The following has not been meant to be a blog post, but a reply to a dear "mercantilist" friend who stubbornly insists that the US Steel industry’s decline has been solely due to "high" wages which require the "inflation" or the Keynesian "money illusion".

Since I am not an expert of the steel industry, I based the following from a variety of studies to debunk such “fallacy of a single cause” political absurdity

I am posting this to share with others, as well as, for my personal reference too.

The idea that the steel industry has been primarily about high wages is simply not a reality.

The Peterson Institute of International Economics suggested that long years of government interventionism has prompted for the declining competitiveness of the industry

Interventionism in History:

Steel trade has been in turmoil since the late 1960s. Without exaggeration, more Washington trade lawyers work on steel disputes than any other trade issue. To recap the trade saga:-In 1968, US steel producers filed a series of countervailing duty cases against subsidized European steel- makers. These cases led to “voluntary restraint agreements” that were terminated when the global steel market recovered in 1974.-In 1977, US steel producers filed a series of antidumping cases primarily aimed at Japanese steel firms. These cases led to a system of minimum reference prices for steel imports, known as the “trigger price mechanism” (TPM). The TPM system was soon extended to European steel.-In 1974 and 1979, at both the launch and the ratification of the Tokyo Round of multilateral trade negotiations, the US antidumping law was amended (at the insistence of the steel industry and to conform with the Tokyo Round Antidumping Code), making it easier for domestic producers to prevail in antidumping cases.-In 1982, dissatisfied with the workings of the TPM system, US steel producers filed many antidumping and counter- vailing duty cases. These were resolved by new voluntary restraint agreements, which lasted until 1992.-In the mid-1980s, trade remedy cases were filed against “new” exporters, such as Brazil and Korea. Most of these cases resulted in high antidumping and countervailing duty penalties.-In 1989, the United States launched an effort to negotiate a Multilateral Steel Agreement designed to abolish subsidies. The negotiations failed and were ultimately abandoned in 1997.-In 1992, when the voluntary restraint agreements expired, a new set of trade remedy cases were filed. Many of the resulting penalty duties remain in effect today.-In March 1999, the House of Representatives passed H.R. 975, Congressman Peter Visclosky’s (D-IN) steel quota bill, 289 to 141. After a spirited debate, bill was defeated in the Senate. The current round of steel trade initiatives essentially renews the 1999 debate.Why so much trade turmoil? One reason is persistent overcapacity in the global steel industry abetted by widespread market distortions. Persistent overcapacity has translated into cyclically falling prices and industry losses in every business slowdown. Another reason is the combination of rapid productivity growth and slow demand growth. Wheat farmers and steel workers share two traits: both have greatly increased their output per worker-year and both face sluggish demand for their products. The result is a painful secular decline in employment. These forces—in an effort to cushion the domestic steel industry—have provoked a series of rearguard trade actions.

The Unintended Effects from Peterson

Market DistortionsIn a normal industry, prolonged operating losses will weed out weak firms. Ideally, steel firms with the highest costs would be the first to close. But the real world is far from ideal. Many plants have closed and steel employment has plummeted. In the United States alone, over the last three years, 18 steel firms went bankrupt and about 23,500 workers lost their jobs. However, it is not production costs but rather market distortions that often determine the global “exit order” of struggling firms. Moreover, these distortions prolong the agony of failing firms by stretching the duration of depressed prices for the whole industry.One such distortion is cartel practices—private arrangements that enable some steel producers to maintain high prices in their home markets and sell abroad at low prices. Another distortion is public subsidies used to cover huge fixed costs (debt burdens, pension benefits, etc.). The United States is not the worst sinner when it comes to market distortions, but it is hardly free of guilt. Federal guarantee programs totaling several billion dollars have absorbed the pension responsibilities of some bankrupt steel firms and staved off bankruptcy for others.As a result of these distortions, the least efficient firms are not necessarily the first to close their doors and the industry as a whole sheds its excess capacity at a very slow pace.

Same observation from Cuts International

No different from the Heritage Foundation

The overproduction of steel is due to government intervention in the marketplace. Steel producers, left to themselves, have an incentive to produce only what consumers demand. Otherwise, they would be adding needless costs to their operations. When government intervenes and offers subsidies or other protections, normal market incentives are altered. Government subsidies thus may encourage a steel firm to produce more steel even if it exceeds consumer demand.Subsidies are a common practice in the steel industry, both around the world and in the United States. For example, the American Iron and Steel Institute reports that between 1980 and 1992, foreign steel manufacturers received over $100 billion in subsidies. In the United States, the steel industry was the beneficiary of more than $1 billion in federal loan guarantees in 2001. When an industry produces more than consumers demand, the surplus puts downward pressure on the price of the product and makes it difficult for firms to earn a profit. As recently as January 10, 2002, even though the price of hot-rolled steel was rising, it was still being sold below cost.Homegrown problems are another reason why the U.S. steel industry is suffering. Prior to 1968, the year the steel industry began receiving government protection from foreign competition, average compensation in the industry was roughly equal to the average in the manufacturing sector. Today, the average total compensation for the steel industry is $37.91 per hour--56 percent higher than the average compensation in the manufacturing sector. One of the principal reasons for this high average compensation is that the steel industry's very strong unions, without the threat of foreign competition, are able to negotiate high compensation packages for employees.

