“As a society, culturally we get what we celebrate”, that’s how prolific Forbes nanotech analyst-writer Josh Wolfe describes the importance of role models in shaping society.

Who we celebrate essentially reflects on our actions. For instance, if we worship politicians and celebrities, we tend to follow their actions. Our time orientation would narrow to match with theirs.

And having a short term time preference means we value today more than the future, thus we would be predisposed to indulge in gambling, hedonistic (high risk but self gratifying) activities and political actions that would dovetail with such values.

However, if we see entrepreneurs or scientists as our role models then we are likely to value the future more than today. We would learn of the essence of savings, capital accumulation and trade.

What has this got to do with P-Noy’s trip to China? A lot.

President Aquino’s entourage simply is a showcase of how the Philippine political economy works.

From today’s Inquirer

Underlining the trade and investment slant of his state visit to China, President Benigno Aquino III arrived here with a 270-strong business delegation, including the Philippines’ top industry leaders.

It is the biggest business contingent of Mr. Aquino’s foreign trips.

And for what stated reason? Newswires say this is meant to secure $60 billion worth of investments.

According to Bloomberg,

The Philippines may secure as much as $60 billion in Chinese investments under a five-year plan to be signed during Aquino’s stay, Christine Ortega, assistant secretary for foreign affairs, told reporters in Manila on Aug. 24. This trip alone may bring $7 billion in commitments, Trade Undersecretary Cristino Panlilio told reporters in Beijing yesterday…

Aquino is counting on investments to boost economic growth that slowed for a fourth straight quarter. Gross domestic product increased 3.4 percent in the three months through June from a year earlier, from a revised 4.6 percent in the first quarter, the National Statistical Coordination Board said today.

Lagging Investments

Net foreign direct investment in the Philippines fell 13 percent to $1.7 billion in 2010 from a year earlier, the central bank said in March. Between 1970 to 2009, the country lured $32.3 billion in FDI, compared with $104.1 billion for Thailand, according to United Nations data.

Higher returns on investments will come from resources “that have been untapped for such a long time,” Aquino said in an Aug. 18 interview, citing plans to explore for energy in the South China Sea. Two of 15 blocks put out for tender in June are in waters China claims.

The Philippines plans to boost hydrocarbon reserves by 40 percent in the next two decades. Mineral fuels accounted for 17 percent of total monthly imports on average last year, from 11 percent in 2000, data compiled by Bloomberg show.

“We want to resolve the conflicting claims so that we can have our own gas,” Aquino said Aug. 29. “Once we have our own, we will not be affected by events in other parts of the world.”

First of all it isn’t true that the Philippines have little access to $60 billion worth of funds for investment.

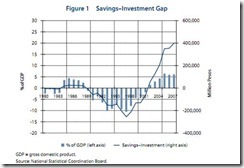

In fact, the Philippines has a disproportion of savings to investment as shown below.

National savings alone is almost enough to bankroll these required investments (charts above and below from ADB)

Yet this doesn’t even count other domestic assets which can be used as collateral or as alternative sources for funding.

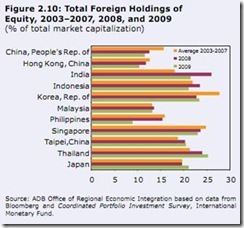

The Philippine Equity markets had a market cap of $202 billion as of the last trading day of 2010.

Foreigners hold around 20% of the market cap; even assuming 50% foreign ownership that’s still $100 billion worth of potential collateral.

And we also have the corporate bond markets (4.1% of GDP) and vast property assets which because of the lack of secured property rights, around 67% of rural residents in the Philippines live in housing that is considered as ‘dead capital’ which is worth about $133 billion Peruvian economist Hernando de Soto estimated in 2001 in his book, the Mystery of Capital

In other words, many of the big shot investors who went with P-Noy do not see sufficient returns on their investments, hence have been reluctant to deploy their savings on local investments.

They instead went with the President to supposedly seek out “partners” to 'spread the risks'.

On the other hand, these business honchos will likely use this opportunity to invest overseas!

Why then the lack of domestic investments?

Aside from the lack or insufficient protection of property rights, a very important hurdle to investments is simply the inhospitable environment for investors.

As the table above shows, the Philippine economy has been strangled or choked by politics.

So bringing in a high powered presidential entourage won’t help unless there would be dramatic structural reforms on our political institutions that would encourage profitable investments.

Most of the deals that would be obtained from this trip will likely be political privileges or concessions (most possibly backed by implicit guarantees from the Philippine government).

This brings us to the significance of role models.

Essentially, P-Noy sees big business as the main way to entice investments or reinvigorate the economy, hence this star-studded retinue (could this be a junket??)

Why leave out the public, when I would presuppose that much of the investable savings are held by them? Is it because that, as his political supporters, this would serve as the ripe opportunity to be rewarded (with state induced deals)?

Or is this authorative show of force simply been about showmanship? (Public choice theory is right again showing how politicians are attracted to symbolisms to promote their self interests)

Bottom line: P-Noy’s China trip reveals of the essence of the Philippine political economy; economic opportunities allocated or provided for by the state.

In short, state or crony capitalism.

Benson, One word....brilliant. thanks for your insight

ReplyDeleteThanks John

ReplyDelete