The mainstream meme has been about the US economy being embroiled in a ‘liquidity trap’, therefore enduring a deflationary environment.

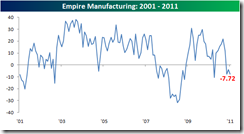

There have been many signs that the US economy seems flagging of late. (The following 2 wonderful charts from Bespoke Invest)

But there hardly seem signs of deflation with money aggregates skyrocketing (charts from St. Louis Fed)

M2…

MZM…

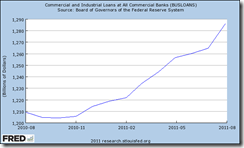

And credit environment has been conspicuously improving too.

For businesses…

And so with consumer loans…

Importantly, the current economic landscape has certainly NOT BEEN A PROBLEM OF CONSUMER SPENDING, which have much been bruited about by deflationists.

(chart below from Professor Mark Perry)

…but from the lack of investments. (See Robert Higgs magnificent explanation here)

Lastly, US CPI inflation keeps ascending (again from Bespoke)

…yet one would note that the calculation for the CPI index may not be accurate or has vastly understated the above inflation rates, perhaps for political reasons (Wikipedia.org).

The composition of CPI index has been disproportionately weighed towards housing.

Great chart above and below from DSHORT.com

And in looking at the performance of each of the components…

…we find that except for the apparel, the entire spectrum of goods and services in the CPI basket has been ascendant! With the only difference seen at the relative performance of prices.

Bottom line:

What Deflation, where?

NOT until central banks will cease and desist from inflating either forced by markets or by politics, and NOT until central banks will sacrifice to the alter of economics and the markets, the high privileged but beleaguered banking cartel.

Bonds markets have NOT been an accurate indicator, for the simple reasons of government designed financial repression and or government manipulation (QEs).

In planet earth, we see inflation as THE predominant theme or the prospects of a stagflation (which could transit into hyperinflation) risk.

And with global political authorities coordinating efforts to intensify inflationism in the hope that the liquidity therapy will solve the malady of insolvency, then expect MORE INFLATION ahead.

Deflation, which has signified as a bogeyman, will be further used to justify expanded inflationism which in reality has been designed to preserve the existing political order.

As the great Ludwig von Mises wrote

It is no answer to this to object that public opinion in the capitalist countries favors the policy of cheap money. The masses are misled by the assertions of the pseudo experts that cheap money can make them prosperous at no expense whatever. They do not realize that investment can be expanded only to the extent that more capital is accumulated by saving. They are deceived by the fairy tales of monetary cranks. Yet what counts in reality is not fairy tales, but people's conduct. If men are not prepared to save more by cutting down their current consumption, the means for a substantial expansion of investment are lacking. These means cannot be provided by printing banknotes and by credit on the bank books.

Unfortunately for us, political authorities and their zealots, fables are seen and adapted as reality, where we have to bear the consequences of their actions.

No comments:

Post a Comment