Phisix 6,000!!! That seems to be the resounding cry which had been embraced by the audience as the year-end target, during the recent assembly that I attended. Well, if realized, that’s tantamount to another mammoth 6% gains from Friday’s record close.

Given the current momentum and environment, it seems foolhardy to dispute such exceedingly high confidence levels. Nonetheless “strong convictions”, especially coming from the highly vulnerable crowd-following retail participants, for me, is something to be concerned about.

This represents a radical change of sentiment. During the same occasion last year, the crowd’s disposition was largely ambivalent. A mainstream analyst showcased the Greece crisis as a major hurdle to the Phisix. It was held that Phisix 5,000 won’t be breached for as long as Greece crisis persisted. Of course I challenged that point of view[1] The rest is history.

Many factors have been rationalized for Phisix 6,000 and beyond for 2013; among them, strong economic growth, election spending, strong corporate earnings, reforms by the PSE to become Sharia compliant or open to Muslim investors, potential credit upgrades, bulging interests from residents, potential capital flows from foreign investors due to the above and etc…

As side note, any improvements on the capital markets are welcome.

The Philippine Stock Exchange [PSE: PSE] should not only consider becoming Sharia law compliant, it should immediately participate in the ASEAN’s thrust to cross list equities.

Crosslistings would allow for greater coverage of the region’s financial markets and more efficient use of capital. Local companies would have wider access to the region’s capital. Similarly, this would provide local investors expanded avenues to allocate capital and to optimize profit opportunities. Financial markets will naturally integrate if given the opportunity to trade freely. Not only that, there will be multiplier effects to the real economy as regional investors become acquainted with one another through free trade. National boundaries will become less of a concern. This is the essence of globalization

The wave of cross-listings has become global; the Malaysian and Singaporean link has already gone online last September[2]. Thailand connected with them last October 15th.[3] In Latin America, the connection of three equity markets of Columbia, Chile and Peru has been in operation since May.

I have argued for a Phisix 10,000 even before I began blogging, but for much different reasons: particularly the business or the bubble cycle[4] and from globalization.

Yet it is important to realize that no trend goes in a straight line.

There are 8 crucial features of the bubble psychology as identified by billionaire but crony George Soros[5]. These are the unrecognized trend, beginning of a self-reinforcing process, successful test, the growing conviction, widening divergences between reality and expectations, the flaw in perceptions, the climax, and the self-reinforcing process in the opposite direction.

Let us see if this has been applicable to the current environment.

Falsifying the Correlations of GDP Growth and Phisix Returns

How strong and feasible has been the so-called causal nexus between the Phisix-Peso and the annual GDP growth?

The above chart hardly provides any substantial evidence to validate on mainstream’s wisdom.

For instance, during the US mortgage crisis which pinnacled with the Lehman bankruptcy, the Phisix more than halved (from peak to trough) in 2007-2008 or based on 2008 returns nearly halved (-48.29%). Such losses has been deeper or at par with the losses endured by her crisis stricken developed economy counterparts. But, ironically the Philippine economy was spared from a recession.

In addition, earnings of publicly listed corporations, which did fall from record highs, remained exceptionally robust in 2008 as I previously pointed out[6].

Philippine stock market essentially priced in a recessionary environment even when the real economy didn’t.

So what justified the price collapse of the Phisix, the general stock market and the Peso then? Essentially little from the real economy, except for the contagion effect from a global liquidity crunch: the chain linkages of the liquidation process from the financial industry which spread to the local domestic financial markets. Yet this was not simply an issue of confidence, the selloff was broad market based. Even the region’s 5- year Credit Default Swaps which embodied the credit risks, spiked[7] or investors then factored in a higher risks of default of Asian sovereigns.

Another example, the annual growth of GDP also registered a sharp decline in 2010-2011. This has likely been in reaction to the sharp rebound from the 2008 crisis (more on this later).

Yet if the pattern of 2007-2008 has been replicated, then we’d be seeing negative returns. But the Phisix (as well as the Peso) continued to advance—see left window.

Although the returns of the Phisix did somewhat reflect on the annual GDP in slowing down, this does not tell the entire story. The general market hardly experienced a slowdown; instead internal rotation or a shifting occurred. The slowing Phisix induced a redirection of money flows or that market’s attention moved to the mining sector—see right window.

Today, this rotational process seems in place, but in the opposite direction: surging Phisix and mining in red ink.

