From xkcd.com (hat tip Mark Perry)

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Tuesday, January 31, 2012

Information Age will be Driven by Three Major Forces

Writing at the Wall Street Journal physicist-entrepreneur Mark P. Mills and Dean of McCormick School of Engineering and Applied Sciences at Northwestern University Julio M. Ottino sees a dramatic reconfiguration of the US economy that would likely be driven by 3 major forces: big data, smart manufacturing and the wireless revolution.

They write, (bold emphasis mine)

In January 2012, we sit again on the cusp of three grand technological transformations with the potential to rival that of the past century. All find their epicenters in America: big data, smart manufacturing and the wireless revolution.

Information technology has entered a big-data era. Processing power and data storage are virtually free. A hand-held device, the iPhone, has computing power that shames the 1970s-era IBM mainframe. The Internet is evolving into the "cloud"—a network of thousands of data centers any one of which makes a 1990 supercomputer look antediluvian. From social media to medical revolutions anchored in metadata analyses, wherein astronomical feats of data crunching enable heretofore unimaginable services and businesses, we are on the cusp of unimaginable new markets.

The second transformation? Smart manufacturing. This is the first structural shift since Henry Ford launched the economic power of "mass production." While we see evidence already in automation and information systems applied to supply-chain management, we are just entering an era where the very fabrication of physical things is revolutionized by emerging materials science. Engineers will soon design and build from the molecular level, optimizing features and even creating new materials, radically improving quality and reducing waste.

Devices and products are already appearing based on computationally engineered materials that literally did not exist a few years ago: novel metal alloys, graphene instead of silicon transistors (graphene and carbon enable a radically new class of electronic and structural materials), and meta-materials that possess properties not possible in nature; e.g., rendering an object invisible—speculation about which received understandable recent publicity.

This era of new materials will be economically explosive when combined with 3-D printing, also known as direct-digital manufacturing—literally "printing" parts and devices using computational power, lasers and basic powdered metals and plastics. Already emerging are printed parts for high-value applications like patient-specific implants for hip joints or teeth, or lighter and stronger aircraft parts. Then one day, the Holy Grail: "desktop" printing of entire final products from wheels to even washing machines.

The era of near-perfect computational design and production will unleash as big a change in how we make things as the agricultural revolution did in how we grew things. And it will be defined by high talent not cheap labor.

Finally, there is the unfolding communications revolution where soon most humans on the planet will be connected wirelessly. Never before have a billion people—soon billions more—been able to communicate, socialize and trade in real time.

The implications of the radical collapse in the cost of wireless connectivity are as big as those following the dawn of telegraphy/telephony. Coupled with the cloud, the wireless world provides cheap connectivity, information and processing power to nearly everyone, everywhere. This introduces both rapid change—e.g., the Arab Spring—and great opportunity. Again, both the launch and epicenter of this technology reside in America.

I think that this will not just be a feature that would influence the US economy, but also of the world, as the significance of political borders trends towards irrelevance.

Said differently, the above forces will likely underpin the accelerating influence of decentralization to the political economic sphere throughout the world.

Japan to Ease Requirements for Foreign Workers

I’ve been saying that the current unsustainable demographical trends in Japan will require the liberalization of migration policies which would allow inflows of foreign workers to offset the nation’s swiftly declining fertility rate (negative population growth).

Chart from Wikipedia.org

So far, rigid bureaucratic requirements has posed as a stumbling block, but this seems likely to change.

From Japan Times,

Non-Japanese applicants hoping to become certified nurses could see the government's notoriously rigorous exams get easier with the inclusion of English-language tests and a new set of communication exams based on basic Japanese.

Non-Japanese hoping to become care workers took the certification test for the first time Sunday, while those aspiring to become certified nurses have been applying for the exam since fiscal 2008.

But the low pass rate is prompting the Health, Labor and Welfare Ministry to consider changing the system.

As I wrote last year

I’d bet cultural inhibitions extrapolated through politics will eventually pave way to embracing reality.

And reality check translates to policy changes.

Chart of the Day: The US Federal Reserve Laughed Their Way to the Bubble Bust

The Daily Stag Hunt tabulated the laughs of the officials of US Federal Reserve, led by ex-chairman Alan Greenspan, from the transcripts of their committee meetings. (hat tip Patrick Ella)

Proof of how clueless they had been of the disaster that was about to shock them.

Monday, January 30, 2012

How Democracy Represents a Form of Socialism

Advancing socialist agendas (like welfare, warfare state and other policies of redistribution, prohibition, taxation and others) by invoking the mob rule (tyranny of the majority) signifies a form of socialism.

Ben O'Neill at the Mises Institute explains, [bold emphasis mine, italics original]

Democracy, of the unlimited kind lauded today, is a form of socialism, in the sense that it arrogates ultimate power over all decisions to the government. Implicit in the notion of people's present love affair with mob rule is the assumption that government, through the collective "will of the people," should have the prerogatives of ownership of all resources in society, should it choose to exercise these. The democrat brooks no limitation on the legitimate powers of government and hence gives total ownership over all of society to this institution. The only limitation in his mind is the limitation of democracy itself — that the rulers in control of the government apparatus must guard against being displaced by another set of rulers, at the behest of the demands of the mob.

