The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Sunday, October 19, 2014

Saturday, October 18, 2014

Eric Margolis: US Supplied Iraq’s Saddam with Chemical and Biological Weapons

Writing at the LewRockwell.com historian Eric Margolis claims that the US has been responsible for supplying chemical and biological weapons to their once favored tyrant ally, Saddam Hussein (bold mine, italics original)

While covering Iraq in 1990 – just before the first massive US bombing campaign – I discovered the US and Britain had secretly built a germ weapons arsenal for Iraq to use against Iran in the eight year-Iran-Iraq War.This while both the US and Britain were fulminating with breathtaking hypocrisy against the alleged dangers of Iraq’s supposed WMD’s (weapons of mass destruction) that never existed. Some years later, the two leading apostles of attacking Iraq, George W. Bush and Tony Blair, delivered Philippics against Saddam Hussein’s weapons programs while never mentioning that high level of western support for Iraq’s late leader.Last week the widely read “New York Times” ran a multi-page exposé entitled “Abandoned Chemical Weapons and Secret Casualties in Iraq.”The NY Times played a key role in driving the US into two wars against Iraq. America’s leading newspaper is finally facing part of the ugly truth over Iraq’s non-existent weapons of mass destruction, the pretext used by the US to bomb, then invade Iraq. Perhaps it’s trying to atone, or clear its besmirched name.Iraq had no nuclear weapons, as the US falsely claimed. But it did have an arsenal of chemical and biological weapons – delivered by the western powers. All were battlefield arms, not strategic, weapons. None could be delivered more than 100 kms.According to the “New York Times,” after the second war against Iraq in 2003, 17 US servicemen and seven Iraqis were injured by mustard and nerve gas after they dug up buried caches of Iraq’s 1980’s chemical weapons. Shamefully, their plight was kept secret by the Pentagon; the soldiers were refused adequate medical care in order to cover up this sordid story.But what I uncovered in Baghdad was far worse.I found two British scientists who had been employed at Iraq’s top secret Salman Pak chemical and biowarfare laboratory near Baghdad. The Brits confided to me they were part of a large technical team secretly organized and “seconded” to Iraq in the mid-1980’s by the British government and the MI6 Secret Intelligence Service. Their goal was to develop and “weaponize” anthrax, plague, botulism and other pathogens for use as tactical germ weapons.The US and Saudi Arabia feared Iran’s Islamic revolution would sweep the Mideast and overthrow its oil monarchs. So Washington and its Arab allies convinced Iraq’s president, Saddam Hussein, to invade Iran and overthrow its new government. Arms and money flowed to Iraq from the US, Britain, Kuwait and the Saudis.After three years of WWI-style warfare, Iraq found its outnumbered troops could not stop Iranian human-wave attacks. Iran was slowly winning its bloody war against Iraq.So the US and Britain supplied Saddam Hussein with chemical and biological weapons to break the waves of attacking Iranians. Chemical warfare manufacturing equipment – disguised as insecticide plants – came from Germany, France and Holland. The feed stock for the germ weapons came from a US laboratory in Maryland –approved by the US government.Over 500,000 soldiers and civilians died in the eight-year Iran-Iraq conflict. To this day, Iran blames the US and the Saudis for instigating the war and causing some 250,000 Iranian casualties.By contrast, in the Anglo-American view, chemical and biological weapons were fine – so long as used to kill Muslim Iranians. Used against westerners, they would be denounced as “terrorism.” In 2013, US President Barack Obama threatened Syria with war over unfounded claims that Damascus planned to use chemical weapons on US-backed insurgents.

Read the rest here

The consequence of the past has been relevant to current events. Mr. Margolis concludes:

the current horrible mess in Iraq and Syria is a direct result of the US-led invasion of Iraq in 2003. ISIS is a manufactured monster that could have crawled out of the germ warfare plant at Salman Pak.

Start of the Breakdown? Signs of Decaying Asian Stock Markets

I know, the US and European markets staged a monster rally Friday, to (partly or totally) offset the collapse or heavy losses acquired during the week. Yesterday’s performance varies with peripheral nations mostly being unable to recover most of the weekly losses.

Such massive short covering represents a Pavlovian response that has been instigated by hints of S-T-I-M-U-L-U-S by St. Louis Federal Reserve James Bullard along with ECB’s Benoit Coeure in the wake of the current stock market meltdown.

In the US, note of the interesting evolving divergence between the small caps and the broad market. Such divergence has been a three day affair where small caps rallied as broadbased markets wilted. Friday, the Russell 2000 sold off modestly in the face of a largely broad market melt UP.

Heightened volatility has been the order of the season.

