From the Foundation for Harmony and Prosperity (hat tip EPJ)

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Thursday, October 31, 2013

More Signs of China’s Hissing Bubble: Four Biggest Banks Post Biggest Surge in Bad Loans

China’s central bank the People’s Bank of China (PBoC) reportedly suspended reverse repo operations which allegedly led to a spike in China’s interest rate markets as previously discussed here and here.

The other day, the PBoC reportedly re-entered the market but appear to have failed to bring down high rates in the Shibor which has spilled over to the yields of China’s 10 year bonds.

Only stocks (as shown by the Shanghai Index above) responded positively to the PBoC’s intervention with the Shanghai index jumping by 1.48% yesterday.

Today fresh reports indicate why yields have remained high, and why the continued stress in the Chinese interest rate markets despite the PBoC’s interventions: Increasing incidences of souring loans from China’s biggest banks.

From Bloomberg:

China’s top four banks posted their biggest increase in soured loans since at least 2010 as a five-year credit spree left companies with excess manufacturing capacity and slower profit growth amid an economic slowdown.Nonperforming loans at Industrial & Commercial Bank of China Ltd. (601398), China Construction Bank Corp. (939), Agricultural Bank (1288) of China Ltd. and Bank of China Ltd. (3988) rose 3.5 percent in the three months to Sept. 30 from June to a combined 329.4 billion yuan ($54 billion), according to data compiled by Bloomberg News based on third-quarter results. Profit rose to 209 billion yuan.The rise in defaults adds to concerns bank profitability may decline as policy makers seek to trim production at cement makers to paper manufacturers that have gorged on credit since 2008, while urging lenders to build buffers to cover loan losses. China’s biggest state-run banks are trading near record-low valuations as investors brace for a surge in bad debts and slower credit growth.

Interest rate payments soar…

Interest owed by borrowers has risen to 12.5 percent of Chinese gross domestic product in 2013 from 7 percent in 2008, Fitch Ratings estimated in a report last month. The figure may rise to as high as 22 percent by the end of 2017, which could “ultimately overwhelm borrowers,” the agency said.

When the markets begin to question the ability of firms or nations to service their debt/s, where the cost of servicing debt (interest and principal) overcome the profit centers, then confidence to refinance existing bad loans will grind to a screeching halt. This leads to more accounts of bad loans and more bankruptcies.

So the bad loans from the periphery has now reached and exacerbated conditions at the core. As I earlier noted:

Fourth some major Chinese banks have been bruised from the recent losses in the bond markets. With $175 billion of maturing debt in 2014 amidst rising interest rates the S&P warns of an escalation of bad loans. So rising rates have begun to bite on China’s real economy. As to how credit will continue to expand in a system inundated with debt as rates continue climb is like water flowing uphill.

The question now is how policymakers will address this.

So far as of this writing Shibor rates have been mixed, with some maturities going up and while others marginally down. Overall, they have been trading at proximately at recent highs.

Yields of Chinese 10 year bonds at new highs (since 2007), again as of this writing.

If Chinese financial markets unglues or crumbles, will there not be a contagion?

Japanese Government Bonds: The Bank of Japan is swallowing everything

One of today’s peculiar dynamics has been the fantastic rally (falling yields) of Japanese Government Bonds (JGBS). Yields of JGBs, despite the target doubling of BoJ’s balance sheet in 2 years (2013-2015), have almost returned to pre-Abenomics levels.

Ironically, the private sector led by the banks has pared down substantially their JGB holdings. Between March and August the Bank of Japan (BoJ) reports that the major domestic banks, once aggressive buyers, considerably reduced their JGBs holdings by 24% to ¥ 96 trillion, according to a report from Reuters.

JGBs held by non-residents likewise fell in June to Y81 trillion from Y82 trillion. Overseas investor holdings of JGBs likewise fell .4% year on year in June, according to the Mni Market news of the Deutsche Borse.

So with the private sector selling, this leaves the Bank of Japan as the major buyer.

JGB holdings by the BoJ has skyrocketed from pre-Abenomics levels at about ¥ 98+ trillion yen to ¥ 126+ trillion yen or a growth of 25.5%. over the past 6 months. Chart from Japan Macro Advisors.

The Zero Hedge points to the ballooning JGB bubble (bold original)

The Bank of Japan's governor Kuroda proudly told the world "long-term yields are bound to rise at some point, but we can curb it when it happens," and on a grand scale - that is what they have done (for now). But market participants are growing increasingly concerned. As we have warned numerous times, the suppression of 'normal' volatility in teh short-term can only lead to larger uncontrollable moves in the future. As The FT reports, some worry, too, that the BoJ has pushed up JGB prices to the point where interest rates no longer bear any relation to the government’s creditworthiness - "effectively we have removed the light from the lighthouse." Some say the transition has been unsettling as many analysts talk more openly of the risks inherent in what the BoJ is trying to pull off. For one thing, liquidity has evaporated... "volatility looks low now, but if some investors start selling, the impact on the market could be much bigger than expected. That is a big risk."As if to support this view that the Japanese are hiding reality, the US Treasury had some thoughts:

The following are noteworthy quotes from the Financial Times article as cited by the Zero Hedge (bold, italics and underline original)

But some say the transition has been unsettling. Analysts are beginning to talk more openly of the risks inherent in what Mr Kuroda is trying to pull off.For one thing, liquidity has evaporated. Banks that used to be busy making markets for private-sector institutions say they have been marginalised...“If a client asks us to bid it’s easy, as the market is very, very stable,” says one dealer who asked not to be named. “But if a client comes with an offer, it is a problem, as the duration to cover a short position is much longer and no one is offering. The BoJ is swallowing everything.”

