``Predicting a circumstance can sometimes help prevent its occurrence—if it’s controllable. And most dramatic changes in life, markets and science often occur from circumstances that couldn’t be predicted. And even if they could be predicted, they might not be controllable (earthquakes, torrential downpours). But that doesn’t stop the circumstances’ actors, 24-hour cable pundits or policy makers from explaining pretty much everything away. This is natural, part of our biology. We seek causation. We seek confirming evidence.”-Joshe Wolfe Forbes Nanotech

Political or Economic Democracy?

Let us divert for a while and dabble on the political context of this issue; as we have repeatedly argued, such inflationary actions (such as currency intervention) add to social inequality. While it stands to benefit select industries as ours, the promulgated intent, as advocated by some mainstream experts, of attaining an egalitarian society or social equality using inflationary activities like the above is almost equivalent to the idiom “left hand doesn’t know what the right hand is doing”. The end effect has always been through diminishing business competitiveness, surge in taxes and rising consumer prices.

One has to understand that the major beneficiaries of government inflationary activities are the banking and finance industries, the main conduits of the Fractional Banking Reserve system, and most importantly the political bureaucracy and their associate providers or “special interest groups” (e.g. the alleged doleouts to select local government units and members of the congress by the present Philippine incumbent administration) where they are accorded the privilege of buying freshly printed money with today’s prices while leaving out the public to buy at tomorrow’s much higher prices-mostly in the name of social equity but behind the scenes is all about the perpetuation of power.

Most politicians, regardless of their affiliations, are inclined to idealistic vote generating rhetoric but are disinclined to do corresponding unpopular actions of sound money and policies when in power. And so goes with the majority of media, where controversies and short-term nostrum sells.

Yet most of the leaderships within the bureaucracy are predisposed towards reaction “knee jerk” based solutions. Recent reactions of global Central banks exemplify this. While the recent credit crisis appears to have seemingly abated, the day of reckoning has simply been postponed but should worsen in scale. This will likewise be reflected in the financial markets.

On the other hand, prevalent in the street, in the café or again in media, it appears that everybody else knows how to spend on other people’s money in one form of social program or another, without looking at its unintended consequences. Just watch political discussion programs or editorials, everybody seems to be an expert in forecasting. The irony, is when you put them into the markets to apply their “expertise”, none of them can call it consistently right, if they even can make a majority of accurate calls. So how can a political social improver, who is unable to predict the markets rightly, make a right judgmental call on the adequate balances of a living and dynamic economy with even more variables to reckon with? In the case of the US Federal Reserves, former Chair Greenspan escaped without much blemish, but will it apply to Chairman Bernanke as well?

For others, the role of our political economy has been to redistribute wealth from productive individuals or entities to those devoid of the virtues of savings, hard work, and industry or to political parasites. As they say there are two ways to generate wealth by hard work and savings or by plunder. Unfortunately some suggestions cater to the latter though indirectly.

As we always aver, when economic opportunities are determined by politicians and the bureaucracy instead of the markets, our political economy is then reduced to a game of musical chairs, where the vicious cycle of personality based politics signifies only a symptom of a deeper structural malaise; the lack of respect for a market driven economy. We opt to choose our leaders via political democracy but elect to have our economic choice determined, not by ourselves, but by political leaders, whose operating incentives are far different than ours.

Some Asian nations have shown, like the Hong Kong and

Correlation Does Not Imply Causation

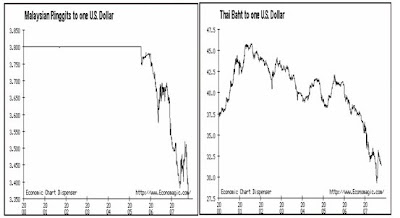

Now back to the financial markets, the perspective that the strength of Peso is required to bolster the Phisix has been tangential as shown in Figure 4.

And in perspective of the past advance cycle in 1986-1997, the Phisix had not been accompanied by an attendant rise of the Peso. Yet, past conditions are unique to the present, unworthy of simplified association.

In short, as we always argue, CORRELATION DOES NOT IMPLY CAUSATION. Although, they may have interlocking relationship somewhere, it COULD NOT BE ESTABLISHED as a textbook case of “cause-and-effect” over the bigger picture. Such attribution requires more evidences of sustained tight correlation over time.

Yet, this similar frame of oversimplified narratives (using different variables) on the Peso’s conditions can be found elsewhere in the mainstream analysis or media reporting, something we will deal with sometime in the future.

No comments:

Post a Comment