We have seen a similar sharp upside move last October 8th as US markets celebrated the Fed’s minutes suggesting the extension of low interest rates regime and a talk down the US dollar. This party turned out to be a one day event as all the gains had been entirely neutralized the following day. So current developments will highlight continued steep volatility in both directions with a possible downside bias. Will the oversold bounce gain momentum? Or will it fade? Will the October 8-9 episode repeat?

Friday’s oversold rally will most likely diffuse to Asia on Monday at least in the early showing. But again its sustainability will remain an open question.

Regardless of this, well, it has less publicly recognized that the current stock market volatility has smacked Asia as well.

After popping above the December 2013 highs last September, the Japan's Nikkei 255 has followed the sharp volatility of the equity bellwethers of her developed economy contemporaries.

And as of Friday, the Nikkei has been down 11.1% and seem on path to approach on the psychological threshold of 14,000.

Notice too that the Nikkei has failed to materially breach the previous highs which makes for a seeming bearish double top formation.

Meanwhile in the Pacific, Australia’s All Ordinaries index has fallen markedly from her record highs.

From the peak, the Aussie benchmark has lost 8.9% but has rallied substantially this week to close the gap to only 7%.

During the June 2013 Taper Tantrum, the AORD retrenched by 10.6% before recovering.

Back to East Asia. Taiwan’s equity benchmark (upper window) has been reeling off the recent highs. The TWII has been down 10.5% which incidentally has signified larger losses than the June 2013 Taper at 8.8%.

Meanwhile Hong Kong’s Hang Seng Index (lower window) has given back 9.3% of her earlier gains, but this week’s partial rally which recovered some of her losses has closed the gap marginally to only 9%.

In early 2013, the Hang Seng approached the bear market nexus with a loss of 16.3%, much of this has been from the Taper Tantrum

South Korea’s KOSPI (upper window) has also been under pressure. Following the August highs, the KOSPI has retreated to yield a negative 8.7% as of Friday’s close.

During January to July 2013 which included the taper tantrum, the Kospi lost 12.19% before regaining lost ground.

Singapore’s STI (lower pane) has likewise been weakening. The STI has fumbled 5.54% from July 2014 highs.

The 2013 Taper Tantrum hit the STI pretty hard. The initial impact was a loss of 11% followed by an additional 3.3% for a total loss of 14.3% through February 2014.

The recent rally in the STI has failed to reach June 2013 highs, but once again we seem to be seeing signs of a meaningful downdraft in motion for the STI.

In the lens of the ASEAN majors.

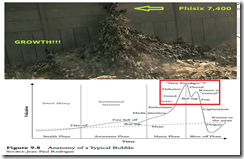

The charts of Thailand’s SETI (upper window) and the Philippine Phisix (lower pane) seem like identical twins or appear almost interchangeable. The difference has been that the Phisix has recently surpassed the milestone 7,400 highs as against the SETI which has yet to make such an attempt. Nonetheless both have been down 4.5% and 4.7% respectively

Charts above are from stockcharts.com

Finally, Malaysia’s KLSE (top pane) has also been exhibiting signs of infirmity as the benchmark has been down 4.8% from record highs.

In one of the rare instance, the Bursa Malaysia has essentially been unscathed by the June 2013 taper tantrum. But not today, where the KLSE seem to have inflected earlier than her peers.

In the meantime, Indonesia’s JCI (bottom pane) has been ASEAN’s best strong performer over the week up by 1.3% which partly has reduced the recent losses.

The JCI recently bested its own June 2013 highs last month (September 2014) by a small margin but nonetheless failed to hold on to the hallowed ground.

Nonetheless the JCI remains 4.1% off the recent landmark highs.

The JCI, like the Nikkei and the Phisix has made recent attempts to exceed their recent highs only to fallback.

More important feedbacks from these developments.

In June 2013, benchmarks of ASEAN or emerging Asia mostly reacted violently to the prospects of the Taper. Most of developed nations were relatively lesser affected.

Today, as the Fed's Taper has become a reality, Developed Asia has apparently borne the brunt of the selling pressures relative to emerging Asia. Apparently, this has been due to the stronger US dollar which has affected the relatively more export dependent nations. The cascade in the JP Morgan Bloomberg Asia-US dollar index (ADXY) seem to reflect on such dynamic.

Also the degree of response differs.

In June 2013, Developed Asia’s drastic response has equally been met by dramatic recoveries. For emerging Asia, the recovery has been gradual and only picked up speed during the second quarter of 2014.

So a divergence developed, emerging Asia’s belated ferocious rally came in the face where developed Asia began to reveal signs of stock market strains as the US dollar gained momentum against the region's currencies.

