In economics, things take longer to happen than you think they will, and then they happen faster than you thought they could― Rudiger Dornbusch

In this issue

Escalating Systemic Risk: As Cash Reserves Plummeted, San Miguel’s 9M Debt Zoomed to an Astonishing Php 1.405 TRILLION!

I. The Public’s Blind Spot: San Miguel’s 9M Debt Zoomed to an Astonishing Php 1.405 TRILLION!

II. San Miguel’s Worsening Liquidity Crunch!

III. SMC’s Debt-in, Debt-out Dynamics: Mounting Signs of Hyman Minsky’s Ponzi Finance Dynamic in Motion

IV. SMC’s Escalating Fragility: Intensifying Concentration and Counterparty Risks

Escalating Systemic Risk: As Cash Reserves Plummeted, San Miguel’s 9M Debt Zoomed to an Astonishing Php 1.405 TRILLION!

The public seems unaware that the published debt of one of the Philippines' largest listed firms, San Miguel, has skyrocketed into the stratosphere! Why this represents a systemic risk.

I. The Public’s Blind Spot: San Miguel’s 9M Debt Zoomed to an Astonishing Php 1.405 TRILLION!

Figure 1

It was a surprise that this tweet on San Miguel's [PSE: SMC] debt had an explosive reach, interactions, and responses, given my tiny X (formerly Twitter) account (few followers).

Except for comparing its nominal growth with SMC's free float market capitalization and my conclusion, "This won't end well," the tweet was mainly about facts and barely an analysis. The Fintweet world seems astounded by the "new" information. If my conjectures are accurate, this only exposed the public's blind spots on the escalating systemic fragilities.

Why has the public been sucker punched?

SMC has openly published their debt conditions not only in their 17Q and 17As but, more importantly, in their "analyst briefing presentations."

Yet, there have been barely any mentions of these in social media or discussions of the consensus experts. Mainstream news has signified an echo chamber of corporate press releases fixating on the top and bottom lines (in percentages).

Other than these, a deafening silence. Possible reasons: Selective attention? The Principal-Agent Problem? Shaping the Overton Window?

II. San Miguel’s Worsening Liquidity Crunch!

San Miguel reported a Php 31.187 billion net income in the three quarters of 2023. That's 141% or Php 18.242 billion improvement from a year ago.

Compared to the PSEi 30 peers, SMC generated the most income in % and pesos in Q3 2023, resulting in the second-best income growth in the last three quarters after JGS.

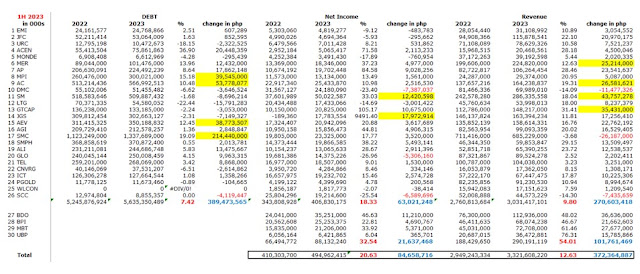

Figure 2

Interestingly, despite the so-called profit boom, SMC borrowed a whopping Php 68.2 billion in Q3 to send its debt level to a mind-boggling Php 1.405 TRILLION! T-R-I-L-L-I-O-N! (Figure 1, upper window) Of course, this hasn't been a strange dynamic to us.

SMC has increased the pace of its quarterly borrowing growth in pesos. It has borrowed over Php 50 billion in the last 5 of the six quarters!

And yes, the 9M aggregate debt growth of Php 153.02 billion represents around 62% of SMC's free market float as of November 17th.

Strikingly, Q3 borrowing exceeded the firm's 9M GROSS profits of Php 62.875 billion!

And despite the profits and the borrowing, SMC's cash reserves plummeted by 18.7% or by Php 60.984 billion!

As a result, current liabilities of Php 450 billion soared past cash reserves of Php 265 billion, which extrapolates to the widest deficit (Php 184.9 billion) ever! (Figure 1, lower graph)

In short, like Metro Pacific, underneath the consensus talking points, SMC has been plagued by a developing liquidity crunch.

