A single seller took it upon the palm of his hands to dictate where the share prices of lepanto are headed for...down! In four consecutive days (since Friday) the seller offloaded or 'dumped' 100 million shares in the market for no apparent logical reason.

Three events transpired during the past month that may or may not have affected the recent selloffs; namely...the labor strike, the rights announcement, and the lawsuit and countersuit filed by both Lepanto and its creditor NM Rotschild.

First the labor strike had been settled.

Second, the rights announcement which was initially disclosed last August 15th appeared to have even generated a good response with Lepanto's share prices recovering until Thursday last week.

Lastly, Lepanto initiated the lawsuit against Rothschild for the latter's intransigence to renegotiate on the hedged portion (forward sales) of Lepanto's gold produce.

I am unaware as to the TRUE rationale behind the sudden 'singlehanded' selloff although the reasons floated "not interested in the rights" or "Rothschild declaration of LC default" are in my opinion, not materially significant to affect Lepanto's mine ownership and operations as to merit such a decline. In short I think the selling has been unwarranted and could be a temporary blip.

Why so?

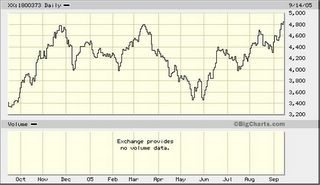

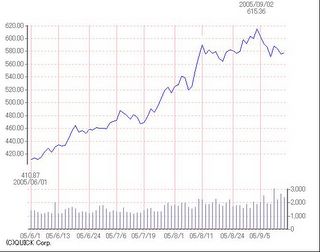

Since prices of underlying commodities mostly determines the bottomline of a mining company (ceteris paribus-all things being equal), rising gold prices should equate to better balance sheets for gold mining companies.

Second, the selloff was not broad based, meaning that other mining companies have not suffered equally shattering setbacks. The odd thing here is that mining companies with operations appear to be taking more damages as they attempt to clean their books compared to speculative dormant companies slated to resume operations soon.

Third, one should not forget that mining investments are primarily valued by its assets or by their proven reserves, it is for this reason why foreign companies buy moribund local mining companies even without operations (e.g. London’s Crew Gold acquisition of Apex Mining).

Lastly, on the issue of lawsuits. Lepanto settled its $30 million liabilities to NM Rothschild last year. Maybe because the management of Lepanto shares my view that gold prices are bound to go up, it became a principal issue for them to resolve on dehedging, as declared during its latest annual stockholders meeting.

According to the PSE disclosure, Lepanto initiated the lawsuit principally because NM Rothschild does not agree to renegotiate the contract whereby the former declared the contract NULL and VOID. In response, NM Rothschild declared Lepanto to be in default. Plainly stated, Lepanto sells to NM Rothschild at $295 per oz when gold prices are above $440 per oz, Lepanto decides to renegotiate, was spurned hence brought its creditor to court.

Even at default, which means a call on the outstanding loans of Lepanto, the company can easily borrow to finance for its liabilities to NM Rothschild and still profit. Remember that $440 per ounce versus $ 295 per oz of forward sales translates to a spread of 49.5%...which means that even if Lepanto borrows to pay off NMRothschild it would still earn over 20% net. However, why borrow when you can sue for leverage? That I think that is what Lepanto did.

Under the context of whether the recent selloff is due to the "stock rights" or to the "lawsuit" (NMRothschild allies/factotums could be the one selling to discourage Lepanto from using its shares as collateral-my two cents), I do not see it as having a significant impact on Lepanto's ownership of the mines as well as its operations, ergo a short term dislocation.

If the stock rights was the issue, tomorrow essentially settles the case, being the ex-date of the said rights. Otherwise, the depletion of securities held by the party engaged in the ‘sabotage’ game plan will determine the true worth of Lepanto’s shares.

Or even Japan's Topix mining index itself. Remember mining economics is fundamentally aggregate; which means based on worldwide demand and supply.

No comments:

Post a Comment