From Bob Gorrell (hat tip Mark Perry)

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Thursday, October 27, 2011

Bank of Japan Expands QE

The Bank of Japan (BoJ) has announced an increase of their version of Quantitative Easing (QE) or central bank asset purchases.

From Bloomberg, (bold emphasis added)

The Bank of Japan expanded stimulus as Europe’s sovereign-debt crisis caused an appreciation in the yen that may endanger a recovery from the March earthquake, tsunami and nuclear crisis.

Governor Masaaki Shirakawa and his policy board expanded their credit and asset-purchase programs to a total of 55 trillion yen ($724 billion) from 50 trillion yen in an 8 to 1 vote, the central bank said in a statement in Tokyo today. It also kept the overnight lending rate between zero and 0.1 percent.

Central banks from Brazil to Russia have cut borrowing costs and India signaled this week it was done with rate increases as nations turn to shelter their economies from the global slowdown. Economists said today’s policy boost was too small to address the strengthening yen and the BOJ may be forced to take further action if overseas economies deteriorate.

“In a word, this was disappointing,” said Masaaki Kanno, a former senior official at the Bank of Japan and now chief economist at JPMorgan Chase & Co. in Tokyo. "They could have taken more active policies to give the market a positive surprise rather than moving little by little."

This only goes to show how addicted the global financial sector has been for bailout policies, such that they would use absurd premises to rationalize on such political actions.

Euro’s Bailout Deal: Rescue Fund Jumps to $1.4 Trillion and a 50% haircut on Greece bondholders

From Bloomberg (bold emphasis mine)

European leaders persuaded bondholders to take 50 percent losses on Greek debt and boosted the firepower of the rescue fund to 1 trillion euros ($1.4 trillion), responding to global pressure to step up the fight against the financial crisis.

Ten hours of brinkmanship at the second crisis summit in four days delivered a plan that the euro area’s stewards said points the way out of the debt quagmire, even if key details are lacking. Last-ditch talks with bank representatives led to the debt-relief accord, in an effort to quarantine Greece and prevent speculation against Italy and France from ravaging the euro zone and wreaking global economic havoc.

“The world’s attention was on these talks,” German Chancellor Angela Merkel told reporters in Brussels at about 4:15 a.m. today. “We Europeans showed tonight that we reached the right conclusions.”

Measures include recapitalization of European banks, a potentially bigger role for the International Monetary Fund, a commitment from Italy to do more to reduce its debt and a signal from leaders that the European Central Bank will maintain bond purchases in the secondary market.

So the money destruction from recapitalization of European banks will be offset by the ECB’s bond purchases.

In addition, the deal transforms the EFSF into an insurance fund. As I earlier noted

In the Eurozone, a proposal being floated to ring fence the region’s banking system will be through the conversion of the EFSF into an insurance like credit mechanism, where the EFSF will bear the first 20% of losses on sovereign debts, but allows the banks to lever up its firepower fivefold to € 2 trillion

Yet the lack of real resources, insufficient capital by the ECB, highly concentrated and the high default correlation of underlying investments could be possible factors that could undermine such grandiose plans. Besides, such plans appear to have been tailor fitted to reduce credit rating risks of France and Germany aside from allowing the ECB to monetize on these debts.

The Eurozone’s rescue will rely heavily on the ECB’s QE program.

The rest of the world will also participate in the Euro bailout via the IMF which should not only dampen global economic performance overtime, but would also reduce available resources when the next crisis arises.

And China is also being asked to contribute more.

From another Bloomberg article,

French President Nicolas Sarkozy plans to call Chinese leader Hu Jintao tomorrow to discuss China contributing to a fund European leaders may set up to bolster their debt-crisis fight, said a person familiar with the matter.

The investment vehicle was one of the options being considered by European leaders at a summit tonight to expand the reach of its 440 billion-euro ($612 billion) European Financial Stability Facility.

Sarkozy’s plea to his Chinese counterpart would come the day before a planned visit to Beijing by Klaus Regling, chief executive officer of the EFSF, to court investors.

Should China give in to the request to support the Euro, this means a weaker US dollar.

Nevertheless, current events in the Eurozone reveals how privileged the US and Euro banking class have been, who are supported by their domestic and regional political patrons, and indirectly the US through the US Federal Reserve whose swap lines to the Eurozone which have tallied $1.85 billion, and the world through the IMF.

Yet all these centralized rescue plans seem to be anchored on hope which only buys time before next episode of this continuing crisis resurfaces.

For the meantime, the QE starved financial markets will likely get another boost. Thus the boom bust cycles.

No Liquidity Trap, US Economy Picks Up Steam

From the Wall Street Journal Blog (bold highlights mine)

U.S. businesses are unsure where the economy is headed, but that has not stopped them from going ahead with capital spending projects. The dichotomy echoes consumer behavior, which finds consumers feeling pessimistic but still shopping.

The big difference: unlike consumers who have seen little wage growth, the U.S. business sector has piles of money to buy new equipment, modernize plants and retrofit office space. Now they just need to add workers.

Shipments of non-defense capital goods excluding aircraft jumped at a healthy 16.7% last quarter. That was the largest gain in five quarters and suggests third-quarter gross domestic product growth was solid (GDP data will be released Thursday).

In addition, new orders for capex goods increased last quarter, meaning business investment will keep growing into 2012.

Company executives are approving spending plans, while at the same time growing more uncertain about the U.S. economy.

The third-quarter Manufacturing Barometer done by business consulting firm PwC shows a plunge in the percentage of U.S. manufacturers who feel good about the economy.

Kontra popular analysts whose incantations have been about an alleged liquidity trap that has been plaguing the US economy, the empirical data above disproves this highly fallacious but popular theory.

