``I wish I had an answer to that because I'm tired of answering that question.” Yogi Berra, former catcher manager in Major league Baseball

One interesting if not amazing development in the marketplace during the recent markdown was crude oil’s resilience despite the attribution of some $10 to $15 of “speculative” or “terror” premium to the price of oil by conventional or mainstream analysts.

Figure 5 Stockcharts.com: Holding WTIC Crude (candle) amidst financial market turmoil.

As Figure 5 shows, the West Texas Intermediate Crude ($WTIC) benchmark meandered sideways (horizontal blue line) as rising “risk aversion” supposedly reduced or marginalized leveraged positions from the high performance markets as shown by the Dow Jones World Index (declining green arrow).

Could the present developments indicate that the resiliency in oil prices amidst the financial turmoil represents a validation of the Peak Oil theory???

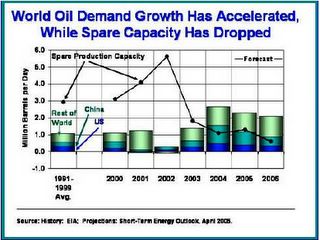

Figure 6 Matthew Simmons: Rising Demand on Declining Spare Capacity

In the face of persistent robust rising demand and supply constraints, (such as dwindling rigs, aging workforces, rusting iron, aging refineries, evaporating cushion, accelerating decline curves, end of technology, low prices that dissipated the once robust industry~Matthew Simmons), as shown in Figure 6, are we then looking at higher oil prices in the immediate future considering a more hospitable inflationary landscape?

Figure 7 Dailywealth: Gold/Oil Ratio: Gold cheaper than Oil

Which brings us to the next premise: could rising oil prices inspire a more animated rally in gold considering that its historical median is about 14 barrels of oil for every once gold, when its present level trades at low of a 8? My probabilistic guess/answer: yes, it would.

No comments:

Post a Comment