Woodside Petroleum Ltd. (WPL)’s purchase of a stake in Israel’s largest natural gas deposit takes Asia- Pacific oil and gas acquisitions to a record $99 billion this year, tying the U.S. for the first time.Australia’s second-largest petroleum producer yesterday said it will pay partners including Noble Energy Inc. (NBL) an initial $696 million and as much as $2.3 billion for part of the Leviathan field. Deals by U.S. energy companies have fallen 35 percent to $98.7 billion in 2012, while Asia-Pacific purchases increased 3.8 percent, according to data compiled by Bloomberg.The Leviathan deal underlines the growing appetite for oil and gas assets among Asia-Pacific companies after energy demand in the region grew at more than double the world average of 2.5 percent in 2011. China Petroleum & Chemical Corp. (600028), Cnooc Ltd. (883) and India’s Oil & Natural Gas Corp. (ONGC) have secured supplies abroad as new fields are found from North America to Africa.“There are so many more options for Asian companies now with new discoveries around the world,” said Laban Yu, head of Asian oil and gas equity research at Jefferies Hong Kong Ltd. “The trend will be led by China, which has a large foreign- exchange reserve and is seeking hard assets.”…A surge in oil and gas production from shale rocks in the U.S. and Canada is prompting operators to rope in partners to meet capital expenditure. Canada, home to the world’s third- biggest oil reserves, will require almost C$650 billion ($655 billion) of investments to develop the nation’s biggest resource projects over the next decade, according to Natural Resources Minister Joe Oliver.“Higher production in North America means large amounts of capital and operators have no option but to sell some of their assets,” said Sonia Song, a Hong Kong-based analyst at Nomura Holdings Inc. “Buyers from Asia are stepping in.”

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Tuesday, December 04, 2012

Shale Gas Boom Attracts Record Asian Takeovers

Saturday, October 13, 2012

Asia as the World’s Precious Metal Hub: Singapore Cuts Taxes on Gold as Hong Kong Adds Storage Facilities

Singapore has repealed a 7% tax on investment-grade gold and other precious metals to spur the development of gold trading in the country. It is hoped the move will lift demand for gold bars and coins in the fourth quarter and applies to gold of 99.5% purity, silver of 99.9% purity and platinum of 99% purity.While in the works for several months, the repeal came into effect on October 1.Singapore is hoping the scrapping of the tax will lure bullion refiners to the country and convince trading houses to open storage facilities, transforming it into a key Asian pricing hub. along the lines of London and Zurich. Currently holding 2% of global gold demand, the Southeast Asian city-state aims to hike that to 10% to 15% over the next five to 10 years.Currently, Singapore imports gold bars from Australia, Switzerland, Hong Kong and Japan, which are then sold to buyers in Southeast Asia and neighbouring India.Singapore's investment gold demand nearly tripled to 3.5 tonnes in 2011, according to consultancy firm GFMS. Singapore has already tripled gold imports year over year, ending December.At least one major refiner has already shown interest in opening a factory in Singapore. More gold traders are expected to set up offices and store more bullion, post the move.Gold scraps from the across the region are also traded in Singapore, which helps determine the premiums for gold bars against prices in London. Earlier, refiners were put off by Singapore's taxes, opting instead to mould and sell gold bars in Hong Kong, which does not impose duties on bullion, and Japan, where the consumption tax on gold was very low.

While the current world hubs for gold trading and storage are London, Zurich, and New York, stores of physical metal are also beginning to migrate east. Gold storage facilities are springing up all over Asia like mushrooms after a summer rain.Back in 2009, the Hong Kong Airport Authority set up the first secure gold storage facility inside the confines of the Hong Kong Airport.This September, Malca-Amit, the Tel Aviv-based diamonds and precious metals company is opening a second state of the art facility at the airport, which will have capacity for 1,000 metric tons of gold.That compares to the 4,582 tons that the US government claims is in Fort Knox, and the record 2,414 million tons that the world’s exchange traded gold funds collectively held – mostly in London– as of July 5th.Malca-Amit also has a facility in Singapore’s Freeport complex, and the company is planning a third Asian precious metals storage facility in Shanghai in the near future.

Monday, July 23, 2012

Will North Korea Pursue Economic Liberalization?

This should signify as a wonderful development if this would materialize.

From Reuters,

Impoverished North Korea is gearing up to experiment with agricultural and economic reforms after young leader Kim Jong-un and his powerful uncle purged the country's top general for opposing change, a source with ties to both Pyongyang and Beijing said.

The source added that the cabinet had created a special bureau to take control of the decaying economy from the military, one of the world's largest, which under Kim's father was given pride of place in running the country.

The downfall of Vice Marshal Ri Yong-ho and his allies gives the untested new leader and his uncle Jang Song-thaek, who married into the Kim family dynasty and is widely seen as the real power behind the throne, the mandate to try to save the battered economy and prevent the secretive regime's collapse.

The source has correctly predicted events in the past, including North Korea's first nuclear test in 2006 days before it was conducted, as well as the ascension of Jang.

The changes could herald the most significant reforms by the North in decades. Previous attempts at a more market driven economy have floundered, most recently a drastic currency revaluation in late 2009 which triggered outrage and is widely believed to have resulted in the execution of its chief proponent.

