``The great enemy of the truth is very often not the lie -- deliberate, contrived and dishonest, but the myth, persistent, persuasive, and unrealistic. Belief in myths allows the comfort of opinion without the discomfort of thought.”-John F. Kennedy

In this issue:

Economics Is About People’s Response To Incentives

Nuclear Option And Inflation’s Uneven Impact

The Normal That Isn’t

An Asian Growth Centric US Dollar Take Down?

The Rueful Inadequate Understanding Of The Inflation Cycle

Mainstream Pollyannas Are Products Of Too Big To Fail Policies

The US Federal Reserve added about $4.272 billion to its US Treasury purchases over the week, according to the Federal Reserve of Cleveland even though it has already reached the $300 billion self imposed quota for its extended Quantitative Easing program.

Also, over the same period, the US central bank added $11.403 billion to its portfolio of mortgage securities with a target of $1.25 trillion by the end of the first quarter of 2010.

Of course, when the US Federal Reserve acquires these securities, which essentially are money from thin air or punched in from the digital press, from mostly private financial institutions (not limited to American institutions), the proceeds of which have most likely been rechanneled into placements or positions in risk asset markets.

This generates momentum trades, where rising asset prices helps repair the besieged or impaired balance sheets of the banking system, as well as, improve on their profitability.

And this is what has been happening today. Bailed out banks as Goldman Sachs, Citicorp and JP Morgan have accrued massive profits in ``trading in stocks, bonds and other financial instruments, and collecting fees for services such as helping companies raise money” (Washington Post)

And here’s the kicker, again from the Washington Post, ``The results have undercut conventional wisdom that the prosperity of banks depends on the prosperity of their customers. Generally, bank profits lag behind economic recoveries as banks wait for people and businesses to start borrowing again. But the federal government has reversed that relationship by investing more than $1 trillion in its efforts to prop up financial markets, seeking to revive the banks as a means of reviving the economy.”

Economics Is About People’s Response To Incentives

“Most of economics”, to quote Professor and author Steven Landsburg, “can be summarized in just four words: People respond to incentives. The rest is commentary.”

So it would seem lamentable to see, hear or read mainstream experts and their adherents to obstinately quibble over theoretical models or indicators as basis for their flawed conclusions, instead of examining the psychological drivers behind the actions of policy makers and the responses by market participants which ultimately is reflected on asset pricing.

Their fundamental assumption is that money from the printing or digital presses have inconsequential impact to people’s behavior (incentives) which applies to money’s purchasing power.

For instance, we keep reading the arguments that boisterously argue of the lack of capacity utilization, unemployment and wages would “suppress” or restrain inflation.

Yet, we know by empirical experience that this hasn’t been true, especially during the extreme episodes. Be it in Zimbabwe, Weimar Germany of the 1920s, Argentina, Brazil or even in the stagflation era of the 70s in the United States, these indicators have failed to predict the outburst of inflation. (see figure 1)

If one would use commodities or precious metals (green line) as benchmark for rampaging inflation during the late 70’s, then rising unemployment (red line) or falling industrial production (widening of the output gap) didn’t stop precious metals (or inflation) from skyrocketing.

It took the burgeoning glut of excess investments which resulted to an oversupply in the commodity markets and the opening of China to the world markets in 1979 aside from the concomitant Federal Chairman Paul Volker experiments (John Tammy on the Paul Volker Myth) on interest rate and money supply policies (PBS Paul Volker interview) to possibly help curb on the speculative excesses brought about by previous “guns and butter” inflationary policies then.

Yet the Washington Post passage appears to be another validation to our oft repeated assertions that the current marketplace reflects on:

1. The severe distortions brought about by colossal government interventions in almost every sphere, which has suppressed pricing signals everywhere. In short, the much avoided phrase: This time is different is very much in operation today…“But the federal government has reversed that relationship…”

Yet the mainstream persevere with reading the bond markets as a manifestation of “deflation worries” when bond markets are being “manipulated” by the US government.

2. The increasing evidences that the Federal Reserve’s goal has been to bolster asset markets (particularly the stock markets).

Stock markets are being used to advance policy goals aimed at reviving the marketplace “animal spirits” confidence or “to prop up financial markets, seeking to revive the banks as a means of reviving the economy.”

In short, the functionality of stock markets has morphed from a leading forward indicator to a policy tool for central banks as “signaling channel” to implicitly communicate policy goals.

This is development continues to confound the mainstream’s mindset.