To add, signs of economic strength seems to defy the 'animal spirits'.

Instead, as what I have been saying, exploding money supply growth appear to be permeating into the US economy where the next possible risk could escalating inflation.

Gold prices appears to be signaling this, where a break above the 50-day moving averages would imply that the bull market in gold remains intact and would likely reaccelerate.

And if US consumer price inflation is to ramp up, then the attendant symptoms would be a recovery in the broader spectrum of commodity markets and the stock markets.

Nevertheless, we still need to see the feedback loop effects of the unfolding events in China and the Eurozone.

Wednesday, October 26, 2011

Globalization Fuels the Africa’s Moment

Globalization has been fueling Africa’s renascence.

From the Economist, (bold emphasis mine)

AFRICA has made a phenomenal leap in the last decade. Its economy is growing faster than that of any other continent. Foreign investment is at an all-time high; Senegal has lower borrowing costs than Ireland. The idea of a black African billionaire—once outlandish except for kleptocratic dictators—is commonplace now. At the same time an expanding African middle class (similar in size to those in India and China) is sucking in consumer goods. Poverty, famine and disease are still a problem but less so than in the late 20th century, not least thanks to advances in combating HIV and malaria.

Africa’s mood is more optimistic than at any time since the independence era of the 1960s. This appears to be a real turning point for the continent. About a third of its growth is due to the (probably temporary) rise in commodity prices. Some countries have been clever enough to use profits to build new infrastructure. The arrival of China on the scene—as investor and a low-cost builder—has accelerated this trend. Other Asian economies are following its lead, from Korea to Turkey.

Yet factors unconnected to resources have been equally or even more important. Africans are taking a greater interest in each other. Regional economic cooperation has improved markedly—borders are easier to cross now, especially in the east. Technology helps too. Africa has 400m mobile phone users—more than America. Such tools boost local economies, especially through mobile banking and the distribution of agricultural information.

As the rest of the world struggles with economic meltdown, Africa is for once enjoying a moment in the sun. Even political violence, long an anti-reformist cancer, is simmering down. Many long-running civil wars have (more or less) ended: Sudan, Congo, Angola. Bad governance is still holding back many countries, but markets are becoming more open thanks to privatisation. Examples of the old Africa (destitute, violent and isolated) are becoming more rare.

The above article echoes on the earlier observations of the McKinsey Quarterly in June of 2010 (bold emphasis mine)

The key reasons behind this growth surge included government action to end armed conflicts, improve macroeconomic conditions, and undertake microeconomic reforms to create a better business climate. To start, several African countries halted their deadly hostilities, creating the political stability necessary to restart economic growth.

Next, Africa’s economies grew healthier as governments reduced the average inflation rate from 22 percent in the 1990s to 8 percent after 2000. They trimmed their foreign debt by one-quarter and shrunk their budget deficits by two-thirds.

Finally, African governments increasingly adopted policies to energize markets. They privatized state-owned enterprises, increased the openness of trade, lowered corporate taxes, strengthened regulatory and legal systems, and provided critical physical and social infrastructure. Nigeria privatized more than 116 enterprises between 1999 and 2006, for example, and Morocco and Egypt struck free-trade agreements with major export partners. Although the policies of many governments have a long way to go, these important first steps enabled a private business sector to emerge.

In short, Africa has greatly reduced dependence on the political distribution of resources (which has reduced wars), has vastly improved property rights, which has enabled free trade and importantly embraced economic freedom.

Basic lessons which Filipinos ought to learn and emulate.

Quote of the Day: The Fading Religion of Global Warming

From Michael Barone (hat tip Matt Ridley)

All the trappings of religion are there. Original sin: Mankind is responsible for these prophesied disasters, especially those slobs who live on suburban cul-de-sacs and drive their SUVs to strip malls and tacky chain restaurants.

The need for atonement and repentance: We must impose a carbon tax or cap-and-trade system, which will increase the cost of everything and stunt economic growth.

Ritual, from the annual Earth Day to weekly recycling.

Indulgences, like those Martin Luther railed against: private jet-fliers like Al Gore and sitcom heiress Laurie David can buy carbon offsets to compensate for their carbon-emitting sins.

Corporate elitists, like General Electric's Jeff Immelt, profess to share this faith, just as cynical Venetian merchants and prim Victorian bankers gave lip service to the religious enthusiasms of their days. Bad for business not to. And if you're clever, you can figure out how to make money off it.

Believers in this religion have flocked to conferences in Rio de Janeiro, Kyoto and Copenhagen, just as Catholic bishops flocked to councils in Constance, Ferrara and Trent, to codify dogma and set new rules.

But like the Millerites, the global warming clergy has preached apocalyptic doom -- and is now facing an increasingly skeptical public. The idea that we can be so completely certain of climate change 70 to 90 years hence that we must inflict serious economic damage on ourselves in the meantime seems increasingly absurd.

If carbon emissions were the only thing affecting climate, the global-warming alarmists would be right. But it's obvious that climate is affected by many things, many not yet fully understood, and implausible that SUVs will affect it more than variations in the enormous energy produced by the sun.

Hoaxes will eventually get exposed for what they truly are.

Apple Jumps Into the TV Industry

A Steve Job-less Apple won’t be inhibited from their innovative ways, they’re moving into integrating TV with their current line of products.

From Bloomberg,

Apple Inc. (AAPL) is turning to the software engineer who built iTunes to help lead its development of a television set, according to three people with knowledge of the project.

Jeff Robbin, who helped create the iPod in addition to the iTunes media store, is now guiding Apple’s internal development of the new TV effort, said the people, who declined to be identified because his role isn’t public.

