I have been repeatedly stating that rising stock markets in conjunction with expanding leverage amidst rising interest rates (as expressed via bond yields) constitutes a ‘Wile E. Coyote moment’ for me.

This doesn’t explicitly mean that equity markets won’t rise, but this means that the further and steeper the increase of the stock markets, in the face of a continuing massive buildup of imbalances, the greater the risks of a bear market or a stock market crash.

In short, debt based asset inflation is simply incompatible with rising yields.

Eventually when interest rates reach certain levels where a critical mass of investments or punts pillared by debts or loans would be rendered unprofitable, and where debt becomes unserviceable, a feedback loop mechanism of margin calls on loans will impel for liquidations which consequently forces down prices of securities and vice versa.

Thus inflationary boom transitions into deflationary bust

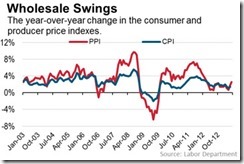

Producer Prices as Signs of Inflationary boom

At the start of the year I wrote this[1]

Yet interest rates will ultimately be determined by market forces influenced from one or a combination of the following factors: balance of demand and supply of credit, inflation expectations, perception of credit quality and of the scarcity or availability of capital.

I have pointed out last week that rising treasury yields partly reflected on the increasing take up on bank credit. This has been confirmed as bank loans in the US nears record levels

From Business Times Singapore[2]

Bank lending to US companies is rising at a pace that will by year-end push the total above the record high of US$1.61 trillion reached in 2008.

Commercial and industrial loans outstanding climbed to US$1.56 trillion in the week ended June 26, an increase of 4.1 per cent this year and up from the low of US$1.2 trillion in October 2010 following the worst financial crisis since the Great Depression, according to Federal Reserve data. The amount surged about US$18 billion last month, the most this year.

And on the back of this inflationary boom has been the expected rise of input prices as partially represented by US producers prices.

U.S. producer prices, according to the Wall Street Journal Blog[3], increased for the second straight month in June and are up 2.5% from a year earlier, the largest 12-month increase since March 2012

Lubricated by expansionary credit, industries in the private sector experiencing credit induced booms along with the government spending will extrapolate to increased competition for specific resources required for their projects. Thus greater demand for resources would be reflected on as price pressures on relative input factors particularly of wages, rents, and producer prices on the capital good sector.

As the great dean of Austrian economics Murray N. Rothbard explained[4]: (bold mine)

Now what happens when banks print new money (whether as bank notes or bank deposits) and lend it to business? The new money pours forth on the loan market and lowers the loan rate of interest. It looks as if the supply of saved funds for investment has increased, for the effect is the same: the supply of funds for investment apparently increases, and the interest rate is lowered. Businessmen, in short, are misled by the bank inflation into believing that the supply of saved funds is greater than it really is. Now, when saved funds increase, businessmen invest in "longer processes of production," i.e., the capital structure is lengthened, especially in the "higher orders" most remote from the consumer. Businessmen take their newly acquired funds and bid up the prices of capital and other producers' goods, and this stimulates a shift of investment from the "lower" (near the consumer) to the "higher" orders of production (furthest from the consumer)—from consumer goods to capital goods industries

In other words, price inflation will unevenly be felt by different sectors but this will be most evident in the capital goods industries.

However, competition for credit and resources would not necessarily translate to consumer price inflation. Nonetheless, competition for credit and resources could also exert upside pressure on interest rates that would eventually put marginal projects on financial strains, including margin debts on financial assets operating on leverage, which lay seeds to the upcoming bust.

The seeming absence of generalized price inflation will mask the boom-bust structure and mislead the mainstream into assuming the sustainability of such dynamic.

How Stock Markets React to Rising Oil Prices

Last week’s bonanza from Mr. Bernanke’s Put option on the markets succeeded to recreate a 2009-2011 boom scenario where stocks, commodities and bonds rallied.

I mentioned commodities.

