Philippine President GM Arroyo’s move to lend an ear to the Catholic Bishops to pave way for a “review” of the mining statute has elicited some concerns among some investors.

The Catholic Church has been openly opposed to the revival of the mining sector due to “environmental” concerns and this, in my view, has prompted several prelates to explicitly call for her resignation using the “legitimacy” issue as camouflage.

PGMA’s resolve to open communication channels with the influential Catholic Church is obviously a political ploy to “damage control” or reverse the declining tide of her political stock.

Nonetheless, considering the cash strapped position of the government plus the potential revenues it can generate, aside from broadening influence of resource-based geopolitics, the renaissance of the mining industry will unlikely be forestalled by the whimsical and baseless impositions of the myopic, self-righteous and socialist leaning Catholic Bishops.

The emerging risks in the mining industry has been on the aspects of “nationalization” (

In the

On the revenue side, when one speaks of generating US$61.4 million from excise taxes, and US$432 million in Corporate taxes annually, such magnitude makes the industry too compelling to ignore as to write it off for the sake of unjustified bugaboos (Mining admittedly has some negative environmental impacts but doesn’t “destroy life”~ pure bunk!). In essence, given the resource rich potentials of the country, no matter who sits as President (even a Prelate!) will be compelled to harness the revival of the industry for financial and economic purposes. The $64 question is, how it would be done (open to foreign investors, or government instituted).

Moreover there is the issue of geopolitics.

Rising commodity prices, which have been the outgrowth of investment and macroeconomic cycles compounded by the ramifications from collective government policies, is here to stay for sometime. Some market experts have even been suggesting that the present cycle could even last until 2050 based on the Kondratieff (Soviet economist Nikolai Kondratieff) rising long wave cycle count which spans from 45 to 60 years peak to peak!

This means that securing resources as oil, natural gas, copper, gold, silver, molybdenum to soft commodities (agriculture) will increasingly be the driving force behind geopolitics!

In the words of Dr. Marc Faber (emphasis mine), ``when markets are glutted and over-supplied, no one is going to fight in order to satisfy his demand. Conversely, when markets are characterised by acute shortages, people will fight and go to war in order to secure their required supplies, particularly when the shortages that might arise or that have already arisen threaten the physical and economic survival of the groups or countries involved.”

What this means is that there would be intense pressures from extraneous forces to revive our resource based industries such as the mining industry, (whether the Catholic Bishops like it or not). For example, I expect the Chinese government to ante up their presence towards shaping local politics (e.g. the aborted attempt to buyout UNOCAL by

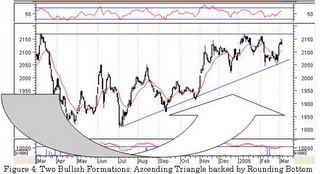

Finally, we should let the market speak for itself. While the present developments may give an investor anxiety over the consistency of policies adopted by the present regime, the financial markets will tell us whether these concerns are treading on valid grounds based on the collective psychology of investors represented by price values. Since the announcement of PGMA to “review” the Mining Act, the performance of local mining companies listed abroad has been mixed, Sur American Gold

Figure 1: Philippine Mining Index