Even prior to the recent improvement seen in the domestic equities market, one industry that has benefited from overseas remittances inflows has been the real estate industry (see January 10 to 14 edition As the Peso rises, Domestic Investment Stocks Lead the Way).

In addition, the prospects of a domestic investment led recovery could augment the industry’s present conditions, (see November 29 to December 30, 2004 Domestic Investment to

Aside, parallel roseate growth prospects from the services sector; particularly, the information and technology, Business Process Outsourcing (BPO) and Business Services Outsourcing (BSO) (see November 14 to 18, 2005 edition, Age Of Internet Boosts Domestic Economic Environment), tourism and the medical services could help churn a ‘critical mass’ to bolster the industry.

Notwithstanding, the recent surge in the prices of soft commodities such as sugar, rice, coffee and other agricultural products could likewise attract sufficient investments that may lead to more demand for properties catering this previously depressed sector, one which has a sizeable impact to the rural population.

Moreover, relative to investment flows, growing regional trade, financial and economic integration could help boost direct or indirect demand for various categories of properties in the country.

Finally, the rising Peso has been providing for a subliminal trigger for local investors to reinvest back into Philippine based assets, as well as, foreign portfolio flows into the country considering a higher yielding currency relative to its traditional favorite safehaven; the US dollar, given the present deluge of global liquidity. Ergo, the Philippine real estate sector could be seen as one channel or beneficiary for possible investment flows from local or foreign investors looking for outsized or above average profits.

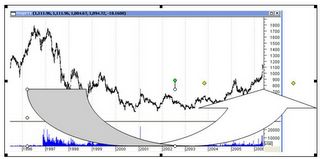

Figure 3: USD/Philippine Peso (blue line) and Philippine Property Index (black candlestick)

As shown in Figure 3 the recent attempts by the USD/Philippine Peso to fall or a rising Peso coincided with a jump in the Philippine Property Index as indicated conversely by the red arrows above, i.e. peak USD/PHP=trough Philippine Property Index and vice versa. In short, somewhat like the Phisix, the Property sector appears to manifest an inverse relationship in its movements with the local currency vis-à-vis the US Dollar.

By the way, the domestic Property bellwether consists of the two major heavyweights such as Ayala Land

I find it refreshing to see the widely followed and respected Canadian independent research outfit, BCA Research, conform to my views. In its latest outlook entitled ``Asia-Pacific Real Estate: Laggard Poised To Outperform”, Bank of Credit Analyst highlights on a possible catch up by Asian real estate markets, writes BCA (emphasis mine)...

``Asia-Pacific real estate markets should catch-up to the global housing boom in the next few years...The 1990s property bubbles in several Asia-Pacific markets have been fully unwound, and real estate in this region is now perking-up anew. However, the recoveries have been very subdued compared with real estate market trends in the rest of the world. This is consistent with history: Asset markets which have experienced a mania and a consequent bust tend to stay depressed for a period and, as a rule, underperform their peers for some time. Looking forward, fundamentals suggest that Asian property markets are set to deliver solid gains in the years to come, outperforming those in the Anglo-Saxon world.”

Figure 4: BCA Research: A Real Estate Boom in Asia-Pacific

While BCA has ostensibly omitted the

Figure 5: Philippine Property Index’s J.LO Bottom

Today, the Philippine Property index is seen advancing towards its 1996 high of 1,793 buttressed by another huge and massive JLo bottom (from 1996 to date) formation, as marked by the blocked arrow.

As of Friday’s close it is about 600 points away from the 1996 target which looks quite realizable over a medium term perspective (1-2 years or even less!).

In short, it is imperative for a Peso based investor (local or foreign) to allocate a significant portion of their portfolio to the said real estate sector to achieve Alpha “outperformance” returns. And to use dips in the market to accumulate.

No comments:

Post a Comment