Oil Prices in the US, as measured by the West Texas Intermediate crude[5] (WTIC), has sharply risen during the past month. The WTIC has even narrowed the gap of European based oil benchmark the Brent crude[6] (BRENT). The other major benchmark the OPEC Reference basket[7] also posted substantial increases. Meanwhile the Dubai Crude[8] has shown marginal increases.

Gasoline (GASO) prices in the US have also surged during the last month.

If the increase in oil prices will be sustained, then this will add to producer price inflation and could even possibly get reflected on consumer price inflation. And an increase in price inflation expectations will likely add an inflation premium on the interest rate markets. This should put increased pressures on the mercurial bond markets.

Aside from rising interest rates, a trend of higher oil prices has not been compatible with climbing stock markets.

For the three occasions where oil prices as measured in WTIC (blue) topped $100, the upside momentum of the S&P 500 (red) had been truncated.

In 2008, as the WTIC soared to $147 per bbl, the S&P crashed as the US housing and mortgage deepened. Eventually the deflationary bubble bust spread to oil prices which also collapsed.

University of California economic professor James Hamilton argues that an “oil shock” played a substantial role in the recession of 2008[9]. Mr. Hamilton further noted that high oil prices had been linked with 11 of the 12 post World War II recessions[10].

Twice when oil prices popped beyond $100 in 2011 and 2012, the S&P’s rise turned into a correction.

If history should rhyme, then one of the two discordant factors will unravel. Which will it be oil or stock markets? Or could there be a third option where both implode?

An Oil Price Bubble?

What has driven prices of oil to recent highs?

Certainly not demand from China as crude oil imports fell in the first half of 2013. Such decline, according to the Wall Street Journal[11], marks the first January-June contraction since the depths of the financial crisis in 2009. If China’s economy continues to flounder then oil imports are likely to fall further unless the Chinese government will use this opportunity to increase their stockpile of strategic petroleum reserves[12].

US demand will reportedly grow marginally in 2013 based on Energy Information Administration (EIA) estimates. According to the Wall Street Journal[13], “Demand in the world's biggest oil consumer will average 18.66 million barrels a day this year, up 0.6% from a year earlier. Last month, the EIA forecasted growth of 0.5%.”

The popular wisdom is that recent US oil price increases signifies a seasonal factor—the summer driving season.

Global oil demand is projected as lacklustre for 2013 and 2014. OPEC estimates that global oil demand, according to the IBTimes[14], will slow by 400,000 barrels per day in 2013 and will rise by 300,000 barrels per day in 2014.

Meanwhile, the International Energy Agency (IEA) expects also marginal growth for global oil consumption. According to the Platts.com[15], the IEA said global oil demand is forecast to grow by 1.3% to reach 92 million barrels a day in 2014, underpinned by a stronger global economy. That’s 1.3% growth for a strong economy, but how about a weak economy enervated by tight money?

The IEA expects global oil production to outpace consumption led by “surging supplies of oil from the US and other non-OPEC producers”

US oil output driven by shale gas and oil has reached records where US oil production now meets 89% of its energy needs according to the Energy Information Administration (EIA).

According to the Bloomberg[16], “Domestic crude output will average 7.31 million barrels a day in 2013 and 8.09 million in 2014, the EIA, a unit of the Energy Department, said in the report.

Could spiking oil prices have been about geopolitics perhaps Egypt or Syria? Possibly but unlikely…yet.

Although the threat of an oil supply shock could occur if events in Syria deteriorates

As Martin Katusa of Casey Research explains[17]

The roots of the differences go back to the 7thcentury CE, with the death of the prophet Muhammad. Those who accepted Abu Bakr, Muhammad's father-in-law, as caliph (meaning successor) became known as the Sunnis. Those who believed that Ali, Muhammad’s son-in-law, should be caliph became the Shiites. From there, the differences grew, many battles ensued, and a schism formed between the two groups.

Why has the American government backed the Sunnis, you may ask. Saudi Arabia is the short answer.