3. Also, one must be reminded that Ben Bernanke is regarded highly among his international peers as one of the most “qualified” expert on the Great Depression, in the light of his extensive studies on the subject, which has all been premised on the Friedman-Keynesian framework.

Hence, Bernanke’s policies have served as some sort of an instruction manual or toolkit for global central bankers, whose approaches have been nearly been similar and well coordinated.

In short, the current marketplace tells us that global central banks have exercised a “globalization of monetary policies” during the latest crisis, where such collective action has largely been unprecedented in scale and intensity.

Nevertheless, these actions have been highly anticipatory or telegraphed from our point of view.

Nuclear Option And Inflation’s Uneven Impact

4. Federal Policies now implicitly seems directed at the nuclear option of currency devaluation, as path to mitigate the debt load, as we pointed out in Gold: An Unreliable Inflation Hedge?.

This comes with explicit and implicit goals of ensuring the flow of banking activities through the avoidance of massive wave of bank failures by assuming the role of lender, market maker, buyer and investor of last resort via taking equity stakes, by adopting zero interest rates policies which is expected to be extended until inflation gains foothold in the real economy (by the way, inflation as interpreted by the mainstream is higher prices from economic growth) and by fostering an interest spread favorable to ex-US dollar to enhance the incentives for carry arbitrages, by running on large fiscal deficits, by consolidating powers of the Fed to ensure the top-down flow of policy implementation and by the activation, implementation and extension of the Quantitative Easing programs.

To argue that devaluation has limited effects because imports represent only 13% of the US GDP would naively be looking at a single channel for such transmission mechanism.

The money generated from all these programs will likely continue flow into asset markets-stock markets, bond markets (yes record global bond issuance, please see Record Corporate Bond Issuance: Where Did All The Money Go?) and to commodity markets, or will seep or leak outwards, perhaps to the same channels.

The idea that monstrous debt consumer and derivatives will neutralize fiscal policies fallaciously underestimates the unlimited powers of central banking to print $1 for every $1 of liabilities even up to the hundreds of trillions, but at the expense of the purchasing power.

Ultimately, unsustainable debts will either be defaulted upon or inflated with. In short, today’s marketplace would reflect on political goals.

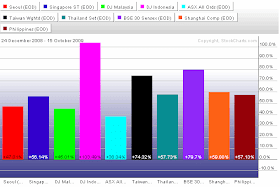

5. The near synchronized fiscal and monetary policies put in place by global policymakers have had distinct results with respect to the national real economy, but have been nearly contemporaneous in terms of the asset markets. (see figure 2)

In contrast to mainstream expectations where global trade have been viewed as myopically confined to mainly a China-US affair, present export or trade dynamics highlights a sharp but defining transition: Asia appears to be trading or exporting more to herself or a strengthening of Asia’s regionalization.

This from Danske Bank: ``The recovery in exports appears to be on track and Chinese imports remain very robust and an important driver for both Asian and global growth. Besides China, South Korea and Taiwan have so far reported September numbers, and they were also better than expected. Looking at the detail, China’s exports have gained across the board, however the strongest gains were for exports to the rest of Asia, particularly the Asean countries and Japan.” (bold highlights mine)

So in defiance to the conventional logic belaboring on the fallacious current account “imbalances”, global policy traction apparently has been cementing its foundations in Asia.

This has stultified several well-known skeptics whom can’t seem to account for why traditional economic indicators haven’t chimed with the strong activities in the asset markets.

The Business Insider takes a mocking view of some of them, however, gloats like these which represent as arrogance or overconfidence, “traditionally” suggests of near inflection points. To repeat traditionalism isn’t today’s playfield.

As the performance chart above, we can generalize that Asian markets have returned by 50%-60% from December 24th of 2008, with a terrific outperfromance by the Indonesia’s JKSE, India, Taiwan, China, Thailand, the Philippine Phisix and Singapore. The laggards have been Seoul, Malaysia and Australia.

The Normal That Isn’t

6. Normal isn’t quite the normal as everybody else seems to expect.

The problem with reading from past performance is to assume that the culminating effect of every detail of the underlying conditions of the previous outcome would be similar today. That simply can’t be true, as the world continues to materially evolve on different circumstances. Hence any conclusion derived from set models presumed to have the same quantified set of inputs would represent “hasty generalization” and would account for as misdiagnosis.

As Mark Twain once said, ``History doesn’t repeat itself-at best it sometimes rhymes”.

