``Men are more moral than they think and far more immoral than they can imagine.”-- Sigmund Freud

Any keen observer of President GMA’s State of the Nation Address (SONA) last week would have noted that the ambitiously grandiose programs enumerated were practically a dead giveaway in terms of stock investments for a serious investor over the long horizon.

These projects have been designed to mainly benefit several industries which we have dealt with as part of the unfolding global big picture trend (see November 29 to December 3, 2004 Domestic Investment to Help Drive the Phisix?), particularly domestic infrastructure, agriculture, tourism and energy. The SONA simply highlights the economic potentials of the Philippines and its crucial role to the region and the world, vicious politics aside(!).

Private Sector Initiatives

At an estimated humongous cost of P 290 billion, critics of these programs miss out the fact that, had the domestic financial markets been more developed and pervasive, e.g. bond (municipal or LGUs/Corporate) or commodities market, funding for these programs would have been complimented if not driven by private investments. PGMA herself appears to have overemphasized on the supply-side and glossed over the demand side, possibly espousing John Say’s Law of “Supply creates its own demand.” Knowing such opportunity I would have suggested to her to add infrastructure programs that would enhance the deepening of the domestic capital markets notwithstanding.

We should not forget that global liquidity has been a key driver of the world’s financial markets from which has propelled real economic growth, to quote a recent article from Joanna Chung of the Financial Times (emphasis mine), ``The sudden interest illustrates a broader theme in emerging markets over recent years: the constant hunt by bond investors for extra yield and their willingness to seek it in ever more far-flung locations”. One could expect the search for yields to spill over towards direct investments for as long as these projects are economically viable in an investor friendly environment (unencumbered by rent seeking politicians and the suffocating onus of regulatory tomes).

Regional Investment trends

Moreover, bilateral or regional investments can also help bolster these investments. Recall that Asia holds about $2trillion of surplus foreign exchange reserves, as shown in Figure 1.

Figure 1 IMF: Foreign Exchange Reserves and Share of Capital flows

China has, for one, financed the ongoing North Rail project in Central Luzon, and has aggressively been expanding its exposure worldwide to even remote distances, far flung and highly volatile areas, as Paul Mooney wrote for Yaleglobal, ``Chinese are busy developing much-needed African infrastructure: roads and rail lines in Ethiopia, Sudan, and Rwanda; a new hospital in Sudan; a farm and a bridge across the Nile; reclaiming thousands of hectares of farmland in Tanzania.”

Clearly, China’s foreign policy has been engineered to ensure a steady supply chain of raw materials and commodities for its rapidly growing resource-hungry economy by positioning and investing in resource-rich countries. Put differently, China’s national economic interests dictate a policy towards securing resources by investing in countries abundant with resources regardless of the underlying political conditions.

Moreover, with its teeming foreign exchange reserves, China has embarked on acquiring over 100 oil fields and companies globally in the past 5 years, according to Bloomberg’s Asian analyst Andy Mukherjee.

In short, this ongoing trend to secure supplies to feed and sustain its prevailing economic growth dynamics is likely to continue for a foreseeable future and is likely to translate to more direct investments into the Philippines for similar motivations.

One must not forget that compared to Africa or Latin America, China has some shared history and culture and is geographically closer to the Philippines, hence, would perhaps merit more investment considerations, but with one possible drawback: our close political affinity with the United States (a topic for another time).

And this has not been limited to China, even other emerging countries as India has shown indications of expanding investments for similar incentives.

Figure 2 IMF: Asia Surpluses to Possibly Find its way back home

One development I am betting on is that once this “Bretton Woods II”, or the tacit or implicit “unofficial” US dollar peg adopted by many Asian nations in order to make their currencies cheap to drive on an export-driven economic growth, outlives its usefulness there is that big likelihood that the plethora of excess dollar reserves stacked up in Asian Central Banks would be channeled towards investments within the region as shown in Figure 2. Where instead of supporting the debt-driven US consumption growth engine through indirect subsidies via investments in US assets, mostly in treasuries, Japanese and Chinese reserves would flow as investments within Asia. Then, your great boom comes into being....the Phisix would cross over the 10,000 mark! But of course, such gradient would not come painless though.

