``Nature has given enough to meet man’s need but not enough to meet man’s greed.”-Mahatma Gandhi

I’ve been asked if the strong correlation of US markets and the Phisix still exists. Well, Figure 1 should give us the answer....

Figure 1 stockcharts.com: Phisix, Dow Jones Industrials and Dow Jones World

Correlations may not signify causation as it may well just be coincidental. Yet under the premises of liquidity driven financial markets, the Phisix (red candle) could most likely be “influenced” by mainly the fate of US dollar among other variables, in as much as the latter’s association had been with the US equity markets, represented by the Dow Industrials (black line superimposed) or with the world markets as in the case of the Dow Jones World Index (line-lower panel).

According to the Financial Times, ``US investors bought a record volume of foreign assets in November amid fears of a weakening currency, according to official data released yesterday....The record net $39.1bn (€30bn, £19.8bn) US investors put into foreign assets reflected both fears about the dollar and broader trends, according to Rick MacDonald of ActionEconomics.”

In addition, today’s “globalization” phenomenon, the accelerating trend of the integration of the world’s capital markets greatly enabled by technology, trends towards deregulation and return-seeking behavior borne out of “surplus” capital, as shown in Figure 2, has enhanced this interdependence.

Figure 2: Economist: Global Gusher

As to its main sources of liquidity, the Economist.com explains (emphasis mine), ``First, average real interest rates in the developed world are still below their long-term average. Second, America's huge current-account deficit and the consequent build-up of foreign-exchange reserves by countries with external surpluses has also pumped vast quantities of dollars into the financial system. A large chunk of Asia's reserves and oil exporters' petrodollars have been used to buy American Treasury securities, thereby reducing bond yields. In turn, low bond-market returns have encouraged bigger inflows into higher yielding emerging-market bonds, equities and property, especially in Asia. Liquidity has been further boosted by the use of derivatives, and by carry trades.”

What this implies is that the policy dictates of today’s global central banks have churned out an explosive expansion “capital”. This why as I pointed out last week the world financial markets have massively outgrown GDP. Put differently, you have global banks collectively sowing the seeds of inflation, and these are being transmitted through different channels at varying degrees. As an example, you see them first in the inflation of global asset markets, then spilling over to producer-consumer prices and possibly or eventually to the labor market.

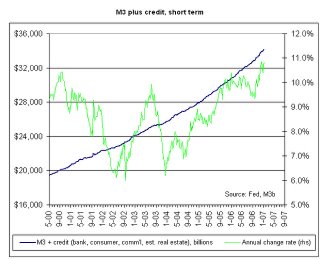

One measure of liquidity is known as the M3, a statistical monetary aggregate, which the US Federal Reserve has discontinued publishing since March of last year based on being “costly”. The M3 basically depicts of the pace of money and credit creation by the FED.

While it is one of the most helpful statistics in monitoring the activities of the FED, it does not completely reveal about the trends in monetary policy. We can use either the Bank Credit or the price of gold as alternative means of tracking such policies. Nonetheless, inflationary policies cannot be hidden from the market. It will eventually reflect upon the diminishing purchasing power of the currency unit which undertakes such policies.

Figure 3: Nowandfutures.com: M3 Reconstructed

The explosive growth of M3+Credit as reconstructed by Nowandfutures.com shown in Figure 3, buttressed by an equally noteworthy acceleration of its rate of change (green line). Could this be the reason why gold (up $7.8 over the week) holds steadfastly at its present levels in the face of a selloff in oil and other metals? One must remember that gold has been in a bull market not only priced in the US dollar but against all major currencies.

Long time favorite analyst of mine John Maudlin brought up a very interesting Christmas carol from American billionaire real estate entrepreneur Sam Zell entitled, “Capital Keeps Falling on My Head”, which was sang to the tune of “Raindrops Keeps Falling on My Head”. You may watch it at http://www.yieldsz.com.