The socialistic nature of democracy is true regardless of the size of governments elected under a democratic order or their particular policies. It is true even when a democratic government chooses policies that are relatively liberal and purportedly support the ownership of private property. For such property ownership is regarded as conditional. Supporters of the system of democracy assert their right to forcibly interfere in the lives of others whenever they have sufficient support from the mob to do so, or are otherwise capable of capturing political power. By supporting the existence of a democratic order they implicitly sanction an arrogation of ultimate ownership of all society to the government, whether decisions over particular resources are exercised by government or not.

Any private property or personal autonomy allowed under democracy exists only with the permission of the government, and under the constant threat of the whims of the mob, rather than existing as a recognized enforceable moral right against the government. The ideal of democracy dictates that a person's private rights are always subject to being overruled by the government, and so it is actually the government that is the implicit owner of all the resources (and people) in its territory. Such a society is implicitly socialist in character, unless and until people reject the legitimacy of government power over their resources, a view which requires the rejection of mob rule as a governing principle.

Read the rest here.

Ludwig von Mises on Some Objections to the Gold Standard

Former IMF chief Economist Simon Johnson raised an objection, at the New York Times Blog, to the gold standard:

And the idea that pegging the value of the dollar or any currency relative to gold leads to financial and economic stability is an illusion. During the 19th century the dollar was freely convertible into gold — except when it wasn’t. There were serious “suspensions” of convertibility about every 10 to 15 years; most of these were the outcome of boom-bust cycles in the private sector and had nothing to do with the government, which had a very limited monetary role before the Civil War…

The gold standard is just a rule and rules are broken by powerful people under all monetary systems. Assuming that this won’t happen in any future arrangement just encourages illusions.

Apparently the great Ludwig von Mises, decades ago, had a retort on what seems as a recycled (or stereotyped) challenge. [bold emphasis mine]

The gold standard is certainly not a perfect or ideal standard. There is no such thing as perfection in human things. But nobody is in a position to tell us how something more satisfactory could be put in place of the gold standard. The purchasing power of gold is not stable. But the very notions of stability and unchangeability of purchasing power are absurd. In a living and changing world there cannot be any such thing as stability of purchasing power. In the imaginary construction of an evenly rotating economy there is no room left for a medium of exchange. It is an essential feature of money that its purchasing power is changing. In fact, the adversaries of the gold standard do not want to make money's purchasing power stable. They want rather to give to the governments the power to manipulate purchasing power without being hindered by an "external" factor, namely, the money relation of the gold standard…

However, the futility of interventionist policies has nothing at all to do with monetary matters. It will be shown later why all isolated measures of government interference with market phenomena must fail to attain the ends sought. If the interventionist government wants to remedy the shortcomings of its first interferences by going further and further, it finally converts its country's economic system into socialism of the German pattern. Then it abolishes the domestic market altogether, and with it money and all monetary problems, even though it may retain some of the terms and labels of the market economy. In both cases it is not the gold standard that frustrates the good intentions of the benevolent authority.

The significance of the fact that the gold standard makes the increase in the supply of gold depend upon the profitability of producing gold is, of course, that it limits the government's power to resort to inflation. The gold standard makes the determination of money's purchasing power independent of the changing ambitions and doctrines of political parties and pressure groups. This is not a defect of the gold standard; it is its main excellence. Every method of manipulating purchasing power is by necessity arbitrary. All methods recommended for the discovery of an allegedly objective and "scientific" yardstick for monetary manipulation are based on the illusion that changes in purchasing power can be "measured." The gold standard removes the determination of cash-induced changes in purchasing power from the political arena. Its general acceptance requires the acknowledgment of the truth that one cannot make all people richer by printing money. The abhorrence of the gold standard is inspired by the superstition that omnipotent governments can create wealth out of little scraps of paper.

It has been asserted that the gold standard too is a manipulated standard. The governments may influence the height of gold's purchasing power either by credit expansion — even if it is kept within the limits drawn by considerations of preserving the redeemability of the money-substitutes — or indirectly by furthering measures that induce people to restrict the size of their cash holdings. This is true. It cannot be denied that the rise in commodity prices that occurred between 1896 and 1914 was to a great extent provoked by such government policies. But the main thing is that the gold standard keeps all such endeavors toward lowering money's purchasing power within narrow limits. The inflationists are fighting the gold standard precisely because they consider these limits a serious obstacle to the realization of their plans.

What the expansionists call the defects of the gold standard are indeed its very eminence and usefulness. It checks large-scale inflationary ventures on the part of governments. The gold standard did not fail. The governments were eager to destroy it, because they were committed to the fallacies that credit expansion is an appropriate means of lowering the rate of interest and of "improving" the balance of trade…

The struggle against gold, which is one of the main concerns of all contemporary governments, must not be looked upon as an isolated phenomenon. It is but one item in the gigantic process of destruction that is the mark of our time. People fight the gold standard because they want to substitute national autarky for free trade, war for peace, totalitarian government omnipotence for liberty.

