Ellen Brown thinks hyperinflation is a bogus theory, she writes...(bold emphasis mine)

``So long as workers are out of work and resources are sitting idle, as they are today, money can be added to the money supply without driving prices up. Price inflation results when “demand” (money) increases faster than “supply” (goods and services).”

Let’s take her assumptions and apply it to Zimbabwe (all colored charts courtesy of indexmundi.com)

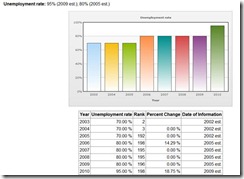

Checklist number 1: Zimbabwe has 95% unemployment rate (idle workers)

Checklist number 2: Zimbabwe has also seen a successive collapse of GDP -depression! (idle resources)

1+1=2? Or unemployment + idle resources = no inflation? Of course, not.

In fact inflation skyrocketed at an annual rate of 11,200,000% (according to Index Mundi’s data) or Hyperinflation!

Based on Professor Steve Hanke’s calculation this actually much higher...

79.6 billion % for 2008! The second worst in world history.

The reason for this is that the Mugabe-Gono government financed public debt (expenditures) with seemingly endless printing of money, because the nation’s access to credit has been severed externally (international) and internally (domestic savings).

So unless the US is immune to the universal laws of economics, whereby unfettered printing of money equals no inflation and is a recipe to prosperity, which has been falsified when applied to the experience of other countries, I wonder who embraces a theory that is bogus?

![clip_image002[4] clip_image002[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiLp1cjeJnUW4PTFFOY0r-w2trOEwc69p6gr_DrA568dWW2EbEBGd4qOPXfjPaOxldt1A5LoKdtmrLWv3P15mAeefkZdkBHSDW0dVUZdhfcqsaHt6G6zldOAvNSwd6NmWiRRwxU/?imgmax=800)

No comments:

Post a Comment