One of my favorite guru Dr. Marc Faber says that Asians should be thankful for QE 2.0.

In a way, I would agree with him

From Newsmax

"U.S. monetary policies have been very good for Asia, specifically for China because it fostered industrial-production growth in China, employment growth, wage increases, domestic consumption, increased demand for raw materials," Faber tells CNBC.

"That then lifted commodities prices. For that, actually the developing world, the emerging economies including China, Vietnam, Brazil and so forth should all send a 'Thank You' note to Mr. Bernanke."

But of course, we know Dr. Faber as being sarcastic.

That’s because he knows that bubble policies have intertemporal diametric effects: namely immediate (boom) and distant (bust).

Newsmax further quotes Dr Faber..

Excessive liquidity and dropping dollar bills from helicopters like Mr. Bernanke suggested — the problem with that is he doesn't know where the money will flow," Faber says.

"In this case, the excess liquidity flows into emerging economies and precious metals, and new bubbles are building up that at some point will burst.”

The bubble cycle in Asia appears to be flourishing as seen by the surging property prices in many Asian countries (of that’s aside from stock markets).

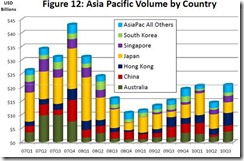

The Asian Investor reports a booming real estate market (above chart also from Asian Investor)

[bold emphasis added]

Transaction volumes in the Asia-Pacific increased 44% to $20.8 billion during the quarter as the region resumed its upward trend. It follows a second-quarter blip blamed on domestic cooling measures brought in by Beijing.

Global transaction volumes also returned, rising 15% quarter-on-quarter to total $303 billion for the past 12 months – a 47% increase year-on-year.

Asia-Pacific accounted for 26% of global volumes in the third quarter, up from 21% in Q2 but down on 29% in the first three months, finds a report by the Asia-Pacific Real Estate Association (Aprea) and Real Capital Analytics (RCA).

“The general trend is a rising one in terms of global transaction volumes and that has been mirrored in Asia,” says Lok So, Aprea’s operations director based in Singapore. “Do we see transactions in Asia continuing to rise? You would expect so. In terms of investible real estate in the world, it is almost a no-brainer that Asia will get the lion’s share of that, driven by China.”

So yes, it still seems like party time.

But no, parties don’t last forever and the hangover will haunt us in the fullness of time.

No comments:

Post a Comment