It’s is of no puzzle for me to see how the supposed corruption-free ‘good governance’ has been all the while a rigmarole or “smoke and mirrors”.

From today’s headlines at the Inquirer.net:

Former Sen. Joker Arroyo on Sunday accused Malacañang of attempting to deceive the public by lumping him together with 19 senators who received additional pork barrel amounting to P1.107 billion a few months after the Senate voted to convict then Chief Justice Renato Corona last year.Arroyo found it strange that Budget Secretary Florencio Abad would now claim that the former senator’s office received P47 million worth of projects in February, eight months after Corona was ousted by the Senate sitting as an impeachment court.Along with Senators Miriam Defensor-Santiago and Ferdinand Marcos Jr., Arroyo voted to acquit Corona of charges of betrayal of public trust and culpable violation of the Constitution for dishonesty in his statements of assets, liabilities and net worth.

Extending pecuniary favors to political allies from the Senate to the House of Representatives, from another Inquirer headline article:

Members of the House of Representatives received what senators got in extra lump sum funds from the Disbursement Allocation Program (DAP), albeit in smaller amounts.Budget Secretary Florencio Abad said on Saturday that each representative received last year between P10 million and P15 million in DAP, a little known lump-sum budgetary item that pooled savings from unused budgetary items or lower-than-expected expenses of state agencies.“The same accommodation we extended to the senators we also extended to the House representatives,” Abad said in a series of text messages to the Inquirer…In the 15th Congress, there were 285 representatives. If 200 got P10 million to P15 million each, the total amount would be P2 billion to P3 billion.A total of 188 House members (or twice the minimum one-third vote or 95 signatures needed) impeached Corona on Dec. 12, 2011. Some lawmakers complained that Majority Leader Neptali Gonzales II had told them to just put their name on the complaint although they hadn’t read the articles of impeachment against Corona.Two days later, the Senate convened itself into an impeachment court. On May 29, 2012, 20 senators found Corona guilty of betrayal of public trust and culpable violation of the Constitution largely because he was untruthful in his financial declaration.

If true, then the Renato Corona ouster or impeachment of ex-Supreme court Chief justice, has all been about the proverbial “pot calling the kettle black” or ferreting out corruption with corruption or the rewarding of political constituencies with earmarks “extra lump sums” who voted or towed along with the President's desires.

The end of such actions served nothing more than to raise poll rating approvals or populist politics in order to justify the administration’s expansionary government and political control over society.

This is just a validation of what I have been saying about the sham of ‘good governance’ from a new administration.

Commons sense tells me that immense elections expenses will need to be recovered and that the political baggage from assorted horse trading and backroom dealing with different and ideologically opposed political groups will suggest more of the same policies, but with a subtle difference-the distribution of power will be based according to the degree of political debts as perceived by the new leaders.In other words, the only “changes” I expect to see post elections are personalities involved in dispensing public funds and controlling power (and not in the system dominated by cronyism and client-patron relations).

And the Pork barrel has been used as one of THE instruments for “assorted horse trading and backroom dealing” again from another article of mine:

So essentially, the Pork Barrel culture reinforces the patron-client relations from which the Patron (politicos) delivers doleouts and subsidies, which is squeezed from the Pork Barrel projects, to the clients who deliver the votes and keeps the former in power. Hence, the Pork Barrel system is essentially a legitimized source of corruption and abuse of power seen from almost every level of the nation’s political structure, an oxymoron from its original “moralistic” intent (unintended consequences). As the saying goes “the road to hell is paved with good intentions”.

The great the French classical liberal Claude Frédéric Bastiat warned at the Law of the mass delusions espoused by the public on the worship of the state-law-legislature (p.43)

One of the strangest phenomena of our time, and one that will probably be a matter of astonishment to our descendants, is the doctrine which is founded upon this triple hypothesis: the radical passiveness of mankind,—the omnipotence of the law,—the infallibility of the legislator: this is the sacred symbol of the party that proclaims itself exclusively democratic

Unless there will be massive orchestrated and coordinated coverups or whitewashing, expect to see the deepening and broadening of the scandal and a possible dramatic change in the sentiment of "radial passiveness" of domestic politics.

Yet the public should clamor for an independent non-partisan audit on earmarks (Pork barrel) of all incumbent officials (which should include previous tenures or positions) beginning with the highest to the lowest ranking.

But this would signify a Herculean task of cleaning up the Aegean stable that would be met by stiff resistance and would likely extrapolate to a wholesale expose of how filthy the local political system operates.

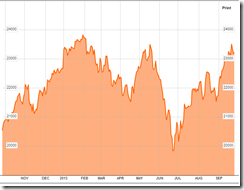

Let me add that should today's inflationary boom be faced with economic reality, then this will compound on political woes endured by this supposed puritanical administration from the unraveling Pork Barrel scam saga.

The Pork barrel scam is really peanuts to the stealth plunder from an inflationary boom which has in fact partly financed the Pork Barrel via zero bound rates