While there has been a massively inflating bond bubble orchestrated by BoJ’s Kuroda which has temporarily succeeded to bring down yields, reducing ‘risk free’ collateral from the banking system has its consequence. When markets encounter turbulence or when banks are required by regulators to meet specified capital ratios, the growing lack of supply of JGBs will eventually incite volatility.

So far, the Japanese yen appears to be holding ground, despite the goal of Abenomics to hit 2% inflation target. Yet if the yen fails to break from the current consolidation phase, this likely means that the BoJ’s objectives will founder.

Said differently, whatever short term gains acquired from the recent spike in money supply over the past 6 months, may not be enough, such that this will instead result to a reversal of those gains. Boom will turn into a bust.

So I expect the BoJ to ante up on their means to attain their inflation targets in order to kick the proverbial can further down the road or to avoid an interim bust.

Curiously the chart of the Nikkei and the yen appears to reflect on each other, albeit there has been little signs of symmetry in their (yen-nikkei) flows.

The conditions of the yen and the Nikkei, along with the JGBs will highlight on the whereabouts of the stages of Japan’s inflationism.

Wednesday, October 30, 2013

Quote of the Day: The Difference between a Politican and a Private sector CEO

Some of the president’s most central and important claims about Obamacare are revealed now – and widely admitted – to be wrong. If he were the CEO of a private company he would be sued, publicly lambasted by all the major media, perhaps hauled before an admittedly grandstanding Congressional committee, and possibly prosecuted, convicted, fined, or even imprisoned for fraudulent misrepresentation. But because Obama is a politician, his misrepresentations are excused as simplifying descriptions aimed at persuading the doofus public to fall for legislation that they would not have fallen for had the president described that legislation honestly and accurately.

Politicians typically use noble sounding rhetoric (e.g. "change", "equality") to push for political agendas that serves their interests. Yet they rarely have been accountable for their actions, even in the face of flagrant failures. This gambling away of society's civil liberties, financial and economic resources and social order has largely been a product of the lack of skin in the game.

And in the face of failures, politicians would usually resort to propaganda blitz by shifting the blame elsewhere, hoping that fickle voters will forget. And for as long as politicians can get away with this, they will keep on gambling away society's treasures.

Philippine Economy: The Unseen Factors behind the “Doing Business” improvements

Domestic media and the mainstream cheers on reports of the vast improvements by the Philippines in the Doing Business rankings by the IFC-World Bank.

The Philippines joins other outperformers led by Ukraine, Rwanda, the Russian Federation, Kosovo, Djibouti, Côte d’Ivoire, Burundi, the former Yugoslav Republic of Macedonia, and Guatemala

This article from Rappler gives a good account where the gist of the so-called positive developments has been allegedly made.

Regulatory reforms that helped improve the Philippines' ranking were evident in the following 3 criteria:One, the introduction of a fully operational online filing and payment system that made tax compliance easier for companies.The government has aimed to reduce the number of steps to pay taxes to 14 from the previous 47. The survey showed it still takes 36 steps.Two, the simplified occupancy clearances that eased construction permitting:The government wanted to cut the steps to obtaining construction permits to just 12 from 29. The survey results showed it currently takes 25.Three, the new regulations guaranteeing borrowers’ right to access their data in the country’s largest credit bureau.These were some of the areas the government has created specialized teams for to address each of the 10 indicators on the difficulty or ease of doing business in the country that IFC is tracking.The teams' priorities were on indicators that have to do with starting a business, getting credit, protecting investors and resolving insolvency.

Here I will offer a contrarian analysis (using the great Bastiat's Seen and Unseen analytical framework) of the so-called outperformance in Doing Business rankings based on the areas which posted the biggest advancement.

1. Paying Taxes.

It is natural for the Philippine government to prioritize in the enhancements of tax collections.

That’s because the government has been spending far more than the revenues the government has generated. Data from NSCB and Bureau of Treasury

Yet the increase in the growth rate of government spending has been accelerating to the upside. On the other hand, revenues while also increasing has failed to keep up with the pace of spending growth.

Moreover, while the rate of government spending appears “linear”, revenues has been subject to fluctuations in the economy

The current “boom” has hardly cut back on the budget deficits that had been accrued during the global 2008 crisis.

In 2010, deficits swelled in the aftermath of a sharp decline in tax revenue collections relative to what seems as steady or constant increase in the trend of government spending. The current deterioration of deficits erased the earlier efforts by the past administration to balance the budget.

In addition, according to the Department of Finance, through July year on year growth of revenues was at 17.3% relative to spending at 21.7%. So nominal deficits (-4.4%) at the current rate will likely even deteriorate more if such a trend persists.

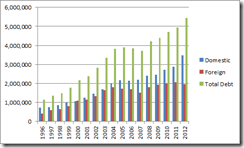

Of course deficit spending unfilled by taxes has been and will be covered by debts. So underneath the surface of a supposed boom has been the swelling of the debt levels.

The government has already been spending a lot more than they can earn, even at pre-Doing Business improvement levels. This means that in contrast to the optimistic perspective, more efficient tax collection will motivate politicians to spend even more. And with bigger government spending, efficient tax collections will extrapolate to higher taxes.

Moreover, money spent for public consumption will mean less money spent for productive activities. Government spending will only add temporarily to statistical growth. In reality, via crowding out of the private sector, government spending diminishes real economic growth. That's because government has no resources to fund any of their spending programs such that the government principally relies on the forcible extraction of savings, output or wealth from the productive agents by taxation. And because government spending cannot be measured by market metrics as they are a monopoly, such spending represent consumption.