The world’s premiere bond guru, the chief honcho of PIMCO Bill Gross believes that the world will undergo a major economic evolution under a “new Normal” as we discussed last September in Not Just A Bear Market Rally For Philippine Phisix or Asia and last May’s Tomorrow’s Investing World According To The Bond King.

Mr. Gross deems that the world will fundamentally be transitioning into a system with diminishing leverage (Delevering), more regulation (Reregulation) and the lesser degree of globalization (Deglobalization).

Essentially Mr. Gross’ lens is viewed from a US centric world.

For us, Delevering will be a function of the groups blighted by the recent bust; that would mean the US and UK consumers and their banking systems, as well as, parts of Europe.

Elsewhere, global governments have intensely been taking up the leveraging slack from these affected areas. In addition, the private sectors of Asia and emerging markets have been doing the same substitution or relevering.

So delevering isn’t quite the delevering in the sense that implies a global dynamic, instead it simply suggests that bubble dynamics have been shifting from bubble bust entities to those unimpaired or least loaded by systemic leverage.

Second, “more regulation” seems like a knee jerk reaction to portray officials as heroically “doing something” to alleviate the crisis.

However, as markets and economies continue to build upon recent gains, some of the proposed “new” regulations or regulatory reforms will likely either be shelved, abandoned or postponed.

In the past, the regulatory lapses came about because of euphoric days. Some call it as the Kool-Aid or “cognitive capture” Factor. According to Econolog’s Prof Arnold Kling, ``regulators were drinking from the same Kool-Aid as the financial executives, believing that new financial instruments had dramatically lowered risk and made the system more stable.”

From our end, the regulator’s prevailing attitude will likely be shaped by “why stop the party?”, or perhaps, they’d probably say, we should “keep the ball rollin!’”-which obviously has been the governing sentiment among today’s global political leaders and their technocratic bureaucracy.

Yet today’s policy triumphalism will be virtually touted as the next Kool Aid elixir. Credit Bubble Bulletin’s Doug Noland eloquently argues along this line,

``The consequences of that bout of policy-induced excess led to a more potent inflationist policymaking elixir in the early-nineties to mop up the financial mess. Since then, ever more emboldened Credit inflation has been required to battle crisis after crisis after crisis. Easy money and Credit – the bane of Capitalism – were allowed to overwhelm the workings of the system. The point of Trillion dollar deficits and zero interest rates has been reached – with the undeterred inflationists now bent on this sorry state of affairs continuing indefinitely. By now, one would hope the inflationists would challenge their own views, doctrines and Mentalities. Instead, they trumpet the same old failed policy responses – only in much larger dimensions and with greater conviction. And that is precisely the flaw in inflationist doctrine: once it gets rolling it becomes extremely painful to rein in the forces pushing for only greater inflation. The more spectacular the inflationary boom and bust - the more strident the inflationists become. History is strewn with enough collapses, worthless currencies and social upheaval that I find it ridiculous that the inflationists would today be taking shots at sound money and Credit. It is the inflationists Clinging to Misguided Monetary Mentalities. The principle of sound money and Credit has no reason to have to defend itself.”

Yes indeed, the principle of sound money and Credit has no reason to have to defend itself!

Lastly, deglobalization won’t probably absolute. The export data from the above reveals of signs of the seismic shifting roles in global trading dynamics.

However, the overall response to last year’s crisis had been 155 temporary tariffs (see table above), worldwide with the US and India taking the lead role.

According to the DLC.org, ``All but three significant trading economies have permanent tariff systems. (Hong Kong and Libya have none; Singapore imposes tariffs only on beer and a local liquor called samsu. ) The World Bank calculates the average worldwide tariff on manufactured goods at about 7 percent, and the average U.S. tariff at about 3 percent.”

For as long as protectionism will remain controlled, deglobalization which had been an initial concern of ours will likely remain in check. Protectionism doesn’t appear to be a viable option given today’s political interest predicated on global integration.

So the New Normal for Mr. Gross would be distant from our version of the new Normal.

But in fairness, Mr. Gross sees of an Asia centric world is part of his reformed new Normal. In September he wrote, ``Asia and Asian-connected economies (Australia, Brazil) will dominate future global growth” and ``The dollar is vulnerable on a long-term basis.”

At least Mr. Gross would be “putting his money where his mouth is”, as his company PIMCO is reportedly working on its ``plans to set up its first dedicated Asian bond fund in Japan in coming months” (Bloomberg)

An Asian Growth Centric US Dollar Take Down?