Robbin’s involvement is a sign of Apple’s commitment to extending its leadership in smartphones and tablets into the living room. Before his Oct. 5 death, Apple co-founder Steve Jobs told biographer Walter Isaacson that he had “finally cracked” how to build an integrated TV with a simple user interface that would wirelessly synchronize content with Apple’s other devices.

“It will have the simplest user interface you could imagine,” Jobs told Isaacson in the biography “Steve Jobs,” released yesterday by CBS Corp. (CBS)’s Simon & Schuster.

Trudy Muller, a spokeswoman for Cupertino, California-based Apple, declined to comment. Outside of Jobs’s remarks in the book, Apple hasn’t acknowledged that it’s developing a TV set. And according to one person, it’s not guaranteed that Apple will release a television.

Until now, the company’s TV efforts have been limited to Apple TV, a small $99 gadget that plugs in to a television and gives users access to content from iTunes, Netflix Inc. (NFLX)’s streaming service and YouTube. Jobs had called it Apple’s “hobby,” rather than something designed to be a serious moneymaker.

The relentless pursuit of profits forces producers to earnestly work to satisfy the consumers, partly through innovation. If they fail, then they lose money. It’s a calculated risk for them that comes with no guarantees.

For consumers this means more choices and access to products at lower prices.

That’s the beauty of free markets.

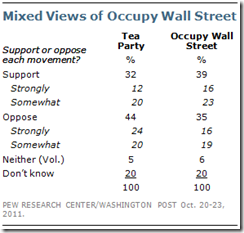

Poll: Occupy Wall Street versus Tea Party, Cut Between Partisan Party Lines

Each day that passes, my theory about Occupy Wall Street as a re-election campaign strategy for President Obama has been generating more confirmations.

From Pew Research (bold emphasis mine)

About four-in-ten Americans say they support the Occupy Wall Street movement (39%), while nearly as many (35%) say they oppose the movement launched last month in New York’s financial district.

By contrast, more say they oppose the Tea Party movement than support it (44% vs. 32%), according to the latest survey by the Pew Research Center for the People & the Press and The Washington Post, conducted Oct. 20-23 among 1,009 adults. One-in-ten (10%) say they support both, while 14% say they oppose both.

Partisanship plays a strong role in attitudes about the two movements. About six-in-ten Republicans (63%) say they support the Tea Party. That jumps to 77% among Republicans who describe themselves as conservative. Just 13% of Democrats support the Tea Party movement, while 64% are opposed.

About half of Democrats (52%) – and 62% of liberal Democrats – say they support the Occupy Wall Street movement. Among Republicans, 19% say they support the anti-Wall Street protests, while more than half (55%) oppose them.

Independents have mixed opinions of the Occupy Wall Street movement: 43% support the movement and 35% are opposed. By contrast, the balance of opinion among independents toward the Tea Party is much more negative: Just 30% support the Tea Party movement while 49% are opposed.

Pew Research essentially confirms the Gallup survey who also showed earlier that only a segment of the American population has been in favor of Occupy Wall Street.

We must remember that the Tea Party has served as a critical influence in turning the tide to favor Republicans during the 2010 Congressional elections.

In the realization that election season nears and that the approval ratings for both Congress and the President are at record lows, which in essence diminishes the odds of the re-election of the Democrat incumbents, thus the seeming urgency for the beleaguered Democrats (through their allies) to organize, mobilize, finance and expand a populist movement that could neutralize the Tea Party forces.

So the Occupy Wall Street movement basically rests on the political gimmickry of class warfare which advocates the expansion of government control in the delusional belief that the ends will justify the means.

Importantly, the Pew survey above has been exhibiting how Occupy Wall Street and the Tea party movement appear to be galvanizing across partisan party lines, which essentially has been confirming my theory.

So far on this account, the survey suggests that Occupy Wall Street as rather a new movement that rides on fancy noble but unattainable abstract goals has been achieving their objective as a prominent counterbalance to the Tea Party movement.

But this has yet to spillover to President Obama’s approval ratings or to his re-election odds.

The Intrade prediction market says that as of this writing Obama’s re-election odds is at 48.7%.

It is interesting and fascinating to witness how people have been so gullible as to be unwittingly used and manipulated to support political causes whose benefits only accrues to politicians seeking office. This also clearly shows how politics can strip or rob people of their common sense.

Chart of the Day: The US TV Media Industry

From Wall Stats.com

For a larger view, please press on this link which should redirect you to the source page

By the way here is a link showing the list of the largest players in US media (cable, TV, Print, Telecom and Radio)

Tuesday, October 25, 2011

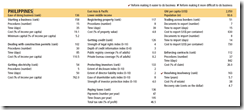

Doing Business 2012: Philippines Ranking Down

The World Bank in conjunction with the International Financial Corporation recently released Doing Business 2012

Doingbusiness.org attempts to measure how business friendly an economy is.

A fundamental premise of Doing Business is that economic activity requires good rules—rules that establish and clarify property rights and reduce the cost of resolving disputes; rules that increase the predictability of economic interactions and provide contractual partners with certainty and protection against abuse. The objective is regulations designed to be efficient, accessible to all and simple in their implementation. In some areas Doing Business gives higher scores for regulation providing stronger protection of investor rights, such as stricter disclosure requirements in related-party transactions.

Doing Business takes the perspective of domestic, primarily smaller companies and measures the regulations applying to them through their life cycle. This year’s report ranks economies on the basis of 10 areas of regulation—for starting a business, dealing with construction permits, getting electricity, registering property, getting credit, protecting investors, paying taxes, trading across borders, enforcing contracts and resolving insolvency (formerly closing a business). In addition, data are presented for regulations on employing workers.