Developed Asia’s weakness has been reinforced by the US. Since the US has been de facto leader of the world, in terms of central bank sponsored debt financed asset inflation, the recent tremors in her booming overextended and overvalued stock markets has spread to cover most of the major world equity benchmarks. Such strains seems to have diffused to Asia’s high flyers which aside from ASEAN, includes the New Zealand (NZ50), India (SENSEX) and even Vietnam (Ho Chi Minh).

So divergences seem as transitioning into convergence.

As one would note, initial pressures surfaced on Emerging Markets (June 2013), then this spread to Developed Markets (revealed by divergent market internals), and now a seeming convergence (both developed and emerging markets)—the periphery to the core dynamic.

The feedback from such phenomenon loops in a two way transmission mechanism. If the downside volatility will continue to reassert its presence in the stock markets of developed economies led by the US, then this should reinforce the current convergence downhill trend in Asia and in emerging markets. And pressures on Asia and EM markets will likewise reverberate on Developed Markets.

The persistence of such trend will eventually extrapolate to a grizzly bear market for global stocks, a world recession and a global financial crisis.

Friday, October 17, 2014

Wendy McElroy on how Wars Create Drug Addicts

Wendy McElroy at the Daily Bell explains of the vital link between substance abuse and wars.

[Note: this article proceeds from two assumptions. First, drugs can be abused but the abuse could not possibly be more destructive than the War on Drugs has been. Second, drug use is in no way the same as drug addiction.]"The American narcotics problem is an artificial tragedy with real victims." – Dr. Marie Nyswander, New Yorker, June 26, 1965America has a drug problem. It is reflected in local newspapers such as the Herald Times Reporter (Oct. 9) that stated, "In just two years the number of heroin deaths has increased 50 percent in Wisconsin." It is reflected nationwide; Slate (Oct. 3) stated, "Deaths from heroin overdoses have accelerated, doubling in just two years, according to ... the Centers for Disease Control and Prevention."An under-discussed aspect is the pivotal role government has played in creating a drug problem, especially through war and returning soldiers.The American Government Creates Drug AddictsThe first American war in which drug addiction was documented, both during and afterward, is probably the Civil War (1861-1865). The drug was opium, especially in the form of morphine. Touted as a wonder drug, morphine was often administered through the then-recently developed hypodermic syringe. Both sides used it as an anesthetic in field hospitals, a general painkiller and a 'cure' for diarrhea. One Union officer reportedly made all under his command drink opium daily as a preventative for dysentery. As many as 400,000 soldiers are said to have returned home with an addiction. Many continued to use morphine thereafter to dull the agony of war wounds, both physical and psychological. The addiction was called the "Soldier's disease."World War I (1914-1918, U.S. 1917-1918) has been called the "Tobacco War." By then, opiates were controlled but the government wanted something for soldiers to ease the periods of long boredom and calm stress. The solution: cigarettes. According to the Tobacco Outlook Report put out by the USDA, at the turn of the 20th century, the per capita consumption of cigarettes was 54 a year with less than .5 percent of people consuming 100 a year. And, then, cigarettes were distributed to millions of American soldiers as part of their military rations. By the end of the war, an estimated 14 million cigarettes were being distributed on a daily basis. In a 1918 cable from France to Washington, D.C., General John J. Pershing wrote: "Tobacco is as indispensable as the daily ration. We must have tons of it without delay. It is essential for the defense of democracy." Tobacco use soared after 1918.In World War II (1939-1945, U.S. 1941-1945), nations on both sides gave its military men liberal amounts of amphetamine, a drug recently synthesized for pharmaceutical use. For example, in the 1930s, Smith, Kline & French (now GlaxoSmithKline) sold it as Benzedrine. A powerful central nervous system stimulant, amphetamines were called "pep pills" and boosted both stamina and morale. A now-elderly relative of mine was involved in General George Patton's march toward Berlin; he described staying awake and walking for days because of the 'go pills.' The U.S. Air Force was particularly notorious for 'drugging' pilots to keep them alert on long-haul missions. America continued to hand out amphetamines up to the invasion of Iraq in 1991.Information on drug use during the Korean War (1950-1953) is thinner, perhaps because the government became less transparent and actively denied accounts of 'illegal' drug use. The government did continue to distribute amphetamines, however. And a factor that would characterize wars thereafter rose to prominence. The arena of conflict and areas adjacent to it were sources of plentiful, cheap drugs. The use of local product was often officially discouraged but this does not mitigate the responsibility of authorities for depositing young men in high stress arenas where addictive drugs flowed. In his book The Korean War, Paul M. Edwards stated: "The Department of Defense reported that in the Far East Command, the number of men arrested for narcotics abuse tripled since 1949. ... The amount of heroin seized was about three times the amount. In some cases, usually around the port cities, it was not unheard of that 50 percent of their men were involved in drugs. ..."The Vietnam Game ChangerThe Vietnam War (major U.S. involvement 1965-1975) became the first in which soldiers' drug use received mass media attention. Marijuana and heroin were readily and cheaply available on the Indochina market, with amphetamines still being officially supplied. By 1969, the military was reportedly arresting more than a thousand soldiers a week for possessing marijuana. Some accounts blame the pot crackdown for driving soldiers to heroin. A 1969 investigation by Congress found that 15-20 percent of soldiers in Vietnam used heroin regularly. This prompted Rep. Robert Steele, head of the investigation, to claim that a "soldier going to Vietnam runs a far greater risk of becoming a heroin addict than a combat casualty." It was a risk that hyperbolic politicians were willing to inflict on young American males. It is estimated that at least 40,000 veterans came home as heroin addicts.Vietnam may have pioneered another means by which government and war promote domestic drug use. Frank Lucas was a black heroin dealer in Harlem who cut out the middleman by using contacts in the Golden Triangle to establish a direct relationship with a heroin source. Then he built "an army inside the Army" that facilitated an international drug network in exchange for bribes or other rewards. Heroin was shipped home in the false bottoms of military coffins. In short, Vietnam provided Lucas with the contacts, the personnel and the method of shipment he needed to create an incredibly successful drug empire.