One would also wonder how a shift in the composition of global trading dynamics would impact the US dollar, if trading transactions will remain invoiced in US dollars, but would increasingly be in the context of non-US trades.

We surmise that one, for as long as global trade doesn’t grow but more of these will account for non US transactions (say Asia’s regional trade) then financing will be conducted in terms of shifts in USD forex reserves.

Second, if US buys more from the world than the world buys from her, then liquidity will be siphoned off and global forex reserves will ebb.

Such liquidity suction will likely provide renewed stress in the global markets and a rally in the US dollar, but at much diminished (no crisis) scale.

Remember the US dollar as the world’s de facto currency reserve needs to provide liquidity not just to America but to the world, if transactions are to be consummated in US dollars.

China’s President Hu Jintao reminded the US in an audience of G-20 leaders in Pittsburg about the role of an international liquidity provider, as quoted by Bloomberg, “Major reserve-currency issuing countries should take into account and balance the implications of their monetary policies for both their own economies and the world economy with a view to upholding stability of international financial markets.”

So the US just can’t export more without draining liquidity from the system.

So far this has not been the case, as China continues to pocket record foreign reserves at $2.273 trillion (Bloomberg) and as global reserves soar to record high-estimated record high at $7.399 trillion (Bloomberg’s Alex Tanzi-Doug Noland)

The same liquidity stress will be accounted for if global trade grows on a platform where the US would have lesser trade participation or significantly reduced share of imports.

Nevertheless if the global growth will be led by an Asian centric world as proposed by Mr. Gross then it would be obvious that there will be a material shift in the manner global trade will be conducted. This, we agree with Mr. Gross will even put pressure further the US dollar.

And the writing is on the wall, it isn’t just foreign private investors reducing their holdings of US dollars, but likewise global central banks in terms of foreign exchange reserves, as discussed in US Dollar Looks Increasingly Like An Orphan 2

According to a Bloomberg report, ``Policy makers boosted foreign currency holdings by $413 billion last quarter, the most since at least 2003, to $7.3 trillion, according to data compiled by Bloomberg. Nations reporting currency breakdowns put 63 percent of the new cash into euros and yen in April, May and June, the latest Barclays Capital data show. That’s the highest percentage in any quarter with more than an $80 billion increase.”

Moreover, Russia and China appears to have reaffirmed their role to conduct energy trades in their respective national currencies. (RIA Novosti)

In addition, Iran declared that it would totally abandon the US dollar as their banking system’s reserve currency (Tehran Times).

True enough in accordance to the Triffin Dilemma, for as long as the US can’t revitalize its role of providing international liquidity cover by expanding deficits, the US dollar will have to lose its role as the sole foreign currency reserve provider.

The Rueful Inadequate Understanding Of The Inflation Cycle

7. In spite of the conventional or frequent use by governments to inflate the system for political reasons, we have expected the public, but not mainstream experts to have a pathetic grasp of the inflation cycle.

Nonetheless, such ignorance can be construed as either sheer political blindness (refusal to accept economic reality due to political dogmatism) or as an attempt to sidetrack or to deceive themselves in the belief in the fables of inflation as a magical economic elixir.

In a speech delivered by Congressman Ron Paul to the US Congress last November, Mr. Paul poignantly thundered, ``If the crisis was predictable and is explainable, why did no one listen? It’s because too many politicians believed that a free lunch was possible and a new economic paradigm had arrived. But we’ve heard that one before--like the philosopher’s stone that could turn lead into gold. Prosperity without work is a dream of the ages.”

Just because rising consumer prices haven’t been reflected in official government statistics, it does not mean that the risks of consumer price inflation is far from occurring or serves as a “clear and present danger”.

The reality is that statistical inflation indices are not only lagging indicators, but also manipulated for political designs, such as reduced payments on the real benefits to welfare recipients.

Nevertheless, the stages of inflation anew from Ludwig von Mises,

``This first stage of the inflationary process may last for many years. While it lasts, the prices of many goods and services are not yet adjusted to the altered money relation. There are still people in the country who have not yet become aware of the fact that they are confronted with a price revolution which will finally result in a considerable rise of all prices, although the extent of this rise will not be the same in the various commodities and services. These people still believe that prices one day will drop. Waiting for this day, they restrict their purchases and concomitantly increase their cash holdings. As long as such ideas are still held by public opinion, it is not yet too late for the government to abandon its inflationary policy.