"Ri Yong-ho was the most ardent supporter of Kim Jong-il's 'military first' policy," the source told Reuters, referring to Kim Jong-un's late father who plunged the North deeper into isolation over its nuclear ambitions, abject poverty and political repression.

The biggest problem was that he opposed the government taking over control of the economy from the military, the source said, requesting anonymity to avoid repercussions.

North Korea's state news agency KCNA had cited illness for the surprise decision to relieve Ri of all his posts, including the powerful role of vice chairman of the ruling party's Central Military Commission, though in recent video footage he had appeared in good health.

Ri was very close to Kim Jong-il and had been a leading figure in the military. Ri's father fought against the Japanese alongside Kim Jong-il's late father Kim Il-sung, who founded North Korea and is still revered as its eternal president.

The revelation by the source was an indication of a power struggle in the secretive state in which Kim Jong-un and Jang look to have further consolidated political and military power.

Kim Jong-un was named Marshal of the republic this week in a move that adds to his glittering array of titles and cements his position following the death of his father in December. He already heads the Workers' Party of Korea and is first chairman of the National Defence Commission.

Observe that despotic or totalitarian regimes, in realization of the futility of their centralized political institutions, have slowly been giving way to globalization.

However this runs in contrast to formerly free (developed) economies who seem to be progressively headed towards fascism if not despotism.

The opposite path of political directions represents the major force that will drive wealth convergence.

Wednesday, July 04, 2012

Will France’s Fairness Doctrine Save the EU?

From Zero Hedge

With the Great June Socialist Revolution spilling over into July, here are some details as they become available from France:

But... FRANCE TO ANNUL PLANNED VAT INCREASE PLANNED BY SARKOZY

After all, it's only fair. In other news, we are rotating our secular long thesis away from Belgian caterers and into tax offshoring advisors, now that nobody in the 1% will pay any taxes ever again.

Politicians believe the path to prosperity is only through confiscation and redistribution. They also believe that growth comes with subtraction and division and not from addition and multiplication

They further think that the wealthy are dingbats whose actions are limited by the dictates of politicians.

Professor Ludwig von Mises was right…

Nothing is more calculated to make a demagogue popular than a constantly reiterated demand for heavy taxes on the rich…

Confiscations of capital through the legal form of taxation are neither socialistic nor a means to Socialism. They lead, not to socialization of the means of production, but to consumption of capital. Only when they are set within a socialist system, which retains the name and form of private property, are they a part of Socialism.

So the French government will spend MORE and get LESSER revenues as productive segments of society either reduces productive activities and or flee to other havens. Capital will be consumed at a more faster rate.

After all, money goes where it is best treated.

Yet under the sustainment of such political conditions, the Euro’s death warrant has been sealed.

Asia should welcome with open arms the prospective diaspora of French capital by implementing policies opposite to those embraced by the French politicians. Yes, such policy is known as economic freedom.

Tuesday, June 19, 2012

A Global Migration U-Turn?

In the past, people from developing countries flocked to developed nations mostly to find greener pastures. Such flow of migration caused controversial social issues as the mythical “brain drain”, “immigration restrictions” and etc..

As pointed out before, this trend seems to be in reversal.

From Gillian Tett of the Financial Times, (bold highlights added) [hat tip Sovereign Man]

It is a telling little indication of how the world is being subtly turned on its head, amid the rolling crises. During the past five decades, if anybody has been packing their bags to travel overseas to send remittances home, it has typically been the Brazilians, or other “emerging markets” peoples, not the developed Europeans. In recent years, Spain and Portugal have been pulling in vast quantities of migrant workers, both skilled and unskilled, as Poles and other eastern European workers have flooded to places such as the UK and Ireland. America has sucked even larger numbers of migrants, not just from Brazil but from other parts of South America. A couple of months ago, for example, the Pew Hispanic Center (PHC) in America released a fascinating report which calculated that 12 million immigrants have moved from Mexico to the US in the past four decades alone, to seek jobs and cash. “The US today has more immigrants from Mexico alone – 12.0 million – than any other country in the world has from all countries of the world,” the PHC report observed, noting that in absolute terms “no country has ever seen as many of its people immigrate to this country as Mexico has in the past four decades.”

Yet these days the most fascinating detail of the PHC report, which echoes that Boston lunch, is that a change is afoot. Last year “the net migration flow from Mexico to the United States has stopped and may have reversed,” it says, for the first time since records began.

Part of the explanation is “the weakened US job and housing construction markets, heightened border enforcement, a rise in deportations,” along with “the growing dangers associated with illegal border crossings and the long-term decline in Mexico’s birth rates”. But another issue is the improved “broader economic conditions in Mexico”. Life south of the border, in other words, is no longer quite as grim as it was before, or not relative to the risks of moving to the US.

Sadly, there is surprisingly little comparable data for other immigration flows. As Ian Goldin, an Oxford academic, has long lamented, the world lacks any centralised system to track migration flows in a timely way, let alone devise policies. Thus we do not really know how many young Portuguese or Spanish are seeking jobs in Latin America now (although Reuters reports that around 328,000 Portuguese hold work permits for Brazil, 50,000 more than last year, it is unclear whether these have been exercised). Nor is it clear how many Poles are returning to their homeland from the UK or Ireland, as austerity bites there; or how many young Irish may now be seeking their fortunes overseas (yet again). While I have recently heard plenty of anecdotes at American dinner parties and conferences about how young American graduates are becoming so disillusioned with their jobs markets that they are moving “temporarily” to Brazil or India, tracking data on that American flux – if it exists – is hard.