Here is a piece of the song, ``What lies ahead: we're old -- the western world is aging, we'll need income from our pension funds, where's it coming from? The yields we see won't fuel no party... And there's one thing I know -- To get things back to normal it's a long haul that's global. Yields won't improve 'til growth soaks up this liquid freefall. Capital keeps raining on my head. So much is out there that the world is out of whack. When will we see balance back? It's gonna be a long time 'til returns meet expectations. We need to be prepared for slim annuities..."

Mr. Maudlin further comments (emphasis mine), ``“Nothing's worrying me," is how B.J. Thomas ends the original version. That ending keeps playing in my head. Investors cannot be worried by much to look at real estate at 22 times projected future earnings. Or emerging market debt at little more than what you get for US government debt. Yields on all manner of investments have been compressed. How? As Zell says, "Illiquid assets have been alchemized into currency in play competing for returns."

Yes, nothing seems to be worrying the markets today. Yet, Mr. Zell message has been in the same light as ours, but forgets to add that the world is getting deeply more leveraged as increasing amount and rate of leverage are being utilized to squeeze out additional returns.

Gillian Tett of the Financial Times points out of the rapidly accelerating growth trend of ‘Structured Finance’, particular in the Collateralized Debt Obligation (CDO) market, which according to him “could make anybody blink” (emphasis mine)...``According to data released by JPMorgan this week, total issuance of CDOs - repackaged portfolios of debt securities or debt derivatives - reached $503bn worldwide last year, 64 per cent up from the year before. Impressive stuff for an asset class that barely existed a decade ago. But that understates the growth. For JPMorgan's figures do not include all the private CDO deals that bankers are apparently engaged in too. Meanwhile, if you chuck index derivative portfolio numbers into the mix, the zeros get bigger: extrapolating from trends in the first nine months of last year, total CDO issuance was probably around $2,800bn last year, a threefold increase over 2005.”

In another article Mr. Tett relates of how “frighteningly” such leverage multiplies in today’s financial markets (emphasis mine), ``the case of a typical hedge fund, two times levered. That looks modest until you realise it is partly backed by fund of funds' money (which is three times levered) and investing in deeply subordinated tranches of collateralised debt obligations, which are nine times levered. "Thus every €1m of CDO bonds [acquired] is effectively supported by less than €20,000 of end investors' capital - a 2% price decline in the CDO paper wipes out the capital supporting it.”

In essence, today’s market conditions have been increasingly dependent on the continuity of rising asset prices in support of these hastening and deepening trends of liquidity generation via leveraging.

Liquidity has been basically self-reinforcing; the larger the increase in one’s portfolio value, the more the access to larger leverage in order to generate marginal returns. Since extensive competition has driven down returns, low returns necessitate the use of more leverage. And the cycle revolves.

Even as economic fundamentals depict of a prospective downshift, these have been taken to mean as “good” for the financial markets, as Central Banks have been expected to deliver their roles as “financers of last resort”.

Valuations, no matter how high, relative to historical standards have been considered as “cheap”.

Credit spreads between once known as “risky” investment classes and “risk-free” government backed Treasury benchmarks has narrowed to record levels, implying that the degree of risks variance among diverse assets classes has substantially diminished.

Volatility indices are at record lows, suggesting that the world has become less risky!

Any news, either good or bad, has been justified as “good”. It’s been a “Brave New World” of highly leveraged asset-based economies out there! It has also basically been a high-risk low-return approach, where rampant speculation rules!

All these are manifestations of the outgrowth from the inflationary policies thrown to us by global central banks. As the leverage mounts, the risks become increasingly systemic. The world has never encountered such degree of leverage, and exploding growth in innovative financial instruments has not been stress tested.

We could never size up the potential scenario arising from the possible unwinding of this ‘house of cards’. It could be a combination of “debt deflation” and collapse of the faith based paper money system. Unless of course, a miracle occurs and economic growth upends the amount leverage in the system.

So far, the world financial system appears to have the capacity and room to absorb all these yet. Party on!

No comments:

Post a Comment