A good trader has to have three things: a chronic inability to accept things at face value, to feel continuously unsettled, and to have humility. -Michael Steinhardt, American investor and philanthropist

The tide must have turned immensely to favor the bulls.

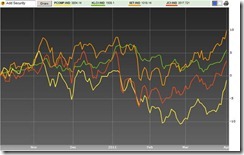

Figure 1: Bloomberg: Jumpstarting the ASEAN Equity Markets

ASEAN markets appear to have been jumpstarted.

We have been repeatedly pounding on the table saying that this turnaround was about to happen. The bulls have been knocking on the door, but few had the grit to pay heed.

And that the previous weakness was not a manifestation of an inflection point nor was it representative of a reversal back to the bear market days. Instead, such market infirmities accounted for as a normal countercyclical process called profit-taking. The basic market lesson is that trends do not move in a straight line.

Yet the profit taking theme seemed unacceptable for the consensus. First because it is boring stuff. And second, because it would seem unworthy of conversations. Part of social conformity requires contemporaneous expressions. And unstylish themes don’t fit such bill.

Social signalling is prioritized more than the relevance of the returns on investments.

Moreover, because people’s intuitive desire is for the graphic, the controversial and the sensational, mainstream experts fed on this false attribution by fixating on the current exogenous factors—the political crisis in Middle East and Africa and Japan’s triple whammy calamity—which they interpreted as having driven markets.

Never mind if evidences hardly supported such assertions, the important thing was to blabber on what seemed fashionable and conversational.

Hardly anyone appear to realize that applying mental shortcuts or heuristics (such as available bias) draped with technical gobbledygook, which would look good from the outside or from the surface, are hardly the pertinent factors when accounting for real investment returns.

In reality, risks and uncertainties stare at our faces at every moment of our lives. Yet, it is just a matter of managing the diversified degree of risk-uncertainty environment that makes the difference. The proverbial wheat is, thus, separated from the chaff.

And as predicted, markets have gradually been digesting on the uncertainty-risk environment from these events. The constant stream of variable, localized, fragmented and frequently contradictory information, which allows markets to discount[1] the uncertainty-risk factor[2], has apparently reduced the perception of the event risk.

The aesthetics of the marketplace is the scintillating evidence of the perpetual flow of the great F. A. Hayek’s description of knowledge[3] and its indispensible role in breathing life to the marketplace via the pricing mechanism and the coordination and discoordination process underpinning the dynamism of prices.

We are now in the process of being vindicated anew!

No comments:

Post a Comment