The other unmentioned factors are the repressive measures undertaken by governments of developed economies to forcibly wring out resources from the private sector, only to transfer them to crony or pet industries of the political class, that has led to sharp deterioration in investments and thus reduced employment opportunities.

Such is aside from the explicit policies of currency devaluation (or inflationism) by developed nations, that has caused boom bust cycles and thus reduced their respective standards of living. Example, the net worth of US families fell by almost 40% between 2007-2010

A reversal of the poor to rich global migration trend are manifestations of the wealth convergence dynamic.

Saturday, May 12, 2012

More on US Exodus: Facebook co-founder Gives up US citizenship

Wow. Wealthy Americans giving up on their citizenship seems to be snowballing.

Now we’ve got a high profile case; one of Facebook’s founders has reportedly renounced his citizenship before the company’s IPO.

From Bloomberg,

Eduardo Saverin, the billionaire co- founder of Facebook Inc. (FB), renounced his U.S. citizenship before an initial public offering that values the social network at as much as $96 billion, a move that may reduce his tax bill.

Facebook plans to raise as much as $11.8 billion through the IPO, the biggest in history for an Internet company. Saverin’s stake is about 4 percent, according to the website Who Owns Facebook. At the high end of the IPO valuation, that would be worth about $3.84 billion. His holdings aren’t listed in Facebook’s regulatory filings.

Saverin, 30, joins a growing number of people giving up U.S. citizenship, a move that can trim their tax liabilities in that country. The Brazilian-born resident of Singapore is one of several people who helped Mark Zuckerberg start Facebook in a Harvard University dorm and stand to reap billions of dollars after the world’s largest social network holds its IPO.

“Eduardo recently found it more practical to become a resident of Singapore since he plans to live there for an indefinite period of time,” said Tom Goodman, a spokesman for Saverin, in an e-mailed statement.

Saverin’s name is on a list of people who chose to renounce citizenship as of April 30, published by the Internal Revenue Service. Saverin renounced his U.S. citizenship “around September” of last year, according to his spokesman.

Singapore doesn’t have a capital gains tax. It does tax income earned in that nation, as well as “certain foreign- sourced income,” according to a government website on tax policies there.

Exit Tax

Saverin won’t escape all U.S. taxes. Americans who give up their citizenship owe what is effectively an exit tax on the capital gains from their stock holdings, even if they don’t sell the shares, said Reuven S. Avi-Yonah, director of the international tax program at the University of Michigan’s law school. For tax purposes, the IRS treats the stock as if it has been sold.

Renouncing your citizenship well in advance of an IPO is “a very smart idea,” from a tax standpoint, said Avi-Yonah. “Once it’s public you can’t fool around with the value.”

The tax bill from Facebook’s IPO, I believe, could be just one issue seen by the media.

Future taxes and civil liberties, I think, could be of the more important unnoticed concern.

Of course, America’s loss, in the case of Mr Saverin, should likely benefit Singapore, which is another sign of wealth convergence or productive capital moving to Asia and emerging markets. Another wow, the billionaire is only 30 years old (signs of how technology has been reshaping industries).

Unless the political trend towards repressiveness in the US reverses, there will be more cases of exiting wealthy Americans.

And speaking of taxes, globalization and the information age seems to have conspired to create opportunities for technology companies to use legal loopholes to arbitrage away taxes through overseas corporate vehicles.

From the New York Times

The growing digital economy presents a conundrum for lawmakers overseeing corporate taxation: although technology is now one of the nation’s largest and most valued industries, many tech companies are among the least taxed, according to government and corporate data. Over the last two years, the 71 technology companies in the Standard & Poor’s 500-stock index — including Apple, Google, Yahoo and Dell — reported paying worldwide cash taxes at a rate that, on average, was a third less than other S.& P. companies’. (Cash taxes may include payments for multiple years.)

Even among tech companies, Apple’s rates are low. And while the company has remade industries, ignited economic growth and delighted customers, it has also devised corporate strategies that take advantage of gaps in the tax code, according to former executives who helped create those strategies.

Apple, for instance, was among the first tech companies to designate overseas salespeople in high-tax countries in a manner that allowed them to sell on behalf of low-tax subsidiaries on other continents, sidestepping income taxes, according to former executives. Apple was a pioneer of an accounting technique known as the “Double Irish With a Dutch Sandwich,” which reduces taxes by routing profits through Irish subsidiaries and the Netherlands and then to the Caribbean. Today, that tactic is used by hundreds of other corporations — some of which directly imitated Apple’s methods, say accountants at those companies.

So class warfare politicians appear to be increasingly caught in the bind of economic reality. Raise taxes, capital flees.

Wednesday, April 04, 2012

China Deepens Liberalization of Capital Markets

I have pointed out that the ongoing tensions in the political spectrum in China may have been ideologically based.

Entrepreneurs in China may have grown enough political clout enough to challenge to the degenerative command and control political structure of the old China order.

And it seems as if the forces of decentralization seem to be getting the upper hand, as China undertakes further liberalization of their capital markets.

From the Bloomberg,

China accelerated the opening of its capital markets by more than doubling the amount foreigners can invest in stocks, bonds and bank deposits as the government shifts its growth model to domestic consumption from exports.