So this hardly signifies a positive news over the long term.

2. Construction Permits

In the consensus perspective, ballooning budget deficit and public debt figures when compared to the statistical growth (debt/gdp, deficit/gdp) has been seen as 'stable' or barely viewed as a source of concern.

This is largely because the 'strong' denominator or statistical growth figure (gdp) have “muted” the numerators (debt and deficit).

Such underappreciation of risks has been due to the skewed computation of statistical growth. Yet debts and deficits has largely been driven by the very factors (government spending), aside from the bubbles in the formal economy (nominal private sector debt), constituting statistical growth.

This leads us to the next "big" advance in Doing Business.

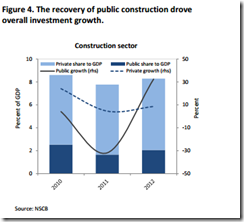

The 2nd quarter 2013 Philippine statistical growth clock came at 7.8%. But when one scrutinizes on the National Statistical Coordination Board data, economic growth emanated from mostly construction and government spending (based on expenditures).

And the construction share of growth includes government spending, where the share of public construction has increasingly added to statistical growth data based on World Bank data

In short, measures to improve regulations in the construction and real estate industry seem as deliberately designed to accommodate a real estate-construction boom in order to boost the statistical economy.

Yet how has the boom in these sectors been funded? Well by credit expansion.

BSP data shows how bank lending to the real estate has exploded since 2010 until 2012

Despite some moderation in the current pace of bank lending, construction and real estate loans remains vastly above “statistical growth”. Of course there has also been the Philippine version of the shadow banking industry.

3. Getting Credit.

The third room for the Doing Business upgrade has been in the partial easing of credit regulations, particularly “guaranteeing borrowers’ right to access their data”

As noted above, the booming areas, specifically real estate and construction and allied industries have mainly been funded by a credit boom

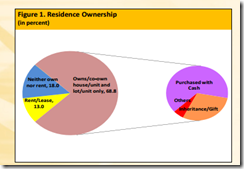

On the consumer side, given that 8 in every 10 households are estimated as unbanked according to the BSP’s annual report…

…and that only 4% of the households have credit cards…

…and where 6.8% of households borrowed money for housing

The above data suggests that “Guaranteeing borrowers’ right to access their data” will hardly be a factor in enticing the informal economy to access the formal banking sector. The average borrower will hardly be concerned about right to access data but rather over access to funds.

True, consumer credit has grown in 2010-2012

…and also through 2013, but they have largely remained below the pace of the supply side growth rate.

Again the so-called “guaranteeing borrowers’ right to access their data” will unlikely boost the overall credit market for the simple reason it does not address the disease: rigid regulations (e.g. AMLA) and taxes that inhibit access to the formal banking system.

Instead “getting credit” will likely buttress the asset speculators, whom have been driving an asset mania, the same entities who have access to the formal banking sector and to the capital markets, as well as, the financiers of these speculative boom.

In short, the credit financed boom has been concentrated to a small sector of the Philippine economy who will benefit from "doing business" upgrade.

Yet in order to maintain current statistical growth levels largely dependent on debt, this means inflating bigger asset bubbles financed by even more ballooning of debt levels. The so-called Doing Business reforms has just facilitated this.

Bottom line: The biggest improvements in the Philippine IFC’s "Doing Business" has hardly been about promoting small and medium scale businesses and or the informal economy

Induced by zero bound rates, the selective easing of regulations essentially compounds on the accommodation by the government of the debt financed speculative binge on asset markets, as well as, debt financed government consumption.

Instead,

ease of paying taxes, construction permits and getting credit only

reinforces the transfer of resources (via inflationism, deficit spending and asset inflation) from society to the political class and their favored allies and constituents

This has been hailed by the short term looking consensus as an ideal growth paradigm.

But as the great Austrian economist Ludwig von Mises warned,

The popularity of inflation and credit expansion, the ultimate source of the repeated attempts to render people prosperous by credit expansion, and thus the cause of the cyclical fluctuations of business, manifests itself clearly in the customary terminology. The boom is called good business, prosperity, and upswing. Its unavoidable aftermath, the readjustment of conditions to the real data of the market, is called crisis, slump, bad business, depression. People rebel against the insight that the disturbing element is to be seen in the malinvestment and the overconsumption of the boom period and that such an artificially induced boom is doomed. They are looking for the philosophers' stone to make it last.

Yet the soundness of such paradigm may soon be tested by the global bond vigilantes

How Wall Street Gamed the TARP

Through a report from a special investigative body appointed by the US Congress, Sovereign Man’s Simon Black explains how Wall Street cronies in cahoots with the US Treasury gamed the $700 billion bailout Troubled Asset Relief Program (TARP)

In the wake of the bailout, Congress created a special position to oversee how the funds were spent. Like anything else in government, they used an unnecessarily long name followed by a catchy acronym–Special Inspector General for the Troubled Asset Relief Program, or SIGTARP.(The first SIGTARP was a former federal prosecutor who had previously indicted 50 leaders of the Revolutionary Armed Forces of Colombia… just the right man to keep a watchful eye on bankers.)SIGTARP just released its quarterly report to Congress… and it’s scatching, suggesting that “the toxic corporate culture that led up to the crisis and TARP has not sufficiently changed.”There are some real zingers in the 518 page report, including:

Soaring stock markets, induced by the Fed's easy money policies, has been part of such implicit bailout-transfers in favor of Wall Street and other cronies

Tuesday, October 29, 2013

Peter Schiff: The Website is Fixable, Obamacare Isn’t

Peter Schiff explains on why Obamacare virtually digs itself into an abyss.

