``If a man gives no thought about what is distant, he will find sorrow near at hand”-Confucius

If there is anything that has been validated during the past week or so, is that global markets have been porous and that capital or portfolio flows have reflected a singularity of action across a variety of asset classes all over the world. This is what I have been writing about all along, that the world financial markets have been evolving towards increased integration such that global capital flows have been materially correlated to the directional paths of the financial benchmarks, including that of the Philippines. In the words of acclaimed French critique and Nobel Laureate Andre Gide, ``Everything has been said before, but since nobody listens we have to keep going back and beginning all over again.”

Well, some of my contemporaries have commented on these, mostly taking a leaf out of the observations from the international media, yet the others appear to be in a pertinacious state of denial citing “knee-jerk” reactions over what has been happening. Knee-jerk reactions are usually a very short-term phenomenon and not stretching over a week or longer.

On the other hand, there are also some who bluster about some arcane formulaic “timing” elixirs towards stock market investing. Of course, I have to admit that at times there have been occasions where “hot strategies” had one way or another worked, such as the Nifty Fifty in the late 60’s or the Dogs of the Dow in the 1990s, however, once they have become too popular or when the crowd starts to jump in they cease to deliver what is expected of them. Further, these erstwhile “hot strategies” were not timing tools, unlike those ventilated by our local “hotshots.” Market savant Warren Buffett once admonished on this, ``Read Ben Graham and Phil Fisher, read annual reports, but don't do equations with Greek letters in them."

Raising the Yellow Flag

``All of our knowledge has its origins in our perceptions." Leonardo da Vinci

Today’s investing environment seems to manifest a ‘yellow’ or warning flag. In my case, such milieu translates to a necessary action: portfolio underweighting. I have learned to identify cautionary indicators on the following circumstances; when “there are more fools than money than of money more than fools”, when “cost of capital rises above returns of invested capital”, and/or when “the risk prospects rises above rate of return potentials”.

I have noted in our previous outlook that world financial markets appear to have weakened arising from explanations in the causalities of “continued higher interest rate expectations and high inflation data” when these phenomenon has bizarrely been long imbedded into the financial markets or into the global economic framework for quite sometime.

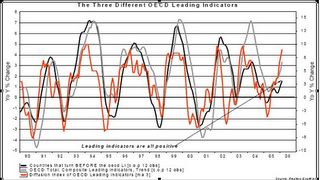

As argued for last week, as in the past (see November 14 to 18 Inflation Cycle A Pivotal Element to Global Capital Flows) global central banks have nurtured the seeds of another secular inflationary cycle as to pump up economic growth taking advantage of the “disinflationary” backdrop caused by the inclusion of formerly closed economies as China and India, which have greatly contributed to competitive “low price/cost” pressures of globalization via the transmission mechanisms of excess capacities and labor surpluses (in the past), aside from the rapidly evolving technological breakthroughs especially in the field of information technology and communications. Of course, such inflationary cycles would vacillate over the long term with peaks and troughs rising over generations and have been manifested in the past by rising gold and commodity prices as discussed previously (see March 27 to 31 edition, Listen To Your Barber On Higher Rates and Commodity Prices!).

In short, I am predisposed to think that ‘rising inflation and interest rate concerns’ have served as the scapegoats for the largely vulnerable investing public seeking for “oversimplified” explanations to the present crosscurrents.

US led Global Market Correction

Figure 1: Chart of the Day: Nasdaq Testing Critical Support

While there have been incipient signs of stresses in a rather risk complacent or previously low volatile world, the recent selloffs in Iceland’s currency & bonds and the crash of Middle East bourses from their stratospheric perch could have been a warning signal. But no less than the recent swoon in the US markets have led to a ripple effect throughout global financial markets not limited to equities (suggested reads from the Guardian “Ten days that shook the world's markets”).

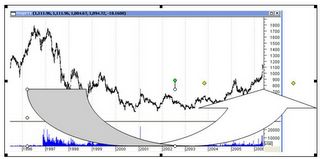

Figure 1 shows of the former market leader the major technology weighted benchmark, the Nasdaq, courtesy of Chart of the Day, testing on its 21-month CRITICAL support level. The Nasdaq and the major US benchmarks could be expected to bounce off coming in the coming sessions from the succession of serial selling (due to technical oversold levels) but needs to keep the 21-month trend intact.

Figure 2: Philadelphia Housing Index Breaks Down!

Could this be a mere hiccup? With the US debt driven and consumer led economy banking on its housing or real estate industry for continued financing of its consumption driven engine, the recent breakdown of the benchmark housing index as shown in Figure 2 aggravates my concern about the resiliency of the global markets, especially under the background of an inimical continued tightening “expectations” and high energy prices. Rising cost of capital appears to be edging towards or closing in on Returns of Invested Capital?