Mainstream economists still detest the gold standard, which reminds me this quote attributed to Janos Feteke (who I think was the deputy governor of the National Bank of Hungary)

There are about three hundred economists in the world who are against gold, and they think that gold is a barbarous relic - and they might be right. Unfortunately, there are three billion inhabitants of the world who believe in gold

Socialist Amerika?

16 signs or statistics suggesting that the United States has been transforming into a socialist nation. The Land of the Free no more?

From the Economic Collapse Blog

#1 According to the Census Bureau, 49 percent of all Americans live in a home that gets direct monetary benefits from the federal government. Back in 1983, less than a third of all Americans lived in a home that received direct monetary benefits from the federal government.

#2 The amount of money that the federal government gives directly to Americans has increased by 32 percent since Barack Obama entered the White House.

#3 The number of Americans receiving Social Security disability benefits has increased by 10 percent since Barack Obama first took office.

#4 Back in 1990, the federal government accounted for 32 percent of all health care spending in America. Today, that figure is up to 45 percent and it is projected to surpass 50 percent very shortly.

#5 The number of Americans on food stamps recently hit a new all-time high. It has increased by 3 million since this time last year and by more than 14 million since Barack Obama first entered the White House.

#6 Today, one out of every seven Americans is on food stamps and one out of every four American children is on food stamps. This is unprecedented in American history.

#7 In 2010, 42 percent of all single mothers in the United States were on food stamps.

#8 Back in 1980, government transfer payments accounted for just 11.7% of all income. In 2010, government transfer payments accounted for 18.4% of all income, which was a new all-time high.

#9 By the end of 2011, approximately 55 million Americans received a total of approximately 727 billion dollars in Social Security benefits. As theretirement crisis becomes much worse, that dollar figure is projected to absolutely skyrocket.

#10 According to the Congressional Budget Office, the Social Security systempaid out more in benefits than it received in payroll taxes in 2010. That was not supposed to happen until at least 2016.

#11 Back in 1965, only one out of every 50 Americans was on Medicaid. Today, one out of every 6 Americans is on Medicaid, and things are about to get a whole lot worse. It is being projected that Obamacare will add 16 million more Americans to the Medicaid rolls.

#12 The U.S. government now says that the Medicare trust fund will run outfive years faster than previously anticipated.

#13 The total cost of just three federal government programs - the Department of Defense, Social Security and Medicare - exceeded the total amount of taxes brought in during fiscal 2010 by 10 billion dollars.

#14 It is being projected that entitlement spending by the federal governmentwill nearly double by the year 2050.

#15 Right now, spending by the federal government accounts for about 24 percent of GDP. Back in 2001, it accounted for just 18 percent.

#16 When you total it all up, American households are now receiving more money directly from the federal government than they are paying to the government in taxes.

The growth trend of US entitlement spending from Heritage Foundation

All of which has been playing right into the prediction of Professor Ludwig von Mises.

Professor Murray Rothbard wrote,

Indeed, the American economy has virtually reached the point where the crippling taxation; the continuing inflation; the grave inefficiencies and breakdowns in such areas as urban life, transportation, education, telephone and postal service; the restrictions and shattering strikes of labor unions; and the accelerating growth of welfare dependency, all have brought about the full-scale crisis of interventionism that Mises has long foreseen.

The instability of the interventionist welfare-state system is now making fully clear the fundamental choice that confronts us between socialism on the one hand and capitalism on the other.

Phisix and the Rotational Dynamics

It is a sobering fact that the prominence of central banks in this century has coincided with a general tendency towards more inflation, not less. [I]f the overriding objective is price stability, we did better with the nineteenth-century gold standard and passive central banks, with currency boards, or even with 'free banking.' The truly unique power of a central bank, after all, is the power to create money, and ultimately the power to create is the power to destroy.- Former US Federal Reserve chairman Paul Volcker

The Phisix fell 1.43% for the first time in four weeks. This comes after a turbocharged advance since the start of the year. Year to date, the local benchmark has been up 7.04% based on nominal Peso returns. But for foreign investors invested in the Phisix, the returns are higher. Since the Philippine Peso has materially gained (over 2%) from the same period, returns from local equity investments in US dollar terms is about 9+%.

Could this week’s decline presage a correction phase?

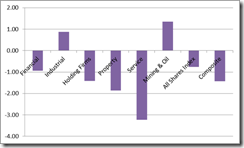

Rotational Dynamics in the PSE and the Cantillon Effects

The decline of the Phisix has not been reflected over the broad market as exhibited by the positive differentials of the advance-decline spread. This means more issues gained despite the natural corrective profit taking process seen on many of the Phisix component heavyweights.

And leading the market gainers has been the mining index which seems to have reasserted the leadership after a rather slow start. Also defying the profit taking mode has been the industrial sector.

From the start of the year, despite this week’s retrenchment, the property sector remains the best performer followed by the mining and the financial sectors.