Here is slice from LewRockwell.com

Since Obamacare made its debut, discussions have focused on Ted Cruz’ efforts to defund the law and the shockingly bad functionality of the Website itself. Fortunately for Obama, polling indicates that Senator Cruz has lost, at least for now, the battle for hearts and minds. The President has not been nearly so lucky on the technological front. If current trends continue, the rollout may go down as the worst major product launch in history. But given the government’s enormous resources, it’s safe to say that the site itself will ultimately be fixed. But when it is finally up and running, the plan’s many deeper, and more intractable, flaws will come into focus. That’s when the fun will really begin.Put simply the program is built on a mountain of false assumptions and is covered by a terrain of unanticipated incentives. Any cleared-eyed observer should conclude that it is perfectly designed to raise the costs of care and wreck the federal budget. However, like just about every other complicated problem that bedevils the nation, the public has become far too caught up in the politics and has ignored the horrific details.Most people agree that the plan can only remain solvent if enough young and healthy people (“the invincibles”) agree to sign up. They are the ones who are likely to pay more into the system than they take out. But now that insurance coverage is guaranteed to anyone at any time (at the same price — even after they have gotten sick or injured), the only incentive for the invincibles to sign up will be to avoid the penalty (I think we can dismiss “civic duty” as an effective motivator). But as I detailed in a column last year, Justice John Roberts declared the law to be constitutional only because the penalties are far too low to actually compel behavior. Once young healthy people understand that they can save money by dropping insurance, they will. No amount of slick, cheerful TV ads will change that.The good news for Obama is that the plan will get a large percentage of young people covered. The bad news is that many of those that do sign up will not help the bottom line. The youngest and healthiest of the group are under 26 and will now be able to stay on their parents’ plans. This group will add nothing to the pool of premiums (but will use services). Among those older than 26, the ones who qualify for the largest subsidies will be more inclined to sign up. The way the plan is structured, individuals and families earning between 1.38 and 4 times the Federal poverty level will qualify for a subsidy. The government subsidy covers almost the entire premium for those near the bottom of that spectrum. These individuals will definitely sign up. But just like those under 26, they will be a net drain on the system.From my estimations, private premium contributions don’t surpass the government contributions until an individual or a family makes about 2.5 times the poverty level (which equates to about $28,000 for an individual and $55,000 for a family of 4). Since a very large percentage of young people earn less than that, many will sign up to get the benefit. But these people will likely be net drains to the system as well. Their total premiums paid may be more than the services they receive, but that may not be true when you look only at what they actually pay in.

Read the rest here

More on Russell 2000s Outrageous Valuations

The usual or conventional way to spin or rationalize a bubble is to embellish or sell them as “growth”.

And that’s the way media treats the outrageous valuations of the small cap Russell 2000 which I earlier discussed

And that’s the way media treats the outrageous valuations of the small cap Russell 2000 which I earlier discussed

Media says that since robust revenues from Russell 2000 companies depend on domestic demand, then the booming Russell 2000 heralds a strong economic recovery.

From Bloomberg:

Gains in smaller companies that are more dependent on U.S. growth show investors are betting the world’s largest economy will pick up even after jobs growth slowed and the government shutdown weighed on gross domestic product. Smaller firms are surpassing analyst earnings estimates by more than Dow (INDU) companies and are forecast to grow faster next year….

The average company in the Russell 2000 gets 84 percent of its sales from the U.S. and is valued at $972 million, compared with 55 percent and $152 billion for the Dow, data compiled by Bloomberg show.

And this trend supposedly should support the current bull market.

Smaller companies usually climb faster at the start of a bull market, making them a proxy for future economic activity. The Russell 2000 was up 71 percent in the first six months of the 2009 rally, compared with a 46 percent advance in the Dow. This year’s outperformance is occurring almost five years after stocks started rallying, signaling the economic recovery will accelerate from what has been the slowest rate since World War II….

Small-cap gains of this size have proven prescient in the past. They preceded faster economic growth and a broader stock market advance in 2003 and 1991, and coincided with them in 1979. The Russell 2000’s outperformance in 2003 was at the start of the last equity bull market, when the S&P 500 more than doubled from October 2002 through October 2007. GDP expanded at the fastest rate in four years in 2004.

To be balanced, the article did allot 3 short paragraphs to some critics, but almost the entire article has been framed to convey "bullishness".

For instance, they presented the National Federation of Independent Business’s optimism index which I used last Sunday on the side of the bulls. But if one would note of the actual quote by the NFIB, bullishness has hardly been the message.

Let us put into perspective the article’s allegation that outperforming stocks of smaller companies serves as harbinger to “the start of the bull market”

For instance, they presented the National Federation of Independent Business’s optimism index which I used last Sunday on the side of the bulls. But if one would note of the actual quote by the NFIB, bullishness has hardly been the message.

Let us put into perspective the article’s allegation that outperforming stocks of smaller companies serves as harbinger to “the start of the bull market”

The above represents the 3 year trend of the S&P 500

Based on the chart from bigcharts.com which compares the S&P 500 relative to the Russell 2000 over a ten year period, the Russell 2000’s shocking vertical climb, which has severely outclassed the S&P, seems like a manic episode.

And instead of a “start of the bull market”, the consequence based on past behavior of the RUT-SPX has been the opposite:

Each time the RUT pulls away from the S&P as in the case of 2007 and 2011 (green ellipses), what followed has been significant retracements (2011), if not a bear market (2007).

