Just as the US and European governments were offering to extend their surplus oil reserves to the hurricane blighted ‘thin-as-a-drum-supply margins’ of the US oil industry, now comes a report in the New York Stock Exchange that publicly listed Rowan Companies , an international and domestic contract drilling services company, announced that ``it has been awarded a term drilling contract by the Saudi Arabian Oil Company ("Saudi ARAMCO") for five Class 116-C jack-up drilling rigs to begin operating offshore Saudi Arabia in early 2006...The contract is for a three-year term and contains options for one additional year. Each rig is currently under contract in the Gulf of Mexico. The relocation of rigs to the Middle East will begin late in the fourth quarter of this year and should be completed by the end of the first quarter of 2006.” reports the yahoo biz news.

The contract according to Businessweek magazine was about 30% to 50% higher than a year ago which means that Saudi Aramco practically outbid the other energy companies from which the rigs are currently located at the Gulf of Mexico.

The $64 billion dollar question is, WHY would Saudi Aramco operate or invest in FIVE OFFSHORE or underwater oil projects in 2006-2009 and NOT ONSHORE rigs when they publicly claimed to have more than sufficient onshore supplies? Would they not prefer to operate on their cheaper oil first? Or are they running out of cheap oil that impelled them go offshore? Hmmm. This development more than meets the eye!

While admittedly Saudi Officials say that ``the Organisation of the Petroleum Exporting Countries will be unable to meet projected western demand in 10 to 15 years.” notes the Financial Times, it appears that the OFFSHORE drilling projects are portentous of LESSER oil supplies relative to demand rather than the oil bear’s claims of growing supplies.

And to consider today’s rig rental rates have surged to $400,000 a day(!!) for the first time according to Bloomberg’s Bruce Blythe for the prized rigs that ``can drill in waters as deep as 10,000 feet (3,048 meters)”. There are only about 20 rigs around the world that has the capacity to drill the deepest waters. For rigs that are designed for waters 5,000 feet (1,524 meters) ``averaged $210,000 (!!) a day during the second quarter, up 57% for a year earlier according to ODS-Petrodata.”

The contract according to Businessweek magazine was about 30% to 50% higher than a year ago which means that Saudi Aramco practically outbid the other energy companies from which the rigs are currently located at the Gulf of Mexico.

The $64 billion dollar question is, WHY would Saudi Aramco operate or invest in FIVE OFFSHORE or underwater oil projects in 2006-2009 and NOT ONSHORE rigs when they publicly claimed to have more than sufficient onshore supplies? Would they not prefer to operate on their cheaper oil first? Or are they running out of cheap oil that impelled them go offshore? Hmmm. This development more than meets the eye!

While admittedly Saudi Officials say that ``the Organisation of the Petroleum Exporting Countries will be unable to meet projected western demand in 10 to 15 years.” notes the Financial Times, it appears that the OFFSHORE drilling projects are portentous of LESSER oil supplies relative to demand rather than the oil bear’s claims of growing supplies.

And to consider today’s rig rental rates have surged to $400,000 a day(!!) for the first time according to Bloomberg’s Bruce Blythe for the prized rigs that ``can drill in waters as deep as 10,000 feet (3,048 meters)”. There are only about 20 rigs around the world that has the capacity to drill the deepest waters. For rigs that are designed for waters 5,000 feet (1,524 meters) ``averaged $210,000 (!!) a day during the second quarter, up 57% for a year earlier according to ODS-Petrodata.”

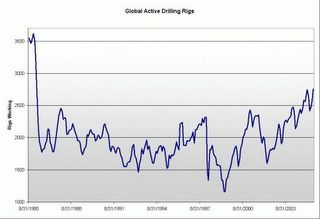

Source: Energy Information Administration

The chart above courtesy of the Elliott Gue’s The Energy letter, shows that drilling activities have scaled to almost 20 year highs! While Oil drilling activities may foreshadow more supplies hence a bearish oil market, coupled with recent data showing US oil supplies above 5 year average, paradoxically, oil prices have continually spiked to fresh record highs. Why? According to Elliott Gue, ``The reason that high inventories and massive drilling activity aren’t pushing prices lower is simple: Demand growth is extraordinarily strong and oil companies are having a very hard time developing new supplies.”