Economic Drivers: The Myth of Government Spending and Election Spending

Recently media has raved optimistic about recent strength in statistical growth. Unfortunately the public through the mainstream media only regurgitates “hook line and sinker” the announcements by political agencies without having to dwell or investigate deeper into the details or the economic composition of the recent statistical growth.

News says that this “surprising” growth has been about domestic consumption and government spending. Officials even contrived “Aquinomics” to such supposed feat.

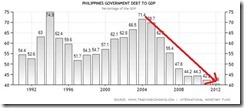

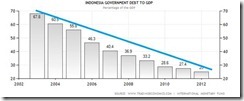

None has been said, as I explained earlier[8], about the past administration’s intense austerity measures of slashing of government debt to GDP by 27 percentage points in 2004-2010, relative to the current administration whom has only pruned 4 percentages points since assuming office. This means that the actions of the past administration have basically paved way for this administration to engage in “record” infrastructure spending.

In politics, credit grabbing is the norm which why I am anti-politics.

Also, government or infrastructure spending do not guarantee productivity increases. Government spending is consumption even when applied to public works—they are not engineered to produce revenues or profits.

Yet such projects will have to be financed through the acquisition of more debt, higher taxes or higher consumer prices.

It’s no wonder the current administration has been desperately targeting big industries who gets academic support from foreign institutions[9] to justify the raising of taxes e.g. SIN tax, SMS tax, Mining excise tax[10] and etc…

This government has been trying to squeeze the proverbial goose that lays the golden egg in the name of anti-corruption or good governance.

Café Hayek’s Professor Don Boudreaux aptly describes the empty histrionics behind stereotyped politics[11]

Applause today, as loud as possible: that's pretty much all that matters to the thespians we call "government officials."

Higher taxes also means a crowding effect which implies productive output will be substituted, by rechanneling resources, to politically directed consumption activities which will lead to shortages of capital goods.

As the great Ludwig von Mises explained[12]

The fundamental error of the interventionists consists in the fact that they ignore the shortage of capital goods. In their eyes the depression is merely caused by a mysterious lack of the people's propensity both to consume and to invest. While the only real problem is to produce more and to consume less in order to increase the stock of capital goods available, the interventionists want to increase both consumption and investment. They want the government to embark upon projects which are unprofitable precisely because the factors of production needed for their execution must be withdrawn from other lines of employment in which they would fulfill wants the satisfaction of which the consumers consider more urgent. They do not realize that such public works must considerably intensify the real evil, the shortage of capital goods.

In short, all these political projects will translate to suppressed real economic growth overtime.

Public works, while nice to hear, mistakenly assumes the government’s superior knowledge in the allocation of resources. Such programs presume that political authorities know what exactly society needs; when in reality, pet projects are politically directed (e.g. oriented towards delivering votes or higher approval ratings or reward cronies, friends or etc…).

Banking consultant Patrick Barron expounds[13],

The common man may not know the term "tragedy of the commons", but he knows it when he sees it. As the scramble for public resources ensues, however, another economic phenomenon kicks in: the fallacy of composition, which states that what benefits one segment of the economy at the expense of everything else cannot possibly prove beneficial for the economy as a whole. Put simply, we cannot all subsidize each other and come out ahead. While most want to be subsidized by others without having to pay anything in return, special interests from all sides ensure that the looting becomes universal.

People hardly learn from experience. These are some examples:

In the US public stadiums[14] have been blotted by red ink. In Japan the $800 billion spending stimulus program in 1992-1998[15] has failed to lift Japan’s economy from two decades of stagnation, as well as contributing to record unsustainable debt levels. Airports, legacy of such public spending programs continues, to bleed taxpayers dry[16].

In China, the huge $586 billion stimulus program in 2008[17] which has been deployed as shield to the global financial meltdown has led to numerous collapsing bridges, money losing railways, empty cities, corruption charges and more[18]. To add, state public works has played a significant part in the ballooning of China’s shadow banking system[19].

Incidentally, Japan’s government has announced last week a second stimulus package worth ($10.7 billion) in less than one month[20].

Over two decades of the same set of interventionist approaches, particularly a bunch of QEs coupled with a series fiscal stimulus, reveals of the increasingly desperate political leadership. This will only advance Japan’s path towards a full blown debt crisis which is likely sooner than later.

And from political distribution of economic projects, there will always be the issue of cost overruns, quality of work and ethical problems as cronyism, favoritism, corruption and etc…

In the same plane, the idea that election spending will drive the Phisix higher seems highly unfounded.