Here is the current ranking:

Unfortunately the Philippine fell two notches from 134 last year to 136th. Notice how ‘unfriendly’ the domestic business environment has been. The other implication is that the local business environment has been uncompetitive and requires a high hurdle rate to attract investors, which why jobs are inadequate.

Here is the measure of progress by 183 nations monitored by the institution.

For the Philippines, there has hardly been any progress from 2005. This implies that the deluge of media based politicking has resulted to little progress.

The only reform, doingbusiness.org has identified is the passing of a law on ‘Resolving insolvency’. Yet we don’t even know how ‘fair’ or ‘equitable’ and enforceable this law is.

Finally here is overall scorecard. Except for trading across the borders (globally ranked 51st) and getting electricity (54), most of the other metrics has been dismal: starting a business (158), dealing with construction permits (102), registering property (117), getting credit (123), protecting investors (133), paying taxes (136), enforcing contract (112) and resolving insolvency (163).

If there is any important lesson that can be gleaned from the above is that the Philippines political economy remains firmly hamstrung or plagued by the lack of property rights. Obviously, this has been the result of excessive politicking or overdependence on political resolution of socio-economic problems.

Filipinos hardly realize that politicians don’t care about our property rights, what they care about is the usurpation and the expansion of their political control and the privileges that accompanies this.

We can fantasize about so and so politician delivering us from our economic woes. However, economic reality will only persistently frustrate us, because there are NO miracles from redistributionist policies.

Forcibly taking resources from Pedro’s pockets and to give to Juan is not only a ZERO sum activity that leads to a waste of resources, but importantly also promotes a culture of sloth and dependency, which politicians and their media accomplices has been perennially parroting—control here, control there and control everywhere. Yet the only thing that needs controlling should be their loquacious economically abstract 'noble' sounding mouths.

Progress would have to come from our respect for property rights which serves as the foundation for economic freedom. Ultimately the path to progress starts from us, and not from politicians-a reality which most can't comprehend.

China Bails Out the Ministry of Railways

From Forbes’ Gordon Chang, (bold emphasis mine)

Last week, the powerful National Development and Reform Commission saved the country’s Ministry of Railways from default by announcing that the bonds of the troubled agency have “government support.” The announcement followed a decision earlier this month to cut taxes on interest paid on railway bonds. Moreover, the Railways Ministry reached agreement with the central government to force state banks to support its nationwide building program. Reports indicated that some of these financial institutions had previously cut their quota of loans to the debt-ridden ministry.

The series of steps saved the country’s railroad-building program, which had been floundering. Due to a cash crunch, contractors had stopped payments to cement and steel companies, migrant workers had not received wages for months, and projects to build thousands of kilometers of track had been put on hold.

Beijing in 2008 embarked on a gargantuan program, the world’s largest high-speed rail network. By the end of last year, the Railways Ministry had overseen the construction of 8,358 kilometers of high-speed rail track. It is building lines totaling a little more than 10,000 kilometers.

The centerpiece of the program is, by itself, the most expensive civil engineering project in history, the Beijing-Shanghai line, costing an estimated 221 billion yuan, about $34.6 billion. That overtakes the second-place Three Gorges Dam, which cost a mere 203.9 billion yuan. The line connecting the two cities is 1,318 kilometers, including 16 kilometers of tunnels. The service opened this July, about a year ahead of schedule.

The high-speed train cuts travel time between the two cities from 10 hours to less than five—when it is running. A series of power outages have plagued the showcase project since it began operating. Yet the repeated service interruptions are not nearly as bad as the collision in Wenzhou on July 23 on another line. The two-train accident, according to official statistics, killed 40 people and injured 177…

Zhao, perhaps China’s foremost critic of the high-speed rail system, points out that the low usage has created a debt crisis. The Beijing Jiaotong professor argues that if the Railways Ministry goes ahead and spends 4 trillion yuan as planned, it “will have absolutely no ability to repay.” Even now, the agency is having difficulty meeting its obligations. It has issued a series of bonds this year, in part to pay off maturing obligations and partly to pay suppliers.

The financial difficulties of the Railways Ministry have begun to affect state enterprises, such as China CNR Corporation, a train maker. CNR is now issuing bonds to meet its obligations to repay short-term debt. It has short-term debt because its accounts receivable skyrocketed due to “delayed payments” by the Ministry of Railways. As a result of mounting debt, CNR’s stock is among the worst performers in Asia. And the markets have also punished the shares of its competitor, CSR Corporation, the other state train maker.

The Railways Ministry is expected to issue 100 billion yuan of bonds this year, but some analysts think the agency has severely underestimated its cash needs. The ministry says it needs to raise 45.5 billion yuan for fixed assets this year when others think the actual figure is closer to 1.05 trillion yuan.

In any event, MOR, as the Railways Ministry is known, now has 2.1 trillion yuan of debt. Before the NDRC’s vague announcement of support last week, analysts were quietly talking about the ministry’s default. A bailout, perhaps in the form of the Ministry of Finance assuming the railway debt, is still necessary. The rescue effort will be costly: the Railways Ministry’s obligations are more than 5% of China’s GDP.

Beijing has the financial resources to save the ministry, but unfortunately it is not the only debtor that can use a hand. Chinese officials decreed the construction of most of the infrastructure built in the last three years because they wanted to create GDP. Now, however, they are busy thinking about how they will pay for all the “ghost cities” and train tracks to nowhere they have just built for this purpose.

In China, broadening signs of bailouts have not been signs of stabilization. Instead, the whack a mole or piecemeal approach signify as indications of a broadening deterioration of her economy. As I earlier said, expect more bailouts to come.