III. SMC’s Debt-in, Debt-out Dynamics: Mounting Signs of Hyman Minsky’s Ponzi Finance Dynamic in Motion

Figure 3

SMC's interest expenses have recently soared, even as it dipped in Q3.

Its quarterly share of gross margins has been on an uptrend since 2016. (Figure 3, topmost pane)

To be sure, BSP's recent rate hikes have worsened SMC's onus exhibited by the rising interest expense.

But it isn't interest rates alone. Rising debt levels are the biggest contributor to SMC's mounting debt burden. (Figure 3, middle and lower charts)

Figure 4

SMC's FX exposure represents about half of its debt liabilities. (Figure 4, upper chart)

From SMC's Q3 17Q: "The increase in interest expense and other financing charges was mainly due to higher average loan balance of SMC and Petron coupled with higher interest rates."

Though the net income (before interest and tax) bounce has lifted SMC's Interest Coverage Ratio (ICR) above the 1.5% threshold, the above numbers show why "EBIT" could be erroneous, and thus, the dubiety of the higher ICR. (Figure 4, lower graph)

Remember, Php 450 billion of 9M SMC's debt is due for payment within a year (current), while "net cash flows provided by operating activities accounted" for Php 142.450 billion during this "profit boom." Aside from the current borrowing to bridge the current gap, if cash flows sink further, wouldn't this require even more borrowing?

To be more precise, to survive, SMC requires continuous borrowings to fund this ever-widening gap, or it may eventually be required to sell its assets soon!

And this dynamic, as we have repeatedly been pointing out, represents Hyman Minsky's "Ponzi finance."

For Ponzi units, the cash flows from operations are not sufficient to fulfill either the repayment of principle or the interest due on outstanding debts by their cash flows from operations. Such units can sell assets or borrow. Borrowing to pay interest or selling assets to pay interest (and even dividends) on common stock lowers the equity of a unit, even as it increases liabilities and the prior commitment of future incomes. A unit that Ponzi finances lowers the margin of safety that it offers the holders of its debts. (Minsky, 1992)

That is to say, the prospect of the BSP's lowering of interest rates will do little to ease or mitigate SMC's intensifying cash-flow stream predicament.

IV. SMC’s Escalating Fragility: Intensifying Concentration and Counterparty Risks

And that's not all.

It's also about escalating CONCENTRATION and CONTAGION risks.

SMC accounted for 24% and 25% of the PSEi 30's 9M and Q3 gross revenues, 19.3% of 9M cash reserve, and 26.8% gross debt.

SMC's 9M net debt growth of Php 153.019 billion signified the dominant majority or 71.82% of the PSEi 30's Php 213.07 trillion net debt growth! Amazing.

Figure 5

Here’s the kicker: SMC's Php 1.405 TRILLION debt represents a stunning 4.71% share of the BSP's Total Financial Resources at Php 29.855 trillion—which is at an ALL-TIME HIGH! (Figure 5)

Expressly, aside from the government, the financial system has vastly increased its exposure to SMC, which comes at the expense of more productive firms and which translates to savings/capital consumption.

And the financial system's record exposure to SMC also raises systemic fragility. That is to say, it is not only a problem of SMC but also a COUNTERPARTY risk.

So, in addition to the expanded risks to SMC’s equity and bondholders, as Hyman Minsky theorized, other creditors, suppliers, employees, and the daisy chain or lattice network of firms doing business with SMC (directly and indirectly) may suffer from a creditor's "sudden stop."

That being said, the buildup of SMC’s risks represents a non-linear, non-proportional, and asymmetrical feedback loop.

Aside from political entrepreneurship, the BSP's easy money regime has fostered and nurtured SMC's privileged financial status, which increasingly depended on the expansion and recycling of credit. As such, SMC has transformed into a "too big to fail" firm.

When crunch time arrives, will the BSP (and) or Bureau of Treasury bailout SMC? Or, will these agencies finance a bailout of it by a consortium of firms?

How will these impact the economy and the capital markets?

Stay tuned.

____

References

San Miguel Corporation, SEC Form 17Q, Management Discussion and Analysis; Edge.PSE.com.ph, P.8, Table p.18; November 15, 2023

Hyman P. Minsky The Financial Instability Hypothesis The Jerome Levy Economics Institute of Bard College May 1992