Some Keynesian diehards reach a state of egotistical orgasm, when they see the financial markets crashing, accompanied by record low interest rates.

They extrapolate these selective events as having to prove their point that today’s environment has been enveloped by a deflation induced liquidity trap- or the economic conditions, which according to Wikipedia.org, when monetary policy is unable to stimulate an economy, either through lowering interest rates or increasing the money supply.

Let’s see how valid this is.

The Dow Jones Euro Stoxx 50 or an equity index representing 50 blue chip companies within the Eurozone is down by about 28% as of yesterday’s close from its peak in mid-February.

For the month of August, the Stoxx 50 fell by a dreadful 16%.

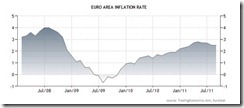

Yet according to the Bloomberg the Eurozone’s inflation has raced to the highest level in 3 years.

European inflation unexpectedly accelerated to the fastest in almost three years in September, complicating the European Central Bank’s task as it fights the region’s worsening sovereign-debt crisis.

The euro-area inflation rate jumped to 3 percent this month from 2.5 percent in August, the European Union’s statistics office in Luxembourg said today in an initial estimate. That’s the biggest annual increase in consumer prices since October 2008. Economists had projected inflation to hold at 2.5 percent, according to the median of 38 estimates in a Bloomberg survey.

Chart above and below from tradingeconomics.com

So low growth, high unemployment and elevated inflation in the Eurozone characterizes a stagflation climate and NOT deflation, in spite of the stock market meltdown.

While it is true given that commodity prices have crashed lately, which should temper on or affect consumer price inflation levels downwards, this is no guarantee that deflation in consumer prices will be reached. Perhaps not unless we see a nasty recession or another bout of a funding crunch. So far global central banks continue to apply patches in the fervid attempt to contain funding pressures.

Besides, contra-liquidity trap advocates, everything will depend on how monetary policies will be conducted in the face of unfolding events.

The ECB has actively been purchasing bonds (Danske Bank).

Yet despite these actions, the ECB has adapted a relatively less aggressive stance compared to the US in 2008. This implies that the policy response has continually lagged market expectations, and importantly, has been continually hobbled by political divisions, which has led to the ensuing turmoil.

This is not to say that aggressive responses by political authorities would solve the problem, but as in the US, they could serve as a balm. These are the “extend and pretend” actions that eventually will implode. For me, it’s better to have the painful market adjustments now, than increasingly built on systemic fragility which eventually would mean more pain.

Yet, despite current hurdles central bankers have not given up.

Denmark will unleash the same inflationism to bailout her banks. According to this report from Bloomberg,

Denmark’s central bank said it will provide as much as 400 billion kroner ($72.6 billion) as part of an extended collateral program to provide emergency liquidity to the country’s banks.

Lenders will also be able to borrow liquidity for six months, alongside the central bank’s existing seven-day facility, at a rate that tracks the benchmark lending rate, currently 1.55 percent, the bank said in a statement today.

The country’s lenders face a deepening crisis that threatens to stall a recovery in Scandinavia’s worst-performing economy. Two Danish bank failures this year triggered senior creditor losses, leaving international funding markets closed to all but the largest banks. Lawmaker efforts to spur a wave of consolidation and help banks sidestep Denmark’s bail-in rules have so far failed.

For as long as central bankers fight to preserve the political status quo by using expansionary credit easing tools or inflationism, deflation remains a less likely outcome.

No comments:

Post a Comment