read the rest here

Ms Elroy’s trenchant conclusion:

What is the truth of it? Sometimes intentionally and sometimes not, often directly and often through circumstance, the American government is the greatest cause of drug addiction at home.

More Reasons Not to Trust Statistical GDP: China Edition

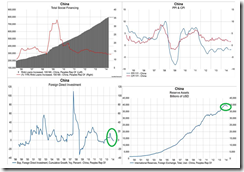

The fabulous guys at Gavekal at today's blog post “China Slowing is Evident Everywhere Except GDP” shows how China’s GDP has been egregiously inconsistent with other economic activities.

While loans continue to bulge (upper left window), (consumer and producer) inflation rates have topped out (upper right window). The likely rational for this is “debt in debt out”. Current borrowings, instead of financing expansion, are being made to offset earlier acquired liabilities.

China’s record reserve assets seems to have peaked.

FDI’s have markedly slowed to reflect on diminishing investments.

The slowdown in inflation rates can be seen by the decline in money supply growth rates (upper right window) which reinforces the Debt IN Debt OUT dynamic.

From the production (industrial) to consumption (retail) and even to transports (seaport cargo and freight and passenger traffic), the numbers converge to suggests of a meaningful slowdown in China’s economic activities in contrast to the headline growth numbers..

But like the Philippines, statistical G-R-O-W-T-H for the Chinese government has many important political implications, e.g. forestall financial instability, social unrest, justify supposed anti-corruption activities (really a purge of the political opposition) et.al.

And G-R-O-W-T-H should justify rising stocks to give the impression that “all is well” in the overleveraged plagued Chinese political economy.

"All is well" really means stealth QE, as well as, managing stock market activities by intervening in the IPO market.

All these have really been designed to buy time.

Nonetheless China’s Shanghai Composite remains one of the few national bellwethers unscathed by the current return of Risk OFF

Thursday, October 16, 2014

Phisix: Another Panic Buying Day Amidst Global Meltdown

I have to give credit to the local bulls today for their tenacity to relentlessly push up the Phisix in the face of collapsing stock markets around the world.

From the opening bell right up to about three quarters of today’s session, bulls made a fantastic (nearly 1.5%) charge from the intraday lows to the highs of the session. (chart from technistock.net) Unfortunately the bulls failed to sustain the highs thus the pullback at the end.

Today’s upswing has largely been a two sector, three company affair. Bulls concentrated their "pump" on the services sector (+1.37%) particularly on TEL +2.8% and GLO +3.11% and the property sector (+1.07%), specifically on ALI +3.08%.

The combined share distribution or weightings of the three companies to the Phisix basket has been at 21.05% (based on the day’s close).

Moreover, the gains in the Phisix hasn’t been shared by most, as declining issues led advancing issues by nearly 2 to 1.

Neither does today’s run up seem about momentum, which has been interrupted this week by a sharp selloff, nor has this seem about “profits” from trade. Instead today’s pump look like more about ego or symbolism.

It is hard to argue that this has been about lack of awareness of the environment. US markets have been downhill since September and we seem to be seeing sharper downside actions. Yet 7-8 billion pesos worth of bids signifies hardly small change. I don’t think this eludes the pump operators.

And as of this writing, Asia has been in a sea of red (based on the Bloomberg website), with only Australia S&P/ASX 200 up by a measly .18% and Indonesia’s JCI also up by a paltry .24% and the Phisix as the odd man out with outstanding gains.

Moreover, today’s panic buying suggests that stocks as I previously noted will not only rise forever but will EXPLODE to the firmament soon. So it takes either deeply held convictions (this time is different) or other motives for such actions.