This week’s market activities demonstrate what I have always called as the rotational process or dynamic. Sectors that has lagged outperforms the previously hot sectors which currently has been on a profit taking mode. Eventually the overall effect is to raise the price levels of nearly issue.

Here is what I previously wrote[1],

A prominent symptom of inflation is that prices are affected unevenly or relatively.

Eventually prices in general moves higher, but the degree and timing of price actions are not the same.

It’s the same in stock markets, which represents as one of the major absorbers of policy induced inflation.

Prices of some issues tend go up more and earlier than the others. At certain levels, the public’s attention tend to shift to the other issues which has lagged. This brings about a general rise in prices.

These are the spillover effects which I call the rotational process.

The mining sector has been narrowing the gap with the property sector and has surpassed service and financial sectors. The industrial sector which has been the tail end, has shrugged off the current profit taking process.

In the real economy, the effects of inflation has been similar, this known as the Cantillon Effect (named after the Mercantilist era Irish French economist Richard Cantillon) who brought about the concept of relative inflation or the disproportionate rise in prices among different goods in an economy[2]

The great Murray Rothbard dealt with the social and ethical considerations of Cantillon Effect or the relative effects of inflationism to an economy[3]

The new money works its way, step by step, throughout the economic system. As the new money spreads, it bids prices up--as we have seen, new money can only dilute the effectiveness of each dollar. But this dilution takes time and is therefore uneven; in the meantime, some people gain and other people lose. In short, the counterfeiters and their local retailers have found their incomes increased before any rise in the prices of the things they buy. But, on the other hand, people in remote areas of the economy, who have not yet received the new money, find their buying prices rising before their incomes. Retailers at the other end of the country, for example, will suffer losses. The first receivers of the new money gain most, and at the expense of the latest receivers.

Inflation, then, confers no general social benefit; instead, it redistributes the wealth in favor of the first-comers and at the expense of the laggards in the race. And inflation is, in effect, a race--to see who can get the new money earliest. The latecomers--the ones stuck with the loss--are often called the "fixed income groups." Ministers, teachers, people on salaries, lag notoriously behind other groups in acquiring the new money. Particular sufferers will be those depending on fixed money contracts--contracts made in the days before the inflationary rise in prices. Life insurance beneficiaries and annuitants, retired persons living off pensions, landlords with long term leases, bondholders and other creditors, those holding cash, all will bear the brunt of the inflation. They will be the ones who are "taxed."

The distributional impact of an inflation generated boom means the chief beneficiaries of inflation policies are the first recipients of new money who constitutes the political agents (politicians, bureaucrats), the politically privileged (welfare beneficiaries) or politically connected economic agents (war contractors, government suppliers, cronies and etc.). Where they spend their newly acquired money on will then serve as entry points to the diffusion of these new (inflation) monies to the economy.

The impact of current series of inflation policies works the same way too, they are meant to benefit, not the economy, but the insolvent banking and financial system of developed nations and their debt dependent welfare states teetering on the brink of collapse. And such policies have partly been engineered to buoy the financial markets (stock markets, bond markets and derivatives markets) because the balance sheets of their distressed banking system have been stuffed or loaded with an assorted mixture of these paper claims.

In the stock market, a similar pattern occurs, early receivers of circulation credit who invest on stock markets will benefit at the expense of the latecomers, usually the retail participants, where at the end of every boom, retail investors are left holding the proverbial empty bag.

As Austrian economist Fritz Machlup wrote,

the money which flows onto the stock exchange and is tied up in a series of operations, need not come directly from stock exchange credits (brokers' loans) but that any "inflationary” credit, no matter in what form it was created, may find its way onto the stock exchange[4]…

Extensive and lasting stock speculation by the general public thrives only on abundant credit[5].

So for as long as the interest rate environment can accommodate an expansion of inflationary or circulation credit, then stock markets are poised for an upside move.

Rotational Dynamics Abroad

The distributional and rotational dynamic can also be seen in the actions of ASEAN-4 bourses where Thailand’s SET has swiftly been closing on the lead of the Phisix on a year to date basis, while Indonesia and Malaysia has yet to get started.

Not only have the rotational effects been manifested in the region but also seem to be percolating around world.

Of the 71 bourses in my radar list, only about 18% have been in the red. The current environment has been the opposite of what we have seen in 2011.

And importantly, similar to the dynamics dynamics in the Philippine Stock Exchange, last year’s laggards have currently been outperforming.

About two weeks ago, the Philippine Phisix took the second spot[6] after Argentina among world’s top performing bourses. Apparently the relative effects of inflation has prompted for a strong recovery for the previous tailenders—such as the BRICs [Brazil, India, and Russia to the exclusion of China whose bourses have been closed for the week in celebration of the Year of Dragon] and developed economies as Germany and Hong Kong as well as a fusion of other nations from developed as Austria to the frontier markets Peru—to eclipse the gains of the Phisix and Argentina.

Central Banking Fueled Inflationary Boom

Financial markets have only been responding to what seems as synchronized efforts to deluge the world with liquidity in the hope that these efforts would lead to a structural economic recovery.