``But then finally the masses wake up. They become suddenly aware of the fact that inflation is a deliberate policy and will go on endlessly. A breakdown occurs. The crack-up boom appears. Everybody is anxious to swap his money against "real" goods, no matter whether he needs them or not, no matter how much money he has to pay for them. Within a very short time, within a few weeks or even days, the things which were used as money are no longer used as media of exchange. They become scrap paper. Nobody wants to give away anything against them.”

Oil (WTIC) has decisively broken out of its trading range at the $65-$75 level last week.

To argue that the commodity boom hasn’t been as generally been diffused is analogous to claiming to look at an object with blinders on.

The Dow Jones Precious Metals Index (DJGSP) and the CRB appear to be reaching for new higher levels. In the meantime, the Dow Jones-UBS Agriculture Sub-Index (lowest window) is likewise making a belated rally.

While rising metals, energy or other non-food commodities can be less politically sensitive, wait until when surging food prices starts to provoke outcries of hunger from the politically underprivileged!

Soaring food prices will only trigger more political scapegoatism that would prompt global politicians to “curb greedy speculators” by imposing various kinds of price controls that will require more printing press money to offset, but will none the less trigger massive supply shocks in the economic system!

Moreover it is a further illusion that the mainstream harbors that inflation can be pegged at an annual or fixed rate. This technocratic gibberish functions as misleading belief that inflation behaves like some domesticated pet whose actions can be ordered by the master.

If these have been true, then paper currencies would have had a pretty long survival rate or paper monies would have been the predominant monetary standard throughout human history. And hyperinflations would only exist in children’s storybooks or in the imagination of the Austrian Economists.

Yet based on history, such assumption is pure nonsense. As recent example, the Bretton Wood quasi gold standard lived through 1944-1971 or 27 years. The US dollar standard took over the Bretton Woods and is basically 38 years old.

Yet the irony is, if inflation can be controlled then why would the public even talk about the risks of a US dollar crash? Or why then, would global policymakers babble on substituting the US dollar?

The other unfortunate part is the dearth of understanding of the inflation process as a political phenomenon.

Because inflation is a political phenomenon, it means that policies have been enacted to influence or control people’s behavior in accordance to accomplishing specific political goals.

And once the public responds to the expectational changes shaped by the underlying incentives from the new regulatory regime, market dynamics then takes hold by reflecting on people’s responses through pricing channels.

So when Mr. von Mises wrote, ``Everybody is anxious to swap his money against "real" goods, no matter whether he needs them or not, no matter how much money he has to pay for them”, it simply means that the political dynamics have compelled people to rapidly alter their expectations on the utility or the functionality of the currency from which their political economic system operates on.

Now if the regulators or the political leadership can’t make the accurate estimates from which entails an appropriate action that would reshape expectations, the ensuing outcome would be an overshoot-panic or crashes. In short, the loss of faith or credibility on a currency could essentially trigger a run!

In 2008, where everybody went gaga over selling ex-US dollar assets, as global liquidity vaporized, the public responded via panic “flight-to-safety” mode migration to the US dollar. In stark contrast, today’s risk involves the potential for the public to migrate to either foreign exchange* or to real assets!

*this assumes that non currency reserve crisis or presumably if applied to the US dollar, ex-US dollar currencies take countermeasures such as backing their currency with gold.

So managing inflation expectations through so-called inflation targeting suggests that the officialdom knows how people will respond to their policies.

And that’s a supercilious assumption founded on too much confidence, yet it seems plain rubbish.

At the end of the day, measuring inflation will be an exercise of fait accompli.

Mainstream Pollyannas Are Products Of Too Big To Fail Policies

8. The mainstream debate argues about superficiality.

The bears, who argue about the risks of deflation, impliedly argue for more inflation, protectionism and other forms of regulations.

On the hand, the bulls argue about technology gains, organic earnings or economic growth derivative anywhere from the impact of policy stimulus to the resiliency of the US economy as basis for an expected sustainable rise in equity assets.

In my view both camps are quite off tangent.

Since we’ve spent too much time arguing against inflation addicts who brandish the scare crows of deflation, this means that we will deal with the mainstream Pollyanna.

Blind allegiance to presumed resiliency discounts the essence of why the US has been resilient.

Resiliency is an outgrowth of a successful system and not simply out of faith.

