An important read from Bill Ridley of the jameswinston.com...the political equation in Saudi Arabia could even tilt oil prices to the roof!

Saudi Arabia - The Next Mid East Flashpoint

The last thing the United States needs right now is another conflict in the Mid East to deal with, but unfortunately America’s key ally in that troubled region is showing signs that they are on the brink of a civil war.

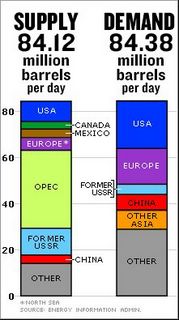

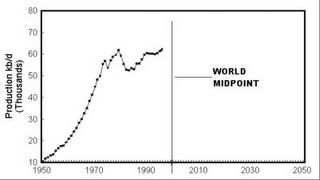

At stake here are 26% of the world’s oil reserves and 204 trillion cubic feet of natural gas. If extremist revolutionaries get their way, they will attempt to bring the U.S. and the rest of the western world to their knees by jacking up oil prices to punitive levels.

For the worst possible reasons, the likelihood of oil and gold dropping much further in price seems highly unlikely. In fact, it is very possible we could see sharper price spikes.

Playing into the latest price surge over $60 has been the recent death of Saudi Arabia 's King Faud, which has traders fretting the country's oil output could be disrupted as concerns of a civil war heighten. Just hours before the newly crowned King Abdullah arrived in the holy city of Medina , security forces killed the leader of al Qaeda in Saudi Arabia in a gun battle.

Earlier this month, terrorism concerns caused the U.S. to shut an embassy and two consulates. In an already skittish market, any unrest in Saudi Arabia is especially unnerving particularly given the fact that the major source for terrorism funding and manpower comes mostly from Saudi Arabia who are also world’s leading supplier of oil.

Saudi Arabia has the potential to become the world’s biggest political and economic disaster and is one of the major reasons why we are now paying more to fill up our cars.

Some energy economists are saying that the cost of a barrel of oil now has a $10 to $15 premium due to the uncertainty in the Middle East . Analysts are also worried that the now ruling King Abdulla will lose control of Saudi security and most importantly, control of the oil infrastructure.

Increased terrorist activity is hard for oil analysts to ignore. Last year a truck bomb blasted a main Saudi police station which was followed by the May 29th attack at a foreign workers compound in Khobar. An organization calling itself the al-Qaeda of the Arabian Peninsula later released statements denouncing members of the Saudi Royal Family and accusing them of plundering the nation’s oil wealth.

You would think that a nation that controls 25% of the world’s oil reserves would be a shining star for education and development for their people instead of the home base for terrorist financing and training.

So what happen?

Close examination reveals that the Saudi Royal Family of some 6,000 princes (women are excluded), along with favored business buddies like the bin Ladens, absorb virtually all the billions of oil revenues. This is another classic example of third world politics where the power elite keep themselves in luxury while their subjects are kept under strict control.

The Saud Royalty enforce Islamic laws and harsh punishments against the 22 million subjects under their rule. By our standards, their rule of the law is primitive. For the worst lawbreakers, public beheadings are still the norm.

To help keep the masses somewhat happy however, billions of dollars have been doled out to the under classes. These funds have gone to some positive things such as schools and mosques however there is a clear money trail showing that al Qaeda terrorists have also been on the receiving end.

Clearly, this terrorist financial support shows there is dissention within the ranks of the Saudi power elite. The clearest example being Osama bin Laden himself.

Life in the Desert

The Saudi ruling classes have riches beyond our comprehension. They have gone to the best schools in Europe and the United States, received the best medical care from American and European doctors. I remember one story from a nurse who said that one of the sheiks she had given care to in his palace had gold bars on the floor of his bedroom to keep his feet cool!

Unfortunately this extravagant wealth has not trickled down to the average family who live in the streets outside the palace gates in Riyadh. Millions of fundamentalists live in a world of fear, ignorance, and poverty which has breed contempt. Such a state of mind is open to believing the negative religious doctrine that focusing on death and destruction of those people and places which they believe are responsible for their unhappiness.

The mind control tactics of the religious leaders will keep the masses satisfied until they reach paradise either by their natural death or by sacrificing themselves for their cause. When you live a life of hell, a suicide bombing, is a glorious answer and a face saving escape.

Of course in reality what is happening is a transfer of power from one group of self centered control fanatics to another. One group uses their education, breeding and military control to maintain power and the other use religious doctrine to persuade the masses to do their biding.

Caught in the middle of this mess is the economic stability of the western world.

In the 1970s another U.S. ally, the Shah of Iran, was driven out of power by religious fanatics led by the Ayatollah Khomeini. Washington insiders are now worried The House of Saud may also fall victim to an internal uprising.

The state of mind of the average Saudi citizen is worrisome. Their views of the world are summed up within the pages of the Arabian bestseller, Bin Laden, Al-Jazeera, and I.

The book reviews an interview with Osama bin Laden well before September 11th. In the book he proclaims that "Every American man is an enemy, whether he is among the fighters who fight us directly or among those who just pay U.S. taxes."

When it comes to the oil resources bin Laden says, “A barrel of oil should cost $144. By these calculations, Americans have stolen $36 trillion from Muslims. They owe each member of the faith $30,000."

The only reason that OPEC hasn’t put the screws to the western world has been the overpowering influence of the Royal Saud family.