Bulls are by nature territorial. Having lost their grip on the 7,000 levels during the past few days which has apparently wounded the their ego may have prompted for today’s vicious and desperate thrust to retake the said threshold levels. Domestic bulls have essentially dismissed risks in order to attain a superficial goal.

As I wrote back in June 2013: “Denial” rallies are typical traits of bear market cycles. They have often been fierce but vary in degree. Eventually relief rallies succumb to bear market forces.

There is another possibility, this hasn’t about trading profits but about political symbolism.

Phisix 7,000 and 7,400 will have to be reclaimed as the 2016 national election nears. Rising stocks because of G-R-O-W-T-H may help spur chances for a re-election or for the election of an appointed representative. So much of these 3 company pump or massaging of the Phisix may have been part of the publicity machinery campaign to boost the political capital of the incumbent. If public pension money have been used, then pensioners may likely face future funding problems.

Sad to say economic realities have began resurface which should upend and expose all the delusions that has enthralled the public during the past 6 years.

The bottom line: the obverse side of every mania is a crash.

We are already seeing emergent signs of crashes (oil, stocks of some oil producing nations and Europe).

My “Black Swan” theme seems to have arrived.

Simon Black: Atlas Shrugged Goes Real Time

From the Sovereign Man’s prolific Simon Black (bold original)

“John Galt is Prometheus who changed his mind. After centuries of being torn by vultures in payment for having brought to men the fire of the gods, he broke his chains—and he withdrew his fire—until the day when men withdraw their vultures.”Sick of the overbearing regulation, taxation, and entitlement mentality in society—in the book Atlas Shrugged, John Galt went to one entrepreneur after another to convince them that they just didn’t need to put up with it anymore.They didn’t need to keep propping up a system that was trying to destroy them. Where’s the point in continuing to feed a parasitic system?So one by one, these innovators and producers simply closed up shop, deciding to just “shrug” and abandon what they were providing thanklessly to the looters.Today many companies are doing the same. They may not be abandoning their businesses altogether, but they are moving them out of the hands of the parasites by moving their tax bases abroad.In Ayn Rand’s book, the Economic Planning Bureau dealt with this by legislating that no businesses could leave: “[a]ll the manufacturing establishments of the country, of any size and nature, were forbidden to move from their present locations, except when granted a special permission to do so.”In real life today, we have a string of policies being proposed to similarly discourage companies from leaving, or failing that, to try to claw as much money as possible from them first.First, take the H.R. 5278: No Federal Contracts for Corporate Deserters Act, which bars federal contracts for American companies that have gone overseas for tax purposes.Then take the H.R. 5549: Pay What You Owe Before You Go Act, which seeks the seizure of unrepatriated corporate revenue.Even the language used by these bill’s supporters is eerily similar to the novel, as politicians call for corporations to pay their “fair share” and bemoan that Americans have to “pick up the tax burden inverted companies shrug off.”At the time, Rand might have thought that she was writing about an extreme, fictional society. But it seems that the Land of the Free is eager to exceed even her worst expectations.When she wrote about the “Economic Emergency Law”, which forbade any discrimination “for any reason whatever against any person in any matter involving his livelihood”, she was likely thinking about criteria such as race, gender, and age.She might have even considered they would try to prevent employers from making judgments based on a person’s ability, though I’m sure she would not have even imagined what politicians have actually come up with in the US.Try the S. 1972/ H.R. 3972: Fair Employment Opportunity Act that proposed to prohibit discrimination according to a person’s history of unemployment.Or even worse, the S. 1837: Equal Employment for All Act that would have prohibited employers from even looking at prospective employee’s credit ratings.The literary similarities don’t just stop with corporations either. Compare the fictional Project Soybean, designed to “recondition” people’s dietary habits to the actual H.R. 4904: Vegetables Are Really Important Eating Tools for You (VARIETY).Tell me, which one sounds more ludicrous to you?With each new piece of legislation being proposed in the Land of the Free, Atlas Shrugged seems to be ever more prophetic.While even the most terrifying elements of the book are coming true, so are the reactions.People and companies are leaving, refusing the put up with the looting of their efforts any longer.

Start of the Breakdown? European Stocks Collapse!

What a night.

European stocks went into a broad based meltdown...

The Europe’s blue chip bellwethers the Stox 50 and Stoxx 600 dived by a stunning 3.61% and 3.16%!

The bloodied benchmarks reflected the intense selloff in the major equity benchmarks of Europe’s largest economies: German Dax –2.87%, France CAC –3.63% and UK’s FTSE –2.83%

Europe's periphery took even more punishment: Spain’s IBEX –3.59%, Portugal’s PSI -3.21%, Italy’s MIB –4.44% and Greece’s ATG –6.25%.