Harvard School’s Crimson Staff who wrote against the Bush era Protectionist tariff resonates

In defending the administration’s decision, U.S. Trade Representative Robert B. Zoellick said, “The global steel industry has been rife with government intervention, subsidies and protection,” and explained that the American response served to counter the protectionism of other governments. In order to equalize trade opportunities, the administration should not raise America’s trade barriers, but rather continue to break down the barriers of other countries. American tariffs will only lead to retaliatory tariffs, which will weaken the international free market economy and possibly lead to a trade war.

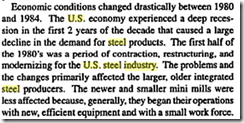

Failure to adapt with technological changes has also been a factor:

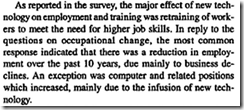

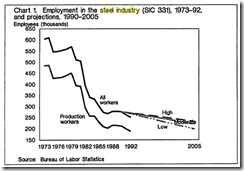

From the US Bureau of Labor and Statistics Technology and its effect on labor in the steel industry

Advancement in a technology led to productivity boom that led to a decline in employment

Again from the BLS:

From Multinational Monitor.org or “Fifteen Years of Neglect Have Left the Industry in Crisis - And Thousands of Workers Without Hope”

Since the early 1970s, when Japan became the world's leading steel producer, the industry has followed a policy of disinvesting in low-profit operations and diversification into oil and other industries. U.S. Steel has led the way: once the nation's largest industrial corporation, its share of the market has dropped from 75 percent in 1906 to around 20 percent today; and its major mills at Gary, Indiana, and Fairfield, Alabama were constructed at the turn of the century.Instead of rebuilding, the industry has relied on outdated technology. According to Ira C. Magaziner and Robert B. Reich in their recent book Minding America's Business, the industry "made small, incremental investments to obtain `cheap' capacity rather than make the larger, more aggressive, and riskier investments that could have led to superior productivity.

A 1986 MIT paper analysis the significance of technology

This paper exemplifies a techno-economic-strategic analysis in which key characteristics of technologies are first analyzed, economic consequences are then derived, and strategic implications are followed. Additionally, it demonstrates how technological innovations coupled with critical fixities of a firm can partially explain the entry, exit, and performance of firms in the U.S. steel industry. Because of the reluctance of existing firms to switch to new technologies, entrants using these new technologies entered the low carbon steel market and earned an extra profit. The existing integrated firms would rather have suffered accounting losses than replace their obsolete equipment as long as the cash flow remained positive.

From a 2012 Princeton Paper by Allan Collard-Wexler and Jan De Loecker Reallocation and Technology: Evidence from the U.S. Steel Industry

There is extensive evidence that large gains in productivity can be attributed to reallocation of resources towards more productive plants. This paper shows the role of technology and competition in the reallocation process for the American Steel industry. We provide direct evidence that technological change can itself bring about a process of resource reallocation over a long period of time and lead to substantial productivity growth for the industry as a whole. More specifically, we find that the introduction of a new production technology spurred productivity growth through two channels.First, the entry of minimills lead to a slow but steady drop in the market share of the incumbent technology, the vertically integrated producers. As minimills were 11 percent more productive, this movement of market share between technologies is responsible for a third of productivity growth in the industry.Second, while the new technology started out with a 25 percent productivity premium, by the end of the sample, minimills and vertically integrated producers are very similar in terms of efficiency. This catching-up process of the incumbents came about from a large within reallocation of resources among vertically integrated plants. On the other hand, minimills productivity grew moderately, and almost entirely because of a common shift in the production frontier.As as consequence of productivity growth, prices for steel products fell rapidly, though at different rates for those products which minimills could produce, versus those they could not. Markups decreased substantially, reflecting that prices fell more rapidly than production costs. This indicates increased competition for U.S. steel producers, which further drove increases in productivity.

The Economist went against Bush steel tariffs and cited the puffed up high costs from labor union privileges of “legacy liabilities”

Tariffs fail to address the real problem—high costs, including “legacy liabilities” in health-care and pension benefits. Many companies will fold anyway. When they do, putting workers out of a job and rendering those promised benefits null, the tariffs will only make the victims, as consumers, even worse off than they would have been

Failure to address inefficiencies through bankruptcy laws are another:

From Cato’s Dan Ikenson’s How Subsidies and Protectionism Weaken the U.S. Steel Industry

Some say that industry consolidation is necessary, but that significant legacy costs are preventing mergers and acquisitions. That may be true, but consolidation is not the only alternative for eliminating inefficient capacity. Attrition works too. Attrition works if the inefficient firms are liquidated in bankruptcy, and their assets are auctioned to the highest bidders.The largest obstacles to attrition are subsidy programs like the Emergency Steel Loan Guarantee Program, unrealistic unions seeking to prevent shutdowns, and the U.S. trade remedy laws. Inefficient operations need to be retired, and this can be accomplished only if market signals are not distorted by these interferences.When an operation is inefficient and losing money, access to investment naturally dwindles. Attempts to mitigate this outcome perpetuate the root problem. Although its expansion is being considered under different legislation pending in Congress, the Emergency Steel Loan Guarantee program should be abolished