The China Securities Regulatory Commission increased the quotas for qualified foreign institutional investors to $80 billion from $30 billion, according to a statement on its website yesterday. Offshore investors will also be allowed to pump an extra 50 billion yuan ($7.95 billion) of local currency into the country, up from 20 billion yuan

China, the world’s second-biggest economy, has pledged this year to free up control of the yuan and liberalize interest rates as the government deepens reforms to revive growth and offset slowing exports and a cooling housing market. China needs to rely more on markets and the private sector as its export- oriented model isn’t sustainable, World Bank President Robert Zoellick said in February.

Here’s more

The regulator had granted a total of $24.6 billion in quotas to 129 overseas companies since the program first started in 2003 through the end of March. About 75 percent of assets were invested in Chinese stocks, with the rest in bonds and deposits, according to the statement.

The CSRC accelerated the program last month, granting a record $2.1 billion of quotas to 15 companies. It was more than the $1.9 billion in 2011 as a whole.

“The QFII program enhances our experience of monitoring and regulating cross-board investment and capital flows,” the CSRC said in the statement. “It is a positive experiment to further open up the market and achieve the yuan convertibility under the capital account.”

Premier Wen Jiabao is seeking to attract international investment as economic growth cools, prompting the benchmark Shanghai Composite Index to slump 24 percent in the past year. The country posted its largest trade deficit since at least 1989 in February as Europe’s sovereign-debt turmoil damped exports.

China needs to break a banking “monopoly” of a few big lenders that makes easy profits, Wen told private company executives in Fujian province yesterday, as cited by China National Radio.

Breaking up a privileged banking monopoly essentially transfers resources to the productive sector which should serve China well, as well as, serves as welcome and enriching news for Asia and the rest of the world.

And by liberalization of their capital markets, China will become more integrated with the world, and thus diffusing risks of brinkmanship geopolitics, or the risks of military confrontations.

Again such development adds evidence to my theory that the Spratlys tensions may have just been about political leverage or about helping promote indirectly the US arms sales.

Nevertheless, China has yet to face the harmful unintended consequences of her past and present Keynesian bubble policies.

However the long term is key, or far more important. The kind of reforms matters most.

And reforms that deepen economic freedom or laissez faire capitalism (away from state capitalism) in China and the attendant development of capital markets could likely mean that the rest of Asia may follow suit. The implication is that regional and domestic capital will less likely be recycled to the West, and instead would find more productive use at home or a ‘home bias’ for Asian investors.

Moreover, the crumbling welfare states of the west would mean more capital flows into the Asia as savings seek refuge from sustained policies of inflationism.

All these should accentuate my wealth convergence theory.

Of course, China’s strategy to liberalize her capital markets may also represent a move to challenge the US dollar standard.

Recently BRICs officials slammed US and Euro’s monetary “tsunami” policies and in the process has been contemplating to put up their version of a World Bank—joint development bank.

While these gripes have been valid, the latter’s action has little substance. What the other ex-China BRICs should to do is to mimic China’s path to rapidly liberalize their economy and their capital markets.

That’s because societal integration functions as a natural force when commercial activities or economic freedom intensifies.

As the great Ludwig von Mises wrote about the social effects of the division of labor,

Social cooperation means the division of labor.

The various members, the various individuals, in a society do not live their own lives without any reference or connection with other individuals. Thanks to the division of labor, we are connected with others by working for them and by receiving and consuming what others have produced for us. As a result, we have an exchange economy which consists in the cooperation of many individuals. Everybody produces, not only for himself alone, but for other people in the expectation that these other people will produce for him. This system requires acts of exchange.

The peaceful cooperation, the peaceful achievements of men, are effected on the market. Cooperation necessarily means that people are exchanging services and goods, the products of services. These exchanges bring about the market. The market is precisely the freedom of people to produce, to consume, to determine what has to be produced, in whatever quantity, in whatever quality, and to whomever these products are to go. Such a free system without a market is impossible; such a free system is the market.

Monday, March 19, 2012

Will Japan’s Investments Drive the Phisix to the 10,000 levels?

The boom produces impoverishment. But still more disastrous are its moral ravages. It makes people despondent and dispirited. The more optimistic they were under the illusory prosperity of the boom, the greater is their despair and their feeling of frustration. The individual is always ready to ascribe his good luck to his own efficiency and to take it as a well-deserved reward for his talent, application, and probity. But reverses of fortune he always charges to other people, and most of all to the absurdity of social and political institutions. He does not blame the authorities for having fostered the boom. He reviles them for the inevitable collapse. In the opinion of the public, more inflation and more credit expansion are the only remedy against the evils which inflation and credit expansion have brought about.-Ludwig von Mises

Last week I noted that a broad based strengthening Philippine Peso against major currencies could likely fuel carry trades and arbitrage opportunities ahead that may push the Phisix towards the 10,000 levels.

I wrote[1],

What this means is that the Philippines (and our ASEAN contemporaries) is likely to lure spread arbitrages or carry trades from US, Japanese, Swiss and European investors or punters that is likely to kick start a foreign stimulated boom in the local assets including those listed on the Philippine Stock Exchange.

It has barely been a week since I penned this observation. However today’s news headlines seem to provide clues in the direction which may confirm my long held thesis.

The headline says that Japanese investors are bullish the Philippines and would likely commit more investments[2].

