“This time is different is a phrase” which I usually loathe. But applied to safehaven or refuge assets during a crisis, “this time has indeed been different” as Gold, the Swiss Franc and the Japanese Yen has replaced the US dollar, as discussed here.

Now a report from Bloomberg says that today’s market rout has seen gains in commodity currencies which may become alternative havens.

The currency havens are disappearing as Switzerland and Japan intervene in foreign-exchange markets, while U.S. and European debt loads undermine credit ratings.

The biggest beneficiaries in the $4 trillion-a-day currency market may be Norway’s krone and the Australia and New Zealand dollars, according to Frankfurt Trust, which oversees about $23 billion. All have debt that is less than 48 percent of gross domestic product, compared with about 60 percent in the U.S., 77 percent in the U.K. and 79 percent in Germany, according to data compiled by Bloomberg.

The Swiss franc and Japanese yen, which had become favorites of traders skittish about holding dollars and euros, became perilous after the Swiss National Bank unexpectedly cut interest rates and Japan sold its currency. The yen weakened as much as 3.2 percent on Aug. 4, according to Bloomberg Correlation-Weighted Indexes. The U.S. came within days of defaulting and Italian and Spanish bond yields approached levels that spurred bailouts of Greece and Ireland.

“You want to stay away from the euro and dollar because this is really an ugly pair and there are alternatives,” Christoph Kind, the head of asset allocation in Frankfurt at Frankfurt Trust, said in a telephone interview last week. “I like currencies like the Australian and New Zealand dollars, the Swedish krona and the Norwegian krone. They are AAA-rated countries with a currency they can manage and handle, and they have pretty liquid markets.”

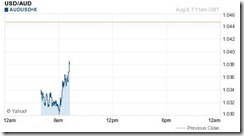

Charts below from Yahoo Finance

One day does not a trend make.

While Norway krone (NOKUSD) and Sweden’s krona (SEKUSD) are headed up and above yesterday’s close (red horizontal line), this isn’t true with Australia (AUDUSD) and New Zealand’s (NZDUSD) dollar both of whom appear to be rebounding but are significantly below their respective previous closes. Before I forget, the charts above represent a one day window.

No comments:

Post a Comment