Saudi Arabia and the US have maintained a special relationship since 1945 when President Roosevelt and King Ibn Saud cut a deal whereby the U.S. would help keep them in power in exchange for reliable oil supplies.

This arrangement had worked well for many years but now it appears to be unraveling. To guarantee their wealth, the House of Saud has had to suppress the religious fanatics while keeping up appearances that they themselves are of the faith of the righteous.

To facilitate their security, the Royal family has had to rely on American help, without being too obvious about it.

Showdown in the Desert

Last year the House of Saud decided they should crack down on these misappropriated “charity” organizations that have supported terrorism. One such foundation called the Al Haramain Islanic Foundation has dished out about $50 million a year to groups who have links to terror organizations.

The situation is further complicated by power struggles within the top ranks of the Royalty. There are those within the House of Saud who oppose King Abdullah. And it would seem, so do many Saudi citizens.

The British newspaper, The Observer commented that "Anti-government demonstrations have swept the desert kingdom in the past months in protest at the pro-American stance of the de facto ruler, King Abdullah.”

Saudi’s minister of interior, Prince Nayef, who is also in charge of preventing terrorism, has strong support though he seems neutral toward the extremist element. Perhaps this is why four terrorists where able to disguise themselves as security forces and enter the well fortified foreign workers compound at Khobar which killed 22 people in 2004. More unbelievable is that the terrorists actually escaped while being surrounded by hundreds of security forces!

Aside from al Qaeda, much of the Saudi population are not big fans of the United States because of the close ties with Israel and U.S. military’s presence there since the end of the Gulf War.

If Prince Nayef decides to challenge Prince Abdullah, he may have the help of terrorist supporters. Within Saudi Arabia there is a generation of hard core religious fanatics who have been brainwashed into believing they are on a mission to rid the world of non-believers. This is what one Arab writer has described as the “culture of death.” These are the people who don’t think twice about blowing up innocent people along with themselves.

Meanwhile, the targets of choice for terrorists in Saudi Arabia are the western workers who live and work there. Alex Standish, the editor of Jane’s Intelligence Digest, said the situation in Saudi Arabia has strong parallels to the fall of the Shah of Iran who was toppled in 1979. He said there is a lot of evidence to suggest al Qaeda is gathering strength.

This isn’t a pleasant scenario however it’s very real. More troubling is that if Saudi Arabia ’s oilfields ever go offline for too long, the world will go into a major economic tailspin. The United States and the rest of the industrial world are counting on Saudi to increase their oil production, not dial it back. It should be more then obvious the world will not sit idly by and wait for the Saudi’s to sort out their political problems.

Vinnell Corporation “Mercenaries are Us”

You may recall hearing about Vinnell Corporation last year when the bombing of their premises in Saudi Arabia made headlines around the world. This was the second such attack on Vinnell’s property and personnel in Saudi Arabia , the first attack having been done in 1995.

Vinnell is a subsidiary of Northrop Grumman and in 2004 they were in the last year of a $831 million five year contract to train Saudi’s 80,000 National Guard under the supervision of the U.S. Army.

Jane's Defense Weekly has described these guardsmen as "a kind of Praetorian Guard for the House of Saud, the royal family's defense of last resort against internal opposition." That is why Vinnell and its employees were targeted in 1995 and again in May 2004.

By extension, The Saudi Arabian National Guard, are seen as a de-facto American military force. Without the National Guard, the royal family would be forced to leave the country and the revolutionaries could step in and use their control of oil to bring down the western world.

This cannot happen and it won’t. What remains unclear is to what degree will the U.S. military need to act in order to stabilize Saudi oil supplies over the upcoming months. As it looks right now, Saudi Arabia could be the next the next battle ground for U.S. forces.

In 2004, Saudi authorities with guidance from the CIA, started uncovering a network of Islamic extremists, arms, and sleeper cells all over the kingdom. Though a strong anti-Saud movement has been in existence for many years, officials are stating they have only just discovered these cells since last year following the May 12 suicide bombing in Riyadh.

Since the bombings back in May, Saudi officials have arrested more than 200 suspects.

Though authorities have just scratched the surface of uncovering these militants, it is clear from the large numbers of terrorist cells found and the sophistication of their arsenal, that this group is very powerful and well connected to money and the black market arms trade.

Militant expert and journalist with the Asharq alAwsat newspaper, Mishari al-Thaidi, says “it’s clear that they have sympathizers all over the Muslim world, including many young Saudis vulnerable to the call of Jihad (holy war), more recently because of the US war in Afghanistan and Iraq. The portrayal of those as crusader wars against Muslims makes it easier for al-Qaeda to gather recruits.”

Conclusion

Back in 1945 President Roosevelt and King Ibn Saud cut a deal whereby the U.S. would help the Royal House of Saud stay in power in exchange for reliable oil supplies. Though the U.S. has had many worry free years of oil supplies from Saudi Arabia , things are unwinding.

Though we don’t get a lot of news about Saudi Arabia ’s growing revolution, it just may be the main stream media’s top news story in the not too distant future.

If extremist revolutionaries get their way, they will attempt to bring the U.S. and the rest of the western world to their knees by jacking up oil prices to punitive levels.

Having positions in gold has always been the best insurance policy against the potential for a major financial and political upheaval. It’s been decades since global economic security has been in such tenuous position. The logic of owning gold in some form makes more sense today then ever before in our generation.