``Short the industry which the majority of Harvard Business School want to join.” – Dr. Marc Faber

For most part of this year, global financial markets have played a ‘guessing game’ on the US Federal Reserves’ next move. Since the US is the world’s largest economy, the world’s most important consumer engine, the nucleus of today’s monetary structure, and houses the world’s most important capital markets, present capital flow dynamics have largely been dependent on its evolving developments.

Financial markets, on the other hand, have largely moved in a synchronized fashion based on its underlying economic, financial and political prospects and its projected ramifications to the world. As pointed out in the past editions, particularly with reference to the equities benchmarks, the Philippine Composite index (Phisix), emerging markets and industrialized economies equity bellwethers have acted in unison with special emphasis during the last quarter. For instance, last May’s simultaneous global cross-markets shakeout had been a virulent reaction to jitters of a liquidity crunch emanating from coordinated actions to raise interest rates by global central banks aside from the narrowing windows for arbitrage plays or “carry trades”. Analyses ignoring these underlying trends are missing out the genuine drivers of the present market dynamics.

Today, post-May’s shakeout, the global financial markets appear to be nearsighted if not encompassed by chronic myopia to bid up equity prices in the outlook of a “moderation” of equity markets. Global markets have recoiled back from May’s shakeout low in anticipation of the US Federal Reserves’ interest cycle peak. In other words, the global investing community, which have been addicted to a prolonged period of loose money environment, have come into conclusion that slower economic growth does equity markets well.

The assumption here is that the technology-inspired productivity growth, coupled with low inflation and loose liquidity would allow for higher market multiples, aside from the cash rich US corporate world to go into an investing spree in the near future. Moreover, reactions evinced by the market suggest that it presumes a “soft landing” scenario and discounts the possibilities of a recessionary risk. In short, the market is functioning on a “Goldilocks” environment. With the hope that these anthropomorphic bears won’t turn its beastly selves to devour on Goldilocks!

Of course, under ‘normal’ circumstances this would not have been the case. Slower growth translates in general to lower earnings and multiples, such that price values would adjust accordingly. In addition, under the circumstances where the cash flow abundant US corporate world have restrained themselves from expanding throughout the cyclical recovery period in 2003 to early 2006, what would motivate them to do so under the present milieu considering that the main driver of its economy appears to have stalled?

However, under the backstop of a tidal wave of liquidity or excess money sloshing around in search for marginal returns, signs of renewed stimulus in the form of a rate pause or rate cuts have driven global investors back into a rekindled vigor. Yes, addicts are hyperanimated when shown of the substance that feeds on their ephemeral ecstasy. They are restimulated.

Market consensus view that the “moderating” or an expected “orderly” growth slowdown would compel Bernanke to bring back the “stimulative” environment. I have quoted the world’s savviest Bond maven, Mr. Gross last week on his forecast of a “last Bond bullmarket” as the Fed goes “reflationary”. The view is that as aggregate demand is compressed on a slowdown, inflation will be subdued. The likely outcome based on the consensus view is that under the zenith of the present Fed interest cycle, bond markets will rally, the US dollar will fall, equities will be boosted and Gold and commodities will go on a full blast.

I hope they are right, because a segment of my portfolio has been constructed out of this scenario. However, the consensus is usually wrong during major turning points in the market.

As the Fed decides on August 8th on where its policies are headed for, let us use history as a guide to vet on whether the premises of the consensus expectations are cogent or grounded on flawed apriori inferences.

Figure 1: Economagic: 10-year Treasury (blue) Fed Funds rate (red)

Relative to the bond markets, while in general the Fed funds rate tend to follow actions in the Treasury market rather than Fed funds rate determining the direction of the Bond markets, I have noted in four instances where at the peak of the cycle, the benchmark treasuries jumped over the short term (see arrows) in contrast to market expectations!

With the exception of 1970s, the bond markets mostly declined on recessions. However, under the present inflationary landscape, there is that risk that bond yields may, in contrast to Wall Street expectations, climb as it had in 70s!

Why? Let me quote Peter Schiff of Euro Pacific Capital (emphasis mine), ``Economists are also mistaken in their belief that a weakening economy will counteract inflationary pressures. This overlooks the fact that a weakening U.S. dollar will stimulate demand abroad at the same time it restrains it here at home. So even as Americans consume less, prices will continue to rise as they are forced to compete with wealthier foreigners for scarce consumer goods.”

Put differently, inflation is conventionally deemed as a product of economic growth, which is a misplaced view. Inflation is monetary phenomenon as argued by economist Milton Friedman, such that the expansionary environment of money and credit would find a transmission channels towards demand abroad. Further, the predilection towards the Keynesian fixation on the aggregate demand side of the equation misses out the possible impact on the supply side...a slowdown may induce a reduction of supplies too, which would offset any decline in demand!