Scandinavian stocks had likewise been pummeled: Denmark's Copenhagen 20 -2.27%, Norway's Oslo All shares -2.1%, Sweden's Stockholm 30 -2.9%, as well as Finland's Helsinki index -2.98% and Iceland's ICEX -1.65%

All charts above from stockcharts.com

The bloodletting in Greece financial assets apparently spilled over to her sovereign bonds where 10 year yields have spiked.

Should the meltdown in equities intensify, the Greece bond selloff should spread to other European periphery bonds.

And even prior to last night’s collapse, Europe’s market breadth continues to deteriorate

Notes the Gavekal Team:

To say that MSCI Europe has been the hardest hit equity region over the past several weeks would be a major understatement. European stocks have been washed out more recently than at anytime since 2011. However, if 2011 is an indicator, a vast majority of stocks can continue to trade below its 200-day moving average for quite a few months so the bottom probably hasn't been seen in Europe yet.

US markets came strongly back from an early deep drubbing, nonetheless still closed red.

The periphery to the core dynamic seems to be spreading fast and intensifying.

Wednesday, October 15, 2014

Will a Collapse in Oil Prices Burst the Middle East Bubble?

Last late June 2014, I noted of tremors in the some of the stock markets of major Arab oil producers, the Gulf Cooperation Council (GCC). The GCC is composed of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates.

The key concern then has been on the region’s escalating wars or increase in social instability, compounded by some worries over property bubbles. Apparently the global risk ON environment has been strong enough for speculators to gloss over or ignore these concerns from which their respective stock markets have partially recovered.

But now a new dynamic compounds on the existing predicaments: Collapsing oil prices in the face of the rallying US dollar.

Pardon me but I will have to compress these charts so as not to make my blog size too big.

As example, one would note of the skyrocketing US dollar against the Kuwaiti dinar and Saudi riyal.

The strong US dollar which has been become a broad based phenomenon has usually underscored a risk OFF environment. As I noted back in mid-September:

As a final note on markets, the US dollar index has been firming of late. Since July 1, the US dollar index has been up by 5%!The basket of the US dollar index consist of the euro (57.6%), the Japanese yen (13.6%),British pound (11.9%), the Canadian loonie (9.1%), the Swedish Krona (4.2%) and the Swiss franc (3.6%).Their individual charts reveal that the US dollar has been rising broadly and sharply against every single currency in the basket during the past 3 months.This may have been due to a combination of myriad complex factors: ECB’s QE, expectations for the Bank of Japan to further ease, Scotland’s coming independence referendum, or expectations for the US Federal Reserve to raise rates in 1H 2015 (this has led to a sudden surge in yields of US treasuries last week), escalating Russian-US proxy war in Ukraine and now in Syria (as US Obama has authorized airstrikes against anti-Assad rebels associated with ISIS, but who knows if US will bomb both the Syrian government and the rebels?) more signs of a China slowdown and more.Yet a rising US dollar has usually been associated with de-risking or a risk OFF environment. Last June 2013’s taper tantrum incident should serve an example.

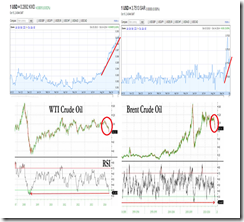

So the strong US dollar contributed to last night’s hammering of the US West Intermediate Crude (WTI-lower left) which dived by 3.18% and Europe’s Brent (lower right) which crashed by 4.33%. Yesterday's sharp cascade has been part of the recent downhill trend of oil prices.

The Zero Hedge notes that “WTI has just hit the most oversold levels since Lehman” and “what is gong on with Brent turned out to be far worse, and as the weekly RSI indicator shows the selloff in Brent is now the worst, well, ever!” (bold original)

Some will argue that this should help consumption which subsequently implies a boost on “growth”, but I wouldn’t bet on it.

Current events don’t seem to manifest a problem of oversupply. To the contrary current developments in the oil markets seem to signify a problem of shrinking global liquidity and slowing economic demand whose deadly cocktail mix has been to spur the incipient phase of asset deflation (bubble bust)

Others argue that this could part of an alleged “predatory pricing” scheme designed as foreign policy tool engaged by some of major oil producers to strike at Russia, Iran or even against Shale gas producers in the US.

This would hardly be a convincing case since doing so would mean to inflict harm on the oil producers themselves in order to promote a flimsy case of “market share” or to “punish” other governments.