Unfortunately such short term oriented policies will only mask the problems by delaying the required adjustments and at worst, build or compound upon the current imbalances which would significantly increase systemic fragility which ultimately leads to a bubble bust.

Four central banks cut interest rates this week[7] (Thailand, Israel, Angola and Albania) with India paring down on the reserve requirements—mandated minimum reserves held by commercial banks.

Most of the world’s major central banks have been enforcing an environment of negative real rates, where as I have earlier noted, global interest rates reached the lowest level since 2009[8].

Meanwhile the US Federal Reserve recently announced the extension of the incumbent zero interest policy (ZIRP) rates “at least through late 2014”[9] on economic growth and unemployment concerns.

Also US Federal Reserve Chair Ben Bernanke has again been signaling the prospects of the revival of Fed’s bond buying which he said is “an option that is certainly on the table”[10].

In reality, the Bernanke led US Federal Reserve has been using the economy as cover or as pretext to rationalize the funding of what has been the uncontrollable spending whims by US politicians, aside from providing support to the banking system (both the US and indirectly Europe), which serves as medium for government to access financing.

However it would seem that access to financing windows has been closing.

The US debt ceiling, without fanfare, had been raised anew[11], which accounts for the relentless increase in the spending appetite of the incumbent administration.

Next foreign financing of US debts are likely to shrink, perhaps not because of geopolitical issues but because economic developments could alter the current financing dynamics. For instance, Japan’s trade balance posted a deficit for the first time in 31 years[12] and that China’s trade surpluses have been steadily narrowing[13]. China has already been reducing its holding of US treasuries.

If the trade balance of the key traditional financers of the US turns into extended deficits, this would put a cap on funds from Japan and China. Unless other emerging markets will fill in their shoes, and with low domestic savings rate, the US government will be left with the US Federal Reserve as financier of last resort. Of course, the Fed may possibly work in cahoots with other central banks through the banking system to accomplish this.

This only translates to a growing dependency on the printing press for an increasingly debt reliant welfare-warfare based political economic system.

And importantly, monetization of debts would have to be supported by zero bound rates to keep the US treasury’s interest expenditures in check.

So the current debt and debt financing dynamics will imply for a deeper role of the US Federal Reserve. All of which will have implications to markets and the production aspects.

Yet Bernanke’s nuclear option (helicopter drop approach) has palpably become the conventional central bank policy doctrine for global central bankers, specifically for most of developed economies.

There is no better way to show of the unprecedented direction in central bank policymaking than from the aggregate expansion of, in terms of US dollar, the balance sheets of 8 nations (US, UK, ECB, Japan, Germany, France, China and Switzerland) in order to keep the current system afloat.

By such nonpareil actions, there would no meaningful comparisons in modern history (definitely not Japan circa 90s or the Great Depression)

Deflation as Political Agenda and the Fallacy of Money Neutrality

It is important to stress that the mainstream’s obsession with so-called deleveraging process, although part of this is true, operates in an analytical vacuum. For their analysis forgoes the political incentives of the central banks to forestall the markets from clearing. For allowing the markets to clear will translate to a collapse in the current redistribution based political system. Deflation, a market clearing process, is a natural consequence to the distortions brought upon by prior inflationary policies or the boom bust cycle.

The irony is that those who benefit from inflation (government and banks), will be the ones who will suffer from deflation.

As Professor Jörg Guido Hülsmann explains[14],

the true crux of deflation is that it does not hide the redistribution going hand in hand with changes in the quantity of money. It entails visible misery for many people, to the benefit of equally visible winners. This starkly contrasts with inflation, which creates anonymous winners at the expense of anonymous losers. Both deflation and inflation are, from the point of view we have so far espoused, zero-sum games. But inflation is a secret rip-off and thus the perfect vehicle for the exploitation of a population through its (false) elites, whereas deflation means open redistribution through bankruptcy according to the law.

Thus the shrill cry over deflation amounts to nothing more than a front for vested interest groups who insists on pushing forward the inflationism agenda. Yet despite years of ceaseless incantations about deflation, asset markets and economic activities have behaved far far far away from the scenarios deflationists have long been fretting about. To contrary the risks has been tilted towards higher rates of consumer inflation.

I would further add that another mental lapse afflicting mainstream analysts, who embrace the “we inhabit a deflation, deleveraging reality”[15] mentality is that their aggregatism based economic analysis sugar-coats what in reality signifies as largely heuristics or mental short cuts predicated on political beliefs or appeal to acquire readership or catering to the mainstream to get social acceptance.

They believe that money printing by central banks has neutral effects—which means changes in money supply would lead to a proportional and permanent increase in prices that has little bearing on real economic activity as signified by output, investment and employment.

In reality, prices are determined by subjective valuations of those conducting exchanges, given the particular money at hand, the goods or services being traded for and the specific timeframe from which trade is being consummated, thus changes in the supply of money will not affect prices proportionally.