The same dynamic can be seen in the RUT-Dow Jones Industrials chart.

But there is more…

Notice that the spread—between RUT on the one side relative to the S&P and Dow Industrials—have not only been in an unprecedented widening, but the intensifying variance has also signified unparalleled duration.

In other words, at NO time in the last 10 years have we seen such a massive departure by the RUT vis-à-vis the SPX and the Dow in terms of relative variance of stock price performance for an extended period of time!

So while for the bulls, the above represents "this time is different!", but if past were to rhyme, today’s manic phase suggests of a coming major retrenchment. It's now a question of until when FED policies will be able to extend maintaining such massive imbalances.

Let’s go back to fundamentals…

Again recent surveys has not supported such incredibly wild optimism.

The July survey by Wells Fargo optimism improved (highest since Great Recession) but “recovery has been slow”

However according to an October survey by the Wall Street Journal, small business sentiment has materially deteriorated!

Of 692 business owners surveyed online between Oct. 7 and Oct. 16, 36% said they felt the economy was improving, down from 47% in September. Just 21% said they expect conditions to pick up in the year ahead, down from 30%, according to the survey, which was conducted before Congress reached an agreement on Oct. 17 to reopen federal offices. The survey was limited to firms with less than $20 million in annual revenue.

Overall, the WSJ-Vistage Small Business Confidence Index dropped to 97 from a record-high 105.3 in September, though it is up from 95.3 a year ago. The monthly index is based on survey responses to issues ranging from economic conditions to hiring and spending plans. The index had remained above 100, its baseline score, since February….

A separate survey of more than 600 small and midsize businesses, released Wednesday by the Principal Financial Group, also found that small-business owners are keeping spending tight. While two-thirds of owners said they had surplus capital, 75% said they aren't spending it, the survey found. Most owners blamed the spending slump on health-care costs and the unsteady economy.

So we have a parallel universe, soaring RUT while real business sentiment and activities reflect on apprehensions over the future.

Recent economic data supports these anxieties. Factory output in the US in September reportedly rose less than expected along with a slump in the pending sales of US housing

Recent economic data supports these anxieties. Factory output in the US in September reportedly rose less than expected along with a slump in the pending sales of US housing

From another Bloomberg article:

Factory output rose less than forecast in September and contract signings for U.S. home purchases fell the most in three years, showing the economy was having trouble gaining traction before the government shutdown.

The 0.1 percent advance in manufacturing followed a revised 0.5 percent gain in August that was smaller than initially estimated, figures from the Federal Reserve showed today in Washington. Pending sales of previously owned homes slumped 5.6 percent in September, the fourth straight month of declines, the National Association of Realtors reported.

So how will unimpressive factory output translate to explosive earnings growth for SMEs?

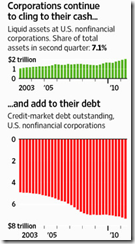

Also non-financial companies hold record cash even as they pile up on debt.

Nonfinancial companies held more than $2 trillion in cash and other liquid assets at the end of June, the Federal Reserve reported Friday, up more than $88 billion from the end of March. Cash accounted for 7.1% of all company assets, everything from buildings to bonds, the highest level since 1963.

So this squares with the October small business survey where “small-business owners are keeping spending tight”.

If small and medium firms have been dithering on capital spending, which should translate to future revenues, I wonder where will small businesses of the Russell 2000 get their profits to justify such stupefying valuations?

If small and medium firms have been dithering on capital spending, which should translate to future revenues, I wonder where will small businesses of the Russell 2000 get their profits to justify such stupefying valuations?

The trouble with fiction... is that it makes too much sense. Reality never makes sense.

Monday, October 28, 2013

Quote of the Day: In democracies the main alternative to majority rule is the markets

In the minds of many, one of Winston Churchill’s most famous aphorisms cuts the conversation short: “Democracy is the worst form of government, except all those other forms that have been tried from time to time.” But this saying overlooks the fact that governments vary in scope as well as form. In democracies the main alternative to majority rule is not dictatorship, but markets

This is from prolific blogger, author and professor Bryan Caplan’s must read The Myth of the Rational Voter

Phisix: The Implication of the US Boom Bust Cycle

We are big fans of fear, and in investing, it is clearly better to be scared than sorry. -Seth Klarman

Stock markets of the US and select developed countries continue with its melt-UP record smashing breakout streak.

This week, the Dow Industrials (not in chart) climbed 1.1% approaching a record while her peers at historic highs also posted gains, particularly, S&P 500 +.88% and the Nasdaq +.74%. The Russell 2000 small cap closed nearly unchanged +.003%.

Outperforming US stocks, this week, relative to emerging markets and against many other developed peers imply that the share of US stocks in terms of market capitalization to the world should be expanding.

However, the flagging US dollar has essentially offset nominal currency gains made by US equities.

Net foreign selling in US equities during the 2nd quarter, which I cited two weeks back[1], represents the second largest in record since the 1990s.

Political bickering theatrics over government shutdown, debit ceiling and Obamacare reportedly prompted for net foreign selling of US assets in August. Net sales of U.S. equities by official holders abroad were a record $3.1 billion, according to a report from Bloomberg[2].

Rising stock markets amidst severe currency strains hardly represents signs of economic strength. Instead such dynamics are manifestations of an escalation of monetary ailment.