Aside from the global demand which I previously discussed in my previous newsletters, here is another eye opener; the US and the Chinese governments have commenced on stockpiling of more oil!!

According to the recently enacted bill, the Energy Policy Bill of 2005, which President George W. Bush signed last August 8, 2005, the Strategic Petroleum Reserves (SPR) would be increased to 1 billion barrels of oil from the present 700.6 million barrels!

In addition, China’s government is in the process of building its own version of the strategic petroleum reserves, according to Larry Edelson of Safe Money Report, ``China is building its first-ever strategic oil reserves. Indeed, China has already acknowledged it will start pumping the oil into the tanks right away — starting September 1...Just four sites — in Zhenhai, Daishan, Xingang and Huangdao — have the capacity for a total of 100 million barrels. And oil should start flowing into these tanks in just a few days.”

If we are to piece the puzzles together, we find the following interesting developments:

First, Saudi Arabia is diversifying out of its traditional reserves which could well be an impending sign of depletion from its current oil reserves.

Second, despite the tremendous increases in the daily lease rates for oil rigs to record levels, oil companies have shown no let up in the search for oil and energy alternatives. Nonetheless, Saudi Arabia bidded up by about 30% to 50% more in contract prices to secure 5 offshore oil rigs which could again be construed as a sign of desperation??!!

Third, the recently enacted US Energy Policy Act of 2005 signed by President George W. Bush last month signifies the US government’s plan to underwrite additional reserves to the Strategic Petroleum Reserves from 700.6 million barrels to 1 billion barrels or by additional 43%.

Lastly, China has been in the rush to build its strategic petroleum reserves in 4 locations with a capacity of 100 million barrels with oil flowing into these reserves beginning this month.

Question: If oil is believed to be `speculatively high’, what do these major oil players fear from to initiate drastic actions to secure supply at current levels? Hmmmm. Peak Oil Theory perhaps?

If these fundamentals serve as any indications it looks like oil prices aren’t headed any significantly lower anytime soon.

Aside from the global demand which I previously discussed in my previous newsletters, here is another eye opener; the US and the Chinese governments have commenced on stockpiling of more oil!!

According to the recently enacted bill, the Energy Policy Bill of 2005, which President George W. Bush signed last August 8, 2005, the Strategic Petroleum Reserves (SPR) would be increased to 1 billion barrels of oil from the present 700.6 million barrels!

In addition, China’s government is in the process of building its own version of the strategic petroleum reserves, according to Larry Edelson of Safe Money Report, ``China is building its first-ever strategic oil reserves. Indeed, China has already acknowledged it will start pumping the oil into the tanks right away — starting September 1...Just four sites — in Zhenhai, Daishan, Xingang and Huangdao — have the capacity for a total of 100 million barrels. And oil should start flowing into these tanks in just a few days.”

If we are to piece the puzzles together, we find the following interesting developments:

First, Saudi Arabia is diversifying out of its traditional reserves which could well be an impending sign of depletion from its current oil reserves.

Second, despite the tremendous increases in the daily lease rates for oil rigs to record levels, oil companies have shown no let up in the search for oil and energy alternatives. Nonetheless, Saudi Arabia bidded up by about 30% to 50% more in contract prices to secure 5 offshore oil rigs which could again be construed as a sign of desperation??!!

Third, the recently enacted US Energy Policy Act of 2005 signed by President George W. Bush last month signifies the US government’s plan to underwrite additional reserves to the Strategic Petroleum Reserves from 700.6 million barrels to 1 billion barrels or by additional 43%.

Lastly, China has been in the rush to build its strategic petroleum reserves in 4 locations with a capacity of 100 million barrels with oil flowing into these reserves beginning this month.

Question: If oil is believed to be `speculatively high’, what do these major oil players fear from to initiate drastic actions to secure supply at current levels? Hmmmm. Peak Oil Theory perhaps?

If these fundamentals serve as any indications it looks like oil prices aren’t headed any significantly lower anytime soon.

No comments:

Post a Comment