Money is never neutral. Professor Thorsten Polleit explains[16],

What is more, money is a good like any other. It is subject to the law of diminishing marginal utility. This, in turn, implies that an increase in the stock of money will necessarily be accompanied by a drop in money's exchange value vis-à-vis other goods and services.

Against this backdrop it becomes obvious that a rise or fall of the money supply does not confer a social benefit: it merely lowers or raises the exchange value of the money unit. And a change in the money supply also implies redistributive effects; that is, a change in money stock is not, and can never be, neutral.

So even as central banks continue with their onslaught of adding bank reserves at a pace that has never happened in modern history, they believe that such actions will be engulfed by “deleveraging”.

And going back to the “policy trap” or path dependency of policymaking that has been tilted towards inflationism, as said above, the balance sheets of crisis affected financial and banking institutions greatly depends on artificially bloated price levels. And in order to maintain these levels would require continuous commitment to inflationary policies, which means compounding or pyramiding inflation on top of existing inflation. Inflation thus begets inflation.

Again Professor Machlup[17],

An inflated rate of investment can probably be maintained only with a steady or increasing rate of credit expansion. A set-back is likely to occur when credit expansion stops.

And anytime central banks’ desist or even slow the rate of these expansions, this would entail or usher in violent downside volatilities in the marketplace (including the Phisix). Thus “exit strategies” signify no less than political agitprops.

A noteworthy and relevant quote from James Bianco[18], (which includes the chart above)

Until a worldwide exit strategy can be articulated and understood, risk markets will rise and fall based on the perceptions and realities of central bank balance sheets. As long as this is perceived to be a good thing, like perpetually rising home prices were perceived to be a good thing, risk markets will rise.

When/If these central banks go too far, as was eventually the case with home prices, expanding balance sheets will no longer be looked upon in a positive light. Instead they will be viewed in the same light as CDOs backed by sub-prime mortgages were when home prices were falling. The heads of these central banks will no longer be put on a pedestal but looked upon as eight Alan Greenspans that caused a financial crisis.

So how does one know that “expanding balance sheets will no longer be looked upon in a positive light” considering that central banks can elude accounting rules? My reply would be to watch the interest rate price actions, currency movements and prices of precious metals along with oil and natural gas.

No Decoupling, a Redux

Any belief that the Phisix operates separately from the world would be utterly misguided.

2011 should be a noteworthy example.

The Phisix ended the year marginally up while the US S&P 500 was unchanged. Except for the first quarter where the S&P 500 and the Phisix diverged (green oval, where ironically the US moved higher as the Phisix retrenched), the rest of the year exhibits what seems as synchronized actions. Or that based on trend undulations, the motion of the Phisix appears to have been highly correlated with that of the S&P.

While correlation does not translate to causation, what has made the US and the Phisix surprisingly resilent relative to the world has been the loose money policies adapted by the US Federal Reserve. Money supply growth in the US has sharply accelerated during the latter half of the year despite the technical conclusion of QE 2.0.

Not only has such central bank actions partly offset and deferred on the potential adverse impact from the unfolding crisis in the Eurozone, aside from exposing internal weaknesses, monetary inflation has buoyed the US financial markets.

The deferment of recession risks magnified the negative real rates environment in the Philippines and the ASEAN financial markets which has prompted for the seemingly symmetrical moves and the outperformance relative to the world.

My point is that the notion where Philippine financial markets will or can decouple or behave independently from that of the US, or will not be affected by developments abroad, has been baseless, unfounded, in denial of reality and constitutes as wishful and reckless thinking that would be suicidal for any portfolio manager.

Final Thoughts and Some Prediction Confirmations

Bottom line:

Given the added empirical indications of an ongiong an inflationary boom, here and abroad, the current correction phase seen in the Phisix will likely represent a temporary event

The seemingly synchronized actions by global central bankers to lower rates allegedly to combat recession risks will magnify the negative real rate environment that should be supportive of the bullish trend in both the Phisix and the Philippine Peso and also for global markets.

The hunt for yield environment will be concatenated by the debasing policies of central banks of major economies which will likely spur international arbitrages or carry trades.

Before I conclude, I would like to show you some confirmations of my predictions

An inevitable confirmation of my assertion that the actions of central bankers represent as the main drivers of price trends and not chart patterns[19] can be seen in the above chart from stockcharts.com.

The price actions of the US S&P 500 segues from the bearish death cross, which now officially represents a failed chart pattern, that gives way to the bullish golden cross.

Above is another vital confirmation of my thesis against gold bears who claimed that December’s fall marked the end of the bull market[20]. Gold has broken out of the resistance level which most possibly heralds a continuation of the momentum that would affirm the bullmarket trend.

[1] See Phisix: Why I Expect A Rotation Out of The Mining Sector, May 15, 2011

[2] Wikipedia.org Richard Cantillon Monetary theory

[3] Rothbard, Murray N. 2. The Economic Effects of Inflation III. Government Meddling With Money What Has Government Done to Our Money?