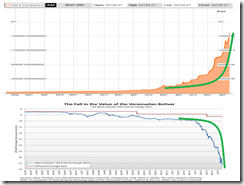

A good example of such extremes can be seen in the unfolding real time currency crisis in Venezuela. The Caracas Index or Venezuela’s stock market benchmark has been in a phenomenal vertiginous parabolic climb—up 347.5% (!!!) year-to-date, this adds to the 2012 gains at 302.81% for a total of 650.31% in one year and ten months (!!!)—as the collapse of the Venezuelan Bolivar[3] as shown via its black market rates steepen.

Ironically, in the face of massive goods shortages or an economic standstill, the increasingly desperate Venezuelan government decrees a Vice Ministry of Supreme Social Happiness[4]. Individual “happiness” will now be substituted for collective “happiness” as perceived and implemented by the political leaders[5].

I know the US is not Venezuela. Japan is not Venezuela too. But all three has exercised the same currency debasement programs, resulting to the same outcomes at varying degrees.

Venezuela which is at the advance stage of a currency crisis, serves as example of what may happen to the US or Japan if political leaders insist proceeding towards such trajectory.

And since the world still depends on the US dollar as main currency for foreign currency bank reserves and as the principal medium for payment and settlements for international financial transactions, despite actions by some nations to wean themselves from the US dollar via currency swaps, bilateral currency trade deals and barter[6], the fate of the US dollar will have significant influence on the direction of the global financial markets.

I would also add that aside from the US dollar, developments in the US financial markets—the largest in the world, for instance, the US stock markets, despite the fall of US market cap relative to the world, remains at 34.6% (as of October 13, 2013) according to Bespoke Invest[7]—will also have big sway on global markets. The meltdown from the perceived tapering by the Fed last May which intensified the actions of the bond vigilantes should be a noteworthy example.

In today’s globalization expect connectivity not just in the web, or telecoms but also in financial markets and economies.

Manipulating Earnings Guidance to Boost Share Prices

When market participants frenziedly bid up stock prices to astronomical levels, the unsustainability of such actions can be established by simple observations.

Again as I pointed out last week, zooming stocks has led to astonishing valuations. The small cap Russell[8] 2000’s PE ratio[9] has been valued at a fantastic 84.51 as of Friday’s close.

Given that the Forward PE has been estimated at 22.5, this means that earnings for the coming year have been expected to explode by a stunning 276%!

However if one were to weigh on the sentiment of small businesses to assess such potentials, a recent survey by small business (conservative lobbying[10]) organization the National Federation of Independent Business (NFIB)[11] seems barely sanguine to justify such valuations (bold mine)

Small-business owner optimism did not “crash “ in September, but it did fall, dropping 0.20 from August’s (corrected) reading of 94.1 and landing at 93.9. The largest contributing factor to the dip was the significant increase in pessimism about future business conditions, although this was somewhat offset by a notable increase in number of small-business owners expecting higher sales

So we have basically a neutral condition unsupportive of wild earnings growth expectations.

The same hold true with Dow Utility. With a trailing PE at 30.89 and forward PE at 16.15 this means that priced at Friday’s close, the drop in forward PE will mean that earnings must jump by 92%!

Aside from bond based share buybacks discussed last week, publicly listed companies “beat earnings estimates” by resorting to lowering guidance[12] has been a major pillar in driving up US stocks.

As one would note, 62.6% of corporations recently beat earnings estimates. Although the positive surprise trend has been on a decline since 2006.

On the other hand, the spread or the variance between positive and negative guidance by companies has been in a deficit since the 3rd quarter of 2011.

In other words, listed firms set easier profit goals which they eventually outperform via “beat estimates”. The positive surprise then spurs higher prices.

In my view this looks like accounting prestidigitation.

Yet negative guidance according to the Factset has been at record levels[13]

For Q3 2013, 89 companies have issued negative EPS guidance while 19 companies have issued positive EPS guidance. If 89 is the final number of companies issuing negative EPS guidance for the quarter, it will mark the highest number of companies issuing negative EPS guidance since FactSet began tracking guidance data in 2006.

Managing earnings expectations in order to “beat the estimates” has usually been a bear market technique used by the management.

According to Investopedia.com[14] “It is one of the analyst's jobs to evaluate management expectations and determine if these expectations are too optimistic or too low, which may be an attempt at setting an easier target. Unfortunately, this is something that many analysts forgot to do during the dotcom bubble.”

The Factset graph also shows that Utilities and Telecoms have had 100% negative guidance changes. In short, these two industries expect materially LOWER profits thus the widespread downscaling of their estimates.

So how on earth will Utility earnings jump by 92%?!

Except for the energy sector, positive guidance has been a scarcity.

Since corporate profits represent a component of the income side of the National Income and Product Account (NIPA) [15], the lowering of profit guidance hardly reflects on a robust economy. This hardly justifies a sustainable upside run of stock market prices.

But again over the interim, rational irrationality may rule.

The other way to look at these: Management of many publicly listed corporations may have purposely been guiding “earnings” expectations down in order to generate “surprises”. Such positive surprise should extrapolate to an increase in (earnings performance based) compensation.

Rewarding executives based on earnings performance has been loaded with agency (conflict of interest) problems

According to an academic paper written by Lan Sun of UNE Business School, Faculty of the Professions[16] (bold mine)

In theory, a link between a CEO's compensation and a firm performance will promote better incentive alignment and higher firm values (Jensen & Meckling, 1976). However, executive compensation contract is an incentive where opportunistic earnings management behaviour is likely to be detected since CEOs are expected to have incentives to manipulate earnings if executive compensation is strongly linked to performance. A substantial literature has emerged to test the relationship between executive compensation and earnings management and has documented that compensation contracts create strong incentives for earnings management…When earnings management is driven by opportunistic management incentives, firms will ultimately pay a price and its negative impact on shareholders is economically significant.