In a survey, JETRO, the Japanese government’s trade and investment outfit, said that the Philippines has the ‘the least problematic’ factors for investments among ASEAN neighbors. And this would serve as the impetus for Japanese investments.

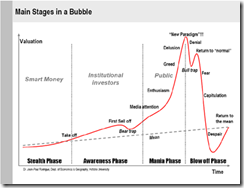

Rationalization Process of the Reflexivity Theory

First of all, I would say that this represents the rationalization phase of the current bullmarket.

By rationalization, I mean that price signaling channel exerts influence to the real world (or economic) developments, which at present, are being extrapolated with rose colored glasses. And developments in the real world eventually reinforces the thrust to further bid up of stock market prices paving way to a reflexive feedback loop or the reflexivity theory at work.

Writes the Billionaire (and crony) George Soros[3],

The underlying trend influences the participants' perceptions through the cognitive function; the resulting change in perceptions affects the situation through the participating function. In the case of the stock market, the primary impact is on stock prices. The change in stock prices may, in turn, affect both the participants' bias and the underlying trend.

The essence of the reflexivity theory is the dynamics of the bubble psychology as reflected on people’s expectations and their consequent actions expressed through the price mechanism and through real world actions.

Going back to the politically colored Pollyannaish article, it has been rightly pointed out that the wide scale dislocation or disruption from Japan’s total shutdown of the entire nuclear power industry (except for the two remaining plants)[4], which has been prompted for by last year’s catastrophic earthquake-tsunami disaster, has served as one of the primary reasons for their proposed investments here.

Japan’s nuclear industry previously contributed to about 30% of the nation’s energy requirements. Now the Japanese has to import 84% of their energy requirements[5]; this has partly led to the recent record trade deficits.

Also note the phrase ‘least problematic’ instead of ‘best potential returns’ as basis for attracting Japanese investments from which several criterion has been enumerated supposedly to the advantage of the Philippines, particularly “increasing financial costs”, “rising prices or shortage of land or office”, “skyrocketing payroll costs”, aside from labor conditons of “recruiting general staff”, “recruiting executives”, “low rate of employment retention”, “problems in workers competency”, “difficulty in quality control” and the “the least problems in salary base rate”.

So in a shade of schadenfreude, the Philippines may benefit from the adverse developments in Japan. With seemingly limited options, least problematic becomes a significant variable and has been equated with competitiveness in attracting Japanese investments.

Déjà vu, Asian Crisis 2.0? Phisix 10,000

Yet the article’s projections have been based on Jetro’s survey. Surveys or polls are predicated only from opinions which may or may not reflect on the real motivations or values of surveyed actors. And because there are no stakeholdings involved in surveys, they are fluid, ambiguous, and volatile, ergo, unreliable.

Whereas demonstrated preferences or the actual choice taken by the economic agents represents the more important of the two, since this signifies actual voting or expression of preferences or values.

As the great Professor Murray N. Rothbard wrote[6],

The concept of demonstrated preference is simply this: that actual choice reveals, or demonstrates, a man's preferences; that is, that his preferences are deducible from what he has chosen in action

Since Japan’s calamity struck last year, it should be of note that Indonesia has been the largest recipient, in terms of percentage, of Japan’s outward Foreign Direct Investment (FDI) flow[7].

Meanwhile, Thailand and Vietnam has substantially bested the Philippines. The Philippines only ranked 6th in Asia.

A better perspective of Japan’s OUTWARD FDI long term trend in ASEAN can be seen above. The trumpeted competitiveness framed by media hardly reveals on the reality.

Of course, these charts represent ex post actions and that ex ante could translate to vital changes as proposed. But I doubt so.

Yet there are several very important things of note from here.

One, as pointed above, the Philippines has not been grabbing the biggest pie of Japanese FDI. There have been little signs of any radical changes into the direction as broached by the headlines.

So far, Thailand has been the biggest magnet in attracting Japanese FDIs. Thailand has the largest nominal dollar based flows at $7.1 billion, signifying 54% share of Japan’s outward FDI flows into ASEAN in 2011.

The Philippines, despite recent material gains, has the smallest inflows.

Two, the growth trend of nominal US dollar based investment flows exhibits that even Vietnam ($1.8 billion) has far outclassed the Philippines ($1.0 billion).

Three, ALL of the ASEAN majors have registered substantial Japan based FDI gains. ASEAN has basically surpassed their regional Newly Industrial Country (NIC) contemporaries in attracting Japanese money.

In short, Japan’s investments in ASEAN do not seem to be country specific, but more of a regional dynamic. Or that the Japanese probably hedge their ASEAN exposure by spreading their investments throughout the region.

Well the past, according to Mark Twain, does not repeat itself, but it rhymes.

Today’s FDI flows eerily resonates or resembles on the time window[8] of the 1985 Plaza Accord to the post Japan bubble in 1990s until the climax, the 1997 Asian Crisis.

The Business Insider quotes author and former Deputy Chief of the Hong Kong Monetary Authority Andrew Sheng[9] in the latter’s book From Asian to Global Financial Crisis

… shift production to countries that not only welcomes Japanese FDI but also had cheap land and labour… By the late 1980s, Japan had become the single largest source of FDI for the fast-growing emerging Asian economies. This trend was particularly clear when another surge of Japanese FDI into Asia took place between 1993 and 1997, with Japanese FDI rising nearly twofold from US$6.5 billion to US$ 11.1 billion during this period…

… banks followed their manufacturing customers into non-Japan Asia in earnest… From 1985 to 1997 Japanese banks supplied over 40 percent of the total outstanding international bank lending to Asia in general… The massive expansion in Japanese bank lending, in both yen and foreign currency, created huge capital flows globally.”