The US has been the world’s premier representative of democratic capitalism and of free markets especially during its nascent years.

Austrian Economist Murray N. Rothbard aptly describes America’s proud origins, ``An undeveloped and sparsely populated area originally, America did not begin as the leading capitalist country. But after a century of independence it achieved this eminence, and why? Not, as the common myth has it, because of superior natural resources. The resources of Brazil, of Africa, of Asia, are at least as great. The difference came because of the relative freedom in the United States, because it was here that the free-market economy more than in any other country was allowed its head. We began free of a feudal or monopolizing landlord class, and we began with a strongly individualist ideology that permeated much of the population. Obviously, the market in the United States was never completely free or unhampered; but its relatively greater freedom (relative to other countries or centuries) resulted in the enormous release of productive energies, the massive capital equipment, and the unprecedentedly high standard of living that the mass of Americans not only enjoy but take blithely for granted. Living in the lap of a luxury that could not have been dreamed of by the wealthiest emperor of the past, we are all increasingly acting like the man who murdered the goose that laid the golden egg.” (all bold highlights mine)

Unfortunately historical events appears to have turned the clock of progress backwards, again from Mr. Rothbard, ``The steady decline in the underpinnings of our civilization began in the late nineteenth century, and accelerated during the World Wars I and II and the 1930s. The decline consisted of an accelerating retreat back from the Revolution, and of a shift back to the old order of mercantilism, statism, and international war.” (bold highlights anew)

In short, the US has long transitioned from relative free markets to “corporatist capitalism” from which have been blamed as “failure of free markets”.

This notwithstanding, the onslaught of growth of regulatory codes and the mass expansion of the bureaucracy and government spending, as discussed in Has Lack Of Regulation Caused This Crisis? Evidence Says No.

Moreover, the recent motions by the US government appear to validate Mr. Rothbard’s assessment that will “shift back to the old order of mercantilism, statism, and international war.”

When the curtailment of free trade becomes a popular demand even for ridiculous reasons, then we can expect economic stagnation or underperformance to occur.

The path towards statism today extrapolates to the assumption of greater concentration of risks via centralization or Too Big To Fail. Aside from economic opportunities dispensed as licensing, cartelization or monopolies to favored interest groups via regulation.

In an attempt to “bring back stability” from the recent crisis, the US government has provided a protective mantle to the US banking at the expense of its tax payers.

According to Casey Research, 116 banks account for the 77% of the $13 trillion of assets held by FDIC Insured Institutions.

This is the reason why Wall Street seems agog over the recent rally. It’s not mainly because of traditional fundamentals, from which anybody can use (with various indicators) to justify or fit to their biases or assumed conclusion. It’s because of the optimism provided for by the incentives derivative from recent government actions… the premises of moral hazard.

Perhaps lingering in their subliminal thought “It doesn’t matter how much risk we take, because we know that we’ve got the US government behind us!”

And as David Kotok recently noted, ``Too big to fail is growing – Washington does not know how to stop digging. Markets will like this in the short term, because markets like free lunches and bailout money.”

Academically trained economists, I once expected to have a full grasp of the fundamental operations of how incentives prompt people to respond. It has come to my realization that many of them, operate with cognitive blind spots caused by political or economic ideology or by plain bias for a preferred outcome.

By failing to understand how incentives and not “models or math indicators” drives people’s actions, we tend to misdiagnose problems by underestimating how people will likely respond. Yet with wrong analysis follows wrong prescriptions and or wrong actions. As market participant, my proclivity is to gravitate towards the high percentage of success in both analysis and market action.

Anyway, the last word from Professor Kenneth Rogoff in a recent interview,

``We’ve created the mother of all moral hazard problems. We have deposit insurance writ large, everything is insured. Even if the government backs away from it, it has no credibility. This idea that we’ll get rid of too-big to fail banks and we’ll be OK — that’s nuts because a really big bank is only going to fail if there’s a systemic crisis. But if there’s a systemic crisis a lot of little banks are going to fail too, and it’s not credible that your going to let so many little banks go. The government needs to have much stronger regulation on short-term borrowing to try to prevent the short-term leverage buildups that the financial system tends to gravitate towards. That’s a recurrent theme across most of the crises that we looked at. There’s a huge build-up of short-term leverage somewhere in the system — could be consumers, corporates, the government — and it gives this false sense of profitability and sustainability that collapses when confidence is lost.” (bold highlights mine)

No comments:

Post a Comment