Importantly, these are risks that can't be ignored.

Occupy Wall Street: More Signs of President Obama’s Re-election Campaign Strategy

From Washington Post (bold emphasis mine)

Labor groups are mobilizing to provide office space, meeting rooms, photocopying services, legal help, food and other necessities to the protesters. The support is lending some institutional heft to a movement that has prided itself on its freewheeling, non-

institutional character.And in return, Occupy activists are pitching in to help unions ratchet up action against several New York firms involved in labor disputes with workers…

The coordination represents a new chapter for the anti-Wall Street activists, who have expressed anger at establishment forces in both major political parties and eschewed the traditional grass-roots organizing tactics long deployed by labor unions.

It also suggests an evolution for organized labor, which retains close ties to President Obama and the Democratic Party but sees the Occupy protests as a galvanizing moment. Some union officials concede that their efforts to highlight income inequality and other economic concerns have fallen short, scoring few victories with a White House that many on the left see as too close with Wall Street.

President Obama’s job approval rating hits NEW record lows

From Gallup

This seems to validate polls which shows that the theme espoused by the ‘noisy minority’ have not been supported by the general public.

Such gimmickry seem as telltale signs that for the Obama administration, desperate times calls for desperate measures

Vatican supports Occupy Wall Street

From the Reuters

The Vatican called on Monday for sweeping reforms of the world economy and the creation of a ethical, global authority to regulate financial markets as demonstrations against corporate greed continued to spring up in major cities across the globe.

An 18-page document from the Vatican's Justice and Peace department said the financial downturn had revealed behaviours like "selfishness, collective greed and hoarding of goods on a great scale," adding that world economics needed an "ethic of solidarity" among rich and poor nations.

Urging Wall Street powerbrokers to examine the impact of their decisions on humanity, the Vatican called on those who wanted to change economic structures to "not be afraid to propose new ideas, even if they might destabilise pre-existing balances of power that prevail over the weakest."

The document was released as "Occupy Wall Street" protests this month sparked similar anti-capitalist movements around the world with demonstrators angry over government bailouts of big banks, corporate bonuses, and economic inequality.

Vatican wants the governments to impose “heaven on earth” policies in the delusional belief that governments are essentially ‘immaculate’ and has the power to repeal the law of economics by the use of force. This only shows how Vatican has NO idea of the origins of the evil she decries of, and the complicit role of governments in the current political order.

The Pope needs to know that the Governments has been masterminding the current “collective greed” political arrangements. The Vatican needs to answer who has been conducting bailout policies and most importantly WHY this are being done?

Second, Vatican prefers the use of more violence through the “creation of a ethical, global authority” to discipline or “to regulate” the markets.

It is ironic that the Vatican has been proposing actions which runs contrary to what she preaches.

Just how can love or ‘ethic of solidarity’ be attained through the enforcement of redistributionist policies that have been anchored on violence?

Heaven on Earth.

Monday, October 24, 2011

Numerical Probabilities as Metaphorical Expressions

In an earlier post I argued that assigning numerical probability to what has been a constantly changing environment can be a dangerous undertaking because this either depends on presumptive omniscience or requires heavy reliance on unrealistic assumptions that replaces people’s choice.

I would like to add the allegation where numerical probabilities serve as “framework for communication” does not improve the efficacy of numerical based probabilities because the basis of such communication would be ABSTRACTION.

Professor Ludwig von Mises calls this metaphorical expression(bold emphasis mine)

It is a metaphorical expression. Most of the metaphors used in daily speech imaginatively identify an abstract object with another object that can be apprehended directly by the senses. Yet this is not a necessary feature of metaphorical language, but merely a consequence of the fact that the concrete is as a rule more familiar to us than the abstract. As metaphors aim at an explanation of something which is less well known by comparing it with something better known, they consist for the most part in identifying something abstract with a better-known concrete. The specific mark of our case is that it is an attempt to elucidate a complicated state of affairs by resorting to an analogy borrowed from a branch of higher mathematics, the calculus of probability. As it happens, this mathematical discipline is more popular than the analysis of the epistemological nature of understanding.

There is no use in applying the yardstick of logic to a critique of metaphorical language. Analogies and metaphors are always defective and logically unsatisfactory. It is usual to search for the underlying tertium comparationis. But even this is not permissible with regard to the metaphor we are dealing with. For the comparison is based on a conception which is in itself faulty in the very frame of the calculus of probability, namely the gambler's fallacy.

In short, numerical probabilities serve to gratify one’s cognitive biases which in essence is a form of self-entertainment rather than a dependable methodology for risk analysis.

Higher Education in the Information Age

How higher education may look like in the future

From Mark Weedman (hat tip Professor Arnold Kling)

A school in this Google model derives its identity from its faculty and curriculum, or its “software” while de-emphasizing the importance of its infrastructure, such as its classroom, library and other campus facilities. In other words, it is possible to provide a first-class education in a school without a full range of campus facilities (or maybe even a school without a traditional campus) as long as the curriculum gives students access to the right kind of critical thinking, formation and training. It used to be that to provide a first-class education required institutions to assemble all three components: faculty, library and classrooms. The Google model suggests that it is possible to re-conceive that structure entirely by shifting the focus to curriculum (and the necessary faculty to teach it) and then adapting whatever “hardware” is available to give the curriculum a platform.