So could we be experiencing a déjà vu, Asian Crisis 2.0?

Let me be clear: bubbles or business cycles account for as policy induced processes, fuelled by monetary injections, marked by transitional stages.

FDI’s are by itself not the source of the disease but are symptoms or the ramifications of manifold political actions.

This is NOT to say that ASEAN faces the risks of an imminent bust soon. Instead this is to say that if these flows continue at a pace similar to 1985 to the mid-1990s then they could evolve into a full pledge bubble.

Yet there are many other indicators which will converge to give evidence to the maturing phase or the climax of a domestic business cycle. These may include the current account balances, state of banking credit, the yield curve, financial innovation, currency values and the state of the stock market.

And speaking of the stock market in the 1986-1997, Japan’s investment flows pumped up the region’s stock markets including the Phisix.

The 11 year bull market phase (green circle) of the local benchmark had two interruptions marked by two botched coup d'état attempts in 1987 and 1989, but nonetheless went to climax at 3,300+ levels. Remember, in 1986 the Phisix was at about only 150.

Put differently, if a similar Japan based investment flow dynamic should swamp into the region, then the Phisix is likely to put to realization my 10,000 level target first, before the structural implosion would occur. Again, trends don’t go in a straight line, and there can be substantial medium term obstacles or counter cycles or bear markets, like 2007-2008, before my targets could be fulfilled.

I would like to repeat, money flows won’t likely be limited to a Japan dynamic but from major western economies as well. This is the wealth convergence in motion.

Capital Flight Camouflaged as FDIs and Portfolio Flows

The recent surge in Japan’s FDI could just be the beginning.

The far more important or the major driver of Japan’s coming FDI and portfolio flows into ASEAN has already been manifested in the region’s currency markets.

Since the advent of 2012, the long term price appreciation of the Japanese Yen relative to ASEAN markets (Peso, Rupiah, Baht and Ringgit, the order from the top left to bottom right) seems to have been reversed.

Under pressure from politicians[10], the Bank of Japan (BoJ) has aggressively been ramping up its balance sheet[11] to allegedly support the economy by making ‘exports’ competitive.

Thus ASEAN-4 currencies along with the US dollar relative to the Yen have recently spiked!

If Japan’s basic problems today have primarily been due to a dysfunctional nuclear energy sector, then it would represent a logical error to see money printing as replacing the idled nuclear energy sector. Money is just a medium of exchange. Money doesn’t produce energy.

In reality, Japan’s banking system has been stuffed with loans to electric utility companies, many of them nuclear based. The industry’s risk profile has previously been viewed as almost at par with government debt, thus has been part of the banking system’s portfolio. Syndicated loans to the electric power companies had reportedly tripled to 1.16 trillion yen in 2011 from 448.8 billion in 2010[12]. Thus, with a crippled energy sector, Japan’s banking system, which has still been nursing from the scars of the last bubble bust, is once again confronted with heightened risks of defaults. Thus the BoJ rides to the rescue!

The foremost reason why many Japanese may invest in the Philippines under the cover of “the least problematic” technically represents euphemism for capital fleeing Japan because of devaluation policies—capital flight!

As the great Ludwig von Mises wrote[13],

The holders of ready cash try as far as possible to avoid the dangers of devaluation which today threaten in every country. They keep large bank balances in those countries in which there is the least probability of devaluation in the immediate future. If conditions change and they fear for these funds, they transfer such balances to other countries which for the moment seem to offer greater security. These balances which are always ready to flee-so-called “hot money”—have fundamentally influenced the data and the workings of the international money market. They present a serious problem in the operation of the modern banking system.

The bottom line is that YES we should expect Japanese FDI and portfolio investments into the Philippines and the region to swell.

But since (inward) capital flows into ASEAN will reflect on global central bank activities, this dynamic would not be limited to Japan but would likely include western economies as well.

And under the political climate that induces yield chasing dynamics, YES we should expect these flows to translate to a vastly higher Phisix and ASEAN bourses overtime, largely depending on the degree of inflows. This will be further augmented by the response of local investors to such dynamic as well as to local policies.

Although NO the Philippines will not decouple from events abroad and the pace of FDIs and investment flows will largely be grounded on the general liquidity environment.

And finally NO, the incumbent political leadership has a smidgen of responsibility for today’s dynamic. The current global negative real rate environment has mainly been driven by collective central bank actions. Profit from folly.

