The Wall Street Journal editorial highlights on the baneful effects of the Fed’s inflationist policies, which is being transmitted via the US dollar, to the world. Such paradox had partly been captured by the famous quote attributed to former US Treasury secretary John Connally “our currency, but your problem.

From the Wall Street Journal, (bold highlights mine)

The larger story is that the world is starting to protect, and perhaps ultimately free, itself from America's weak dollar standard. The European Central Bank recently raised interest rates and may do so again to prevent an inflation breakout. China is allowing more trade to be conducted in yuan, a first step toward making it a global currency. At a meeting of developing countries—the so-called BRICs—in China recently, leaders called for "a broad-based international reserve currency system providing stability and certainty." They weren't referring to the dollar.

Even in the U.S., Americans are buying commodities (oil per barrel: $111) and gold ($1,500 an ounce) as a dollar hedge, and the state of Utah recently took steps to make it easier for citizens to buy and sell gold as a de facto alternative currency. Whether or not these prove to be wise investments, they are certainly signals of mistrust in Washington's economic stewardship.

At an economic town hall this week, President Obama blamed "speculators" for rising oil prices. He should have mentioned the Fed and his own Treasury, which have encouraged the world to invest in hedges against the falling dollar. Chairman Ben Bernanke and Mr. Geithner have deliberately pursued a policy of unprecedented monetary and spending stimulus to reflate the economy and boost asset prices. The bill is coming due in a weak dollar, food and energy inflation, and the decline of U.S. economic credibility.

But inflationism eventually will be everyone’s problem.

There will be feedback mechanisms from other nations. And this process is exactly what the Wall Street Journal article has been about. Other nations have been taking defensive maneuvers from a policy of sustained inflationism adapted by the US Federal Reserve.

And one consequence is that the US dollar will shed its pre-eminence as the world’s reserve currency.

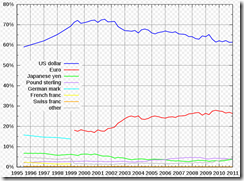

Sustained inflationism means that the US dollar will diminish her role as the world’s reserve currency. The above chart shows how this process has been taking place.

The rise of the Euro came amidst the US Technology bust in 2000. Overtime, the Euro has grabbed a larger slice of the reserve currency pie. But it is unclear if the Euro will be a worthwhile substitute as the Euro suffers from the same malaise as the US. The difference is just a matter of degree.

Nevertheless, the great Ludwig von Mises described how the inflation process negates the role of money. (bold highlights mine)

The course of a progressing inflation is this: At the beginning the inflow of additional money makes the prices of some commodities and services rise; other prices rise later. The price rise affects the various commodities and services, as has been shown, at different dates and to a different extent.

This first stage of the inflationary process may last for many years. While it lasts, the prices of many goods and services are not yet adjusted to the altered money relation. There are still people in the country who have not yet become aware of the fact that they are confronted with a price revolution which will finally result in a considerable rise of all prices, although the extent of this rise will not be the same in the various commodities and services.

These people still believe that prices one day will drop. Waiting for this day, they restrict their purchases and concomitantly increase their cash holdings. As long as such ideas are still held by public opinion, it is not yet too late for the government to abandon its inflationary policy.

But then, finally, the masses wake up. They become suddenly aware of the fact that inflation is a deliberate policy and will go on endlessly. A breakdown occurs. The crack-up boom appears. Everybody is anxious to swap his money against "real" goods, no matter whether he needs them or not, no matter how much money he has to pay for them.

Within a very short time, within a few weeks or even days, the things which were used as money are no longer used as media of exchange. They become scrap paper. Nobody wants to give away anything against them.

It’s a process in motion.

No comments:

Post a Comment