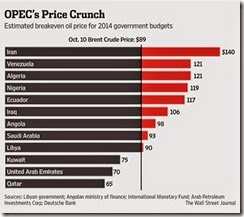

Say Shale oil. There are LOTS more at stake for welfare states of OPEC-GCC nations than are from the private sector shale operators (mostly US). Shale operators may close operations or defer investments until prices rise again. There could also be new operators who could pick up the slack from existing “troubled” Shale oil and gas operators. Such aren’t choices available for oil dependent welfare governments of oil producing nations. As one would note from the above table from Wall Street Journal, at current prices only Kuwait, the UAE and Qatar remains as oil producers with marginal surpluses.

And a shortfall from oil revenues means to dip on reserves to finance public spending. And once these resources drain out from a prolonged oil price slump, the risks of a regional Arab Spring looms.

And the heightened risk of Arab Springs would further complicate the region’s social climate tinderbox. Add to this the economic impact from a weak oil prices-strong dollar, regional malinvestments would compound on the region’s fragility.

Thus, the adaption of "predatory pricing" supposedly aimed at punishing other governments would only aggravate the region’s already dire conditions that risks a widespread unraveling towards total regional chaos.

Two wrongs don’t make a right.

While I don’t expect politicians to be “smart”, their self-interests in maintaining power would hardly let them be dismissive of the welfare state which has been the source of their current political privilege.

As a side note, the region’s complex and deteriorating conditions can be seen in the following developments: Despite aerial bombing by Allied forces, Sunni Islam militants the ISIS has reportedly taken control of much of Western Iraq and has been closing in fast on Baghdad This is aside from advances by the ISIS on the Syrian Kurdish town of Kobani on the Syrian-Turkish border which has reportedly “threatened” to destabilize Turkey

Meanwhile Russia has dipped into $6 billion from its reserve to support her currency the ruble afflicted by sanctions, capital flight and collapsing oil prices. So crumbling oil prices are having a broad based effect on the oil revenue dependent welfare state even from the non-GCC nations.

And as one can see, the GCC has long depended on a weak dollar (easy money) environment. This appears to have now reversed, thus exposing their internal structural fragilities from unsustainable economic bubbles and the welfare state as well as tenuous regional and geopolitical relationships.

This brings us back to the stock markets. There has been renewed signs of stock market tremors among GCC states.

Bahrain’s All Share index appears to be in a topping process, so as with Kuwait Stock Exchange Index whose rally from the Apr-June meltdown appears to have winded down.

Meanwhile Oman’s Muscat index experienced a waterfall as Qatar Exchange Index seems least affected among the GCC, nonetheless has exhibited signs of innate weakness.

Both equity benchmarks of Saudi and UAE crashed 6.5% early this week.

Saudi Arabia’s Tadawul index was hardly affected by the April-June meltdown but the weak oil price-strong US dollar dynamic seems to have permeated to the second largest oil producer (after the US).

Meanwhile like Kuwait, the seeming recovery of UAE’s Dubai Financial General from the collapse a quarter back seems to have faded.

Unlike the April-June episode, GCCs stock markets appear to be in unison in signaling a downturn.

I’d say that this serves as reinforcing signs of the periphery to the core dynamics in motion.

Will the current weakness deepen? Or will this just be another cyclical dip? We’ll see.

Tuesday, October 14, 2014

What has China’s stock market got to do with export growth?

I have always questioned the sanctity of the government statistics. I guess the account below adds to my skepticism.

Some economists have reportedly questioned on the supposed recent strength of China’s exports.

From the Wall Street Journal Real Time Economics Blog: (bold mine)

A sharp increase in Chinese exports to Hong Kong seen in September data released Monday has some analysts wondering whether traders are engaged in another round of overinvoicing or round-tripping, a variety of practices wherein trade flows are used to get around strict capital market restrictions.China’s exports through Hong Kong – a major trade gateway — should roughly track the nation’s total exports. In September, however, even as year-on-year exports to all regions rose a stronger-than-expected 15.3% year on year, those to Hong Kong grew by 34%. (This compared with a drop in exports to Hong Kong of 2.1% in August.)The sharp September increase comes amid recent appreciation of China’s currency, the renminbi.“Given that China’s exports to Hong Kong have surged again while the RMB is appreciating, it is natural to suspect the round-tripping trade is reviving,” said ANZ economist Li-Gang Liu, who added that trade developments between Hong Kong and China need to be closely monitored.China’s monthly exports to Hong Kong should in theory equal Hong Kong’s imports from China. In practice, they tend to differ by a few billion dollars, largely because each side counts trade differently. Between late 2012 and March 2013, however, that monthly gap rose to a peak of $27.8 billion.“It was a blow-out,” said Oliver Barron, head of investment bank North Square Blue Oak’s Beijing office. “The latest data clearly exhibits some symptoms of the first quarter of 2013.”

Stealth fund flows into the stock market?