[1] See Phisix: The Journey Of A Thousand Miles Begins With A Single Step, March 12, 2012

[2] Inquirer.net Japan to pour more investments in PH, March 18, 2012

[3] Soros George The Alchemy of Finance p.53 John Wiley & Sons

[4] New York Times, Japan’s Nuclear Energy Industry Nears Shutdown, at Least for Now, March 8, 2012

[5] World Nuclear Energy Nuclear Power in Japan, Updated March 2012

[6] Rothbard Murray N. Toward a Reconstruction of Utility and Welfare Economics, July 6, 2008

[7] Jetro.go.jp FDI flow (Based on Balance of Payments, net), Japan's Outward and Inward Foreign Direct Investment Japanese Trade and Investment Statistics

[8] Thomsen Stephen SOUTHEAST ASIA: THE ROLE OF FOREIGN DIRECT INVESTMENT POLICIES IN DEVELOPMEN 1999 OECD.org

[9] Sheng Andrew From Asian to Global Financial Crisis Japan's Role In Asian Financial Crisis 1997, March 17, 2011 Business Insider

[10] See Bank of Japan Yields to Political Pressure, Adds $128 billion to QE, February 14, 2012

[11] Danske Bank No real easing from Bank of Japan this time Flash Comment March 13, 2012

[12] Reuters.com Japan utilities may return to bonds as $19 bln debt matures, January 25, 2012

[13] Mises, Ludwig von 4. The Flight of Capital and the Problem of “Hot Money” III. INFLATION

Tuesday, March 13, 2012

Laissez Faire Capitalism and City Competitiveness

The Economist devised a new measure of competitiveness applied to cities.

The 120 cities in the index are home to some 750m people and $20.2 trillion worth of GDP, 29% of the world's total. High concentrations of skilled residents, infrastructure and institutions mean that the top of the index is dominated by America and western Europe, with 24 cities in the top 30. Comparing the index to the EIU's cost of living data (a measure of western-style living expenses), identifies those cities which also represent good value for money for the ambitious expatriate.

Explaining their findings, they add

Well over half of the world’s population now lives in cities, generating more than 80% of global GDP. Already, global business is beginning to plan strategy from a city, rather than a country, perspective.

Given the rapid growth and development of many cities, particularly in emerging markets such as China and India, competition between them for business, investment and talent will only get fiercer.

Size alone does not determine a city’s growth potential. While some megacities, such as New York and Tokyo, are immensely influential, there are smaller ones, such as Hong Kong and Singapore, which have established themselves as globally competitive centres in recent years. Meanwhile, emerging market cities such as Ahmedabad and Tianjin are witnessing double-digit economic growth and have the potential to grow even faster.

Competitiveness, however, is a holistic concept. While economic size and growth are important and necessary, several other factors determine a city’s overall competitiveness, including its business and regulatory environment, the quality of human capital and indeed the quality of life. These factors not only help a city sustain a high economic growth rate, but also create a stable and harmonious business and social environment.

The scatter plot diagram has a substantially significant message: the state of competitiveness is highly correlated with the standards of living. The more competitive a city is, the higher standards of living and vice versa. Given the above, the US and the west has, at present, the highest level of competitiveness, which similarly extrapolates to the highest ranking of standard of living. Meanwhile, Africa and Latin America has lagged.

And what has been the causal link which drives the correlation between competitiveness and quality of living?

The answer is capital accumulation via laissez faire capitalism

The great Professor Ludwig von Mises already explained this more than half a century ago or that the city competitiveness index merely validates Professor von Mises. (bold emphasis mine)

The truth is that the accumulation of capital and its investment in machines, the source of the comparatively greater wealth of the Western peoples, are due exclusively to laissez-faire capitalism which the same document of the churches passionately misrepresents and rejects on moral grounds. It is not the fault of the capitalists that the Asiatics and Africans did not adopt those ideologies and policies which would have made the evolution of autochthonous capitalism possible. Neither is it the fault of the capitalists that the policies of these nations thwarted the attempts of foreign investors to give them “the benefits of more machine production.” No one contests that what makes hundreds of millions in Asia and Africa destitute is that they cling to primitive methods of production and miss the benefits which the employment of better tools and up-to-date technological designs could bestow upon them. But there is only one means to relieve their distress—namely, the full adoption of laissez-faire capitalism. What they need is private enterprise and the accumulation of new capital, capitalists and entrepreneurs. It is nonsensical to blame capitalism and the capitalistic nations of the West for the plight the backward peoples have brought upon themselves. The remedy indicated is not “justice” but the substitution of sound, i.e., laissez-faire, policies for unsound policies.

Monday, January 16, 2012

Migration Trends: The Coming European Diaspora?

Take migration trends, what used to be popular—where citizens of emerging markets migrate to western nations—could now be in a process of reversal: Western people are leaving for Emerging Markets.

After all, what usually drives social mobility is the search for greener pasture or about following the money.

Economic distress is driving tens of thousands of skilled professionals from Europe, and many are being lured to thriving former European colonies in Latin America and Africa, reversing well-worn migration patterns. Asia and Australia, as well as the U.S. and Canada, are absorbing others leaving the troubled euro zone.At the same time, an influx of Third World immigrants whose labor helped fuel Europe's growth over the past decade is subsiding. Hundreds of thousands of them, including some white-collar professionals, have been returning home.The exodus is raising concern about a potential long-term cost of the economic crisis—a talent drain that could hinder the euro zone's weakest economies as they struggle to climb out of recession.

As the WSJ reports, the principal reason for the reversal of migration trends has been because of the lack or absence of economic opportunities. And this has been because of excessive welfare state, interventionism, bailouts of pet industries of politicians and boom bust policies which has been consuming capital and diverting resources to non-productive activities.

In short, brain or talent drain are symptomatic of failed government policies.

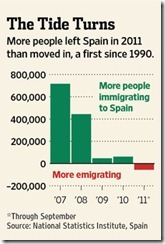

More account of people in Europe voting with their feet, again from the same article.

