In reading media, it’s just amazing how incurably specious their treatment of social issues are.

Take for example the recent issue on supposed “brain drain”. It’s been emphasized that the Philippines appears to be helpless in the exodus of manpower as a result of demand from abroad.

This from the Inquirer.net,

Scientists, engineers, doctors, IT specialists, accountants and even teachers are among the English-speaking talent heading to foreign lands, leaving the government and private companies scrambling to find replacements.

"There is a skills haemorrhage. We are losing workers in the highly professional and skilled categories," Vicente Leogardo, director-general of the Employers' Confederation of the Philippines, told Agence France-Presse.

While they (government and business groups) don’t exactly say it (as this would construed as politically incorrect since OFWs are now an important political force!), the undertone suggests that these should be stopped. How? By Fiat!

I may be wrong but the following seems to be a clue.

More from the same article, (emphasis mine)

The government has been seeking ways to upgrade salaries and benefits, according to Myrna Asuncion, assistant director of the government's economic planning department.

"But local salaries can only go up by so much before they start hurting the competitiveness of local industries," Asuncion told AFP.

"We want to provide employment opportunities in the Philippines but there are some sectors that say salaries are already too high," she said.

You see the problem?

On the supply side, these anecdotes only reveal that the government and Filipino companies are “afraid” or "reluctant" to engage in market competition by paying market rates for these skills. With foreign companies willing to pay local skilled workers enough to tilt the latter’s (cost benefit tradeoffs) choice, thus, they decry the “brain drain”.

In short, this is simply demand and supply or Economics 101 at work.

Of course, media, politicians and their coterie (business interest groups, politically blind academicians and experts) loathe demand and supply. They believe in Santa Claus or free lunch economics.

And here are very important factors which they don’t say:

From TradingEconomics.com

First of all, they don’t tell you that the lowered standards of living have been the result of past collective policies that has resulted to inflation or the loss of purchasing power of the Peso.

Over the years, this has significantly contributed to the reduction of competitiveness. Think capital flight.

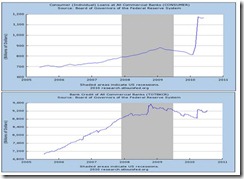

Chart from the BSP

Next, they don’t tell you that a lower Peso (falling from an exchange rate against the US dollar at 2 in the 1960s to 55 in 2005) doesn’t necessarily fuel an export-industry boom.

So policy manipulations (such as welfarism) to diminish the Peso’s worth only sustains distortions in the economic system, via protectionism -which favors select political groups (think cronyism). And these exacerbate the outflows of labor force.

In other words, protectionism is mostly a zero sum game and hardly contributes to goods-services value formation.

Chart from the OECD

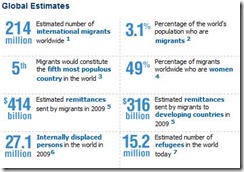

Another, from the demand side, the demographic imbalances or falling fertility rates in developed economies will sustain the need for labor manpower from emerging markets. And the Philippines given the current political economic setting is likely to be a major participant for a long time.

Importantly, with increasing technology based globalization, skilled jobs will be a major contribution to the “labor” aspect of globalization.

Chart from the TradingEconomics.com

Essentially the so-called “brain drain” is a symptom of an underlying disorder.

And one of the primary variable is lack of desire to compete.

So even at relatively low wages (compared to OECD), the market’s response to price signals set by the downtrodden Peso have been undercut by the regulatory, bureaucratic, legal, (property rights) and tax environment.

According to Trading Economics, ``The Ease of doing business index (1=most business-friendly regulations) in Philippines was reported at 141.00 in 2008, according to the World Bank. In 2009, the Philippines Ease of doing business index (1=most business-friendly regulations) was 144.00. Ease of doing business index ranks economies from 1 to 181, with first place being the best. A high ranking means that the regulatory environment is conducive to business operation.”

The Philippines is shown as one of the world’s least business friendly environments in the world, thus, resonating the signs of refusal to adjust to the global market climate. Instead, these interest groups seek political cover—which doesn’t change the nature of economics.

Finally, it’s equally nonsense to imply that brain drain will suck out the heck out of our skilled workers. This will only be true if you think the Philippines is immune to the basic laws of economics.

Why?

Because price signals say supply will adjust to demand!

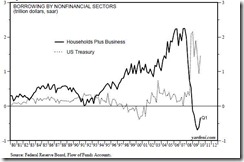

Chart from TradingEconomics.com

Exploding remittances and net migration trend reveals how these dynamic would unfold.

The fertile population of the Philippines should “naturally” respond to these dynamic by having more Filipino youth take on more specialized courses that would meet global demand. Hence restrictions on these adjustments should be avoided.

Unless Filipinos are daft, which I don’t think we are, except in the eyes of politicians and media, I trust that the law of economics would prompt “brain drain” to result to a net positive benefit for the Philippine society, because it is a purposeful choice made by millions of individuals (our countrymen) in response to the current environment.

If we truly want to reverse “brain drain”, then we need to build capital.

And how do we that?

By sloughing off protectionism, cronyism, paternalism and embracing competition, free trade and economic freedom.

As Ludwig von Mises once wrote,

Under a system of completely free trade, capital and labor would be employed wherever conditions are most favorable for production. Other locations would be used as long as it was still possible to produce anywhere under more favorable conditions. To the extent to which, as a result of the development of the means of transportation, improvements in technology, and more thorough exploration of countries newly opened to commerce, it is discovered that there are sites more favorable for production than those currently being used, production shifts to these localities. Capital and labor tend to move from areas where conditions are less favorable for production to those in which they are more favorable.

That’s what media and the mainstream won’t likely tell you.

Outside business administration the major growth area in Philippine education is practically where the skilled exports has been taking place (red arrows)--namely, Medical Sciences (strongest), Math and computers sciences and engineering (growing but variable), that's from NSCB data (see below)