Figure 2: Economagic: Tradeweighted US Dollar Index (blue) and Fed Fund Rate (red)

A correlation is a correlation until it isn’t. As shown in Figure 2, the previous peaks in the Fed fund rate had been corollary to vigorous rallies in the US dollar index, as shown by the three arrows. Furthermore, another notable observation is that, except for the 1990 recession, the previous records of growth contractions in the US (red shadow) have spurred a surge in the US dollar Index! This is contrary to market expectations!

Since the present drivers of the directional ebbs and flows of the US dollar index include its intrinsic cash yield premium and the structural deficits, I am inclined to view that the US dollar may continue its downdraft, as the US goes into an interest rate cyclical peak while global central banks maintain steps to close the yield premium spreads. Besides, out of fundamental considerations, imbalances have not been blown out to its present state relative to the past.

But again, the bearish overall sentiment, technical picture (you see a double bottom?) and historical precedence could pose as countervailing risks of a firming dollar. Seeing this broad picture allows me to understand the bet premises of the underrated US dollar bulls.

Again, we see market consensus operating on largely misplaced assumptions.

Figure 3 Economagic: S & P 500 (blue) and Fed Funds Rate (red)

In my May 29 to June 2 edition, (see US Epicenter of Global Market Volatilities), I quoted John P. Hussman, Ph.D. of the Hussman Funds who argued that investors had been sporting rose colored glasses (emphasis mine) in the expectations of high returns in spite of the culmination of the interest rate cycle, ``It doesn't help to argue that the Fed will stop tightening soon, because the end of a tightening cycle has historically been followed by below-average returns for about 18 months.”

The chart in figure 3 reinforces this perspective, the arrows above shows that each time in the past the Fed goes into a cyclical reversal for interest rates, the equity benchmark as measured by the S & P 500 has declined markedly. Again, we see history working opposite to the conventional market expectations. Could this time be “different”?

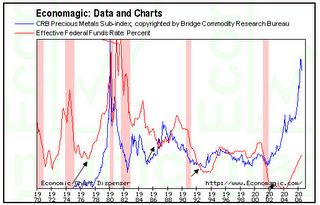

Figure 4 Economagic: CRB Precious Index (Blue) and Fed Fund Rate (Red)

One interesting insight I discovered is that as measure of trends for the Fed fund rate, over the past 35 years, the CRB Precious metal index appears to LEAD it. As shown in Figure 4, the ascension of the CRB precious metal index in the previous 3 cycles, including the present one (see arrows) spawned a hike in the Fed interest rate cycle by a lead time of about 2 years! On the other hand, the crest of the CRB precious metals index has likewise led to reversals in the Fed funds rate by over the same timeframe!

In other words, gold’s price direction could be a meaningful barometer in determining where the future Fed fund rates are headed for, and consequently the global interest rates under the aegis of the US dollar standard system.

For the moment the rallying gold prices could presage a further rise in interest rates over a two year span as Bernanke & Company have been painted to a corner. In the words of analyst Martin Weiss, ``But they're cornered between the unemployment and the inflation. They're fighting two tough wars on two opposite fronts. There's no way they can win both. If they decide to raise interest rates still further, it will be a disaster for the economy. But if they decide not to raise interest rates, it will be a disaster because of run-away inflation.”

In all, as shown in the charts above, the expectations of the market consensus have been mostly on the antipodal side of history. What we see depends on where we stand. While past performances are no guarantee of future outcomes, the present market climate appears to be operating under the predicate of ‘this time could just be different’. I wouldn’t entirely be optimistic on it, since the consensus has been usually wrong during critical junctures, and in most probability they could be wrong again. As German Philosopher Friedrich Hegel once said, ``The only thing men learn from history is that men learn nothing from history.”

Although, in paradox, I have to admit that I am as hopeful that they (consensus) are right this time, so that we won’t be in for nasty surprises. But keep tight those sell stops.

Dear Mr. Te,

ReplyDeleteIf the Fed Reserve decides that this rate pause is only temporary, adn decide to increase rates in the future, how would this affect the present scenario?

Best Regards,

Mr. Du,

ReplyDeleteThis issue has been discussed lengthily in the past. As for the moment the Phisix has been strongly correlated with the movements of Wall Street, implications therein depends on how the US markets respond to perceived Fed activities and its potential ramifications. Second, as noted in the past, I believe that in the long term, interest rates will go up! This implies that indeed a pause and possible rate cuts could simply be a “transition” towards a high interest rate regime. Central Banks around the world have sown the seeds of inflation which has been manifesting itself in assets and now in percolating to government instituted “inflation indexes”. Although, my take is that present financial flow dynamics will eventually transform, from liquidity driven intermarket arbitrage spreads to a “test” on the very foundation of the world’s current monetary structure. Watch Gold.

Regards,