[4] Machlup Fritz The Stock Market, Credit And Capital Formation p.94 William Hodge And Company, Limited

[5] Ibid p. 289

[6] See Global Equity Markets: Philippine Phisix Grabs Second Spot, January 14, 2012

[7] centralbanknews.info, Monetary Policy Week in Review - 28 January 2012, Bank of Albania Cuts Interest Rate 25bps to 4.50%

[8] See Global Central Banks Ease the Most Since 2009, November 28, 2011

[9] Bloomberg.com Fed: Benchmark Rate Will Stay Low Until ’14, January 26, 2012

[10] Bloomberg.com Bernanke Makes Case for More Bond Buying, January 26, 2012

[11] See US Senate Approves Debt Ceiling Increase, January 27, 2012

[12] AFP Japan posts first annual trade deficit in 31 years, January 25, 2012, google.com

[13] Bloomberg.com Shrinking China Trade Surplus May Buttress Wen Rebuff of Pressure on Yuan, January 9, 2012

[14] Hülsmann Jörg Guido Deflation And Liberty, p.27

[15] Mauldin John, The Transparency Trap, January 29, 2012 Goldseek.com

[16] Polleit Thorsten The Fallacy of the (Super)Neutrality of Money, October 23, 2009 Mises.org

[17] Machlup Fritz op. cit, p 291

[18] Bianco James, Living In A QE World January 27, 2012 ritholz.com

[19] See How Reliable is the S&P’s ‘Death Cross’ Pattern? August 14, 2011

[20] See Is this the End of the Gold Bull Market? December 15, 2011

Saturday, January 28, 2012

Twitter Yields to Selective Censorship

This is a sad development for social media: The popular Twitter has yielded to selective censorship

From New York Daily News,

Twitter service may be getting spotty in some countries.

The micro-blogging firm announced on the company blog Thursday that it plans to change its censorship policies to comply with different countries' regulations.

"As we continue to grow internationally, we will enter countries that have different ideas about the contours of freedom of expression," the post read. "Some differ so much from our ideas that we will not be able to exist there. Others are similar, but for historical or cultural reasons, restrict certain types of content, such as France or Germany, which ban pro-Nazi comment."

Users' tweets will be blocked in a country where they are against the law, but shown in nations where they are legal. For example, a pro-Nazi tweet may be scrubbed in Germany, but would appear on the user's account if read in the U.S.

When Twitter removes a comment, it says it will clearly mark when a Tweet has been censored and send it to the Chilling Effects Clearinghouse, which is creating a database of tweets deleted not only because of censorship but also as a result of cease-and-desist notices and copyright infringement.

Despite the setback, which I think is part of any struggle for change through attrition, I remain hopeful that internet freedom will prevail.

Chart of the Day: 8 Major Central Bank Balance Sheets as a percent of Global Equity Market Cap

That’s from Bianco Research (Ritholtz.com)

Some noteworthy aspects.

The scale of market interventions by global central banks since 2008 has been unprecedented. The ratio of central bank balance sheet relative to global equity market cap has exploded from about 12% to the current range (25% to a high of 37%).

Since the 2008 interventions, the dollar value of global central bank balance sheets continue to balloon but the appearance of the % decline signifies faster growth in the equity market cap than the former.

And since money enters the economy at certain points and at different times (from the leakages of bank reserves), there will be lagged (delayed) effects from the current round of increased central bank injections.

It is simply astonishing to see the evolving dependency of the price levels of the asset markets and central bank actions.

Quote of the Day: In Liberty, Institutions Matter

However that may be, the main point about which there can be little doubt is that Smith's chief concern was not so much with what man might occasionally achieve when he was at his best but that he should have as little opportunity as possible to do harm when he was at his worst. It would scarcely be too much to claim that the main merit of the individualism which he and his contemporaries advocated is that it is a system under which bad men can do least harm. It is a social system which does not depend for its functioning on our finding good men for running it, or on all men becoming better than they now are, but which makes use of men in all their given variety and complexity, sometimes good and sometimes bad, sometimes intelligent and more often stupid. Their aim was a system under which it should be possible to grant freedom to all, instead of restricting it, as their French contemporaries wished, to "the good and the wise."

The chief concern of the great individualist writers was indeed to find a set of institutions by which man could be induced, by his own choice and from the motives which determined his ordinary conduct, to contribute as much as possible to the need of all others; and their discovery was that the system of private property did provide such inducements to a much greater extent than had yet been understood. They did not contend, however, that this system was incapable of further improvement and, still less, as another of the current distortions of their arguments will have it, that there existed a "natural harmony of interests" irrespective of the positive institutions. They were more than merely aware of the conflicts of individual interests and stressed the necessity of "well-constructed institutions" where the "rules and principles of contending interests and compromised advantages" would reconcile conflicting interests without giving any one group power to make their views and interests always prevail over those of all others.