During a prosperous decade that ended in 2008, Spain welcomed one of the world's biggest waves of immigrants. Foreign workers poured in at a rate of 500,000 per year to boost its construction and service industries, making the country Europe's prime destination for new arrivals.Last year, with unemployment topping 20%, Spain became a net exporter of people for the first time since 1990, according to Spain's National Statistics Institute. Some 55,626 more people left the country in the first nine months of last year than arrived, the institute said.Spaniards are scattering to better-off European countries and beyond, particularly to Latin America. Of the estimated 37,000 Spanish citizens who left the country in 2010, nearly 60% emigrated to countries outside the European Union.At least 100,000 of Portugal's 11 million citizens moved abroad in 2011, after a decade of anemic growth and rising debt in Western Europe's poorest nation. In Africa, Angola's burgeoning economy has absorbed 70,000 Portuguese since 2003, according to the government-backed Emigration Observatory in Lisbon.The number of Portuguese in Brazil on work-related visas shot up by 52,000 in the 18 months through June 2011.Brazil is profiting from Europe's decline. It is wooing foreign engineers and other construction-related specialists to help carry out housing, energy and infrastructure projects for which the government has budgeted $500 billion through 2014, more than double Portugal's annual gross domestic product.

People respond to changes in the environment and the political economy without directions from the government. Instead they are reacting to failed policies.

And allowing for social mobility will only force governments to compete for the most productive members of any society, as well as, force governments to become more competitive by embracing economic freedom. But of course this would be bad news for politicians, their cronies and their media cohorts..

Finally, the north south migration trends could just be the beginning

More from the same article…

With Europe's crisis and Brazil's boom, migration patterns are shifting again.Brazilians are coming home in epic numbers. The government estimates that nearly half the country's émigrés have returned—from more than 3 million Brazilians living abroad in 2007 to fewer than 2 million today.

Interesting times indeed.

Saturday, January 14, 2012

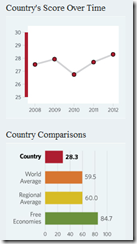

World Economic Freedom Down, Asia and Africa Up

Writes Mike Brownfield at the Heritage ‘Morning Bell’ Blog

Economic freedom — the ability of individuals to control the fruits of their labor and pursue their dreams — is central to prosperity around the world. Heritage and The Wall Street Journal measure economic freedom by studying its pillars: the rule of law, limited government, regulatory efficiency, and open markets. Things like property rights, freedom from corruption, government spending, free trade, labor policies, and one’s ability to invest in and create businesses all factor in to a country’s economic freedom.

Sadly, economic freedom declined worldwide in 2011 as many countries attempted — without success — to spend their way out of recession. The editors of the Index explain what has led to this troubling decline:

“Rapid expansion of government, more than any market factor, appears to be responsible for flagging economic dynamism. Government spending has not only failed to arrest the economic crisis, but also–in many countries–seems to be prolonging it. The big-government approach has led to bloated public debt, turning an economic slowdown into a fiscal crisis with economic stagnation fueling long-term unemployment.”

Though some might think that the United States — the land of the free, the home of the brave — is of course a leader in economic freedom, they would be wrong. The United States fell to 10th place in the world for economic freedom, and its score continues to drop. The U.S. ranked 6th in 2009, 8th in 2010 and 9th in 2011.

The Keynesian (kick the can) approach in resolving crises via government (deficit) spending has been experiencing rapidly diminishing returns. So the developed crisis afflicted world now utilizes more of central bank actions to supplement or buttress fiscal policies.

Yet with far more debt and accreted imbalances from inflationism, such implies temporary fixes and that we should expect another crisis down the road (perhaps at a far larger bigger scale)

Not all is bad news though. The little crisis scathed regions of Asia and Africa appears headed in the opposite direction, again from Heritage…

The United States isn’t alone in the trend away from increased economic freedom. Canada and Mexico lost ground in the Index, and 31 of the 43 countries in Europe saw reduced freedom, as well. Given Europe’s huge welfare programs and out-of-control social spending, that’s unfortunately not surprising. As the world suffers the economic repercussions of Europe’s debt crisis, the price of pursuing policies that constrict economic freedom should be clear.

For all the bad news that the Index uncovered, there is some good news for economic freedom around the world. Four Asia-Pacific economies–Hong Kong, Singapore, Australia and New Zealand–lead the Index with top scores this year, Taiwan has seen increased gains in economic freedom, and eleven of the 46 economies in sub-Saharan Africa gained at least a full point on the Index’s economic freedom scale. And Mauritius eighth place score is the highest ever achieved by an African country.

Much of the world, though, isn’t so lucky. While some countries have seen their economic freedoms increase, others such as India and China are constrained by government control and bureaucracy.

This only means that the wealth convergence dynamic will continue to intensify and that the wealth gap between the West and Asia, Africa and other emerging markets, who continue to embrace economic freedom, will persist to narrow.

Despite my cynicism, I still put some hope into meaningful reforms that can be made in the Philippines. This signifies a mixed opinion of mine, which can be called as the endowment effect or the home bias. The Philippines has shown some progress which means kudos the current administration (if true).

Yet our deepening linkage with the world will represent as the ultimate driver that would pressure the domestic political economic policies to align with the underlying trend, globalization, which drives the rest of the world.

As proof, if Cuba has been opening up her economy, which is not just statistics, (chart from Heritage Foundation), then so should the Philippines.