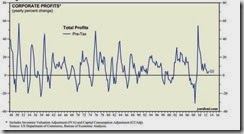

So far, total corporate profits based on y-o-y changes inclusive of Inventory Valuations Adjustments (IVA) and Capital Consumption Adjustment (CCAdj)[17] have chimed with the trend of lowering of profit expectations.

Yet curiously bad news (negative trends), which represents the underlying largely overlooked or ignored real factor of declining trend of profitability or eps growth rate and net income as shown last week, has been seen as good news (by mainly focusing on beat estimates or nominal growth figures or Fed easing)

It’s all about selective perception or picking of information to fit one’s biases or beliefs.

Let’s Keep Dancing: The Intensifying Credit Orgy

In a manic phase of the boom-bust cycle, zooming stocks equals ballooning credit.

Back to the future with exploding leveraged loans and covenant lite bonds, from the Financial Times[18] (bold mine)

Neiman Marcus, the upscale US department store chain, is no stranger to fashion trends. But in the autumn of 2005 the luxury retailer started a very different kind of fad – this time for an unusual new bond structure known as a “payment-in-kind toggle”.Pik-toggle notes, as they became known, gave Neiman Marcus the option to pay its lenders with more bonds instead of cash if the retailer ever ran into financial difficulty. For a company that was at the time being bought by private equity giants TPG and Warburg Pincus, in a leveraged buyout involving about $4.3bn worth of debt, that additional financial flexibility was considered a savvy move….The average amount of debt used to finance LBOs has jumped from a low of 3.69 times earnings in 2009 to an average 5.37 so far this year, according to data from S&P Capital IQ. At the height of the LBO boom, average leverage was 6.05.The $6bn sale of Neiman Marcus to Ares and a Canadian pension fund is expected to leave the retailer with a debt of about seven times earnings.At the same time, more than $200bn of “cov-lite” loans have been sold so far this year, eclipsing the $100bn issued in 2007. That means 56 per cent of new leveraged loans now come with fewer protections for lenders than normal loans.

Regulators have sounded the alarm bells on covenant light loans but the industry group has pushed back saying that loan warnings will hurt the “neediest borrowers”[19]. Such characterizes the rationalization of the mania phase. Echoing the infamous words of ex-Citibank chair Charles Prince during the height of the US housing boom, “For as long as the music is playing, you’ve got to get up and dance. We’re still dancing[20].”

Let’s keep dancing

And when it comes to yield chasing via increased leveraging, the absence of a stamp of approval by credit rating agencies has hardly become a factor to Wall Street’s peddling of Commercial Mortgage Bonds (CMBS). [note credit rating enthusiasts, credit rating warnings ignored by markets]

From the Bloomberg[21]: (bold mine)

Wall Street banks that package commercial mortgages into bonds are forgoing a ranking from Moody’s Investors Service on the riskier portions of the deals, a sign the credit grader isn’t willing to stamp the debt investment-grade amid deteriorating underwriting standards.Moody’s didn’t grade the lower-ranking debt in 9 of the 14 commercial-mortgage bond transactions it’s rated since mid-July, according to Jefferies Group LLC. Deutsche Bank AG (DBK), Cantor Fitzgerald LP and UBS AG (UBSN) are selling a $1 billion transaction this week that doesn’t carry a Moody’s designation for a $64.3 million portion that Fitch Ratings and Kroll Bond Rating Agency ranked the lowest level of investment grade, said two people with knowledge of the deal.Moody’s absence from the riskier securities in commercial-mortgage deals suggests the New York-based firm is taking a harsher view of the quality of some new loans as issuance surges in the $550 billion market, Jefferies analysts led by Lisa Pendergast said in a report last week. Credit Suisse Group AG’s forecast for $70 billion of offerings this year would be the most since issuance peaked at $232 billion in 2007.

Credit bacchanalia has gone global. Booming issuance of high yield (junk) bonds linked to M&A has reached 2007 highs.

From the Financial Times[22]:

A burst of investor “animal spirits” has boosted the value of mergers and acquisitions-related bonds to the highest raised since the financial crisis.Global acquisition-related bond issuance from non-investment grade, or high yield, companies has risen by 15 per cent to $62.9bn for the year to date compared with the same period in 2012.This is the highest amount since 2007, according to Dealogic, the data provider.The surge has been driven by purchases outside the US as non-US acquisition bond issuance nearly tripled to $14.1bn compared with last year, including deals such as Liberty Global ’s $2.7bn issue

High grade corporates likewise reveals of a debt issuance bonanza.

From the Wall Street Journal[23], (bold mine)

According to data provider Dealogic, the $884.3 billion of highly rated corporate bonds sold in the U.S. this year through Wednesday has been the most of any year at that point since 1995, when it began keeping records.October’s rush of supply has helped put 2013 back on track to exceed the record $1.01 trillion issuance seen in 2012.

The accounts above validate my view on the transition process of companies from hedge financing to Ponzi financing.

As I wrote last week[24], (bold original)

So while most publicly listed US companies have yet to immerse themselves into Ponzi financing, sustained easy money policies have been motivating them towards such direction.

The greater the dependence on debt, the more Ponzi like dynamics will take shape.

The Fallacy of Little Screwy People

Record or near record issuance of high yield bonds, commercial-mortgage bonds, covenant lite bonds leverage buyout loans and investment grade bonds constitute signs of liquidity trap? To the contrary it would seem like a tidal wave of money.

Yet most central bankers and the consensus see the former (as if the world exists in some vacuum) to justify direct intervention via QE.