Aside, according to estimates by economist Ms. Asha Bangalore of Northern Trust, ``housing has accounted for roughly 40 percent of new private jobs since the end of the recession.”

Figure 3 courtesy of Northern Trust, Rising Rents and Slowing Homeownership in the face of rising rates

In another case of what goes around comes around, the US CPI index which was allegedly designed to suppress inflationary indicators for political and financial expediency has manifested rising inflation figures emanating from an emerging trend of RISING Rents!

Bloomberg analyst Caroline Baum in her recent article wrote (emphasis mine), ``Sure, owners' equivalent rent, an imputed rental measure that is 30 percent of the core CPI, accounted for 40 percent of the April increase. But it was that same component that artificially depressed the core CPI in 2003. And the Fed wasn't warning everyone that inflation was understated.”

As shown in Figure 3, courtesy of Asha Banglore of Northern Trust, the left chart shows that from the depths in 2003, rents as manifested by Rent of Primary Residence (blue line) and Owner’s equivalent Rent (red bars) has been on an emerging uptrend to collaborate the views of Ms. Baum. This comes in the face of rising mortgage rates (30-year red line), as depicted on the left chart, coincidental with an equally “toppish” percentage of homeownership (blue line).

In other words, the global financial markets could have been telling us possibly of an unraveling of the US real estate industry which is expected to slowdown the consumption driven US economy.

As to whether the Big “R” word comes into fore, or is simply just a slight deceleration remains to be seen. However, in ten days, what has clearly devolved was of a well know axiom `` when the US sneezes the world catches cold”. As to when a probable divergence among asset class would emerge remains to be seen. An attendant sign of rising prospects of risk/uncertainty relative to returns?

Commodity and Bond Markets Aver!

One thing that I learned and adhered from one of my favorite strategic thinkers Dr. Marc Faber is that not to listen to analysts but to listen to the markets instead. And that is essentially what I have been doing; interpret from what the market is essentially saying instead of trying to portray myself as “intelligent sounding” as most contemporary analysts are wont to do. It is the same premise that I ask you not to listen to me but to make your own deductions from your source of data. This outlook is simply a result of my lowly research to aide my decision making process relative to investing which I have been imparting with you.

For those of you who can recall, I mentioned during the last outlook that signs had been that the outstretched prices of precious metals have been petering out. I have likewise suggested you to take profits off the table for some mining issues which remained exceedingly overbought.

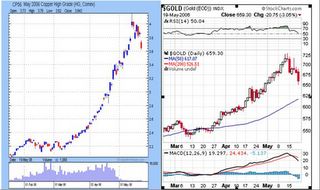

Figure 4: courtesy of stockcharts and futures.tradingcharts.com shows of confirmed downward dynamics of Copper and Gold

If inflation had been the “primary” concern then why has gold been going down as well, (when gold is widely reputed to be an insurance against inflation)? One may explain that the surge in gold prices has “come too fast too soon”, which appears to be a big possibility, aside from of course, the possible unwinding of several hedge funds positions which recently piled upon the monetary metal as previously evinced by the huge jump in commodity derivatives (see May 1 to May 5 editon...and the Falling US Dollar Index For a Rising Phisix, Albeit Caution is Warranted).

Over the week, gold fell $54.30 or 7.6%, whereas copper has lost 10.2%, silver down 13.2% and palladium off .6%.

Although relative to copper prices, its recent furious rise amidst the prospects of a slowdown is nonetheless an expected development. According to metalprices.com, ``Building construction accounts for more than 40% of all copper use. Residential construction is about two-thirds of the USA building construction market.” In short, falling metal prices (industrials) appear to be conforming to the recent US led decline in the global financial markets bolstering my case for a US led slowdown.

With the prospects of a material correction in key metal prices (as shown above) which may continue for quite sometime, confirmed by the downward dynamics in its prices, compounded by attendant increase in volatilities in the global financial markets, and coupled with a possible risk of a slowdown in the global economies, I would suggest for you to take rebounds as opportunities to significantly underweight on resource based issues. While I remain bullish over the long cycle for the resource based investments, the possibility of a sharp correction could be large enough to merit buying on bargains instead of simply holding on.

Figure 5: Rallying US dollar and falling US 10 year yields

Finally, US treasuries appear to be mounting a rally, following the recent sharp selloffs, as shown in Figure 5, in the light of a firming US dollar. Rallying US sovereign bonds deemed as “risk free” are essentially a flight to safety. Gold’s recent infirmities have spurred the rally in the US treasuries. It likewise could be interpreted as a short term respite from inflationary expectations, ergo appended outlook for a possible economic deceleration in the US.

