Global stock markets got clobbered anew as Italian bonds breached the 7% threshold level in the face of Italy’s lingering political crisis in trying to resolve the debt issue. This also demonstrates signs of the diffusion of debt crisis in the Eurozone

From the Bloomberg report, (bold highlights added)

Europe’s biggest clearinghouse said that customers must put down bigger deposits to trade Italian bonds as concern rises that the government will struggle to reduce the world’s third- largest debt burden. Italian yields surged as Prime Minister Silvio Berlusconi said he won’t resign until austerity measures are passed, even after he failed to muster an absolute majority on a routine ballot in parliament yesterday.

A senior lawmaker said German Chancellor Angela Merkel’s Christian Democratic Union may adopt a motion at an annual party congress next week to allow euro members to exit the currency area. In Greece, Prime Minister George Papandreou’s drive to put together a unity government fell into disarray as rival parties squabbled over the next premier.

The important twist here is that the formerly rigid stance of the Eurozone on their membership standings seem to have shifted, EU bureaucrats appear to be exploring the option for member exit.

None the less, if the market’s downside volatility has been due to the Eurozone, then it is a curiosity to see US equities falling more than the Euro stocks

(from Bloomberg)

Are the markets suggesting that US stocks, which has outperformed the Euro contemporaries, will be doing a catching up?

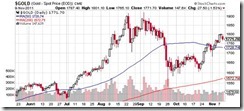

Well gold prices despite yesterdays’ steep losses remain on bullish trend which may indicate that the current volatility may be an interim development

As I have been saying expect sharp market volatilities based on the effects of the politicization of the financial markets and from boom bust policies.

The market climate remains very fragile and highly sensitive to the fluid developments in the realm of global politics.

No comments:

Post a Comment