The Europeans have reportedly been breathing down on profits by the banking sector from commodity trades.

The US has been rigging the rules of the game by apply a Pearl Harbor strategy via a spate of margin hikes in the commodity markets over a short period of time.

Now, China joins the bandwagon on the assault on commodity prices.

Reports the Marketwatch,

The Shanghai Gold Exchange said Thursday it will raise margin requirements for silver futures as part of risk-control measures, its third round of increases in less than a month, according to a statement posted on the exchange's web site. Margin requirements will rise to 19% of a contract's value from 18%, while the daily price limit for the one kilogram silver forward contract will rise to 13% from 10% above or below the previous session's close. The new trading requirements will be effective from May 13.

China has been combating her inner demons during the past 2 years and seems as the most problematic nation among major economies in dealing with inflation (aside from India).

Since China has been a key player in the commodity markets then it’s apparent that coordinating policies with her major trading partners might mean more success in attaining price control goals.

From Hostra University

The above chart reveals of the China commodity consumption story as of 2009, relative to the world. And it’s the reason why China’s growth story has partly been tied with commodity price trends.

There is also the supply side story which we won’t be dealing here.

Relative to China’s silver’s price margin hikes:

China’s industrial demand for silver comprises nearly half of the world’s silver consumption.

According to Goldcore,

Today industrial uses account for 44% of worldwide silver consumption and in conjunction with investment and store of value demand, industrial demand continues to grow.

And China’s silver imports have exploded over the years which turned her from an exporter to a major importer.

According to the Wall Street Journal, (bold emphasis mine)

China's net imports of silver hit a record high of 400% in 2010 to 3,500 tonnes .

China used to be a silver exporter now China has become the importer of silver

About 70% of China's silver demand comes from the industrial sectors. Silver is widely used in the China is the third largest producer of mined silver in the world.

China also is a major consumer of silver, absorbing large and rapidly growing volumes of silver in its manufacturing sector.

Chinese silver mining witnesses significant growth and development in recent years, fueled by technological strides in exploration and an increase in production in response to steady growth in domestic and international demand China is a major global producer and consumer of silver-based brazing alloys.

China has some of the world's largest manufacturing facilities for home electronics and electrical appliances, which utilize various type of silver-based solder.

China is the world's largest producer of solar power and electronics.

Silver price increased more than 80% in 2010.

Silver demand in China is soaring thanks to increasing use for industrial and jewelery purposes.

About 70% of China's silver demand comes from the industrial sectors. Silver is widely used in the China is the third largest producer of mined silver in the world.

So controlling silver prices from spiking could mean ‘less statistical inflation’. This should also represent subsidies to her industrial users. Hence the incentive to join the price control bandwagon.

According to the Financial Times,

Chinese speculators have emerged as a big driver of silver’s spectacular rally and subsequent crash with trading in the metal in Shanghai soaring nearly 30-fold since the start of the year.

The commodity, nicknamed “the devil’s metal” for its wild price swings, surged 175 per cent from August to a peak of almost $50 a troy ounce two weeks ago. Since then, it has plummeted 35 per cent, hitting a low of $32.33 on Thursday.

At the same time, silver turnover on the Shanghai Gold Exchange, China’s main precious metals trading hub spiked, rising 2,837 per cent from the start of this year to a peak of 70m ounces on April 26, according to exchange data.

The number of contracts outstanding, an indicator of investor exposure, doubled over the same period.

Manipulating silver’s prices also means punishing savers who buy silver in the form of hedging against currency debasement. As the article above implies, about 30% of silver’s demand in China have been due to “jewelry”. Given the underdeveloped conditions of China’s capital markets, hedging may come in the form of jewelry.

The global war on commodities is becoming more evident by the day...

Reports the Reuters (highlights mine)

There's no question pressure from Washington is growing.

A group of 17 U.S. senators on Wednesday called on the Commodity Futures Trading Commission to crack down immediately on excessive speculation in crude oil markets, demanding the agency's plan to impose position limits within weeks.

...as we see more and more calls for interventions from politicians around the world.

And the assaults on the commodity markets have also been expected to cover agricultural futures soon.

So we should expect continued volatility until governments would run out of ammunition or once commodity demand and supply backfire on their policies.

Yet for as long the US Federal Reserve pursues the policy of inflationism (this includes other major central banks or even China)…

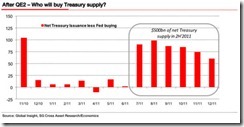

Chart from Minyanville

…the outcome will be higher commodity prices!

Scapegoating speculators and intervening in the markets may temporarily achieve political goals. However, such actions would only worsen the economic balance and lead to even higher prices—the law of unintended consequences.

It is just a matter of time.

In my view, this telling chart forebodes on why the concerted intervention in commodity markets.

Printing money does not equal higher inflation, that’s what’s being portrayed. Why? Because the Fed and their acolytes think that they need more of these, since government spending, for them, is holy grail to resolving socio-economic problems.

Money printing is the way to prosperity, so it is held.

I see higher inflation.

this is nice post

ReplyDelete