If a decisive Shiite victory were to occur in Syria, it would have enduring implications throughout the Middle East, but most importantly in Saudi Arabia. Though Saudi Arabia's population and leadership are both Sunni, and two of the holiest cities of Islam (Mecca and Medina) are situated in the country, the oil-producing areas in the eastern portion of the country have significant Shi'a populations. If an uprising were to occur there in response to Shiite success in Syria, Saudi Arabia's oil production (as well as economic, political, and social stability) would suffer a huge setback.

It is critical for both the US as well as the European Union that Saudi Arabia stay as it is to keep the balance of power intact in the Middle East. That's seen as a necessity for stability in the global oil markets. If Saudi Arabia's oil production were to stop, we could be looking at US$200 or more per barrel of oil immediately. That's how important Saudi Arabia is to the spot oil price.

Egypt’s plight seems hardly different, but may be of lesser impact. A push towards a more anti-US Islam fundamentalist regime from the current secular government is likely to impact geopolitics of oil in the same context as Syria.

Egypt’s oil production[18] has seen a substantial but decline overtim while oil exports[19] have partly reflected on production activities and could be reasons why events in Egypt may not impact oil markets dramatically.

So if oil prices has not been about tight supplies, hardly been about real demand or unlikely about geopolitics then why the price spiral?

Well the likely answer is oil speculation or an oil bubble.

The research team from Credit Suisse suggests that this has been about the unwinding of carry trades[20]:

For the last two to three years, just as the Federal Reserve drove investors to look ever harder for yield, WTI’s steep contango provided a neat carry trade, allowing it to be a fairly steady provider of decent (if unspectacular) returns.

Boiled down to the basics, investors were selling one year out time spreads, where the curve was relatively flat, and waiting for them to move into contango as the futures approached the prompt month. Now that the WTI curve has flipped into backwardation, this trade no longer works and the remaining, perhaps significant, positions are being unwound.

To do so, funds must buy the front and sell the back, further exacerbating WTI’s backwardation.

Whether this has been about the unwinding of the contango based carry trades or not, rising oil prices in the backdrop of easy money environment and monetary pumping by the central banks means that bubble activities, marked by yield chasing dynamics, has apparently percolated into the oil markets.

And tight money is likely to prick the oil bubble as in 2008 unless oil will be seen as an inflation hedge like gold.

Rising Oil Prices Will Impact Real Economies

The heavy dependence on energy imports by Japan, especially amidst the closure of nuclear power plants which previously accounted for 30% of energy generation, and which has been replaced by Liquefied Natural Gas (LNG) and Petroleum according to the EIA[21] makes Japan highly vulnerable to a spike in oil prices.

The good news is that rising international prices of oil will help Kuroda’s Abenomics, via doubling of the money supply in two years, hit their target of attaining price inflation as a weaker yen will amplify price hikes in foreign currency or in US dollar terms.

The bad news is that a surge in price inflation will likely put additional pressure on the highly fragile Japanese bond markets or JGBs which increases the likelihood or risks of a debt crisis.

Finally it isn’t true that high oil prices will curb demand as popularly explained by media. Instead high oil prices represent an income transfer from oil consumers to oil producers. High oil prices will benefit producers that will encourage additional oil production aside from incentivizing consumption on other aspects.

Whereas consumption patterns of oil consumers will likely shift towards more energy conservation or may lead oil consumers with lesser disposable income.

Vietnam, India, China and Thailand with oil and other energy use accounting for 20% or more in % of GDP, appears as most vulnerable to sustained increases in oil prices according to the 2010 estimates by PIMCO[22].

One can omit the Japanese data, since this was computed prior to the Tohoku earthquake where nuclear power played a big role in Japan’s energy generation.

The Philippines is shown as one of the least vulnerable which for me is quite surprising. Since I doubt that the Philippines has reached energy efficiency levels similar to her relatively more developed neighbors, I suspect that there has been significant errors in measuring real energy usage (perhaps due to non-inclusion of the informal economy) or from some other factors which is beyond my thoughts as of this writing.

Nonetheless high oil prices amidst revolting bond markets increases the market risks.

Trade with caution