Further, the firming US dollar could be emblematic of a “lighting rod” syndrome following the recent shocks. These developments highlight capital efflux from global assets back into the US dollar and US bonds, for the moment. Again, all these are manifestations attendant to intensifying volatility, increasing instability and heightened risk of a slowdown.

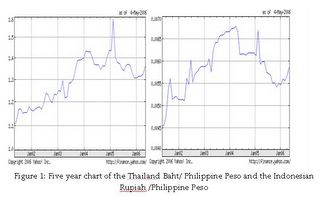

In Asia for instance, currencies fell almost across the board mostly on outflows from equity markets. According to Bloomberg’s Jake Lee, Indonesia’s rupiah fell 5% while its equity benchmark fell a massive 7.9%! ``For the week the Thai baht, Philippine peso, Singapore and Taiwan dollars also weakened. The baht dropped 1.1 percent to 38.11 per dollar. The Philippine peso slipped 1.8 percent to 52.68, according to the Bankers Association of the Philippines. The Singapore dollar declined 1.4 percent to S$1.5838. The Taiwan dollar lost 1.8 percent to NT$31.948...The Korean won dropped 1.5 percent this week to 946.25 per dollar, according to Seoul Money Brokerage Services Ltd.” It has indisputably been a global event.

Derivatives Provoked??

There are of course, jitters that the present shakeout had been derivatives based. Leveraged derivative positions on stock markets or ``variance swaps” have been forced to close due to the recent spike in stock market volatility. Gillian Tett of the Financial Times reports, ``The recent sharp falls in stock markets appear to have been exacerbated by an unusual wave of derivatives activity on the part of hedge funds and big banks, some traders on Thursday indicated...In particular, some banks and big investors appear to have been forced into selling large amounts of equity futures because they have been taking large, leveraged bets on the direction of stock market volatility in recent months – and these bets are now unravelling because the equity markets have recently fallen sharply.”

Some may argue that the recent declines may represent Wall Street’s metaphorical tenet of buying “when blood is on the streets”. But this is no blood on streets. Blood on the streets denote of panic, outright fear or of bullish capitulation. The global financial markets are coming off from record highs (“euphoria” so to speak) which means that given the profuse liquidity backdrop and the reduced risk premia, there had been more fools than money or fools chasing for money, in the hope that a greater fool would assume his risks (Greater Fool theory).

There are those who take on a bullish outlook as the BCA Research, which views the diminished prospects of inflation based on the activities of bonds would set pace to a next rally phase. My assumption here is that BCA could be expecting the FED to sanguinely resolve its present dilemma (raise rates provoke a slowdown; pause and risk runaway inflation). I doubt such optimistic resolve but instead share of Dr Frank Shostak’s, of the Ludwig von Mises Institute, viewpoint (emphasis mine)...

``Sooner rather than later, Bernanke's Fed policy will assume a reactive nature — the US central bank will respond to the data. The fact that the data tends to mirror the effect of past Fed's monetary policies means that the Fed is likely to respond to its own past actions.

``The Fed tries to control the future but ends up only chasing its own tail, which leads to more confusion and uncertainty. All this could be further aggravated if Bernanke were to start setting targets for price inflation. As is always the case with centralized monetary planning, attempts to stabilize only bring about more destabilization.”

In essence, the markets today have been running on ambivalence. As to whether this signifies as simply a typical correction or most importantly, a possible critical threshold that embodies an “inflection point” is something that has yet to be established. As such, prudence would be a better alternate to valor. Staying on the sidelines would be rather judicious while waiting for the markets to resolve its impasses or until a clearer trend would have surfaced.

To recap, the present market debacle has been attributed by mainstream media and personalities to “rising inflation and interest rate expectations” whereas markets appear to tell us that an economic growth deceleration by the US could have been the effective trigger for the recent selloffs. This has diffused into the global markets and among a variety of assets. Moreover, circumstantial evidence reflects on a possibility of a derivative ignited carnage. Under both circumstances, heighten volatility presently suggests more than a simple shallow correction but of a possibility of the risk of a major “inflection point” or a market “top” (US).

The selloffs has markedly damaged several financial market indicators such that even if we expect a short term bounce off the oversold levels, present threshold levels need be mended or rectified as to be reckoned as merely “short term” blips.

Under the shadow of greater risk more than the prospects of returns, plus rising expectations of a narrowing margin between cost of capital and returns on capital, plus manifest dominance of more fools chasing for lower profits, I would take to consider the present environment as underweight or alternatively overweight cash or short term bonds (for Peso denominated assets).