The key to this model is the curriculum. There are a number of reasons why traditional higher education institutions have gotten away with fairly generic curricula (i.e., a series of courses taught in classrooms via lectures and discussion), but one of the most important is that the other components offset the inadequacies of curriculum. Stripping away the infrastructure exposes the curriculum and demands that it be effective and have integrity on its own. Stripping away the infrastructure, however, also frees the curriculum to provide new and dynamic ways of learning. If you have a classroom or library, you have to use it. If you do not have a classroom, then entirely new educational opportunities present themselves.

The information age will transform the way we live.

Sunday, October 23, 2011

Promises of Bailouts: How Sustainable will Positive Market Expectations Be?

The following news account[1] from the Bloomberg on Friday’s discernible jump in the US equity markets reasonably encapsulates what has been driving the global markets for a long time—financial markets highly dependent on political actions.

U.S. stocks advanced, giving the Standard & Poor’s 500 Index its longest streak of weekly gains since February, amid speculation of an agreement to contain Europe’s debt crisis and further Federal Reserve stimulus.

How Strong will the Market’s Expectations be?

So let me play the devil’s advocate: what if the market’s deepening expectations of the political resolutions from the above predicaments does not materialize?

These may come in many forms:

-adapted political actions may be inadequate to satisfy the market’s expectations (possibly from divergences in commitments or the inability to ascertain the optimal adjustments required)

-expected political actions don’t take place (possibly due to schisms or continuing disagreements over the measures or dissensions over the enforceability, degree of participations and or divisions over the efficacy of proposed measures)

-the festering crisis unravels faster than the applied political measures (possibly from miscalculations by the political authorities on the scale of the crisis or from unintended effects of their actions)

-sanguine markets expectations for an immediate resolution erode from either procrastination or persistent irresolution or indecisions (possibly from a combination of the above factors—divergences in calculations, variances in tolerable commitments and doubts on enforcement procedures and dissimilar political interests in dealing with the above junctures or more…)

October 1987 Risk Paradigm

I am in the camp that says that current dynamics suggest that the risks of a US are not as material as many mainstream experts have been projecting. Most of their projections have political implications, the desire for more government interventions.

But there could be a marked difference; stock markets may not be reflective of the actual developments in the real economy. In other words, actions in the stock market may depart from the economy.

Has there been an instance where there had been an adverse reaction to the stock markets from unfulfilled expectations from policymakers which had not been reflected on the economy?

Yes, the global stock market crash of October 19, 1987.

From the US Federal Reserve of Boston[2],

While in hindsight the data provide no evidence that interventions in foreign exchange markets were used to signal policy changes, it is possible that, at the time, market participants interpreted interventions as signals of future policy. If so, significant movements in the exchange rate would be expected at the time of interventions. Central banks actively intervened in foreign exchange markets after the Plaza Accord. Evidence suggests that combined interventions to increase the value of the dollar during this period did result in a significant decline in the deutsche mark/dollar exchange rate. As it became apparent that intervention was not signalling monetary policy changes, market participants apparently stopped interpreting intervention as a signal.

In short, market expectations diverged from the results intended from such political actions.

Many tenuous reasons have been imputed on non-recession stock market crash of 1987. However, the major pillar to this infamous event has been the boom policies of the Plaza Accord of 1985[3] which had been meant to depreciate the US dollar against G-7 economies via coordinated foreign exchange interventions, and the subsequent Louvre Accord of 1987[4], which had been aimed at arresting the decline of the US dollar or the reversal of the policies of Plaza Accord.

What had been initially perceived by policymakers as a US dollar problem, emanating from the advent of globalization, technological advances and the gradual transitory recovery of major Western from the recession of the early 80s, which affected the ‘goods’ side of the global economy, and the increasing financial globalization of the US dollar from the hyperinflationary episodes of some emerging markets (e.g. Latin American Debt Crisis[5]) which affected the ‘money’ side of the global economy, essentially transformed into a problem of policy coordination of interest rates[6] that led to an abrupt tightening of previously loose monetary policies which eventually got vented on global stock markets.

The decline of the trade weighted US dollar (apple green) stoked a boom in the US S&P 500 and similarly on the CRB Precious commodity metals sub-index (red) and an increase in inflation expectations as measured by the 10 year yield of US Treasuries (green). The yield relationship difference between stocks and bonds became unsustainable[7] which consequently culminated with the historic one day decline.

True, the dynamics of 1987 has been starkly different than today. We are experiencing a contiguous banking-welfare based crisis today which had been absent then in 1987.

But one striking similarity is how market expectations, which have been built on political actions, had completely diverged from what had been expected of the directions of policymaking.

Nevertheless the recent temblors experienced by the global financial markets following US Federal Reserve Chair Ben Bernanke’s no ‘QE’ stimulus[8] during last September 21st resonates on a ‘1987 moment’ but at a much modest scale.

This is NOT to say that another 1987 moment is imminent. Rather, this is to say that the sensitiveness to such market risks increases as political actions meant to resolve on the current issues remain ambiguous or will remain in an indeterminate state.

And this is to further emphasize that while a grand “aggressive” “comprehensive” strategy may forestall any major market convulsion for the moment, they are likely to be temporary measures targeted at buying time for the policymakers from which another crisis would likely unravel in the fullness of time.

For now, it would be best to watch closely on how policymakers will react.

I believe that a monumental buying opportunity may arise soon.