If in fact another round of overinvoicing is under way, analysts said, it could be driven by recent appreciation of the RMB or yuan, which is up nearly 2% over the past three months. Overinvoicing also may be driven in part by recent gains in Chinese stocks, some added, which have appreciated some 20% since May.New brokerage accounts rose by as much as 200,000 per week last month, the highest level since March 2012, said Mr. Barron. And China has announced a new program to link the Shanghai and Hong Kong stock exchanges, said Mizuho Securities economist Jianguang Shen, giving investors an incentive to pre-position funds.“There’s no evidence so far that it’s definitely overinvoicing, but the pattern and the export growth rates are abnormal,” Mr. Shen said. “I’m pretty suspicious.”

Of course there will hardly be “direct” evidence in support of such surreptitious fund flows. But “evidence” will hardly surface given the reality of China’s tight capital controls despite promises to liberalize. That would be like asking for the moon!

Yet in the face of stringent regulations or "strict capital market restrictions", the universal market response has always been via the black market or shadow economy or related activities. The statistical disparity alone suggest that there has been a sizeable padding up of export figures. Since money has to flow somewhere, then whether such (in)flows had been channeled to speculate on the RMB or to stocks or even both could be a large possibility, given the growing signs of economic weakness.

This goes to show that economic numbers don’t seem as they are.

And this also exhibits how the Chinese government has been whitewashing their beleaguered overleveraged economy by sprucing up financial assets via stealth QE and by managing IPOs

Labels:

china economy,

China politics,

China Yuan,

currency controls,

Statistics

Monday, October 13, 2014

Ron Paul: Liberty, Not Government, is Key to Containing Ebola

The great libertarian Ron Paul suggests of how the Ebola outbreak can be contained.

From the Ron Paul Institute

According to Forbes magazine, at least 5,000 Americans contacted healthcare providers fearful they had contracted Ebola after the media reported that someone with Ebola had entered the United States. All 5,000 cases turned out to be false alarms. In fact, despite all the hype about Ebola generated by the media and government officials, as of this writing there has only been one preliminarily identified case of someone contracting Ebola within the United States.Ebola is a dangerous disease, but it is very difficult to contract. Ebola spreads via direct contact with the virus. This usually occurs though contact with bodily fluids. While the Ebola virus may remain on dry surfaces for several hours, it can be destroyed by common disinfectants. So common-sense precautions should be able to prevent Ebola from spreading.It is no coincidence that many of those countries suffering from mass Ebola outbreaks have also suffered from the plagues of dictatorship and war. The devastation wrought by years of war has made it impossible for these countries to develop modern healthcare infrastructure. For example, the 14-year civil war in Liberia left that country with almost no trained doctors. Those who could leave the war-torn country were quick to depart. Sadly, American foreign aid props up dictators and encourages militarism in these countries.President Obama’s response to the Ebola crisis has been to send 3,000 troops to West African countries to help with treatment and containment. Obama did not bother to seek congressional authorization for this overseas military deployment. Nor did he bother to tell the American people how long the mission would last, how much it would cost, or what section of the Constitution authorizes him to send US troops on “humanitarian” missions.The people of Liberia and other countries would be better off if the US government left them alone. Leave it to private citizens to invest in African business and trade with the African people. Private investment and trade would help these countries develop thriving free-market economies capable of sustaining a modern healthcare infrastructure.Legitimate concerns about protecting airline passengers from those with Ebola or other infectious diseases can best be addressed by returning responsibility for passenger safety to the airlines. After all, private airlines have a greater incentive than does government to protect their passengers from contagious diseases. They can do so while providing a safe means of travel for those seeking medical treatment in the United States. This would remove the incentive to lie about exposure to the virus among those seeking to come here for treatment.Ebola patients in the US have received permission from the Food and Drug Administration to use “unapproved” drugs. This is a positive development. But why should those suffering from potentially lethal diseases have to seek special permission from federal bureaucrats to use treatments their physicians think might help? And does anyone doubt that the FDA’s cumbersome approval process has slowed down the development of treatments for Ebola?Firestone Tire and Rubber Company has successfully contained the spread of Ebola among 80,000 people living in Harbel, the Liberian town housing employees of Firestone's Liberian plant and their families. In March, after the wife of a Firestone employee developed Ebola symptoms, Firestone constructed its own treatment center and implemented a program of quarantine and treatment. Firestone has successfully kept the Ebola virus from spreading among its employees. As of this writing, there are only three Ebola patients at Firestone's treatment facility.Firestone's success in containing Ebola shows that, far from justifying new state action, the Ebola crises demonstrates that individuals acting in the free market can do a better job of containing Ebola than can governments. The Ebola crisis is also another example of how US foreign aid harms the very people we are claiming to help. Limiting government at home and abroad is the best way to protect health and freedom.

Subscribe to:

Posts (Atom)