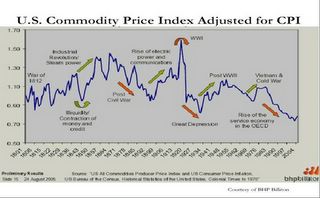

The chart above courtesy of the BHP Billiton shows that in 200 years, the ebbs and flows of commodity price cycle comes in at least a decade with the shortest upswing cycle (inflation adjusted) coming off from the late 60’s to the early 1980’s.

Also noteworthy in the above chart is that today’s newfound uptrend is coming off from a very low base, even as commodity prices may seem to be higher than during the last 5 years.

Economist Julian Simon in his thought provoking book, The Ultimate Resource, showed that commodity prices decreases over the long run mainly due to increased supplies propagated by technological advancement. He made a controversial bet with environmentalist Paul Ehrlich in 1980, predicting that commodity prices (5 of Mr. Ehrlich’s choice) would decline in a decade and won. The chart above affirms Mr. Simon’s argument where commodity prices over the last century were apparently headed lower.

However, Mr. Simon’s theory does not preclude the cyclicality of the commodity price cycle where today’s demand-driven markets have been due to more people gaining access to markets, whereby increasing their standards of living which adds to the collective demand for commodities. While on the supply side, the years of underinvestment has restricted production supplies which has been unable to keep up with surging demand.

Further, to quote analyst Doug Casey of the International Speculator, ``While inflationary policies and wasteful government programs dissipate wealth, they also tend to increase returns on commodities. While the U.S. government is busily manipulating the money supply, my guess is that inflation is not as far below the levels seen in the ‘70s—the highest inflation figures of the last half-century and a trigger for the commodities spikes of 1980—as the Bureau of Labors statistics would have us believe.”

Relative to oil, according to Pierre Lemieux economist at Université du Québec in Outaouais, ``The relative price of oil (in terms of other goods) has fallen by perhaps as much as two-thirds between the 1860s and today. During the same period, the price of oil in terms of salaries has decreased by more than 90%.” Yet if one were to subscribe to Mr. Simon’s and Mr. Lemieux’s arguments of technological advances which leads to abundant supply, why is it the that world appears to be hostaged to or heavily dependent on fossil fuel as to be suffering from the stagflationary effects of exploding oil and energy prices today all over again?

Distortion of market forces by collective governments could be the key answer, namely, inflationary policies, nationalization of oil supplies, the non-transparency of actual reserves and excessive regulations and exploratory restrictions that has obscured investment allocation programs by investors’ public and private alike.

Referring to inflationary policies, Hurricane Katrina’s aftermath has resulted to extraneous and internal pressures on the US Federal Reserve to pause from its tightening policies. The OECD and several US lawmakers have requested the US Federal Reserve to forgo raising rates until a clearer view of the impacts of Katrina could be assessed. Chairman Greenspan could be pressured to accommodate on these politically prompted requests.

As inflation concerns heat up amidst the interest rate debate, we see the gold prices creep higher nearing their 16 year record highs at $449!

Incidentally worldwide demand for gold has been strong up by 14% year on year according to World Gold Council as reported by Reuters while global Jewelry offtake zoomed by 15%. If the momentum persists we could see a new high for gold in the coming weeks or so!

No comments:

Post a Comment