The Living Economics says in Blocked Exit that a combination of the above have prompted for the decline in competitiveness of the US Steel Industry

In a mature industry with a saturated market such as steel, demand comes largely from replacement of existing products and normal growth. Generally, existing capacity that was inherited from the phase of explosive growth is much more than is necessary for current demand. Ideally, market competition should eliminate higher-cost producers in favor of lower-cost producers. However, all steel-producing countries have tried to preserve their production capacity regardless of cost efficiency considerations. In the U.S., for example, many factors have helped to delay consolidation of its steel industry:First, U.S. bankruptcy laws have unnecessarily delayed the steel industry consolidation process. Although 28 U.S. steel companies have filed for bankruptcy since 1997, including the nation's third and fourth largest, not many have actually gone out of business altogether. Chapter 11-bankruptcy protection often keeps the incumbent creditors at bay while allowing the bankrupt companies to receive new loans to continue production.In addition, the huge retiree benefit liabilities of weak companies have deterred potential acquisition by stronger companies. In an extraordinary bid to salvage the industry, USX-U.S. Steel Group proposed buying its troubled competitors Bethlehem Steel Corp., National Steel Corp. and Wheeling-Pittsburgh Corp. in early December 2001. But the $13 billion retiree healthcare and pension liabilities of the acquisition targets have stalled the consolidation process.Even weak steel companies may have out-sized political clout. The industry remains big in swing states of presidential elections such as Pennsylvania, Ohio and West Virginia, where a good portion of 600,000 retired steelworkers live. It is understandable that these states want to preserve the steel companies and their suppliers that provide local and state taxes and jobs.

The idea that high wages alone has been the culprit for the dearth of competitiveness that merits either protection or inflation as a solution has simply been unfounded and wishful thinking, bereft of reality.

This of course, has raised by the great dean of Austrian school of economics, Murray N. Rothbard, who dismissed the impact of inflation and other forms of protectionism to solve what is a politically engendered problem.

On inflationsim…

And every week at his Philadelphia salon, the venerable economist Henry C. Carey, son of Matthew and himself an ironmaster, instructed the Pennsylvania power elite at his "Carey Vespers," why they should favor fiat money and a depreciating greenback as well as a protective tariff on iron and steel. Carey showed the assembled Republican bigwigs, ironmasters, and propagandists, that expected future inflation is discounted far earlier in the foreign exchange market than in domestic sales, so that the dollar will weaken faster in foreign exchange markets under inflation than it will lose in purchasing power at home. So long as the inflation continues, then, the dollar depreciation will act like a second "tariff," encouraging exports as well as discouraging imports.

…as well as other nonsensical interventionists excuses:

The arguments of the steel industry differed from one century to the next. In the 19th century, their favorite was the "infant industry argument": how can a new, young, weak, struggling "infant" industry as in the United States, possibly compete with the well-established mature, and strong iron industry in England without a few years, at least, of protection until the steel baby was strong enough to stand on its two feet?Of course, "infancy" for protectionists never ends, and the "temporary" period of support stretched on forever. By the post-World War II era, in fact, the steel propagandists, switching their phony biological metaphors, were using what amounted to a "senescent industry argument": that the American steel industry was old and creaky, stuck with old equipment, and that they needed a "breathing space" of a few years to retool and rejuvenate.One argument is as fallacious as the other. In reality, protection is a subsidy for the inefficient and tends to perpetuate and aggravate the inefficiency, be the industry young, mature, or "old." A protective tariff or quota provides a shelter for inefficiency and mismanagement to multiply, and for the excessive bidding up of costs and pandering to steel unions. The result is a perpetually uncompetitive industry. In fact, the American steel industry has always been laggard and sluggish in adopting technological innovation--be it the 19th-century Bessemer process, or the 20th-century oxygenation process. Only exposure to competition can make a firm or an industry competitive.

So there you have it, so while wages may have been a factor, it has been miniscule compared to the myriad political interventionism (subsidies, protection, inflation and etc…), the dearth bankruptcy laws, trade unions, and other political influences (lrentseeking, cartels etc…) which have prevented the US steel industry from adjusting to market forces, as evidenced by the failure to embrace technological advances.

Yet the proposed solution of more interventionism will only wound up in worsening of the current status.

For protectionists, the story has always been the same; address the symptoms and not the disease with the more of the same prescription that led to the disease.

Other references:

-Stefanie Lenway, Randall Morck and Bernard Yeung Rent Seeking, Protectionism and Innovation in the American Steel Industry

-ITA.doc.gov The U.S. Steel Import Crisis Global Steel Trade: Structural Problems and Future Solutions

-Wikipedia.org History of the steel industry (1850-1970)

![clip_image004[1] clip_image004[1]](http://lh4.ggpht.com/-ui7n6e_YZec/UScv-qeO7JI/AAAAAAAARxI/xGqtisggfSA/clip_image004%25255B1%25255D_thumb.png?imgmax=800)