Act (PPACA) or the Affordable Care Act(ACA), popularly known as Obamacare was signed into law in March of 2010, basically “the beginning of the recovery”.

And small businesses are the main sector that appear to be hardly affected.

-Small business represents 99.7 percent of all employer firms.

-In 2010, there were an estimated 27.9 million small businesses in the U.S.—5.9 million with employees and 21.4 million without employees.

-Small businesses employ about half of the country’s private sector workforce.

- Small firms accounted for 64 percent or 9.8 million of the 15 million net new jobs created between 1993 and 2011.

Yet from a recent survey conducted by the US Chamber of Commerce, “unease around Obamacare appears to be increasing among small businesses” according to the Huffington Post.

In a survey conducted by National Federation of Independent Business (NFIB) last June, small business optimism continues to be plagued by taxes and government regulations and red tape

As the NFIB chief economist William Dunkelburg wrote (bold highlights mine)

The economy remains “bifurcated”, with the big firms producing most of the GDP growth with little help from small business. That balance is shifting, but unfortunately because larger firms are losing ground, not because small business is growing faster. Housing and energy are helping, and that does involve a lot of small businesses but the rout in housing was so severe that there are now supply constraints developing in new home construction due to lost capacity that cannot be easily reconstituted. Home prices are now increasing at double digit rates. Consumer net worth is allegedly doing well due to stock prices and house prices rising. But the quantity of items held, real wealth (houses, cars, fractions of a company owned), is not increasing that fast, just the prices. Been there, done that.

While US government sponsored surveys or the US Federal Reserve of Philadelphia and Minneapolis says that only a small portion has been affected by Obamacare, circumstantial developments (part time jobs and high cash by non-financial corporations due to reluctance to invest) says otherwise.

Nonetheless, “Big firms producing most of the GDP growth with little help from small business” has been a common feature in today’s QE-ZIRP based global financial economy where monetary policies have been engineered to buoy asset markets (stocks, real estate) via credit fueled destabilizing speculations (bubbles).

The reality is that the Dr. Bernanke's policies has substantially been responsible for these. FED easing policies combined with Obamacare and the increased regulatory mandates (the Federal Register is now over 81,000 pages long. Obamacare has 906 pages, Dodd Frank has 849 pages) and aside from a surge in taxes (US tax code now 72,000 pages) all contributes to the uncertainty over the investor’s property rights, hence the lack of commitment to invest and the corresponding changes in the hiring and employment dynamic.