[bold highlights mine]

The great Friedrich von Hayek, in Individualism and Economic Order, debunked the need for individual reformation—as peddled by mainstream media “I am start [of change]” as a way to progress but is no less than a disingenuous camouflaged way of promoting collectivism predicated on organized and mandated violence—but for people to live in freedom under the parameters of established institutions which protects and advances a system of property rights. [hat tip Professor Pete Boettke]

And a possible enabling factor for this would be the rhetorical, ideological and cultural acceptance by the public or the "Bourgeois Virtues" for such institutions to emerge as Deirdre McCloskey has theorized.

Who Benefits from a US-Iran War?

Writes Professor Michael Rozeff at the lew Rockwell Blog

Which state, the U.S. or Iran, more likely wants a war with the other? It's the side that thinks it benefits from such a war. That side is the U.S. If this war begins, it will be entirely because the U.S. wants it and has decided that the time is right to instigate it or elicit actions from Iran that provide excuses for instigating it. Any U.S.-Iran war will be entirely the doing of the U.S.

Here's how we know this. Iran has nothing to gain because it will lose such a war, its power being so much less than the U.S. This is why Iran has tolerated, so far and to a remarkable degree, the intrusions of U.S. subversions and covert activities in Iran, the assassinations of scientists, the computer disruptions, the embargos, the sanctions, the U.S. warships, the U.S. threats, and the U.S. troops being placed nearby. By contrast, the U.S., in the view of the neoconservatives who are running foreign policy, stands to gain quite a lot, namely, undisputed hegemony over the Middle East, control of a country perched on central Asia, control of oil, support for Israel, and a rise in global dominance more generally. Therefore, when and if such a war starts, no matter by what incidents it is triggered, we can be 100% certain that the U.S. has caused and precipitated this war because it, not Iran, is the state that foresees the benefits of such a war.

There are costs, however, and these are restraining the U.S. from instigating this war at this time. These include war costs of several kinds, since Iran is not a pushover. Iran, if pushed into a war by the U.S., can respond in nearby regions, such as Iraq, Lebanon, Syria, Saudia Arabia, and the Persian Gulf. It can conceivably draw Russia into the war, or perhaps Pakistan. The U.S. will win a war with Iran, but it does not expect an easy win. If it did, it would already have started the war. The war on Libya was a recent warm-up exercise that shows what air power can do in this day and age, but Iran's forces are more formidable.

Like the Iraq war, developments won’t turn out as planned (e.g. Iraq war was thought to be short) and there could be unintended consequences such as more terror activities.

And so when might war break out between the U.S. and Iran? It depends on this balance of costs that the U.S. bears and that depends on actions by Iran. But this is all assuming rationality in the war-making process. It is possible at any time that a leader in Washington or in Israel will cast aside rational calculation and decide that now is the time or the time has come, or make a decision based on some trivial detail or happenstance or incident whose significance he or she mis-estimates. Similarly, it is possible that Iran's leadership will miscalculate or perceive themselves as being backed into a corner where war is the only way out.

The U.S. keeps raising the ante, and that dashes hopes for an eventual peaceful resolution. There is no way that Iran can appease the U.S. If it gives in on one thing, the U.S. will simply demand more and then more and more. The U.S. behavior toward Gaddafi shows what happens when a weak state attempts to cooperate with the U.S. Iran will not do likewise. Its leaders are on record as recognizing U.S. behavior going back for decades. They will not back down. The only hope for a continued standoff is, ironically, that Iran make itself strong enough to deter the U.S. and Israel.

I may add that a war with Iran benefits the US politicians by diverting people’s attention from the problems spawned by present interventionist policies, by rallying people to patriotism in order to get elected, justify the imposition of domestic fascist policies by expanding control over economy, rationalize higher taxation and protectionism, and most importantly, justify inflationary policies for the benefit of both the welfare-warfare state and their cronies.

The seeds to the war on Iran have already been sown. The economic sanctions imposed by Europe, possibly as part of the bailout package with the US, have provoked retaliatory economic policy response from Iran. And upping the ante may just be a trigger away (Middle East version of the Gulf of Tonkin Incident) from unleashing of a full scale war.

Friday, January 27, 2012

Quote of the Day: Knowledge Plus Inequality Equals Progress

The rapid economic advance that we have come to expect seems in large measure to be the result of this inequality and to be impossible without it. Progress at such a fast rate cannot proceed on a uniform front but must take place in echelon fashion, with some far ahead of the rest. The reason for this is concealed by our habit of regarding economic progress chiefly as an accumulation of ever greater quantities of goods and equipment. But the rise of our standard of life is due at least as much to an increase in knowledge which enables us not merely to consume more of the same things but to use different things, and often things we did not even know before. And though the growth of income depends in part on the accumulation of capital, more probably depends on our learning to use our resources more effectively and for new purposes.

The growth of knowledge is of such special importance because, while the material resources will always remain scarce and will have to be reserved for limited purposes, the users of new knowledge (where we do not make them artificially scarce by patents of monopoly) are unrestricted. Knowledge, once achieved, becomes gratuitously available for the benefit of all. It is through this free gift of the knowledge acquired by the experiments of some members of society that general progress is made possible, that the achievements of those who have gone before facilitate the advance of those who follow.

That’s from the great Friedrich von Hayek in the Constitution of Liberty.