First of all I’d like to thank Mr. Kristjan Lepik for his patronage and on adding his priceless thoughts on Estonia.

Mr. Lepik writes,

``Estonia has taken a rather different crisis-management approach than Western world (US, Western Europe et al) – no government stimulus, very low government debt (only around 10% of GDP) and no bailouts. Therefore the steep GDP drop in 2009 (around -15%), if US would have no stimulus or bailouts, the GDP would be surely negative as well.

``I think that Estonia has taken the quick and painful way, whereas a lot of countries have gone the route which may be more painful in the end – big budget deficits must be paid back at some point (probably higher taxes globally).

``I was really negative about Estonia’s outlook in 2006 (as you all know, that is not a popular thing to do), the economy overheated badly. But the normalizing process has been very effective after that, gross wages have dropped around -20%, asset prices around -60%. That surely is not a pleasant process but it is helping to restore Estonia’s competitive advantage.

``The recovery will probably not be not that quick in Estonia, the normalizing process is still ongoing and unemployment has reached 15%. But looking at the macro picture, Estonia looks pretty good (should I use the term “sane” here?) compared to most of the World.”

It may be true that the normalization in Estonia could take awhile as resolving high degree of overindebtedness could pose as significant drag to economic growth as shown by the charts below by the IMF.

From the IMF

Nevertheless, I’d be more optimistic than the IMF or of the mainstream, since they would naturally be more cynical or skeptical of the Estonia's unorthodox or unconventional approach, in a world where government intervention is seen essential or as a standard.

Although I usually refrain (and equally disdain) from making comparisons with past models, my guess is that a free market resolution would have more meaningful relevance than from an interventionist approach.

What truly distorts or impedes a market from delivering its inherent process of clearing the previously established malinvestments are further interventions. And since a free market approach would have less distortions, they are likely to elicit more “similarities” or parallelism.

And on that note, the US depression of 1920-1921 experience should pertinent.

Economist Bryan Caplan in a paper on the US 1920-1921 depression wrote of how events unfolded then,(bold emphasis mine)

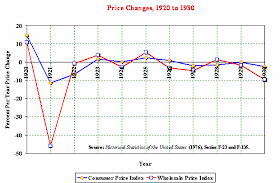

``In one crucial respect, the depression of 1920-21 was actually more severe than the Great Depression itself: there was a rapid decline in the price level of between forty and fifty percent within the course of a single year. As Friedman and Schwartz (1963) explain, “From their peak in May [1920], wholesale prices declined moderately for a couple of months, and then collapsed. By June 1921, they had fallen to 56 per cent of their level in May 1920. More than three-quarters of the decline took place in the six months from August 1920 to February 1921. This is, by all odds, the sharpest price decline covered by our money series, either before or since that date and perhaps also in the whole history of the United States.” (1963, pp.232-233.) The wholesale price index during the Great Depression took about three years to fall by the same amount.

``Employment and output were however not as severely affected as in the Great Depression. Of course precise unemployment data are not available for this period, but one representative estimate (Lebergott, 1957) puts civilian unemployment at 2.3% in 1919, 11.9% in 1921, and back to 3.2% in 1923. Output figures tell a similar story: one aggregate index (Mills, 1932) indexes production at 125.3 in 1919, 99.7 in 1921, and rebounding to 145.3 in 1923. As these stylized facts indicate, the second unusual feature of the depression of 1920-21 was the rapid recovery in employment and output, in sync with a swift adjustment of the real wage to its new equilibrium position. …”

Some charts from EH.net

In other words, a market based adjustment that had been swift and drastic translated to equally a rapid and dramatic recovery in 1920-1921.

And why this should come about?

Austrian economist Robert Murphy provides as a possible answer,

``After the depression the United States proceeded to enjoy the “Roaring Twenties,” arguably the most prosperous decade in the country’s history. Some of this prosperity was illusory—itself the result of subsequent Fed inflation—but nonetheless the 1920–1921 depression “purged the rottenness out of the system” and provided a solid framework for sustainable growth."

When rottenness is purged out of the system, then the recovery is likely to be relatively more robust and sustainable since the economy should reflect on market dynamics than from artificial foundations.

We end with a quote from President Warren Harding’s inaugural speech in 1921 which dealt with the crisis, (all bold highlights mine)

``We must face the grim necessity, with full knowledge that the task is to be solved, and we must proceed with a full realization that no statute enacted by man can repeal the inexorable laws of nature. Our most dangerous tendency is to expect too much of government, and at the same time do for it too little. We contemplate the immediate task of putting our public household in order. We need a rigid and yet sane economy, combined with fiscal justice, and it must be attended by individual prudence and thrift, which are so essential to this trying hour and reassuring for the future.…

``The economic mechanism is intricate and its parts interdependent, and has suffered the shocks and jars incident to abnormal demands, credit inflations, and price upheavals. The normal balances have been impaired, the channels of distribution have been clogged, the relations of labor and management have been strained. We must seek the readjustment with care and courage.… All the penalties will not be light, nor evenly distributed. There is no way of making them so. There is no instant step from disorder to order. We must face a condition of grim reality, charge off our losses and start afresh. It is the oldest lesson of civilization. I would like government to do all it can to mitigate; then, in understanding, in mutuality of interest, in concern for the common good, our tasks will be solved. No altered system will work a miracle. Any wild experiment will only add to the confusion. Our best assurance lies in efficient administration of our proven system.”

We hope that the success of Estonia's model will lead the world the way.

Very good post!

ReplyDeleteI agree completely!