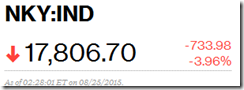

Following five straight days of hammering, the Chinese government posted another rare occasion where they succeeded to electrify their stock markets.

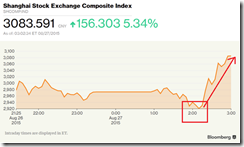

Today’s 5.34% surge in the Shanghai index also comes after all the arrests associated with defying the governments interests and of yesterday’s “restrictions” of accounts which allegedly sold short the market.

Here is how the Bloomberg described of today’s action

The benchmark gauge jumped 5.3 percent to 3,083.59 at the close, with all of the gains coming in the last 45 minutes of trading. About 13 stocks rose for each that fell, with financial shares surging the most in a month. The Shanghai index tumbled 23 percent to an eight-month low in the past five days.“Heavyweight stocks like banks and insurance companies helped pull up the index, and it’s possibly China Securities Finance entering the market again to shore up stocks,” said Zhang Gang, a strategist at Central China Securities Co. in Shanghai.

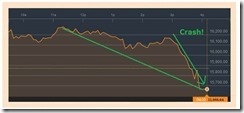

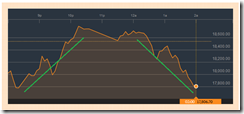

The Shanghai index fell into negative territory before that huge massive last hour push. This can be seen above.

And more…

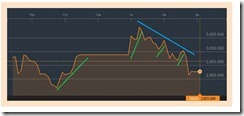

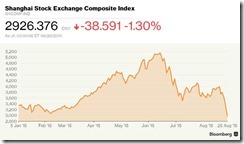

A gauge of 50-day volatility on the Shanghai measure surged to its highest level since 1997 this week amid signs the government had pulled back from rescue measures to support the world’s second-largest stock market. The index tumbled 42 percent from its mid-June peak through Wednesday to erase more than $5 trillion of value as margin traders closed out bullish bets and concern deepened that valuations are unjustified by the weak economic outlook.

So the 1997 like volatility may have prompted today’s fierce pumping by the government?

And possibly one of the institutions mandated to soak up on stocks may have been pensions, as tipped by SCMP’s George Chen.

And the injection of new funds into the banking system by the central bank, the PBoC, may have partly backed the financing of the stock market buying spree

Here is from another Bloomberg report:

China’s central bank brought out an array of tools to target stubbornly high financing costs this week, reducing interest rates, offering cheap loans and adding cash to the financial system through open-market operations. Money-market rates are finally buckling under the pressure, with the overnight rate breaking a record 39-day run of increases and interest-rate swaps slipping to the lowest since July. Supply of cash has lagged demand especially since a shock Aug. 11 yuan devaluation that saw the People’s Bank of China buying the currency on subsequent days to lend it stability. The monetary authority auctioned 150 billion yuan ($23.4 billion) of seven-day reverse-repurchase agreements Thursday, according to a statement on its website. It added the same amount on Tuesday, leaving a net addition of 210 billion yuan for the past two weeks, the most for open-market operations since February.

With the Chinese government practically lopping off or absorbing all the sellers, and with their declaration for keeping those shares for a long time, aside from all the other restrictions imposed on major shareholders, it’s really a wonder what would be the ramifications of the deformed or Frankenstein stock markets of China.

Anyway, in 2014 I predicted that part of the efforts to contain capital flows will be to sell China’s hoard of US treasuries.

I guess this thing is happening now.

From Bloomberg: China has cut its holdings of U.S. Treasuries this month to raise dollars needed to support the yuan in the wake of a shock devaluation two weeks ago, according to people familiar with the matter. Channels for such transactions include China selling directly, as well as through agents in Belgium and Switzerland, said one of the people, who declined to be identified as the information isn’t public. China has communicated with U.S. authorities about the sales, said another person… The latest available Treasury data and estimates by strategists suggest that China controls $1.48 trillion of U.S. government debt, according to data compiled by Bloomberg. That includes about $200 billion held through Belgium, which Nomura Holdings Inc. says is home to Chinese custodial accounts.

The effects of the government’s actions today will likely be short term. Yet all these interventions will have nasty consequences overtime.

And present actions are signs of panic from an increasingly desperate government to stem the tide of rapidly deteriorating economic conditions in China.

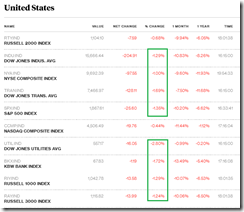

Finally, has there been an unannounced collaboration with central banks/governments of the West, the particularly the US FED, with the goal to stabilize stock markets, as the reason for today’s big move by the Chinese government?