The ellipses in the above charts reveals of the first quarter trends on each of the national elections held since 1995[21] (blue congressional, red-presidential). I am assuming that election spending at the start of the year will have an influence on stock prices going into the Election Day in May.

Yet as the chart shows, there has been no consistency in the direction of trends in the interim, as well as, in the annual returns.

Much of the 1st quarter gains seem to have been acquired or carried over through momentum from yearend rallies. Others sputtered at the start of the year.

On the other hand, annual returns exhibited the flow of the general trend; where as a rule—returns have been positive during bullmarkets and negative during bear markets.

So stock markets actions supposedly influenced by elections, whether bullish via “election spending” or bearish via “election failures”[22], appear as popular myths.

Populist notions of the sustainability of the statistical economic growth, the alleged positive effects of election spending and the charade of good governance, in Mr. Soros’ classification of bubble psychology seems like a deepening of the “widening divergences between reality and expectations” phase.

Consumption Financed by Debt Policies are Unsustainable Bubble Policies

Current economic growth has also been attributed to a surge in capital intensive growth industries such as construction and real estate, which has been pumped by a surge in credit take up. The “property boom” has, so far, managed to neutralize the decline of exports.

But there has been nary a discussion about specific policies undertaken to induce domestic consumption. Let me point this out: negative real rates

Unknown to most, behind the scenes, the one of the biggest force influencing the Philippine financial markets has been domestic (real) interest rates. This is aside from external overseas monetary policies and financial globalization.

One would note of the nominal interest rate increase in 2008 basically manifested on the global contagion phenomenon, which coincided with the collapse of the Phisix.

The aftermath of the crisis, which prompted for an orchestrated global easing by global central banks had been similarly implemented by domestic officials. This has led to a sharp decline in nominal interest rates, which impelled for a magnificent broad market rebound in the Phisix in 2009.

The spillover of the easing policies through unchanged rates in 2010, apparently carried over substantial gains of the Phisix but at a much lower rate.

In 2011, the diminishing “economic growth” and subdued returns of the Phisix has corresponded with the marginal tightening or higher interest rates stance by the domestic central bank the Bangko Sentral ng Pilipinas (BSP). Again during this period it was mining sector that took leadership.

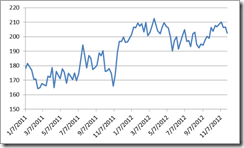

Yet the short-term tightening has been reversed in 2012. The BSP has undertaken the most aggressive easing policy in East Asia, cutting 3 times this year by about .8% as shown in the chart from Asian Bonds Online[23].

Along with Thailand, who also cut rates this year but at a lesser degree, the Phisix and the Thailand’s SET has been running head-to-head for the region’s leadership.

I might add that the impressive surge in Hong Kong’s Hang Seng index has essentially imported the zero bound interest regime the US, given Hong Kong’s currency peg. The speculative fervor in Hong Kong has even inflated a “parking lot” bubble[24].

Negative real rates have been a key pillar behind the shift in the public’s risk appetite.

People hardly realize that social policies are never neutral, as they shape incentives.

The public has been sublimely directed to assume greater risks. This has led to a surge in Ponzi activities[25], the “property boom” or property bubble (which I have been predicting[26]), greater local interests on the equity markets, aggressive speculations in the local stock market—for instance, the average issues traded daily has reached the highest level for the second time this year—this implies that formerly illiquid issues has become liquid out of the public’s desire for yield hunting), the record stock market highs, the near record high on the Peso and all sorts of illusory rationalizations to an inflationary booming market.

I may add that credit rating upgrades by international credit rating agencies will further whet on the appetite of domestic political authorities to wantonly engage in more public spending[27] that may indeed help propel an artificial boom but at the bigger cost to the society in the future through an economic bust, higher taxes and higher costs of living.

In finality, this administration’s policy has been geared towards the Keynesian path of ramping up of consumption activities from both the private sector (via asset bubbles, and credit driven malinvestments) and the public sector (public works) all to be financed by debt and higher taxes, which is unsustainable. This has been same recipe or the common denominator for the lingering crisis enveloping afflicted developed economies.

Real reforms require improving business environment, easing regulatory hurdles and promoting entrepreneurship or economic freedom. Apparently this has been set aside for posturing.