[1] Bloomberg.com S&P 500 Caps Longest Weekly Gain Since Feb., October 12, 2011

[2] Klein Michael Rosengen Eric Foreign Exchange Intervention as a Signal of Monetary Policy US Federal Bank of Boston, June 1991

[3] Wikipedia.org Plaza Accord

[4] Wikipedia.org Louvre Accord

[5] Mises Wiki Latin American debt crisis

[6]Ryunoshin Kamikawa The Bubble Economy and the Bank of Japan Osaka University Law Review, 2006 In the U.S., on the other hand, the new FRB Chairman Alan Greenspan raised interest rates in September. However, the dollar depreciated. Then, the U.S. government requested Japan and West Germany to reduce interest rates. Both countries declined and the Bundesbank performed an operation for increasing in the short-term interest rates in the market. Secretary Baker resented this and stated that the U.S. tolerated a weaker dollar on October 16. Investors recognized that this statement meant the failure of international policy coordination and they moved their financial assets out of the U.S. for fear of collapse of the dollar. This caused the heavy fall in the New York Stock Exchange on October 19 (Black Monday). The depreciation of the dollar continued after that and inflated asset prices and bond prices collapsed in the U.S. Then, Secretary Baker persuaded West Germany to lower the short-term interest rates)

[7] Mises Wiki Black Monday (1987)

[8] See Bernanke Jilts Markets on Steroids, Suffers Violent Withdrawal Symptoms September 22, 2011

Can China’s Slowdown Trigger a 1987 moment?

A very important feature that distinguishes the epic 1987 crash from modern equity market meltdowns has been that the cataclysmic ‘1987 moment’ originated overseas than from the US, as the Wikipedia.org describes[1],

The crash began in Hong Kong and spread west to Europe, hitting the United States after other markets had already declined by a significant margin. The Dow Jones Industrial Average (DJIA) dropped by 508 points to 1738.74 (22.61%).

Ignoring China’s Woes

Much of the concentration of the public’s attention has been in the developments of Europe or the US functioning as the major drivers of the price actions of global equity markets.

Again, most have been ignoring the developments in China.

This week, China’s Shanghai index expunged all gains previously acquired from the declared rescue efforts by the Chinese government’s sovereign wealth fund, Central Huijin to buy shares of major Chinese banks to demonstrate support for her banking and financial sector as well as the stock market, aside from the recently announced bailout measures which extended liberal financing to small scale enterprises following deepening signs of economic weakness[2]

The Shanghai index broke down from her immediate support. Importantly, momentum suggests that a meaningful test or even a possible encroachment of the 15-month critical support levels could happen anytime soon.

Again whether the current conditions signify as plain vanilla economic slowdown or have been symptomatic of a bubble bursting phase of China’s puffed up real estate sector, current events ostensibly exhibits a liquidity contraction process at work as consequences to earlier policies to contain inflation via increases in interest rate and reserve requirement channels and through the appreciation of her currency, the yuan.

China’s policies have shown little difference from the policies of the West, Keynesian attempts to perpetuate quasi-booms that are eventually met with busts.

And as previously mentioned, since China has been a major consumer of commodities, a liquidity contraction will likely extrapolate to price declines over a broad spectrum of commodities. At worst, a bursting bubble could mean a price collapse.

Thus far, the commodity sphere appears to be confirming the China liquidity contraction theme as commodities have shown sharp declines almost in conjunction with recent selloffs in the Shanghai Index.

Industrial metals (GYX), Precious Metals (GPX), Energy (DJAEN) and Agriculture (GKX) have all stumbled markedly and have mostly been drifting in bear market territories except for the Precious metals.

Can China Withstand the Financial Storm Unfazed?

For many there has been much optimism over China’s ability to conduct a successful bailout of the affected segments of her economy. Some say that China has been equipped with ‘financial tools’ and or the wherewithal to arrest the current decline.

While it may be true that China’s government has a lot of savings, estimated at 8% of the GDP, and similarly holds sizeable deposits, where government savings has been estimated at 8% of the GDP[3], it is not clear if these deposits have remained in the banking system or had been lent out as various forms of loans that could have been exposed as off-balance sheet liabilities that has propped up the property bubble.

Also, my skepticism applies to the alleged large pool of state owned assets estimated at 15 times GDP that could serve as cushion to any ‘systemic meltdown’[4].

In short, I am doubtful of these statistical premised presumptions. Further, I am a cynic to the credibility and reliability of the actual metrics used to calculate accurately the existence of these assets.

And speaking of credibility, China’s accounting system has remained partly abstruse, whose transparency should be reckoned as questionable. China has yet to fully adapt and integrate to the world’s standard of generally accepted accounting principles or International Accounting Standards[5]. Up to February of 2010 China’s accounting standards has still been under Chinese standards.

Moreover, much of China’s foreign exchange surpluses have been representative of monetary or credit expansion and thus vulnerable to any credit contraction-hot money outflows from a bursting of her property bubble.

Foreign reserve surpluses are equally vulnerable as Austrian economist Dr. Anthony P. Mueller explains[6],

The expansion of debt by the issuer of the international reserve medium augments the stock of international reserves and the increase of the reserves works like a growth of the global money supply. Central bank balance sheets show that the circulating domestic money forms a debit item, while foreign reserves are part of the credit side. All other things being equal, an increase in foreign reserves implies money creation. This way, foreign debt accumulation by the issuer of a global reserve currency impacts monetary demand through two channels: in the debtor country by the domestic spending of foreign savings, and in the creditor country by the accumulation of foreign exchange reserves which augment the money supply….

And the engagement of further bailouts would only shift the burden to government which would accumulate more debts that ultimately becomes unsustainable

Again Dr. Mueller,

Governmental debt accumulation and monetary expansions tend to go the extremes until they will collapse. While it has taken many years for the capital structures of the economies involved to adapt to these conditions, the catastrophic event of the debt collapse will abruptly confront the capital structure with a new and very different setting. International capital flows driven by government possess the same general features like a debt cycle caused by monetary expansion that is not funded by savings.

For as long as China’s government will persists on with various interventionist policies, bailouts, bubbles, and an expansion of the welfare system, this should lead to capital consumption activities which would undermine whatever supposed advantages accrued from the foreign reserves.

