The Economist has a nice interactive graph which tries to measure “economic overheating” in 27 emerging market economies.

That’s actually euphemism for bubble watch.

For a crispier view pls proceed to the Economist website.

Notes the Economist, (bold highlights mine)

Countries are first graded according to the risk of overheating suggested by each indicator (2=high risk, 1=moderate, 0=low). For example, if the growth in excess credit is more than 5% it scores 2 points, 0-5% 1 point, and below 0% nil. The scores from each indicator are then summed and turned into an overall index; 100 means that an economy is red-hot on all six measures.

There are seven hot spots where a majority of the indicators are flashing red: Argentina, Brazil, Hong Kong, India, Indonesia, Turkey and Vietnam. In particular, the growth in credit is sizzling in all seven. Argentina is the only economy where all six indicators are on red, but Brazil and India are not far behind. China, often the focus of overheating concerns, is well down the rankings in the middle of the amber zone, partly thanks to more aggressive monetary tightening. Russia, Mexico and South Africa are in the green zone, suggesting little risk of overheating.

This just goes to demonstrate how credit signifies as the sine qua non fuel of a bubble.

Nevertheless, aside from the indicators presented in the graphic, there are property prices, yield curve, leverage in the banking sector, off balance sheet exposures, sentiment indicators and the national stock market bellwether.

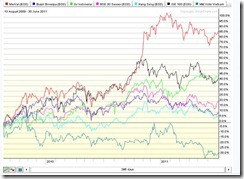

Argentina, among the rest as shown by the above chart from stockcharts.com, evinces formative signs of euphoria since 2009.

Meanwhile, Vietnam’s equity market continues to drift in the negative return territory as the country struggles to contain unwieldy domestic inflation by working to drain liquidity in the system

All the rest have had positive gains but seems unlikely a manifestation of a maturing bubble in progress.

Of course, bubbles can happen in other parts of the economy as in the real estate sector such that this would not necessarily get manifested on stock prices.

That’s why it would pay to look deeper.

No comments:

Post a Comment