And thus far all these credit easing has failed to accomplish its end.

And we don’t need to heed on the former Fed chief Alan Greenspan’s view[25] about forecasting.

We really can't forecast all that well. We pretend that we can but we can't. And markets do really weird things sometimes because they react to the way people behave, and sometimes people are a little screwy.

And if officials can’t forecast on the consequences of their policies using their econometric models, then why experiment?

Yet it is hardly about people being a “little screwy” but more about people responding to daft experiments imposed on societies as economic policies (US and their multiplier effects worldwide) by ivory tower bureaucrats who hardly knows about real economic relationships except to see them as mechanistic mathematical models, and at the same time, have the impudence to undertake grand trials because they barely have skin on the game.

Moreover policies which punish savings and simultaneously “nudge” the public to wantonly indulge in reckless risk activities leads people to become “screwy”. Bad ideas have bad consequences.

So the cost of their policies will be borne by the average citizenry via restrictions of economic opportunities, financial losses, assuming a bigger burden of financing pet projects of politicians and their bureaucracy, diminished purchasing power and many other non-pecuniary social costs (e.g. erosion of moral fiber, curtailment of civil liberties, social upheaval and etc...)

And these booming credit markets have largely undergirded the financing of the housing or the stock markets bubbles rather than channelled to the real economy for productive activities. The opportunity cost for monetary policy-induced speculation has been the productive sectors, thus the real economy’s growth remains muted or sluggish relative to asset markets.

Monetary inflation has essentially been absorbed by the asset markets. Monetary inflation has spurred massive risk taking, speculative splurge, blatant momentum yield chasing, having been financed by exponential credit growth that has resulted to severe misallocation of resources, blatant mispricing of assets and maladjusted economies.

And such asset bubbles have become international. Thus risks from any unhinging of the bubbles from the US or from any developed economies or even from big emerging markets may likely have a domino effect.

We don’t really need to forecast. All we need is to understand the real economic relationships applied to instituted policies to appreciate the risks.

As the great dean of Austrian economics Murray Rothbard explained[26]: (bold mine)

Economics provides us with true laws, of the type if A, then B, then C, etc. Some of these laws are true all the time, i.e., A always holds (the law of diminishing marginal utility, time preference, etc.). Others require A to be established as true before the consequents can be affirmed in practice. The person who identifies economic laws in practice and uses them to explain complex economic fact is, then, acting as an economic historian rather than as an economic theorist. He is an historian when he seeks the casual explanation of past facts; he is a forecaster when he attempts to predict future facts. In either case, he uses absolutely true laws, but must determine when any particular law applies to a given situation. Furthermore, the laws are necessarily qualitative rather than quantitative, and hence, when the forecaster attempts to make quantitative predictions, he is going beyond the knowledge provided by economic science

[1] See Phisix: Rising Systemic Debt Erodes the Margin of Safety October 14, 2013

[2] Bloomberg.com Foreigners Sold U.S. Assets as China Reduces Treasuries October 22, 2013

[3] Steve Hanke Venezuela The Troubled Currencies Project Cato Institute

[4] Telegraph Venezuela creates Social Happiness ministry October 26, 2013

[5] Happiness See Amidst Hyperinflation, Venezuelan Government Decrees a ‘Happiness’ Ministry, October 27, 2013

[6] See Has the Fed’s Taper Talk induced foreign selling, swap and bilateral currency deals? October 23, 2013

[7] Bespoke Invest US Loses Share to Rest of World October 14, 2013

[8] Russell Investments Russell 2000® Index The Russell 2000 is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership.

[9] Wall Street Journal P/Es & Yields on Major Indexes Market Data Center

[10] Wikipedia.org National Federation of Independent Business

[11] National Federation of Independent Business October Report Small Business Economic Trends

[12] Bespoke Invest Guidance Remains Weak October 24, 2013

[14] Investopedia.com Earnings Guidance: Can It Accurately Predict The Future?

[15] Bureau of Economic Analysis Corporate Profits: Profits Before Tax, Profits Tax Liability, and Dividends

[16] Lan Sun EXECUTIVE COMPENSATION AND CONTRACT-DRIVEN EARNINGS MANAGEMENT ASIAN ACADEMY of MANAGEMENT JOURNAL of ACCOUNTING and FINANCE 2012

[17] Yardeni.com US Economic Indicators: Corporate Profits in GDP, October 26, 2013

[18] Tracy Alloway and Vivianne Rodrigues Boom-era credit deals raise fears of overheating Financial Times October 22, 2013

[19] Bloomberg.com Fed Loan Warning May Hurt Riskiest Borrowers, Trade Group Says October 26, 2013

[20] Deal Book Citi Chief on Buyouts: ‘We’re Still Dancing’ July 10, 2007

[21] Bloomberg.com Wall Street Skips Moody’s as CMBS Standards Slip: Credit Markets October 25, 2013

[22] Financial Times M&A bonds surge to highest in six years October 21, 2013

[23] Wall Street Journal Latest Headlines Low Rates Bring Bond Bonanza October 25, 2012

[24] see Phisix: US Debt Ceiling Deal and UNTaper Spurs a Global Melt UP October 21, 2013

[25] BusinessInsider.com 'YOU JUST LEARNED THIS?!?' — Jon Stewart Struggles To Understand How Former Fed Head Greenspan Missed Wall Street 'Screwiness' October 22, 2013

[26] Murray N. Rothbard, 1. Economics: Its Nature and Its Uses CONCLUSION: ECONOMICS AND PUBLIC POLICY Man, Economy & State