The lingering debt crisis in the Eurozone has only increased the indebtedness of the region, which according to reports has boosted the region’s debt average to 85.4 percent of gross domestic product from 79.8 percent in 2009[7]. The continuing growth of debt has been corollary to the increase of ‘budget deficits’ and of ‘bank-recapitalization costs’.

The attendant strains from the transference of scarce resources from productive sectors to unproductive or politically privileged sectors as banks eventually weighs on the creditworthiness standings of foreign reserve surplus nations such as Germany and France as shown in the above chart by Danske Bank[8].

In addition, I am dubious of any implied sophistication of China’s central banking, whose supposed financial tools like any conventional modern central banks have been merely about printing of money. Transferring liabilities from one pocket and to another only to be camouflaged by fiat money from the PBOC will eventually will get exposed when the proverbial tide subsides.

Inflation is a policy that will not last.

Questioning China’s Crisis Management Experience

Furthermore, China’s experience with handling a major banking crisis should be viewed with skepticism. The last time China had a major banking crisis was in the late 90s where China rescued her major state owned banks that had been complimented by recapitalizations through the Hong Kong Stock Exchange[9].

Also China has only had a major recession over the past two decade. The last recession seem to have coincided with the banking crisis in 1998-99, where real growth fell to 5% while reported growth dipped only slightly below 8% according to the Economist[10].

The point that needs to be stressed here is that given the dramatic changes in the scale, the scope and the complexity of the global economy which includes China’s economy which has in the recent years catapulted to the 2nd largest in the world[11], I would have sincere doubts about her ability to conduct an orderly rescue outside the scope of massive reflating the system.

By the same token, it would signify as reckless assumptions to believe that the developed world will be insulated from the risks of a further deterioration of China’s economy.

If the world has supposedly been lifted out of the recession in 2009, led mainly by China and India with the help of the rest of Asia[12], where the region’s share of the economic pie has been rapidly expanding, then we would likely have a reverse contagion effect where a slowdown in China and Asia will exacerbate on the protracted economic pressures being endured by the fragile economies of the crisis affected Western nations.

The degree of contamination will most likely depend on the strength of the internal dynamics of the respective local economies. Thus, it remains to be seen if the massive growth in money supply in the US can offset the liquidity contraction being experienced by China.

China’s Crisis will likely Impact ASEAN Bourses

It would equally be foolish to presume that the ASEAN 4, whom has been outperforming the world in terms of equity markets, would remain unsullied by a China liquidity contraction.

The transmission mechanism from a China crisis postulates that the rapid growth of ASEAN exports to China which has been driven mainly by commodities, information technology and regional supply chain integration[13] would be confronted with tremendous pressures that would have real untoward economic effects.

And despite my bullish bias it would be hard to argue against empirical evidence.

Although the ASEAN majors have not yet violated the 20% threshold level or the technical demarcation for a bear market, chart patterns appear to corroborate such anxious global market sentiments where Indonesia (IDDOW), Malaysia (MYDOW) and Thailand (SETI) bellwethers have transitioned into a bearish ‘death cross’.

People’s actions shape chart trends, this only implies that current market climate has been imbued with too much uncertainty whose present state seems opaquely identifiable. In other words, I am uncertain if we are in a consolidation phase or in a transition to bear market or a pause from a bull market.

Thus, the global equity markets, inclusive of the ASEAN bourses, appear to be much in limbo.

Conclusion

Market signals today appear to be reflective of the rampant uncertainties brought about by the amorphous political environment which has held global financial markets hostage.

Again, the state of extreme fluidity of the events implies that anything may happen in the transition. Equity markets will likely remain sharply volatile in both directions.

And this will remain so until we see major ‘concrete’ actions from global policymakers, including the political stewards of China, the Eurozone, and importantly, from the US Federal Reserve Chief Ben Bernanke, who bizarrely keeps incessantly dangling on variations of his preferred policy action—quantitative easing[14].

The October 1987 crash signified a low probability high impact event or a Black Swan where such event transpired unanticipated by the mainstream.

Such an event risk may seem partly applicable today and could be magnified if the current impasse in policymaking or the stalemate in the political domain remains in place.

On the other hand, for the global financial market greatly dependent on government steroids, concrete or specific actions by policymakers will likely turn the tide that would recalibrate the bubble cycle.

[1] Wikipedia.org Black Monday (1987)

[2] See More Evidence of China’s Unraveling Bubble?, October 16, 2011

[3] US Global Investors Investor Alert - Do Bullish Investors Have an Ace in the Hole?, October 21, 2011

[4] Huang YiPing, Is China's Economy Headed for Trouble? October 12, 2011, Wall Street Journal

[5] Wikipedia.org Chinese accounting standards

[6] Mueller Antony P. Do Current Account Deficits Matter? Mises.org Journals

[7] Bloomberg.com Euro-Area Debt Reaches Record 85.4% of GDP as Turmoil Deepens, October 21, 2011

[8] Danske Bank Preview EU summit: The moment of truth, Strategy October 20, 2011

[9] Xie Andy Here We Go Again, September 10, 2009 China International Business

[10] The Economist, Reflating the dragon, November 13, 2008

[11] The Telegraph China is the world's second largest economy, February 14, 2011

[12] Singh Anoop, Asia Leading the Way IMF Finance and Development June 2010

[13] IMF.org Navigating an Uncertain Global Environment While Building Inclusive Growth, Regional Economic Outlook, October 2011

[14] See Bernanke’s Doctrine: Fed Mulls Purchases of Mortgage Backed Securities, October 22, 2011