And emerging signs of increasing regionalization that would pave way for such realization have been evident; for instance, leaders of the ASEAN community aims to draft a charter next year that would take initial steps to integrate economically ASEAN member countries, according to a report from the Associated Press (emphasis mine), ``A charter for the economic integration of the Association of Southeast Asian Nations, or ASEAN, is being drafted and may be ready by the time Singapore hosts regional heads of state next year, Singaporean Foreign Minister George Yeo said late Tuesday...The creation of a unified ASEAN bloc by 2015 would allow for a free flow of goods, services and human resources across the region, but will not include a single currency system, ASEAN officials say.”

Boom in Agriculture

As per the industries cited, since I have been bullish with gold in 2003 as I had been equally optimistic with soft commodities on the premise of supply inelasticity in the face of growing demand, but on a more subdued degree since agri-based companies make up a lean representation or inventory of publicly listed issues.

As an aside, I think that private sector investments will also continue to effuse towards agri-based industries, despite its endemic volatility, as growing demand may outpace present supplies borne out of a similar theme; the investment cycle~ underinvestments during the past two decade or so.

Future trend dynamics for agriculture will be levered on the growing financial empowerment of resource rich-emerging market population that would uplift consumption trends, unraveling trends of migration to cities or “urbanization”, the continued industrialization of emerging market economies, growing shortages of arable land due to desertification (expanding deserts) and a potential worldwide water crisis, competing demand for energy usage (raw materials inputs) and technological innovation that may spur yield productivity.

Tourism’s Rosy Prospects; Medical Tourism’s Solution to Migrating Professionals

Of course Asia’s vigorous economic growth performance has been a key factor in today’s tourism traffic dynamics. Increasing wealth, burgeoning middle class and growing access to credit has driven growth in the tourism industry.

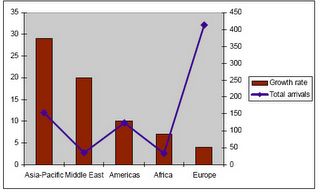

Figure 3 Tourism & Travel Institute: 2004 Positive Growth Rate across all regions led by Asia

For instance, in 2004 around 30 million Chinese (again) took foreign vacations and is likely to reach 100 million in the coming years. According to the World Travel and Tourism Council (emphasis mine),

In terms of demand, growth will double in a decade, ``In World, in 2006, Travel & Tourism is expected to post US$6,477.2 bn of economic activity (Total Demand), growing to US$12,118.6 bn by 2016.”

In terms of growth, `` activity is expected to grow by 4.2% per annum in real terms between 2007 and 2016.”

In terms of capital investment, growth will be expected to also double in 10 years, ``Travel & Tourism is a catalyst for construction and manufacturing. In 2006, the public and private sectors combined are expected to spend US$1,010.7 bn on new Travel & Tourism capital investment worldwide - 9.3% of total investment - rising to US$2,059.8 bn, or 9.6% of the total, in 2016.”

Notwithstanding, the growth prospects of the highly underrated and unappreciated but very lucrative medical tourism industry which according to hotelmarketing.com, ``Medical tourism is growing rapidly, far outstripping the 4 to 6 per cent growth in general travel bookings predicted for 2006, with the number of medical tourist visits to many countries swelling by 20 to 30 per cent a year. The industry in Malaysia, Thailand, Singapore and India, currently worth around half a billion dollars a year in Asia, is projected to generate more than US$4.4 billion by 2012.”

So instead of hollering against medical professionals for leaving overseas over greener pastures and requiring big brother to inhibit or regulate these flows, the proliferation of this medical outsourcing trend should effectively stanch the tide of manpower outflows if given the appropriate incentives to thrive, expand and compete against, note, our very own neighbors. Medical professionals and investors should instead combine to utilize the financial and capital markets to take advantage of this embryonic “hot” growth trend and invest to compete, enrich and retain our workforce. It is savings and entrepreneurship that drives economic prosperity through free markets and not regulations.

In all, the programs cited by the President in her SONA, taken from an apolitical standpoint or perspective, appear to be achievable and come in the light of the present global macro trend dynamics. Under the auspices of a consistent and stable investor friendly regime and politically unfettered market oriented policies, it would seem that the private sector investments could compliment funding or even drive these investment programs. Growing trends of regionalization and economic integration could also be a platform for such investments. In addition, development of the nation’s juvenile capital market infrastructure would essentially buttress these programs.

You want a Stock Market tip? PGMA’s SONA just gave you that list!

No comments:

Post a Comment