The winning streak of the Philippine assets will ultimately depend on the direction of interest rates. Local policy of zero bound rates which have been adapted from the US Federal Reserve has been the main engine in influencing domestic economic agents in helping drive this artificially driven boom. Current policies may be reversed when interest rates climb to reflect on greater demand for credit (insufficiency of resources) or as symptoms of accelerating price inflation or deterioration of credit quality or from another contagion episode from exogenous forces.

Again central banking activism and market’s response to them will determine the course of action of the financial markets.

Here, George Soros seems right, people are easily seduced to superficialities and to short term rewards to docilely eliminate thinking for their own interests. Instead seek comfort in the crowds.

Crowd psychology or social conformity can be our innate Achilles Heels, Mark Twain as previously quoted on this blog[28]

Our table manners, and company manners, and street manners change from time to time, but the changes are not reasoned out; we merely notice and conform. We are creatures of outside influences; as a rule we do not think, we only imitate…

Morals, religions, politics, get their following from surrounding influences and atmospheres, almost entirely; not from study, not from thinking. A man must and will have his own approval first of all, in each and every moment and circumstance of his life – even if he must repent of a self-approved act the moment after its commission, in order to get his self-approval again: but, speaking in general terms, a man's self-approval in the large concerns of life has its source in the approval of the peoples about him, and not in a searching personal examination of the matter.

Again, immensely Pollyannaish outlook which seems out of touch with reality, the escalation of aggressive speculations, rationalizations based on credit induced euphoria are symptoms of bubbles in progress.

More of Bernanke’s Hand on the US Fiscal Cliff

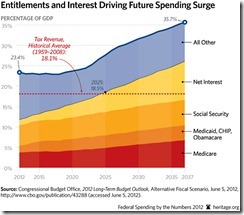

As for the likely effect of the coming the US fiscal cliff on stock markets, deal or no deal, is that the mandatory or entitlement spending and interest rates segments will remain untouched and will continue to balloon.

What will likely be affected will be the discretionary spending segment[29], i.e. military (defense) and non-military budgets as veterans' assistance, the Congress, the White House, the Supreme Court, national parks, law enforcement, education, research and development, and investments in physical infrastructure.

Although I think a deal may be reached at the last hour, as Republicans who seem to be representatives of the military industrial complex will likely seek to curb spending cuts for the industry and may accede to “tax hikes”.

Yet even if the Republicans agree to raise tax rates, historical tax revenues as % of GDP, despite high tax rates in the past, has only averaged 18%, as shown in the chart above from the conservative Heritage Foundation[30].

This means that people are likely to engage in greater tax avoidance measures. In UK newly increased high tax rates have jolted the wealthy, where two thirds of their millionaires vanished[31]!! This will likely be the case for the US too.

Nevertheless because it would seem taboo to touch entitlements, which would translate to suicide for a political career, efforts for structural reforms will be avoided and budget deficits will remain at a trillion dollars a year.

And this means that the US Federal Reserve, which has already bought over $1.6 trillion of US treasuries[32], will stand as contingent to other buyers (residents and non-residents) to US Treasuries, to avert a default.

This means the greater likelihood of expanding the unlimited QE programs through the conversion or the incorporation of the expiring Operation Twist into additional purchases of US treasuries or mortgages via QE 4.0[33]

Some officials have already been amplifying their policy communications or signaling.

With more Fed easing in the pipeline, this likely implies for higher gold prices, and higher equity prices over the interim.

Thus, the recent drop of gold prices does not seem to be consistent with the overall actions of the broader spectrum of commodities and actions of global equity markets.

Industrial metals have shown a vigorous recovery (GYX), oil has exhibited some signs of improvements (WTIC) while agricultural commodities remain in consolidation (GKX).

Soaring Indian and Thai markets have eclipsed gains of the marginal gains of the US, Japan, Germany, France and the Phisix.

Since price movements of gold seems aligned with global stocks which have accounted for a risk ON or risk OFF environment, a confirmation of the Fed’s expansion of the QE most likely during the FOMC’s meeting in December 11-12 will likely push gold and global stock markets higher.

So this also means that both external and domestic policies will likely serve as tailwinds in support of a higher Phisix perhaps at least until the first quarter of 2013. Of course this is conditional to the above. Emergence of unforeseen forces, most likely from the dimensions of political risks may undermine this scenario.

Nevertheless volatility in both directions should be expected but with an upside bias.

However, given the steep ascent and overbought conditions by the Phisix, expect temporary corrections and possibly rotational activities.